Nine-Month U.S. Truck Industry Warranty Metrics:

The four major U.S.-based truck manufacturers have seen product warranty claims costs increase, but have decreased their warranty accruals. At the same time, Paccar has seen amortized revenue from extended warranties increase, and Trane has seen new service contract sales increase.

It's a big month for shopping, which means it's a big month for trucking.

We took a look at the financial statements of some of the largest U.S.-based on-highway truck and heavy equipment manufacturers, and we realized that many of them report extended warranty metrics along with their product warranty data. Trucking is a rare industry from which we are able to gather extended warranty data, along with product warranty data, from most of the major U.S.-based OEMs.

We perused annual reports and quarterly financial statements of U.S.-based truck and heavy equipment OEMs, and found four that reported both product warranty and extended warranty data: Deere & Co., which makes diesel engines and drivetrains along with agricultural, construction, and mining equipment; Paccar Inc., which owns the Peterbilt, Kenworth, DAF Trucks, and Leyland Trucks brands; Cummins Inc., which makes diesel engines and electric powertrains, and acquired commercial vehicle parts supplier Meritor Inc. in 2022; and Trane Technologies plc, which is a HVAC manufacturer that owns the Thermo King brand of refrigerated trucks, trailers, shipping containers, and boxcars.

For each manufacturer, we gathered three key product warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund.

We also gathered two key extended warranty metrics: the amount of recognized/ amortized revenue per quarter, and the amount of new service contract sales per quarter.

In addition, we gathered data on each manufacturer's quarterly product sales revenue, and used these to calculate three additional warranty expense rates: claims as a percentage of sales (the claims rate), accruals as a percentage of sales (the accrual rate), and new service contract sales as a percentage of product sales revenue.

Keep in mind that Deere uses a fiscal year spans from November to October, so its quarters represent a different series of three months than the other three manufacturers in this report. In addition, as we'll see in Figures 6 and 7, Deere ceased reporting its extended warranty data at the beginning of its 2024 fiscal year (which began in November 2023), for reasons unknown to us. Based on the tables provided, we were able to calculate Deere's new service contracts sold for the fourth quarter of calendar 2023 (Deere's first quarter of fiscal 2024), but we don't have enough information to calculate estimates for calendar 2024.

In addition, we'll note that Deere's top U.S.-based heavy equipment competitor, Caterpillar Inc., does not include its extended warranty data in its financial reports, because it has its own separate insurance company that handles its extended warranty operation.

Furthermore, global trucking giants including Volvo Trucks, Daimler Truck, and Traton SE (formerly Volkswagen Truck & Bus) are not included in this report, because they are internationally-based and do not specify any extended warranty metrics in their annual reports. Volvo Trucks owns the Renault Trucks and Mack Trucks brands; Daimler Truck owns brands including Mercedes-Benz Trucks, Thomas Built Buses, Freightliner Trucks, and Western Star Trucks; and Traton owns Scania, MAN Truck & Bus, and International Motors, formerly known as Navistar.

Navistar used to be U.S.-based, but was acquired by Traton SE, the heavy-duty vehicle division of Volkswagen Group, in 2021, and changed its name to International Motors just two months ago, in October 2024. The name International Motors is a nod to its former name, International Harvester, which was changed to Navistar in the mid-1980s after selling off its construction equipment division to Dresser Industries, which later merged with Halliburton; its gas turbine division to Caterpillar; its lawn equipment division to MTD Products, which was recently acquired by Stanley Black & Decker; and its agricultural equipment division to Tenneco. Tenneco merged the International Harvester agricultural equipment brand with its Case Corp. to create the Case IH brand, which today is owned by the Italian heavy equipment manufacturer CNH Industrial N.V. This led International Harvester, which was left with just its heavy truck division, to rename itself to Navistar in 1985, a name that remained until just a few months ago.

Take a look at our October 2024 newsletter "Worldwide Heavy Equipment Warranty Report" for some insight into the global trucking and heavy equipment industry's product warranty expenses, including those of Caterpillar, CNH, and Volvo Trucks, along with Deere & Co.

