Largest Nine-Month Warranty Reserve Fund Changes:

Continuing last week's analysis of the top 110 U.S.-based manufacturers, we are comparing each company's warranty reserve balances to their year-ago levels. Comparing the size of these changes reveals a fuller picture of which companies have had a challenging or exceptional nine months.

The 2022 annual reports are trickling in, and we look forward to releasing 20-year charts for a number of industries in the coming months. While awaiting the complete year-end 2022 data, we have been taking a look at the nine-month data as recent as September 30, 2022. Continuing last week's report on the Largest Nine-Month Warranty Expense Rate Changes, this week we are taking a look at the biggest changes in warranty reserve balances and capacities for the same pool of 110 United States-based manufacturers.

We started with a list of all U.S.-based companies that reported paying warranty claims in 2021. For each company, from the financial reports they filed with the United States Securities and Exchange Commission (SEC), we gathered data for claims paid, accruals held, reserves held, and total product revenue. Since different companies have different quarterly calendars and reporting schedules, we gathered data up to September 30, 2022, but eliminated any companies with their newest data from earlier than June 30, 2022. We also eliminated any companies that did not report both claims and accrual amounts in their first, second, and third quarter expense reports. This excluded all companies that report their warranty expenses only once per year (e.g. General Electric), all companies that missed filing one or more reports, and all companies that reported just the opening and closing balances in their warranty reserve funds without detailing the amount of claims paid and accruals made. In a handful of cases, certain companies reported making $0 in accruals or paying $0 in claims, but at least they reported those amounts.

Next we trimmed the list down to the companies that paid $10 million or more in claims during the first nine months of 2022. This left us with 110 companies that fit our criteria for analysis in this report.

Last week, we reported on changes in the two expense rates, the claims rate and accrual rate (claims / product revenue and accruals / product revenue). This week, we calculated two additional metrics based on these data: rate of change in warranty reserve balances, and warranty capacity in months. The former is a simple percent change formula, comparing each company's reserve total as of September 30, 2022 to its total a year prior. The latter, warranty capacity, was calculated by dividing each company's reserve total as of September 30 to its claims total for the month of September for the respective year (reserves / claims). This gave us two numbers to compare: warranty capacity in months, as of September 2021 and 2022.

While we cannot compare companies to each other, especially when they report their data differently, we can compare them to themselves a year prior. Each company's 2022 metrics were compared to those from 2021, to reveal the biggest increases and reductions in these two metrics measuring warranty reserves. In the four tables that follow, we are listing the 10 biggest percentage gainers and decliners for total warranty reserves (Fig. 1 & and 2) and warranty capacity in months (Fig. 3 & 4).

Since this report is a continuation of last week's analysis of the two expense rates using the same pool of the top 110 companies, there is a theoretical maximum of four appearances in these charts (since one cannot both decrease and increase at the same time). Of the top 110 companies, a total of 48 made an appearance in at least one of the eight charts, while 62, or 56%, did not appear in any. So it's important to note that the majority of the companies included in this analysis actually are not featured in this article at all. Some might even consider this the best news of all, because it shows stalwart and consistent stability between the years.

Of the 110 companies, 26 made exactly one appearance in any of the eight tables. 11 of those 26 make that one appearance in this week's newsletter. These companies are: Acuity Brands Inc., BorgWarner Inc., Diebold Nixdorf Inc., L3Harris Technologies Inc., NCR Corp., SolarEdge Technologies Inc., Tesla Inc., Textron Inc., Westinghouse Air Brake Technologies Corp., Whirlpool Corp., and Winnebago Industries Inc.

13 companies made two appearances, and only two of those 13 are not in this week's charts. The 11 companies that make two total appearances, including at least one in this week's charts, are: Allison Transmission Holdings Inc., American Woodmark Corp., Dana Inc., Enphase Energy Inc., Generac Holdings Inc., iRobot Corp., Kulicke and Soffa Industries Inc., PGT Innovations Inc., Standard Motor Products Inc., Tenneco Inc., and Teradyne Inc..

Eight companies made three appearances. They are: Daktronics Inc., First Solar Inc., Insulet Corp., MKS Instruments Inc., Nvidia Corp., Oshkosh Corp., Taylor Morrison Home Corp., and Visteon Corp. Finally, only one company, Hubbell Inc., appears in the maximum of four charts.

