Service Contract Pricing: Electronics Summary:

The average consumer electronics service contract cost 20% of the product price, but we found a wide spectrum of plans for sale online, with pricing varying based on duration of coverage and the inclusion of accidental damage protection. Coverage lengths ranged from one to five years, and plan to product price ratios ranged from 1% to 410%.

We're wrapping up our Service Contract Pricing series this week with a summary of the 1,144 unique product protection plans we found online, covering six different types of consumer electronics. Over the last six newsletters, we've surveyed the extended service contract offerings of online retailers, for televisions, video game consoles, laptops, printers, computer accessories, and smart home cameras.

In those six newsletters, we catalogued the prices of products, and the protection plans offered for them, sold by 33 different online retailers. That list includes 13 retailers that are clients of Allstate, and 22 retailers that are clients of one of 19 other service contract administrators. This includes some manufacturers and retailers that were administrator and/or obligor of their own plans, and used a warranty group as the insurance underwriter.

Service Contract Administrators

Allstate acquired SquareTrade in early 2017, and began underwriting all of the administrator's extended service contracts. The 13 retailers we found working with Allstate were: Abt Electronics, B&H (along with manufacturer plans), BrandsMart (for certain products), BuyDig, Costco, eBay, Home Depot, HSN, Office Depot, QVC, Sam's Club, Target, and Walmart.

While the majority are now branded as "Allstate Protection Plans," Walmart and BuyDig sell plans branded as "SquareTrade, an Allstate company." Overall, about 38% of all 1,144 data points we collected in this series were Allstate plans. These plans all used obligor CE Care Plan Corp., administrator SquareTrade, Inc., and underwriter Allstate Insurance Company.

The 22 retailers working with other administrators and underwriters were: Adorama, Amazon, Best Buy, BJ's, DataVision, Dell, Electronic Express, Epson, GameStop, Home Depot, HP, HSN, Jetson TV & Appliance, Lenovo, Lowe's, Micro Center, Microsoft, Newegg, P.C. Richard & Son, Samsung, Staples, and Tech for Less. In addition, B&H and BrandsMart sold plans from other administrators, along with the Allstate plans.

BrandsMart sold Allstate plans for laptops, but for printers, computer accessories, and smart home cameras, it sold plans administrated by ProtectALL USA, LLC, with obligor First Shield Consumer Service Corp. ProtectALL's plans are underwritten by Arch Insurance Company, a branch of Arch Capital Group.

B&H sold Allstate plans for electronics, but also offered manufacturer plans when available. Thus, B&H also sold HP plans, with HP Inc. as obligor and administrator, using underwriter AIG; Lenovo plans, with Lenovo Inc. as administrator and obligor, and underwriter Assurant; Canon plans, with administrator Canon USA Inc., and obligor and underwriter AmTrust; and Sony plans, with administrator Servify, and obligor and underwriter AmTrust.

AmTrust and Assurant were popular choices for manufacturer-branded extended warranties. Along with being obligor and underwriter for Canon and Sony plans, AmTrust was the administrator and obligor, as Northcoast Warranty Services, Inc., and underwriter, as Wesco Insurance Company, for Microsoft protection plans. Assurant was the administrator for Samsung's Samsung Care+ plans, as Federal Warranty Service Corporation.

Epson also sold plans underwritten by AmTrust, but using Guardsman US LLC as the administrator and obligor. And Dell was administrator and obligor of its own plans, using Starr Indemnity as the underwriter.

Best Buy had its own service network, the Geek Squad, but used AIG as the administrator, obligor, and underwriter for its extended warranty plans.

Micro Center also had its own service network, and served as the administrator, as Micro Electronics, Inc. d.b.a. Micro Center, and obligor, as National Product Care Company, of its own extended warranties. These plans used Virginia Surety Company, Inc., a branch of Assurant, as the insurance underwriter.

GameStop was also the administrator and obligor of its own protection plans, as GameStop, Inc., using Liberty Mutual Insurance Company as the underwriter.

Lowe's used Assurant as the administrator and obligor, as Federal Warranty Service Corp., and underwriter, as American Bankers Insurance Company of Florida, for its protection plans.

Asurion was the administrator, as Asurion Services, LLC, and obligor, as Asurion Service Plans, Inc., of the plans sold by Amazon, BJ's, and Staples, using Continental Casualty Company, owned by CNA Financial Group, as the underwriter.

Continental Casualty Company was also the underwriter of the Extend plans sold at Adorama, with administrator and obligor Extend Warranty Services Corp.

Newegg sold plans from administrator and obligor Likewize Device Protection, LLC, using underwriter Universal Underwriters Insurance Company, owned by Zurich Insurance Group.

