Top 100 Warranty Providers of 2024:

Carrier Global increased its claims and accrual rates, and its reserve fund balance, while Polaris Inc. decreased all three warranty metrics. Overall, 41 of the top 100 U.S.-based, warranty-issuing manufacturers saw significant increases or reductions in their warranty expense rates from 2023 to 2024.

It's mid-March, which means the deadline has passed for large U.S.-based manufacturers to file their 2024 annual reports with the SEC. This week, we're taking a look at the product warranty expenses of the top 100 U.S.-based, warranty-issuing manufacturers, ranked by the amount they reported in warranty claims paid during the calendar year.

The central theory of our top 100 is, while it would be improper to compare the warranty expense rates of two different manufacturers, it is highly proper and revealing to compare each company against itself, and then compare the magnitude of the changes.

And the results prove that stability is best: 59 companies made no top 10 change charts, while 41 did. Of those 41, most (24) made just a single appearance, while only 17 made multiple appearances, proving that stable expense rates are the norm.

Methodology

First, we perused the annual reports of every manufacturer that issues product warranties, and reports its warranty expenses to the SEC. We extracted three key warranty metrics: the amount of claims paid, the amount of accruals made, and the year-end balance of the warranty reserve fund.

We also gathered data on each manufacturer's product sales revenue, and used these to calculate two additional warranty metrics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

We standardized each manufacturer's fiscal year to the calendar year, using data from subsequent quarterly financial statements, for those whose fiscal 2024 ended before December 31.

We gathered 2024 product warranty expense data for hundreds of U.S.-based manufacturers. We'll summarize these data in our upcoming, and highly anticipated, Twenty-second Annual Product Warranty Report.

For this newsletter, we set about narrowing our list down to the top 100 manufacturers. First, we eliminated any companies that had reported in 2024, but not in 2023, such as newly spun-off GE Vernova.

Next, we sorted our list of hundreds of U.S.-based manufacturers by the total amount of warranty claims paid in 2023. Each of the companies in the top 100 paid $26.9 million or more in warranty claims during calendar 2023.

There were seven companies that we had to eliminate from our list. There were three manufacturers that should have been in the top 100, but were late with their fourth quarter financial reports by our cutoff date: Cornerstone Building Brands Inc., iRobot Corp., and GoPro Inc. And there were four manufacturers that no longer publish their warranty expenses, but likely would have made the top 100 had they reported: Applied Materials Inc., Mohawk Industries Inc., Coherent Corp., PGT Innovations Inc.

For each of the top 100 manufacturers by warranty expenses, we calculated the percent change of the claims rates, accrual rates, and warranty reserve end-balances, from 2023 to 2024. For each metric, we ranked the companies by their rates of change. Figures 1, 3, and 5 show the largest reductions in these metrics, and Figures 2, 4, and 6 show the largest increases.

With six charts in this report, three showing reductions and three showing increases, each manufacturer in the top 100 had a maximum of three possible appearances.

Just two companies appeared in three charts, HVAC manufacturer Carrier Global Corp., which had three of the largest warranty metric increases, and off-road vehicle manufacturer Polaris Inc., which saw three of the largest warranty metric reductions.

15 manufacturers appeared in two charts: Advanced Micro Devices Inc., Boeing Co., Brunswick Corp., CommScope Inc., General Electric Co. (recently re-branded to GE Aerospace), Illumina Inc., Insulet Corp., Johnson Controls, Lucid Group Inc., Nvidia Corp., Peloton Interactive Inc., Rivian Automotive Inc., RTX Corp. (formerly Raytheon), Winnebago Industries Inc., and Woodward Inc.

There were 24 companies that made just one chart. 59 companies, the majority in our top 100 list, made no charts at all. Thus, large fluctuations in the warranty expense rates are not the norm, and it's worth taking a look at those manufacturers that are experiencing more instability in their warranty costs than is typical.