Of course, multiple appearances can either mean really good news or really bad news, depending on whether the metrics are rising or falling. However, in some cases, it can simply mean bad timing and a confluence of several different factors. In particular, big changes in the warranty capacity ratio can be an early warning signal, but sometimes there are false positives and many complexities at play. In particular, mergers and acquisitions can raise warranty costs, but are not "bad news" per se. Simply put, we are looking at patterns and anomalies in the warranty data.

Among the top 110 warranty providers, especially among the very largest, warranty metrics tend not to change much from one year to the next. As noted earlier, the majority of the 110 are not in this or last week's report at all. Furthermore, of the top 20 companies with the largest warranty reserves, only two are included in this report: Tesla, for an increase in its reserve balance, and Whirlpool, for a reduction.

But then there is a subset for which the numbers changed by astronomical factors, including reserve balances that quintupled and sextupled. This reflects a big increase in future anticipated expenses. And every dollar put into reserve accounts is a dollar not factored into net profits.

So these are the members of the following four top 10 lists: the biggest changes in warranty reserve balances and capacity in months. Of course, everything can change when the fourth quarter and annual numbers come in, but these are the numbers as of right now.

Warranty Reserve Balances

As we have surely indicated, we are hesitant to assign any great meaning to changes in the warranty reserve balance alone. To be sure, the balance rose for 62 of the top 110 warranty providers and fell for 47 (one was unchanged from September 2021 to 2022). But unlike the claims or accrual rates we looked at looked at last week, where up is usually bad and down is usually good, we don't want to assign too much significance to these changes. Instead, let's view them as potential confirmations of the trends we saw last week, and perhaps early indicators of companies to keep an eye on in the coming year.

On that basis, of the 20 companies on the charts below, only nine also appear in last week's report on expense rate changes. So in that sense, their repeat appearances confirm that their warranty expense metrics changes by larger proportions than those of most other large warranty providers.

At the same time, we should not assign much meaning to the one-and-only appearances of Whirlpool, NCR, and L3Harris in Figure 1, and Tesla, Winnebago, and Solar Edge in Figure 2. Furthermore, there are five companies that appear in two charts in this report, but none in last week's: Teradyne, Kulicke and Soffa, Allison Transmission, PGT Innovations, and Standard Motor Products. While it's interesting to note changes in reserves, in these cases, we cannot draw definitive conclusions from these data alone.

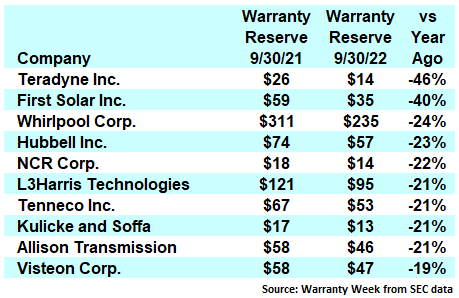

Without further ado, here are the top 10 warranty reserve reductions between September 2021 and 2022.

Figure 1

Top 110 U.S.-based Warranty Providers:

Top Ten Warranty Reserve Reductions,

Sept. 30, 2022 vs. Sept. 30, 2021

(reserves in millions of US dollars)

In Figure 1, the four companies we also saw in at least one top 10 chart based on changes in expense rates are First Solar, Hubbell, Tenneco, and Visteon.

First Solar ranks second for reducing its warranty reserve balance by -40% in a year, from $59 million to $35 million. Surprisingly, this does not correlate with a decrease in expense rates. Rather, First Solar actually saw an increase in claims during the same period; its claims rate more than doubled, from 0.2% to 0.5%. So, this reduction in reserves is partially due to drastically increased claims, with only two of the 110 companies seeing bigger jumps in their claims rate than this.

At the same time, in its most recent quarterly report, First Solar notes that the reduction in warranty reserves is a response to "lower-than-expected warranty claims for [their] older series of module technology as well as the evolving claims profile of [their] newest series of module technology, resulting in reductions to [their] projected module return rates." In other words, they realized they were accruing too much money based on what they were actually paying in claims, and reduced their reserves as a result. So it looks like First Solar's appearance here is a confluence of yes, increased claims, but also a correction to too-large accruals, resulting in a big decrease in reserves. Indeed, we will see in Figure 3 that in September 2021, First Solar had a warranty reserve capacity of 161 months, which reflects a needlessly large sum of money tucked away in that fund. So this correction makes sense.

