Extended Warranty Revenue Trends:

Because so many extended warranty programs are run by small private companies or by huge companies that don't break out their service contract revenue, it's almost impossible to size the business accurately. This week, we're looking at data from three industry leaders, Assurant, Frontdoor, and Lowe's, to get a sense of the state of the American service contract industry.

It seems that the value proposition proposed by extended warranties and service contracts has become a little more attractive to American consumers in the wake of the 2020 pandemic. As we'll see in the following charts, the revenue generated by the sale of extended warranties has increased for three of the major U.S.-based service contract providers, across three different industry segments.

We wish that we could provide our readers with a definitive total for all revenue generated by extended warranty sales in the United States in the past year. We often receive inquiries to this effect. But it's simply not possible, because there are so many privately held service contract providers and underwriters that don't have any obligation to publicly report any revenue or expense metrics.

In fact, in terms of available data, the extended warranty industry is much more opaque than the world of manufacturer-issued product warranties. This week, we'll attempt to assuage the anxiety that a lack of data can cause, by taking a look at the revenue trends of three major U.S.-based extended warranty providers, all of which are publicly traded, and thus publish annual and quarterly reports with relevant metrics for us to extract.

From the vehicle service contract and brown and white goods retail segments of the extended warranty industry, we will look at the revenue trends of Assurant Inc., broken down three ways.

From the home warranty industry, we will look at Frontdoor Inc., parent of American Home Shield.

And from the retail appliance industry, we will look at Lowe's Companies Inc. Lowe's even reports the amount it spends on warranty claims in each quarter, which is a metric that Assurant and Frontdoor do not report.

Unfortunately, as we're speaking about data availability, Apple Inc. ceased reporting its warranty expenses in mid-2022. The company's AppleCare protection plans are a highly popular computer and mobile phone service contract product, into which we no longer have financial insight.

Assurant

First, we'll take a look at the extended warranty revenue trends of Assurant Inc.

As an insurance company underwriting extended warranty programs all over the world, Assurant is a bellwether for the entire retail side of the industry. Especially since its acquisition of The Warranty Group in 2018, its operations have become more or less evenly-split between VSCs and brown/white goods retail extended warranties.

Assurant calls those operations Global Automotive and Connected Living, respectively, and calls their combined operations Global Lifestyle.

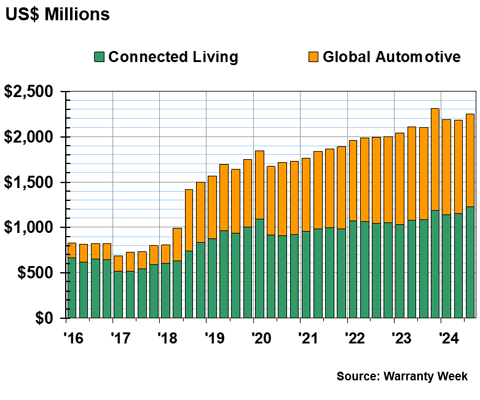

In Figure 1 below, we are charting the quarterly revenue totals for each unit, Connected Living and Global Automotive, for the past 35 quarters, ending with the third calendar quarter of 2024.

Figures 2 and 3 also present the same totals for the Global Lifestyle segment, but broken down in different ways.

Figure 1

Assurant Inc.

Global Lifestyle Segment

Quarterly Revenue: Connected Living & Global Automotive

(in US$ dollars, 2016-2024)

In the first nine months of 2024, Assurant Global Lifestyle generated a total of $6.62 billion in revenue, a 6% increase from the first nine months of 2023.

Broken down, Connected Living, Assurant's brown and white goods service contract segment, generated a total of $3.51 billion in revenue in the first nine months of 2024, a 10% increase from the first nine months of 2023.

In the third quarter of 2024, the most recent for which we have data, Assurant made $1.22 billion in revenue in the Connected Living segment, a 13% increase from the third quarter of 2023.

Global Automotive, Assurant's vehicle service contract segment, generated $3.11 billion in revenue in the first nine months of 2024, a 1% increase from the first nine months of 2023.

In the third quarter of 2024, Assurant made $1.03 billion in revenue in the Global Automotive segment, a 0.3% increase from the third quarter of 2023.

Overall, 53% of Global Lifestyle revenue was generated by the sale of service contracts for brown and white goods, under the Connected Living label, while 47% of Global Lifestyle revenue was generated by the sale of vehicle service contracts, under the Global Automotive label.

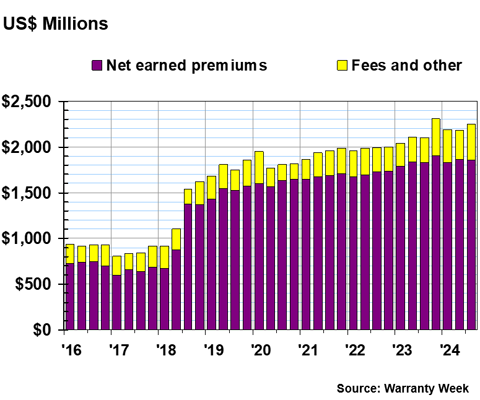

Figure 2 presents the same quarterly revenue totals for Assurant Global Lifestyle, as seen in Figure 1, but broken down by net earned premiums versus fees and other.

Figure 2

Assurant Inc.

Global Lifestyle Segment

Quarterly Revenue: Net earned premiums & Fees and other

(in US$ dollars, 2016-2024)

In the first nine months of 2024, Assurant's net earned premiums totaled $5.55 billion, an increase of 2% from the first nine months of 2023, while fees and other accounted for another $1.07 billion in revenue, up 34% from the first nine months of 2023.