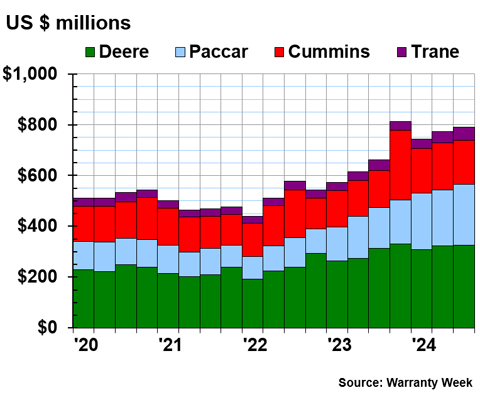

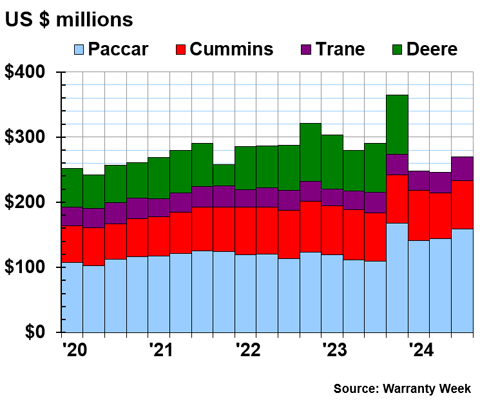

Warranty Claims Totals

Figure 1 shows 19 quarters of product warranty claims costs for the four U.S.-based truck OEMs in this report, Deere, Paccar, Cummins, and Trane.

Figure 1

Truck Product Warranty Metrics

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2020-2024)

In the third quarter of 2024, Deere paid $325 million in warranty claims, a 4% increase from the third quarter of 2023.

Paccar's product warranty claims costs have been growing over the past two years. In the third quarter of 2024, Paccar paid $239 million in claims, a 49% increase from the third quarter of 2023.

Paccar averaged $100 million in claims per quarter in 2022, $158 million per quarter in 2023, and based on the three quarters of data we have from 2024, is averaging about $227 million in claims per quarter this year. So Paccar's quarterly claims costs are staying fairly consistent within each year, but the average cost per quarter, and the annual total, is rising rather notably.

Cummins paid $173 million in claims in the third quarter of 2024, a 18% increase from the third quarter of 2023.

And Trane paid $52 million in claims during the third quarter of 2024, a 24% increase from the third quarter of 2023.

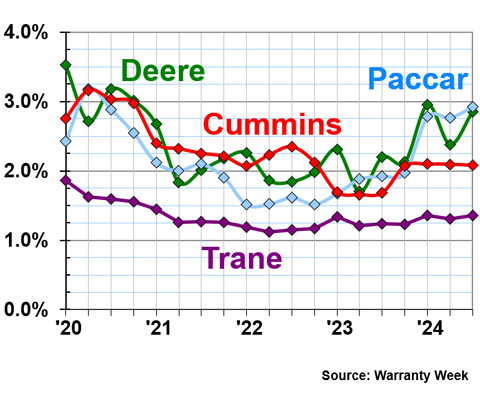

Warranty Claims Rates

Figure 2 shows the quarterly warranty claims rates for these four truck OEMs over the same period of 19 quarters, from 2020 to the third quarter of 2024.

Figure 2

Truck Product Warranty Metrics

Average Warranty Claims Rates

(as a % of product sales, 2020-2024)

In the third quarter of 2024, Trane had the lowest claims rate of the bunch, at 1.36%. Trane has also had the steadiest claims rates over the past few years, meaning that it's spending a consistent proportion of product sales revenue on fulfilling product warranty claims.

Cummins was at the middle of the pack in the third quarter of 2024, with a claims rate of 2.08%.

In the third quarter of 2024, Deere had a claims rate of 2.85%, and Paccar had a claims rate of 2.92%.