Claims Rate Reductions

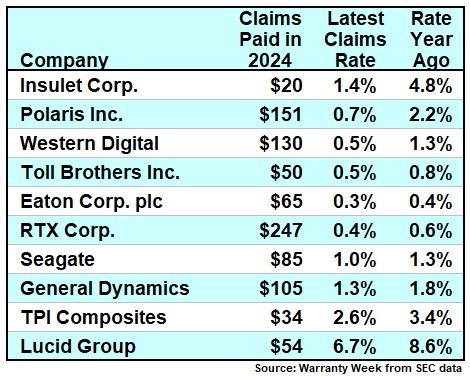

Figure 1 shows the ten largest warranty claims rate reductions from 2023 to 2024. This is great news for these companies, meaning they're spending a lower percentage of their total product sales revenue on paying warranty claims.

Figure 1

Top 100 U.S.-based Warranty Providers:

Top Ten Claims Rate Reductions,

Calendar Year 2023 vs. 2024

(claims as a % of product sales)

Insulet Corp. is a manufacturer of insulin pumps, which in 2023 underwent a voluntary recall for two types of insulin pump, one for an issue with the battery, and the other for an issue with the charging port. From 2023 to 2024, Insulet's claims rate was reduced by about three-quarters, from 4.8% to 1.4%. Insulet was second on the list of the top claims rate increases from 2022 to 2023, so this reduction in Insulet's claims rate marks the end of this recall.

Polaris Inc., maker of snowmobiles and ATVs, saw its claims rate reduced from 2.2% to 0.7%. Hard drive and data storage system manufacturer Western Digital Corp. also saw its claims rate reduced by more than half from 2023 to 2024, from 1.3% to 0.5%.

New home manufacturer Toll Brothers Inc., power management company Eaton Corp., and aerospace and defense conglomerate RTX Corp. all saw their claims rate reduced by about one-third from 2023 to 2024.

Insulet, along with electric vehicle manufacturer Lucid Group, both make two chart appearances, in Figure 1 and Figure 6. That means that both saw significant reductions in their claims rates, but large increases in their warranty reserve end-balance, from 2023 to 2024.

RTX also appears in two charts, Figure 1 and Figure 3. This is a classic pairing, meaning that RTX saw reductions in its claims and accrual rates over the same period.

Claims Rate Increases

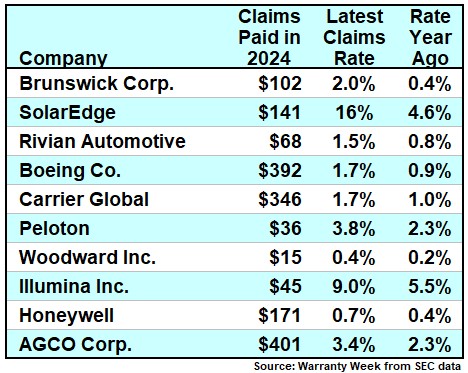

Generally, a significant increase in the warranty claims rate is not good news, and often reflects a recall, a fault product, or a drop in quality. However, an increase in the claims rate can also reflect a decrease in product sales, but claims costs staying the same, as was the case for two of the manufacturers in Figure 2.

Figure 2

Top 100 U.S.-based Warranty Providers:

Top Ten Claims Rate Increases,

Calendar Year 2023 vs. 2024

(accruals as a % of product sales)

Marine recreation manufacturer Brunswick Corp. saw its claims rate more than quadruple from 2023 to 2024; in 2023, Brunswick had a claims rate of 0.4%, and in 2024, the company had a claims rate of 2.0%. Like we said, 2% isn't a particularly high claims rate, but the degree of the increase in just a year's time drew our attention. In the 2023 top 100, Brunswick had the fourth-largest claims rate reduction, showing a lot of fluctuation in the company's warranty expenses. Brunswick also appears in Figure 4 of this newsletter, with one of the largest accrual rate increases.

Solar inverter manufacturer SolarEdge Technologies Inc. saw its warranty claims rate more than triple from 2023 to 2024, but its total warranty claims costs only rose by 3% over the same period. As we previously reported in our October 2024 newsletter "Solar Power Warranty Expenses," SolarEdge lost more than 70% of its share value in 2023, and was dropped from the S&P 500 in the same year. The company's share price fell further, by over 80%, from January to December 2024. Thus, SolarEdge's claims rate rose from 4.6% to 15.6% in just a year, not because claims costs increased, but because revenue decreased by such a large degree.

