U.S. Auto Warranty Annual Reports:

For the third quarter in a row, total warranty claims paid, accruals made, and reserves held collectively set new record highs amongst the three largest U.S.-based auto OEMs, Ford, GM, and Tesla. Ford and GM set aside even more additional funds as changes of estimate to accruals from previous quarters.

The GM Bolt battery fires. The Tesla autopilot recalls. The mid-2024 Ford stock plummet. Sometimes, warranty stories are big enough that they make it into mainstream news media. Articles throw out numbers that represent "warranty costs," but it's not always clear what statistics those figures represent.

While Warranty Week compiles an index of warranty industry headlines, warranty as a topic doesn't often make it into the headlines of publications outside of our industry. So when it does, as we saw with Ford last year, we take notice. With our expertise in reading and analyzing the data in the warranty tables of annual reports, we've set out to put hard data behind the sensational headlines and investor discontent.

This week, we're taking an in-depth look at the last five years of warranty expenses from the three largest U.S.-based auto OEMs, Ford, GM, and Tesla.

Our main takeaway is, yes, Ford faced a challenging two years of higher-than-expected warranty costs. However, GM and Tesla have also seen their warranty expenses rise to new heights in recent years. As we'll see in Figures 1, 3, and 7, the three OEMs collectively set new record highs for total warranty claims paid, accruals made, and reserves held. And as we'll see in Figures 5 and 6, Ford and GM have both been adding in rather significant extra accruals as changes of estimate to previous accruals, meaning that both OEMs under-accrued for new vehicles sold in previous quarters.

So perhaps Ford isn't lagging behind, as much as warranty costs for the whole industry have become less predictable than they used to be. We won't go as far as to say the quality of the vehicles is lower, because there are many factors at play, including price inflation from parts suppliers and dealers, as Ford stated in its 2024 annual report. Perhaps these repair issues are a consequence of OEMs adding so much technology into vehicles over the last decade, without introducing licensed electricians to dealer repair shops; cars have changed, but the repair process hasn't.

Of course, there's a little more at stake with large warranty problems than just extra unpredicted costs. As Ford noted in its 2024 annual report, "launch delays, recall actions, and increased warranty costs have adversely affected and could continue to adversely affect our reputation or the public perception and market acceptance of our products and services."

To compile this report, we gathered data from the annual reports and quarterly financial statements of the three largest U.S.-based auto OEMs, Ford Motor Co., General Motors Co., and Tesla Inc. We extracted three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund. We also gathered data on each manufacturer's quarterly product sales revenue, in order to calculate two additional warranty metrics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

In addition, we gathered data on each manufacturer's quarterly changes of estimate to accruals made during previous periods. The majority of changes of estimate are additional funds deposited into the warranty reserves to correct under-estimation of the product's future warranty costs; however, some changes of estimate are excess funds removed from the warranty reserves.

We don't add changes of estimate into our total accrual calculations, since these changes affect funds accrued during previous periods, and we'd run the risk of double-counting the same funds twice if we did this categorically. But without this metric, we're not telling the full story of Ford's 2023 and 2024 warranty troubles.

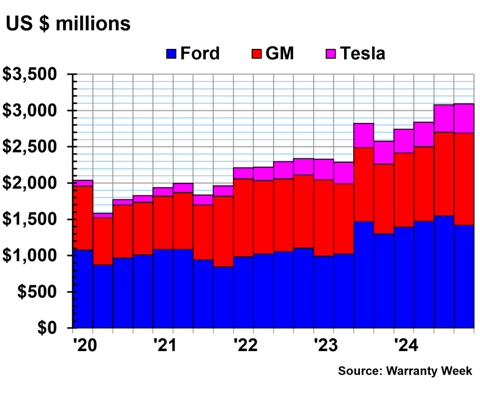

Warranty Claims Totals

First, we'll take a look at the total quarterly warranty claims costs for these three auto OEMs, from 2020 to 2024.