All four manufacturers saw higher claims rates in the third quarter of 2024 compared to the third quarter of 2023, with Paccar seeing the largest jump in the claims rate. We see a similar pattern from Paccar in Figure 2 as we saw in Figure 1, with consistent claims rates between quarters in a calendar year, but a big jump between the fourth quarter of one year and the first quarter of the next. It's especially visible between the fourth quarter of 2023 and the first quarter of 2024.

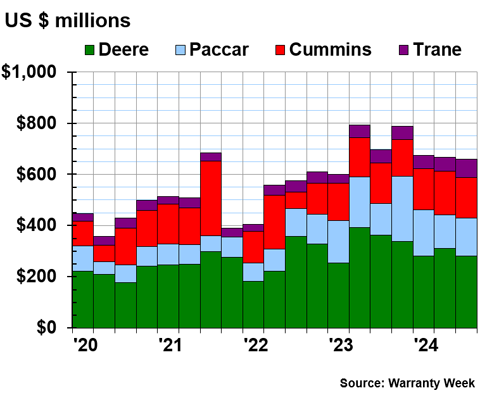

Warranty Accrual Totals

Figure 3 shows the total warranty accruals for the four manufacturers, from 2020 to the third quarter of 2024.

Figure 3

Truck Product Warranty Metrics

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2020-2024)

In the third quarter of 2024, Paccar accrued $149 million, a 21% increase from the third quarter of 2023. So total accruals also increased, but total claims increased at a much sharper rate.

Trane also increased its accruals. Trane accrued $71 million in the third quarter of 2024, a 24% increase from the third quarter of 2023.

Cummins accrued $159 million in the third quarter of 2024, a 1% increase from the third quarter of 2023.

And Deere accrued $280 million in the third quarter of 2024, a -23% decrease from the third quarter of 2023.

Warranty Accrual Rates

Figure 4 shows the warranty accrual rates for these four OEMs over the same 19 quarters.

Figure 4

Truck Product Warranty Metrics

Average Warranty Accrual Rates

(as a % of product sales, 2020-2024)

The accrual rates of the four manufacturers were much closer together than the claims rates in the third quarter of 2024.

At the higher end of the spectrum, Deere had an accrual rate of 2.46% in the third quarter of 2024, down a bit from the third quarter of 2023.

Paccar had an accrual rate of 1.99%, also down slightly compared to the third quarter of 2023. Cummins had an accrual rate of 1.91%, up slightly from the corresponding quarter the year prior.

And at the lower end of the spectrum, Trane had an accrual rate of 1.77% in the third quarter of 2024, which is a bit higher than we saw in the third quarter of 2023. So Trane's accrual rates have been trending upwards, while Cummins has been the most consistent with this metric in the last two years.

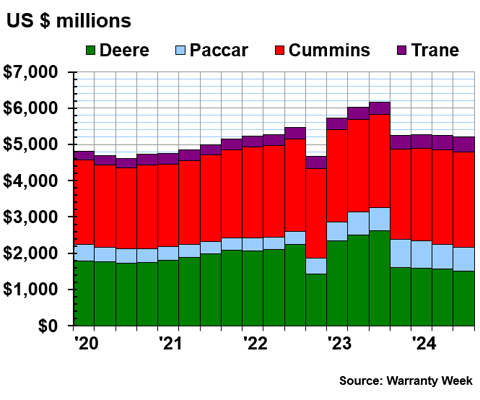

Warranty Reserve Balances

Our final product warranty metric is the balance in each manufacturer's warranty reserve fund at the end of each quarter.

Figure 5

Truck Product Warranty Metrics

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2020-2024)

We can see in Figure 5 that Deere's warranty reserve fund has been shrinking, while Trane's has been growing, and the other two have remained the same.

In the third quarter of 2024, Deere held $1.51 billion in its warranty reserves, a decrease of -42% from the third quarter of 2023.

Cummins held $2.63 billion at the end of the third quarter of 2024, up 3% from the third quarter of 2023. Paccar held $656 million, up just 2%.

And Trane held $409 million, up 17% from the end of the third quarter of 2023.