Hubbell, the only company to appear on the maximum of four lists, ranks fourth, having decreased its warranty reserves by about a quarter. Interestingly, Hubbell also does not appear on the expense rate charts we might expect based on a reduction in reserves: its claims and accrual rates both increased between September 2021 and 2022. Hubbell ranked tenth on the list of claims rate increases, from 0.4% to 0.6%, and seventh on the list of accrual rate increases, from 0.2% to 0.4%. So reserves are not decreasing based on an overall decrease in expenses. However, we note that Hubbell acquired two companies in 2022, PCX Holding LLC and Ripley Tools LLC, helping to explain these changes.

Tenneco, ranked seventh on this list, reduced its warranty reserves by -21%. Tenneco also ranked number one on the list of the largest reductions in accrual rates, from 0.18% to just 0.02%. It looks like Tenneco began the process of merging with Pegasus Merger Co., which is part of Apollo Global Management Inc., early in 2022. So perhaps its decreased accruals and warranty reserves were in anticipation of this merger, which was finalized in November 2022.

Finally, we have Visteon, ranked tenth here, with a reduction in warranty reserves of -19%. Visteon also cut its claims rate in half, from 0.8% to 0.4%. It looks like 2022 was a good year for Visteon overall, with a big increase in net sales as well.

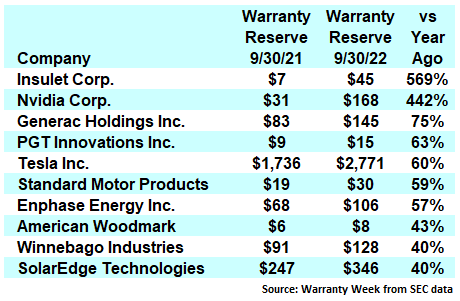

Next, we will take a look in the biggest increases in warranty reserves. Some of these increases reflect recalls and anticipated increases in claims.

Figure 2

Top 110 U.S.-based Warranty Providers:

Top Ten Warranty Reserve Increases,

Sept. 30, 2022 vs. Sept. 30, 2021

(reserves in millions of US dollars)

Ranking first is Insulet, which more than sextupled its warranty reserves in the course of just a year, a percent increase of a whopping 569%. As we reported last week, Insulet also had a huge increase in its accrual rate, from 1.1% last year to 14.3%. For context, we rarely see an accrual rate above 5%. In their most recent quarterly report, Insulet notes that "in October 2022, the company issued a voluntary medical device correction notice for its Omnipod DASH PDM relating to its battery. The company accrued an estimated liability of $36.8 million related to this issue." This lump sum accrual due to malfunctioning batteries for its insulin pumps explains these two huge increases.

Next on the list is the computer graphics processing unit manufacturer Nvidia, which more than quintupled its warranty reserves, from $31 million in September 2021 to $168 million a year later. Nvidia also saw increases in its claims and accrual rates during the same period. Its claims rate technically quadrupled, but this was just from 0.03% to 0.13%. Furthermore, it had the largest increase in accrual rate out of all 110 companies, increasing seventeenfold from 0.1% to 1.8%. In their most recent quarterly report, they report that "in the third quarter of fiscal year 2023, [they] recognized a warranty-related benefit of approximately $70 million in cost of revenue due to favorable product recovery." Note that their fiscal year 2023 began in February 2022.

On the other hand, Nvidia also reported that "a defect was identified in a third-party component embedded in certain Data Center products." These defective parts could not be repaired, but rather needed to be replaced, resulting in greater costs, explaining higher claims and accruals in anticipation of future claims. They note that while they think they have put aside enough money to deal with this defect, they "may need to record additional amounts in the future if [their] estimate proves to be inaccurate." They go on to note another issue with the power connectors for another new GPU product. In short, it seems like Nvidia has been expanding its business, but has also been running into several problems with defective parts that have driven them to dramatically expand their warranty reserves very quickly. The defects explain the increased claims rate, and the anticipation of further issues explains the huge increase in accruals and thus reserves. However, we acknowledge that computer parts manufacturing is a relatively newer and more volatile industry overall.

Ranking third is Generac Holdings, which increased its reserves by 75% from $83 million to $145 million. Generac also saw an increase in its claims rate from 1.1% to 2.1% during the same period. This increase in reserves is mainly due to "a specific warranty provision recorded during the third quarter of 2022 in the amount of $37,338 to address certain clean energy product warranty-related matters." Generac also had an issue with a third-party solar panel dealer, Pink Energy, that went bankrupt last year and left unfilled consumer warranty claims to Generac as the original manufacturer. It seems like the confluence of several different unanticipated expenses caused Generac to increase its reserves.