Two online retailers, DataVision and Tech for Less, sold plans from administrator and obligor Consumer Priority Service.

And then there were three regional chains, Electronic Express, Jetson TV & Appliance, and P.C. Richard & Son, that administrated their own extended warranty programs.

Top Consumer Electronics Categories

At each retailer, we shopped for televisions, game consoles, laptops, printers, computer accessories, and smart home cameras. However, the scope of our online search grew as the series progressed, and as such, we did not initially collect data from BrandsMart or Newegg for TVs or game consoles, nor did we collect data from Adorama for TVs, game consoles, or laptops.

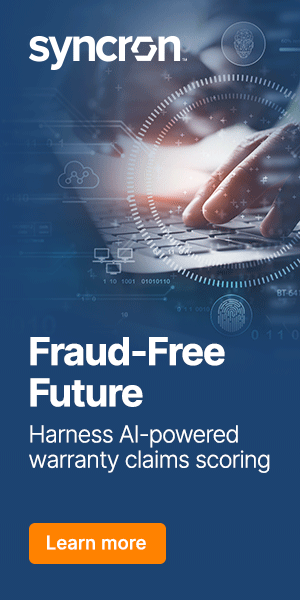

In all, we collected 1,144 data points, each a protection plan attached to a product. These extended warranties ranged in duration from one year to five years. As we can see in Figure 1, the vast majority were two- or three-year plans.

Figure 1

Length of Service Contracts Offered

(in years of protection)

We found products ranging in price from $13 to $13,760, and corresponding extended service contracts priced from $1 to $1,000. The former was for a computer mouse from Micro Center, while the latter was for a color laser duplex printer from B&H.

When we divided the price of the service contract by the price of the product it protected, we got a range of percentages that were nothing short of surprising. At one extreme, Office Depot and Allstate wanted only $110 to protect a $8,025 large-format printer for two years (1%), while at the other extreme, Tech for Less and Consumer Priority Service wanted $43 to protect a $10 computer mouse for two years (410%).

It pays to shop around, not only for the product, but also for the protection plan. For some product categories, the price difference was attributable to either the presence or absence of accidental damage protection. For others, it was nothing more than the greed of the retailer or the price-setting inexperience of the administrator and/or underwriter. At best, some of the plans that cost more than the product itself could be coding errors, but we found them for sale nonetheless. Some prices are far too high, resulting in huge profits, while others are far too low, resulting in huge losses.

Plan Coverage

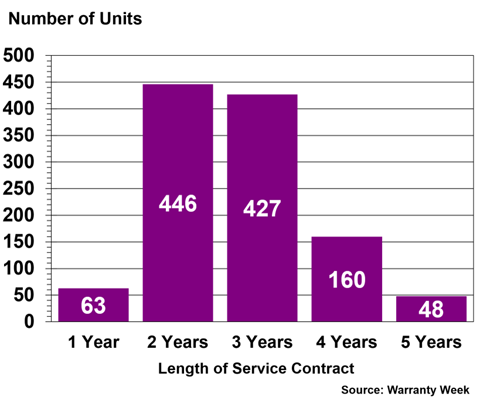

Some of the one- and two-year plans ran concurrently to the product warranty, and offered enhancements beyond the scope of that manufacturer's warranty, including protection from accidental damage from handling (ADH), hard drive data protection, in-home service, and beyond. But, as we can see in Figure 2, a small minority of these plans were "warranty extension" plans, which started only once the manufacturer's warranty expired.

Figure 2

Service Contract Start Dates

88, or 8%, of the 1,144 protection plans started once the manufacturer's warranty ended. These plans were: BJ's Protection Plans from Asurion, DataVision's In-Home Coverage Warranty from CPS, Epson's Replacement/ Repair Extended Service Plan from Guardsman and AmTrust, Micro Center's Extension Protection Plans, all of Newegg's plans from Likewize, Samsung Care+ plans from Assurant, and all of Tech for Less' plans from CPS.

Interestingly, BJ's also added an extra year onto the end of each product warranty, which it called the "BJ's Bonus Year." Any purchased extended warranty plan from BJ's seemed to begin once the manufacturer's warranty and bonus year were both over, so typically, the BJ's extended warranties started in year three of owning the product.

