GE's Warranty Expenses by Industry:

As of April 2024, GE is now three separate companies: GE Aerospace (the successor to the parent), GE Vernova (formerly GE Power & GE Renewable Energy), and GE HealthCare. Now that each spin-off has filed its first annual report, we can break down the former GE's warranty expenses by industry. Broadly speaking, 55% to 65% of GE's product warranty expenses were from the power generation industry, 15% to 25% were from aerospace, and about 20% were from healthcare.

Back in 2004, warranty industry veteran Terry Hawkins told us he believed that GE invented the extended warranty in 1935, when its Electric Refrigeration Department sold a five-year extended warranty plan for the Monitor Top Refrigerator. Over two decades later, it's still the oldest service contract we've heard of.

General Electric, its products, and its warranties have changed so much since that interview with Hawkins 20 years ago. In the wake of the Great Recession, GE started divesting significant portions of its business. First, GE sold half of NBC Universal to Comcast in 2011, and then the other half in 2013.

The GE Capital division was hit especially hard by the Great Recession, prompting the company's retreat from finance and re-focus on industry. GE divested the GE Capital Retail Finance Corp. as Synchrony Financial in 2014. In 2015, GE sold the majority of its property business to Wells Fargo and Blackstone. Also in 2015, GE Capital's private equity lending portfolio was sold to the Canada Pension Plan Investment Board.

Then, in 2016, it sold the GE Appliance division (including licensing the brand name) to the China-based Haier Group. Next, in 2019, it sold the GE Transportation division to Wabtec (Westinghouse Air Brake Technologies Corp.). In 2020, it sold the GE Lighting division to Savant Systems Inc., a divestment that meant GE no longer sold any consumer goods, nor any financial or investment services.

Ultimately, GE's plan for recovery from the Great Recession was attacked from two sides, with its Aviation division devastated by the pandemic, and its Renewable Energy division facing unexpected challenges with its wind turbines. In November 2021, GE announced a plan to split into three separate companies, which was completed in April 2024.

First, GE renamed its Aviation division to GE Aerospace in July 2022. Next, on January 4, 2023, GE HealthCare Technologies Inc. was spun-off from the parent GE.

In early 2024, the GE Renewable Energy, GE Power, GE Digital, and GE Energy Financial Services divisions were combined into GE Vernova. Then, on April 2, 2024, GE Vernova was spun-off from the parent GE, which renamed itself to GE Aerospace.

In February 2025, GE Vernova published its first annual report, and GE Aerospace published its first annual report since the spin-offs occurred.

We perused the annual and quarterly reports of GE Aerospace, GE Vernova, GE HealthCare, and the former General Electric, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund. In addition, we gathered data on each corporate entity's product sales revenue, and used these to calculate two additional warranty statistics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

GE only reported its warranty data annually, rather than quarterly, so we've had to wait until now to get a breakdown of what percentage of the former GE's product warranty costs came from each industry division. GE Aerospace and GE Vernova have followed the reporting style of their former parent, but GE HealthCare reports its warranty expenses on a quarterly basis.

On the bright side, conveniently enough, each new spin-off provided historical data for us in their 2024 annual reports. GE Aerospace and GE Vernova both provided product warranty data for 2022, 2023, and 2024 in their 2024 annual reports. GE HealthCare published its first annual report for 2022, and also provided two previous years of data.

Thus, we have annual GE HealthCare data starting in 2020, and GE Vernova and GE Aerospace data starting in 2022. For 2022 and 2023, we have the historical data provided by GE Aerospace and GE Vernova in their 2024 annual reports, along with the data previously reported by GE in its 2022 and 2023 annual reports. After divesting GE HealthCare, GE updated its historical totals to be sans warranty expenses from that division. GE Aerospace similarly released historical numbers that exclude the expenses of GE Vernova, even from before the two split up.

Therefore, 2022 is a very unique year in these data, since we have data available from the 2022 GE annual report, along with historical data provided by GE HealthCare, GE Vernova, and GE Aerospace in their 2024 annual reports. Since 2022 was before any of the spin-offs occurred, this is a wonderful insight into the composition of GE's warranty expenses by industry before the breakup, something that was always an opaque mystery to us.