A bit lower down the list, we have Enphase ranked seventh, having increased its warranty reserves by 57%. Last week, we saw Enphase ranked eighth on the list of biggest accrual rate increases, from 1.4% to 2.1%. It seems like these increases are due to a change in the way they calculate their estimated warranty costs. They note that "in 2022, the company recorded $29.3 million in warranty expense from change in estimates" due to new studies on product performance. It seems like they have increased these estimates consistently for the past few years, as further studies on their solar microinverters and electric vehicle chargers are conducted. Green energy, of course, continues to increase in popularity.

Finally we take a look at American Woodmark, which increased its warranty reserves by 43%. They also increased their accrual rate from 1.1% to 1.7%, ranking ninth. We couldn't find much information on the kitchen and bath cabinet manufacturer that would explain these increases, but we will keep an eye on them in coming reports.

Warranty Reserve Capacity

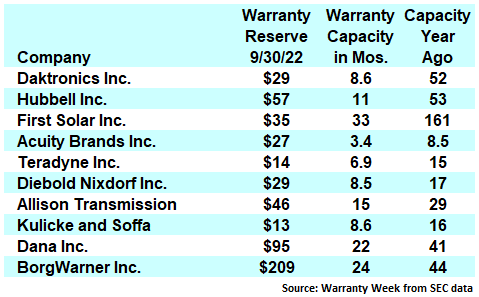

Next we will take a look at the warranty reserve capacity ratio, which is basically how many months of claims payments each company currently holds in its reserves, based on the reserve balance and one-month claims cost recorded in September 2022. Figure 3 looks at the top 10 biggest reductions in reserve capacity in months.

Again, we will not dwell on the companies that make their only appearance on one of these two charts: Acuity Brands, Diebold Nixdorf, BorgWarner, Westinghouse Air Brake, and Textron; nor to those that we noted earlier appear in two charts this week but none last week.

Figure 3

Top 110 U.S.-based Warranty Providers:

Top Ten Warranty Reserve Capacity Reductions,

Sept. 30, 2022 vs. Sept. 30, 2021

(reserves in millions of US dollars)

In first place is Daktronics, the LED display and scoreboard company that we also saw rank first in claims rate increases, from 1% to 5.9%, and third in accrual rate increases, from 1.5% to 7.6%. They note that they "recognized a warranty expense of $1.0 million for probable and reasonable estimated costs to remediate a component and manufacturing quality issue discovered during the second quarter of fiscal 2023."

Next we see Hubbell make another appearance. Its claims and accrual rates increased, its reserves decreased, and its overall warranty capacity went down from over four years to under a year of money at the ready. In third is First Solar, with its capacity dramatically decreasing from over 13 years at the ready to a still-respectable two years and nine months. As we noted earlier, this is evidence of the correction from previous over-accruing.

In Figure 4, we will look at the top 10 reductions in warranty capacity.

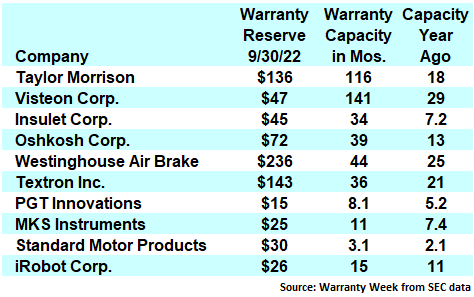

Figure 4

Top 110 U.S.-based Warranty Providers:

Top Ten Warranty Reserve Capacity Increases,

Sept. 30, 2022 vs. Sept. 30, 2021

(reserves in millions of US dollars)

First on the list is Taylor Morrison Home Corp., which increased its warranty capacity from 18 months to 116, or over nine years. They also ranked first on the list of biggest claims rate reductions, and second on the list of accrual rate reductions. They acquired William Lyon Homes in February 2020, right before the pandemic started and new home sales plummeted (at least temporarily). We congratulate them on a great recovery.

We see similar stories from Oshkosh Corp. and MKS Instruments. Oshkosh Corp. ranked second in claims rate reductions and fifth in accrual rate reductions, leading to an increase in capacity in months. MKS Instruments ranked ninth in claims rate reductions, and seventh in accrual rate reductions. Furthermore, iRobot ranked eighth in accrual rate reductions, helping to explain its appearance in tenth place on this list.

In second place is Visteon, which is the only company on this list to also appear in Figure 1. It is intriguing that their warranty reserve balance decreased yet their overall reserve capacity increased. This is due to them cutting their claims rate in half during the same period. Again, congratulations.