Figure 1

U.S.-based Auto Manufacturers

Claims Paid per Quarter

(in millions of U.S. dollars, 2020-2024)

In 2024, Ford spent a total of $5.83 billion on warranty claims payments. This was a 22% increase from 2023's total of $4.78 billion.

In 2024, Ford paid $1.39 billion in claims in the first quarter, $1.47 billion in the second quarter, $1.55 billion in the third quarter, and $1.42 billion in the fourth quarter.

GM paid $4.47 billion in warranty claims in 2024, a 12% increase from 2023's total of $4.01 billion. GM paid $1.02 billion in the first quarter, $1.03 billion in the second quarter, $1.15 billion in the third quarter, and $1.27 billion in the fourth quarter.

Tesla paid a total of $1.45 billion in warranty claims in 2024, a 19% increase from 2023's total of $1.23 billion. Tesla paid $328 million in claims in the first quarter, $340 million in the second quarter, $380 million in the third quarter, and $405 million in the fourth quarter.

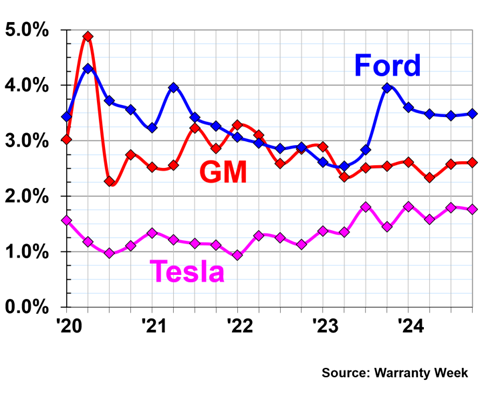

Warranty Claims Rates

Figure 2 shows the quarterly warranty claims rates of the three auto OEMs from 2020 to 2024.

Figure 2

U.S.-based Auto Manufacturers

Warranty Claims Rates

(as a % of product sales, 2020-2024)

We can see in Figure 2 that Ford's warranty claims rate rose in the fourth quarter of 2023, and has stayed high since then. Ford' warranty claims rates stayed right around 3.5% in 2024. In the fourth quarter of 2024, Ford had a warranty claims rate of 3.49%.

GM had the next-highest warranty claims rate, staying around 2.6% in 2024. In the fourth quarter of 2024, GM had a claims rate of 2.61%.

Tesla's claims rates stayed around 1.8% in 2024. In the fourth quarter of 2024, Tesla had a warranty claims rate of 1.76%.

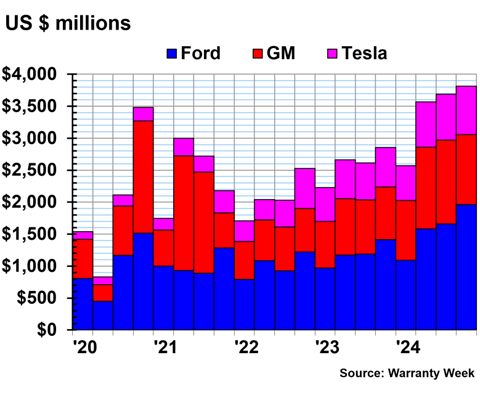

Warranty Accrual Totals

Figure 3 shows the total warranty accruals of the three auto manufacturers from 2020 to 2024.

Later on, in Figures 5 and 6, we'll take a look at the changes of estimate to previous accruals made by Ford and GM over the same period.

Figure 3

U.S.-based Auto Manufacturers

Accruals Made per Quarter

(in millions of U.S. dollars, 2020-2024)

In 2024, Ford set aside the largest sum of funds for future warranty costs amongst the three, but General Motors increased its warranty accruals by the largest increment.

Ford accrued $6.29 billion in 2024, a 33% increase from 2023's total of $4.74 billion. Ford accrued $1.09 billion in the first quarter, $1.58 billion in the second quarter, $1.66 billion in the third quarter, and $1.97 billion in the fourth quarter.