EV manufacturer Rivian Automotive Inc. saw its warranty claims rate almost double, from 0.8% in 2023 to 1.5% in 2024. 2024 was only Rivian's second year of reporting its warranty expenses.

Aerospace manufacturer Boeing, HVAC manufacturer Carrier Global, and home exercise equipment manufacturer Peloton all saw their warranty claims rates increase by about three-quarters from 2023 to 2024.

However, Peloton, similar to SolarEdge, only saw a 1% increase in its total warranty claims costs from 2023 to 2024; instead, the sharp increase in the claims rate was the result of a drop in sales, rather than an increase in warranty claims payments.

Woodward Inc. is a manufacturer of control systems for aircraft and power generation equipment, a supplier for companies including Boeing, General Electric, and RTX, and a defense contractor. Woodward saw its claims rate increase by two-thirds from 2023 to 2024, but strangely, actually saw a reduction in its total claims payments over the same period. In 2023, Woodward paid $42 million in claims, with a claims rate of 0.2%; in 2024, Woodward paid $15 million in claims, with a claims rate of 0.4%.

Woodward and Boeing both appear in two charts in this newsletter, Figure 2 and Figure 3, pairing their claims rate increases with accrual rate reductions.

Along with Brunswick, Peloton and Illumina both appear in Figures 2 and 4, with increases in their claims and accrual rates. Rivian appears in Figures 2 and 6, with an increase in its warranty reserve balance along with the increase in the claims rate.

Accrual Rate Reductions

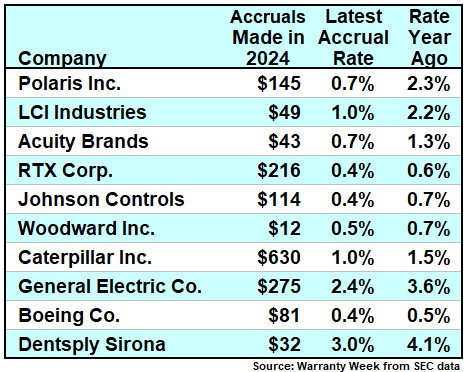

Figure 3 shows the ten largest warranty accrual rate reductions from 2023 to 2024. This is great news, showing savings on warranty compared to total product sales.

Figure 3

Top 100 U.S.-based Warranty Providers:

Top Ten Accrual Rate Reductions,

Calendar Year 2023 vs. 2024

(accruals as a % of product sales)

Along with the second-largest claims rate reduction, Polaris had the largest accrual rate reduction of 2024 among the top 100. Polaris' accrual rate was reduced by about two-thirds, from 2.3% in 2023 to 0.7% in 2024.

RV parts manufacturer LCI industries and lighting and building controls manufacturer Acuity Brands both saw their accrual rates cut in half from 2023 to 2024.

RTX reduced its accrual rate by two-fifths. HVAC and security system manufacturer Johnson Controls, Woodward Inc., heavy equipment manufacturer Caterpillar, and General Electric, recently rebranded to GE Aerospace, all reduced their warranty accrual rate by one-third from 2023 to 2024.

GE's total warranty accruals were reduced by three-quarters, and its accrual rate was reduced by one-third. This was due to the spin-off of GE's power and renewable energy divisions as GE Vernova, which took place in April 2024.

Boeing, along with dental equipment manufacturer Dentsply Sirona Inc., both reduced their accrual rates by one-quarter from 2023 to 2024.

Accrual Rate Increases

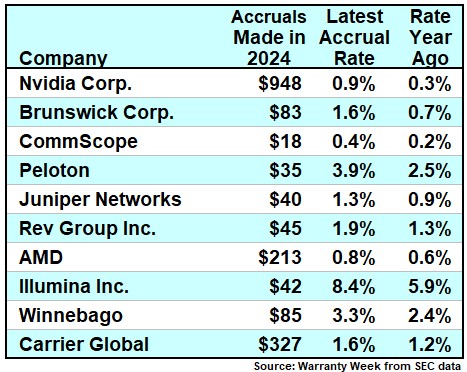

Figure 4 shows the 10 largest warranty accrual rate increases from 2023 to 2024.