Average Price of Protection

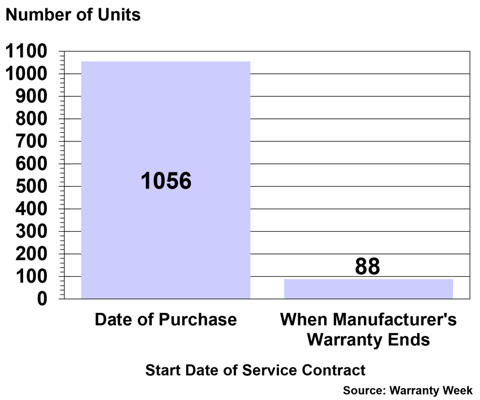

We took 1,144 product/ plan pairs, divided them into five sub-groups based on the length of coverage, and took an average for each. Those results are charted in Figure 3.

As one would expect, the short-term contracts were priced the lowest, while the five-year contracts were priced the highest. The overall average for all service contracts covering all six product categories was 20%.

Figure 3

Cost of Service Contracts Offered

Compared to Length of Coverage

(as a percentage of product price)

Overall, the two-, three-, and four-year plans were right on average, while the one-year plans were much lower than average, and the five-year plans were much higher than average.

We will note that we found a shocking number of outliers while collecting these data. The last time we did a survey of consumer electronics extended warranties, back in 2016, the most expensive plan cost 83% of the product price. This time, we found eight protection plans that cost more than the product itself.

Half of the eight outlier plans included ADH coverage: three computer accessories, and one laptop. However, if you're paying more than the product price for the protection plan, it's probably cheaper to just buy a new one if the old one breaks. Unless there's someone out there buying these plans who's speculating on inflation, and thinks the product price will increase before the product breaks.

Average Price per Product

Four of those outliers were protection plans for computer accessories, two were printers, and two were laptops. So perhaps it's unsurprising that these were the three product categories with the highest average service contract/ product price ratios, as shown in Figure 4.

Figure 4

Cost of Service Contracts Offered

Average for Six Types of Electronics

(as a percentage of product price)

TV protection plans were the least expensive, averaging 15% of the product's price. Next were game consoles, averaging 16%, and then smart home surveillance cameras and printers, both at 18%.

Above average were laptop and computer accessory protection plans. 69% of the laptop protection plans we found covered ADH, so it makes sense that these plans averaged a little higher at 22%.

But the service contracts we found for computer accessories, keyboards and mice, were the most shocking of the whole survey. We found four accessory protection plans that cost more than the product itself, and 12 total plans that cost more than half of the product price. Half of those 12 plans covered ADH.

Administrator Averages

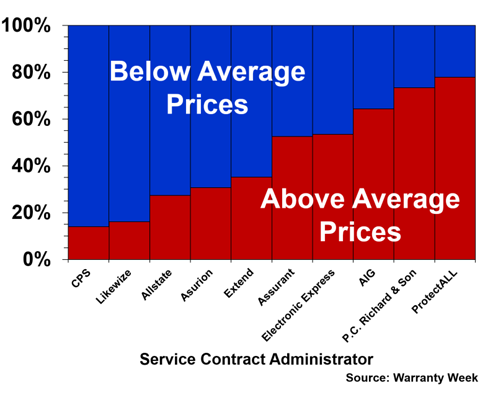

To create our final chart, we organized the product/ protection plan pairs by the name of the administrator. Then, once again, we took an average for each group. Figure 5 depicts the averages for 10 of the most common extended warranty administrators in the survey.

Figure 5

Percentage of Service Contracts

Above or Below Average

(for 10 warranty administrators)

The most expensive group was ProtectALL, with 78% of data points above the overall average of 20%, and 22% of data points below average.

Next was P.C. Richard & Son, which is a self-administering retailer that does not work with a third-party administrator or insurance underwriter. 73% of P.C. Richard & Son plans were above average, while 27% were below average. We doubt this is a coincidence. One of the primary values of working with outside administrators and insurance companies is the expertise they have when it comes to pricing protection plans.

CPS, working with DataVision and Tech for Less, had 86% of its plans fall below the industry average, while only 14% were above average. This is a powerful position for the administrator, especially considering another smaller TPA, ProtectALL, was at the opposite end of the chart from CPS. CPS was unique in offering plans that covered used, open-box, and refurbished products from Tech for Less, along with plans that covered ADH from DataVision.

We had 434 data points for Allstate Protection Plans, the most of any extended warranty provider. 73% of the Allstate plans we found were below average, while 27% were above average.

Allstate, Asurion, and Assurant all fell at the middle of the pack, while AIG was a little on the higher side. Best Buy's Geek Squad plans and HP's Care Pack plans had a wide range of coverage, including ADH, in-home service, next-day service, and even predictive AI diagnostics for preventative maintenance, so it's not surprising to find AIG a little more expensive, with 64% of plans above average, and 36% of plans below average.