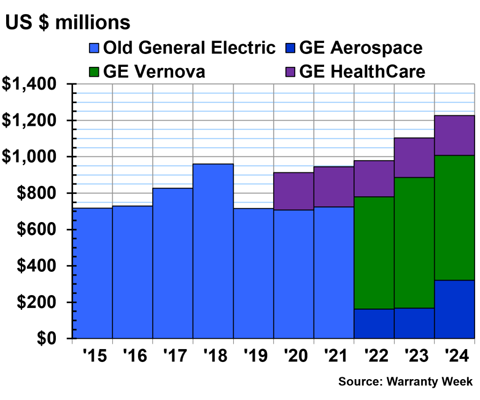

Warranty Claims Totals

First, let's take a look at the breakdown of the warranty expenses of GE, and its subsequent three spin-offs, from 2015 to 2024, in Figure 1.

In the following three charts, based on the color of each division's logos, the former GE is represented by light blue, the successor GE Aerospace is represented by dark blue, GE Vernova is dark green, and GE HealthCare is purple.

Figure 1

The GE Spin-Offs:

Claims Paid by GE & Successor Companies

(in millions of U.S. dollars, 2015-2024)

In 2022, GE reported paying $967 million in product warranty claims.

In its 2022 annual report, GE HealthCare reported paying $199 million in warranty claims. Since the spin-off of GE HealthCare technically took place in January 2023, these funds are double-counted in the GE and GE HealthCare annual reports for 2022.

Thus, we can do a little math, and calculate that GE paid $768 million in warranty claims between the divisions that later split into Aerospace and Vernova. $199 million is about 20% of $967 million, so in 2022, one-fifth of the warranty claims paid by GE were for products sold by the GE HealthCare division.

In their 2024 annual reports, GE Aerospace and GE Vernova both provided their own warranty data for 2022 and 2023, which differed than those reported by the former parent GE back in its 2022 annual report.

In their 2024 annual reports, GE Vernova reported paying $617 million in warranty claims in 2022, and GE Aerospace reported paying $162 million in warranty claims in 2022.

Our readers gifted at addition will notice that $617 million (Vernova), plus $162 million (Aerospace), plus $199 million (HealthCare), does not equal the original $967 million figure reported by GE back in 2022. The sum of these three numbers is $978 million. However, what's $11 million among friends? We'll base our proportions on our new sum of $978 million in claims paid by GE in 2022.

In 2022, GE Vernova products accounted for 63% of all warranty claims paid by the parent GE, GE Aerospace products accounted for 17% of warranty claims, and GE HealthCare products accounted for 20%.

It's quite possible that the GE Aerospace warranty claims costs were so low in 2022 because sales across the aviation sector were driven down so much by the pandemic.

In 2023, the parent GE reported paying $886 million in warranty claims. Since GE HealthCare was spun-off in January of that year, this figure only includes the warranty claims paid by GE Vernova and GE Aerospace.

According to their respective 2024 annual reports, GE Vernova paid $719 million in claims in 2023, and GE Aerospace paid $167 million in claims.

Thus, in 2023, 81% of the parent GE's warranty claims payments were for products sold by GE Vernova, and 19% of GE's claims paid were for GE Aerospace products.

Let's take this a step further, and add in GE HealthCare's warranty claims paid for 2023. GE HealthCare paid $218 million in claims in 2023. Added to the former parent GE's $886 million, we have $1.104 billion in warranty claims paid across these three GE-branded divisions.

Based on that total, in 2023, GE Vernova accounted for 65% of claims paid, GE Aerospace accounted for 15% of claims, and GE HealthCare accounted for 20% of claims. That's just about the same split as we saw in 2022.

We can see in Figure 1 that GE Aerospace's claims payments nearly doubled from 2023 to 2024. So, even though the three divisions were officially all split up in April 2024, let's do some more math just to see if we find the same proportions between the warranty expenses of the three companies.

In 2024, GE Vernova paid $686 million in claims, GE Aerospace paid $321 million, and GE HealthCare paid $220 million. Based on these figures, GE Vernova accounted for 55% of claims paid in 2024, GE Aerospace accounted for 26% of claims, and GE HealthCare accounted for 18%.

Overall, for the three years for which we have these breakdowns between the three divisions, GE Vernova accounted for 55% to 65% of total warranty claims paid, GE Aerospace accounted for 15% to 26% of claims, and GE HealthCare accounted for 18% to 20% of claims.

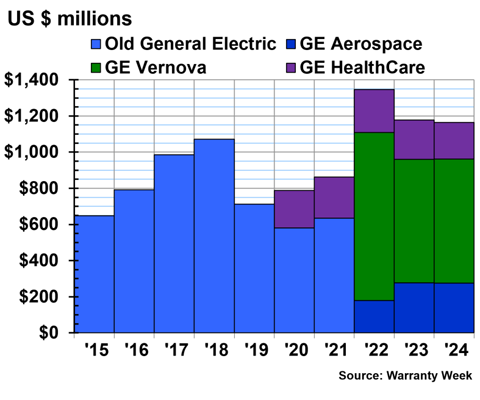

Warranty Accrual Totals

Figure 2 shows the total warranty accruals made by GE and its three successor spin-offs, from 2015 to 2024.