GM accrued $4.62 billion in 2024, a 41% increase from 2023's total of $3.28 billion. GM accrued $934 million in the first quarter of 2024, $1.28 billion in the second quarter, $1.31 billion in the third quarter, and $1.09 billion in the fourth quarter.

Tesla accrued $2.73 billion in 2024, a 17% increase from 2023's total warranty accruals of $2.33 billion. Tesla accrued $547 million in the first quarter, $710 million in the second quarter, $717 million in the third quarter, and $756 million in the fourth quarter.

In Figure 4, we'll take a look at these increases compared to changes in total product revenue, presented as the quarterly accrual rates.

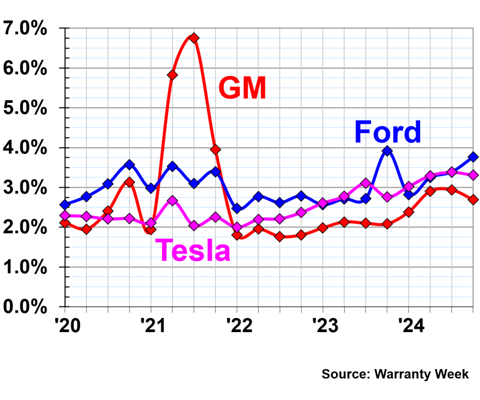

Warranty Accrual Rates

Figure 4 shows the warranty accrual rates of the three auto OEMs from 2020 to 2024.

Figure 4

U.S.-based Auto Manufacturers

Warranty Accrual Rates

(as a % of product sales, 2020-2024)

Ford's accrual rates were on an upward trajectory in 2024. Ford started 2024 with an accrual rate of 2.82% in the first quarter. By the fourth quarter of 2024, Ford's accrual rate rose to 3.76%.

Tesla's accrual rates continued to exceed those of GM in 2024, meaning that although GM spends more total on warranty, Tesla is spending a larger percentage of revenue.

In the fourth quarter of 2024, Tesla had a warranty accrual rate of 3.31%. In the same quarter, GM had an accrual rate of 2.69%.

Changes of Estimate to Previous Accruals

When a company sells a product covered by warranty, it is supposed to estimate that warranty's future cost, and set that amount aside as a warranty accrual. Over time, it is supposed to use its actual claims cost to help adjust those estimates up or down.

These so-called changes of estimate are corrections of past predictions of repair costs that turned out to be too low, or in some cases, too high. In general, positive changes of estimate (extra funds accrued) mean that products are breaking more frequently than expected, or that the repairs are turning out to be much more expensive than predicted, while negative changes of estimate (previous accruals removed from warranty reserves) mean that products are breaking less frequently and repairs are cheaper than expected.

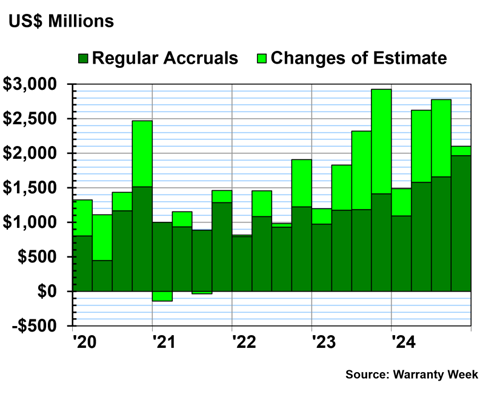

Figure 5 shows Ford's regular accruals, the same sums shown in Figure 3, along with Ford's changes of estimate to previous accruals. The light green bar represents the extra funds that Ford accrued, because warranty repairs for vehicles sold in previous quarters were turning out to be more expensive than predicted.

Figure 5

Ford Motor Co.

Accruals & Changes of Estimate Made per Quarter

(in US$ millions, 2020-2024)

In the first quarter of 2024, Ford set aside $1.09 billion in regular accruals, and added in an additional $397 million in changes of estimate.