Revenue Recognition

Figure 6 shows the quarterly amount of extended warranty revenue amortized by each manufacturer, from 2020 to the third quarter of 2024. As we mentioned earlier, we only have extended warranty data for Deere up until the fourth quarter of 2023 (based on the calendar year).

When an OEM sells an extended warranty, it deposits that revenue into a deferred revenue fund, and gradually recognizes, or amortizes, portions of that revenue over the duration of the service contract, as a net subtraction from the fund. Unfortunately, companies rarely reveal how much they pay in extended warranty claims.

Figure 6 shows the amount of extended revenue amortized per quarter, or, in other words, the amount of net earned premiums per quarter.

Figure 6

Truck Extended Warranty Metrics

Revenue Recognized/Amortized by U.S.-based Manufacturers

(in US$ millions, 2020-2024)

In the third quarter of 2024, Paccar amortized $159 million in net earned premiums, a 46% increase from the third quarter of 2023.

We can see in Figure 6 that the there was a big jump in Paccar's net earned premiums from the third to the fourth quarter of 2023, and this figure has remained relatively high since. Paccar amortized $168 million in service contract revenue in the fourth quarter of 2023, the highest quarterly total we've ever seen from the manufacturer.

So it seems that Paccar is generating more revenue from extended service contracts than ever, a conclusion that is also supported by the sales data we'll see in Figure 7.

Trane's net earned premiums increased a bit as well. Trane amortized $36 million in service contract revenue in the third quarter of 2024, a 14% increase from the third quarter of 2023. It's not record-breaking, like we saw from Paccar, but it is a little higher than the typical quarterly net earned premiums.

Cummins amortized $74 million in revenue from extended warranties in the third quarter of 2024, which is right on the nose compared to the third quarter of 2023, in which exactly $74 million was also recognized. Cummins' service contract earnings have increased a bit over the past few years, but have been quite consistent on a quarterly basis.

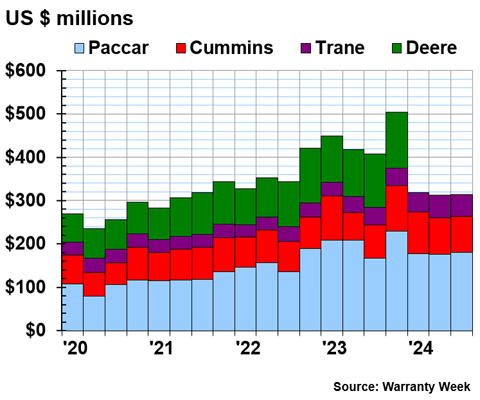

Extended Warranty Sales

Figure 7 shows the total amount of new service contract sales made on a quarterly basis. These totals are the amounts of newly-deferred revenue in each quarter, added into the deferred revenue fund to be amortized periodically, based on the length of the service contract.

So the revenue recognized in a given quarter in Figure 6 is from service contracts sold in previous years, while the data in Figure 7 shows how many extended warranties are being sold, and how much newly deferred revenue is being deposited.

Figure 7

Truck Extended Warranty Metrics

New Service Contracts Sold per Quarter by U.S.-based Manufacturers

(in US$ millions, 2020-2024)

In the third quarter of 2024, Paccar sold $181 million worth of service contracts, a 9% increase from the third quarter of 2023.

The 9% increase in sales is an interesting contrast to the 46% increase in amortized revenue over the same period, from the third quarter of 2023 to the third quarter of 2024. When we look back at the data, we can see that Paccar had a few really good quarters for extended warranty sales in 2023, setting a record in the fourth quarter of 2023 by selling $229 million in new service contracts. And overall, Paccar started selling a lot more service contracts around 2022, so the increases in amortized revenue that we're seeing now are reflections of the increases in sales that began about two years ago.

Cummins sold $83 million in new service contracts in the third quarter of 2024, a 6% increase from the third quarter of 2023.

And Trane sold $50 million in new service contracts in the third quarter of 2024, a 26% increase from the third quarter of 2023. Trane has had a really good 2024 in new service contract sales, so we'd expect higher amortized revenue in the coming years, over the duration of these newly-sold contracts.