Figure 2

The GE Spin-Offs:

Accruals Made by GE & Successor Companies

(in millions of U.S. dollars, 2015-2024)

We're going to do a similar set of calculations for accruals as we just did for claims.

In 2022, GE reported setting aside $1.319 billion in warranty accruals.

In its 2022 annual report, GE HealthCare reported accruing $238 million for warranty. And in their 2024 annual reports, GE Vernova reported $928 million in warranty accruals in 2022, and GE Aerospace reported $180 million in accruals in 2022.

Added together, these three numbers total $1.346 billion. Again, we'll ignore the $27 million discrepancy, that's small change to us. But we'll use the higher total as the denominator for our calculations.

So in 2022, GE Vernova products accounted for 69% of warranty accruals, GE Aerospace products accounted for just 13% of accruals, and GE HealthCare accounted for 18% of accruals.

In 2023, the parent GE reported $961 million in accruals. Since GE HealthCare was divested in January 2023, this figure comprises of accruals made for GE Vernova and GE Aerospace products.

In their 2024 annual reports, GE Vernova reported $684 million in warranty accruals made in 2023, and GE Aerospace reported $277 million in accruals in 2023. That means that in 2023, GE Vernova accounted for 71% of the parent GE's total warranty accruals, while GE Aerospace accounted for 29% of accruals.

If we add the parent GE's $961 million in accruals made in 2023 to GE HealthCare's $216 million in accruals made that year, we get a total of $1.177 billion.

Based on that total, in 2023, GE Vernova accounted for 58% of accruals, GE Aerospace accounted for 24% of accruals, and GE HealthCare accounted for 18%.

In 2024, GE Vernova accrued $687, GE Aerospace accrued $275 million, and GE HealthCare accrued $202 million. Based on these figures, the proportions for 2024 accruals break down as: 59% GE Vernova, 24% GE Aerospace, and 17% GE HealthCare.

Overall, for the three years, based on all three divisions as parts of a whole, GE Vernova accounted for 58% to 69% of warranty accruals, GE Aerospace accounted for 13% to 24% of accruals, and GE HealthCare accounted for 17% to 18% of accruals.

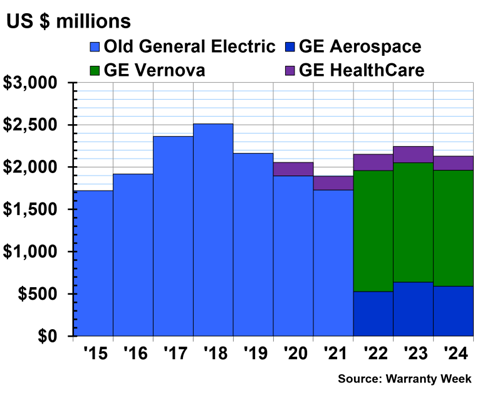

Total Warranty Reserves Held

Figure 3 shows the warranty reserve year-end-balances for GE and its three spin-off divisions, from 2015 to 2024.

Figure 3

The GE Spin-Offs:

Reserves Held by GE & Successor Companies

(in millions of U.S. dollars, 2015-2024)

At the end of 2022, GE HealthCare reported a warranty reserve balance of $193 million. In their 2024 annual reports, GE Vernova reported a 2022 warranty reserve fund end-balance of $1.430 billion, and GE Aerospace reported a 2022 end-balance of $528 million.

Proportionally, GE Vernova accounted for 66% of the parent GE's warranty reserves at the end of 2022, GE Aerospace accounted for 25%, and GE HealthCare accounted for 9%.

At the end of 2023, GE Vernova held $1.414 billion in reserves, GE Aerospace held $639 million, and GE HealthCare held $192 million. Proportionally, GE Vernova held 62% of total reserves between the three divisions, GE Aerospace held 28% of reserves, and GE HealthCare held 9%.

At the end of 2024, GE Vernova held $1.370 billion in reserves, GE Aerospace held $592 million, and GE HealthCare held $168 million. Proportionally, GE Vernova held 64% of total reserves between the three divisions, GE Aerospace held 28%, and GE HealthCare held 8%.

Overall, GE Vernova held 63% to 66% of the parent GE's total warranty reserves, GE Aerospace held 25% to 28%, and GE HealthCare held 8% to 9%.