In the second quarter, the financial results of which prompted an 18% drop in Ford's stock price in one day, Ford accrued $1.58 billion, and set aside an additional $1.04 billion in changes of estimate.

In the third quarter, Ford set aside $1.66 billion in regular accruals, and added in an additional $1.12 billion in changes of estimate.

And in the fourth quarter, Ford accrued $1.97 billion, and set aside an additional $134 million in changes of estimate.

Overall, in 2024, Ford accrued $6.29 billion, and added an additional $2.69 billion in changes of estimate.

In 2023, Ford accrued $4.74 billion, and added an additional $2.65 billion in changes of estimate.

Although Ford accrued slightly more total funds as changes of estimate in 2024 than in 2023, changes of estimate were larger in proportion to regular accruals in 2023, compared to 2024.

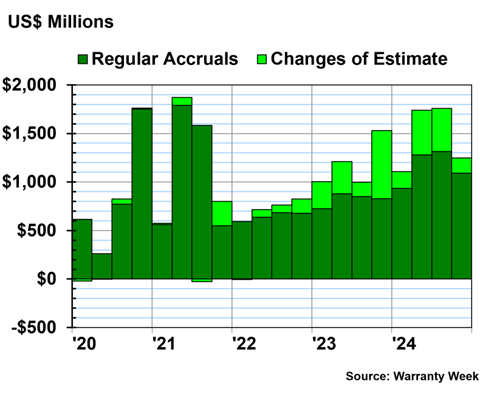

Figure 6 shows regular accruals and changes of estimate for GM over the same period. Note than Figure 5 and Figure 6 have different y-axis scales.

Figure 6

General Motors Co.

Accruals & Changes of Estimate Made per Quarter

(in US$ millions, 2020-2024)

In the first quarter of 2024, GM accrued $934 million, and added an additional $174 million in changes of estimate. In the second quarter, GM accrued $1.28 billion, and added $463 million in changes of estimate. In the third quarter, GM accrued $1.31 billion, and added $444 million in changes of estimate. And in the fourth quarter, GM accrued $1.09 billion, and added $156 million in changes of estimate.

Overall, in 2024, GM set aside $4.62 billion in regular accruals, and added an additional $1.24 billion in changes of estimate. In 2023, GM accrued $3.28 billion, and added an additional $1.46 billion in changes of estimate.

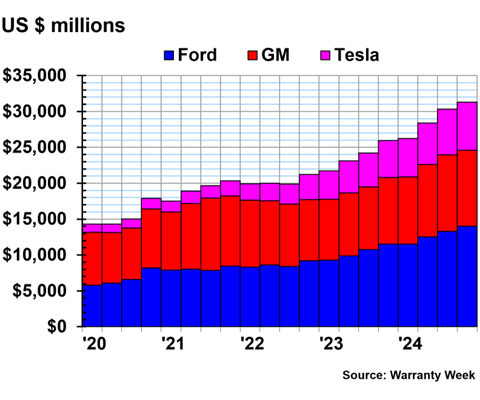

Warranty Reserve Balances

Our final warranty metric is the balance of the warranty reserve fund at the end of each quarter. Figure 7 shows the quarterly warranty reserve end-balances for these three U.S.-based auto OEMs, from 2020 to 2024.

Figure 7

U.S.-based Auto Manufacturers

Reserves Held per Quarter

(in millions of U.S. dollars, 2020-2024)

At the end of 2024, these three auto OEMs collectively held $31.32 billion in warranty reserves. As with warranty claims and accruals, this was the largest sum ever, the most recent in a long line of record-breaking quarters of warranty expenses.

Ford held the largest total reserve fund, but Tesla increased its reserves the most from the end of 2023 to the end of 2024.

At the end of 2024, Ford held $14.03 billion in warranty reserves, a 22% increase from the end of 2023.

On December 31, 2024, Tesla held $6.72 billion in warranty reserves, a 30% increase from the end of 2023.

And GM held $10.57 billion at the end of 2024, a 14% increase from the end of 2023.