Figure 4

Top 100 U.S.-based Warranty Providers:

Top Ten Accrual Rate Increases,

Calendar Year 2023 vs. 2024

(accruals as a % of product sales)

For the second year in a row, GPU manufacturer Nvidia Corp. had the largest accrual rate increase amongst the top 100. From 2023 to 2024, Nvidia tripled its accrual rate from 0.3% to 0.9%. It's also worth noting that over the same period, Nvidia octupled its total warranty accruals, from $109 million in 2023 to $948 million in 2024.

Three manufacturers in Figure 4 had significant accrual rate increases, but only increased their total accruals by less than 10%, meaning that the increase in the accrual rate is due to a decrease in product sales revenue. Brunswick Corp. only saw its total accruals increase by 6%, but its accrual rate more than doubled. Biotechnology manufacturer Illumina Inc. accrued the same total amount, $42 million, in 2023 and 2024, but its product revenue decreased, leading to the accrual rate increasing by two-fifths.

And telecom manufacturer CommScope saw its accrual rate increase by three-quarters from 2023 to 2024, but actually decreased its total accruals by -15% over the same period. Due to a decrease in product revenue, a smaller total amount of warranty accruals was a much larger percentage of sales.

Router manufacturer Juniper Networks and GPU manufacturer Advanced Micro Devices Inc. both make their only appearance in this newsletter in Figure 4. Winnebago and CommScope both also appear in Figure 5, the top 10 warranty reserve reductions.

Warranty Reserve Reductions

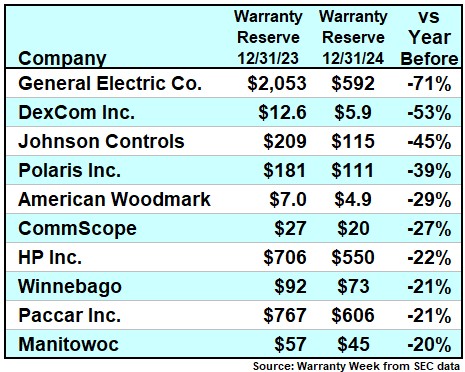

Figure 5 shows the 10 largest warranty reserve reductions from 2023 to 2024.

Figure 5

Top 100 U.S.-based Warranty Providers:

Top Ten Warranty Reserve Reductions,

Calendar Year 2023 vs. 2024

(accruals as a % of product sales)

GE Aerospace had the largest warranty reserve reduction, unsurprising considering the spin-off of GE Vernova, which accounted for a majority of GE's product warranty expenses.

Glucose monitoring system manufacturer Dexcom cut its warranty reserves in half from 2023 to 2024.

Along with reducing their warranty reserves, GE Aerospace, Johnson Controls, and Polaris also reduced their accrual rates, appearing in Figure 3. CommScope and Winnebago both increased their accrual rates, appearing in Figure 4.

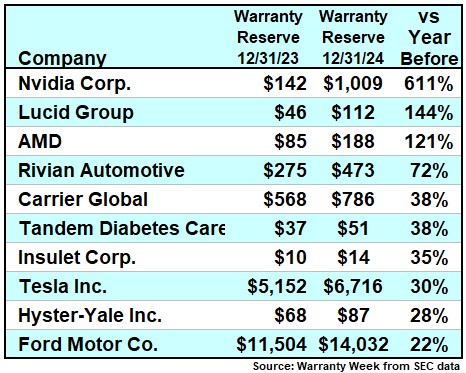

Warranty Reserve Increases

Figure 6 shows the top 10 warranty reserve increases from 2023 to 2024.

Figure 6

Top 100 U.S.-based Warranty Providers:

Top Ten Warranty Reserve Increases,

Calendar Year 2023 vs. 2024

(accruals as a % of product sales)

Nvidia septupled its warranty reserve balance from 2023 to 2024. It looks like the majority of the company's added accruals — which caused it to appear in Figure 4, the largest accrual rate increases — were deposited directly into the warranty reserve fund.

Tandem Diabetes Care, Tesla, Hyster-Yale Inc., and Ford all make their only appearance in this newsletter in Figure 6.