In the third quarter of 2024, Assurant recorded $1.86 billion in net earned premiums, an increase of 2% from the third quarter of 2023, and another $392 million in fees and other, a 41% increase from the third quarter of 2023.

Overall, 84% of Global Lifestyle revenue was generated by net earned premiums in the first nine months of 2024, while another 16% was generated by fees and other charges.

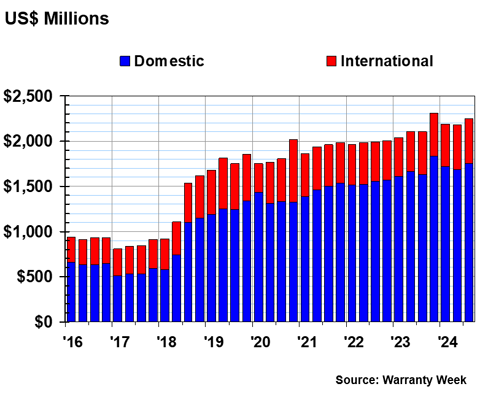

Figure 3 shows Assurant's quarterly revenue broken down by that generated domestically, in the United States, versus internationally.

Figure 3

Assurant Inc.

Global Lifestyle Segment

Quarterly Revenue: Domestic & International

(in US$ dollars, 2016-2024)

In the first nine months of 2024, Assurant Global Lifestyle recorded $5.15 billion in revenue generated domestically, a 5% increase from the first nine months of 2023.

In the third quarter of 2024, Assurant Global Lifestyle generated $1.75 billion in revenue domestically, a 7% increase from the first nine months of 2023.

In the first nine months of 2024, Assurant recorded another $1.47 billion in revenue from international service contract sales, an increase of 9% compared to the first nine months of 2023.

In the third quarter of 2024, Assurant earned $502 million in revenue from international service contract sales, a 6% increase from the third quarter of 2023.

Overall, in the first nine months of 2024, Assurant generated 78% of its Global Lifestyle revenue from domestic extended warranty sales, while international sales represent 22% of revenue.

Frontdoor

Frontdoor is the parent company of American Home Shield as well as the HSA, OneGuard and Landmark home warranty brands. It is by far the largest player in the home warranty and home service contract industry in the United States. It was part of ServiceMaster until 2018, when it was spun off into what amounts to a "pure play" publicly-traded extended warranty company. As such, it too is an excellent bellwether for the industry as a whole.

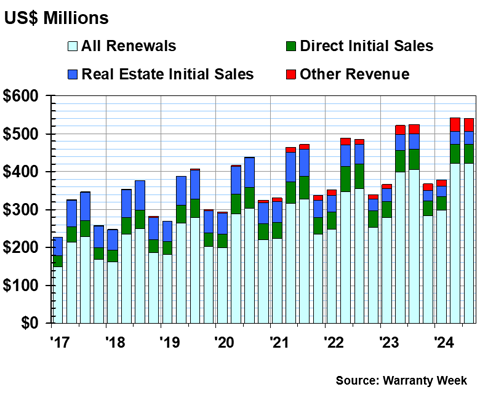

In Figure 4, we're tracking total revenue broken into four segments: direct initial sales of home warranty contracts to homeowners; initial sales of home warranty contracts to homeowners through the real estate channel; annual renewals by all of these homeowners; and other revenue sources.

First of all, it's clear that home warranty sales are a seasonal business, with sales doing best from April to September, and worst from October to March. Second, the summer is always a little busier than the spring, and the fall season is always a tiny bit better than the subsequent winter.

Third, the company's sales are clearly dominated by renewals, which represent anywhere from 66% to 69% of total revenue in any given quarter. And fourth, while initial sales through the real estate channel used to dominate, direct sales have caught up in the past three years.

Figure 4

Frontdoor Inc.

Quarterly Revenue Segments

(in US$ dollars, 2017-2024)

As we saw with Assurant, revenue from extended warranty sales has continued to increase since the pandemic. It seems that service contracts are on the rise, and these gains aren't exclusive just to electronics, or appliances, or vehicles, or homes; instead, it seems that the industry as a whole is seeing revenues increase, based on these industry leaders.

Frontdoor set a new record high for revenue generated from all renewals in the second quarter of 2024, and then just barely beat that record again in the third quarter of the year. In the second quarter, Frontdoor made $421 million from home service contract renewals, and in the third quarter, $422 million.

As we mentioned, the summer and fall are always the most profitable quarters of the year for Frontdoor, which is subject to the seasonal nature of home sales. But the $422 million total for the third quarter of 2024 is still a record high compared to the third quarters of other years; revenue from all renewals increased 4% from the third quarter of 2023 to the third quarter of 2024.

Overall, in the first nine months of 2024, Frontdoor generated $1.14 billion in revenue from all renewals, a 5% increase from the first nine months of 2023.

In contrast, revenue from direct initial sales and real estate initial sales both decreased from the first nine months of 2023 to the first nine months of 2024.

In the first nine months of 2024, Frontdoor made $135 million in revenue from direct initial sales, a -13% decrease from the first nine months of 2023. And in the first three quarters of 2024, Frontdoor made $99 million from real estate initial sales, a -14% decrease from the first nine months of 2023.

So although direct initial sales are now generating more revenue than real estate initial sales are, overall revenue from initial sales decreased from 2023 to 2024, while revenue from renewals increased.

Based on these findings, it seems that consumers are perhaps a little less likely to sign up for a new home service contract, either directly from the provider or through a real estate agent, but once they're signed up for the service contract, they've become slightly more likely to renew at the end of the term. It's interesting to see that although revenue was up overall in the first nine months of 2024, compared to the first nine months of 2023, there was actually a decrease in new customers.

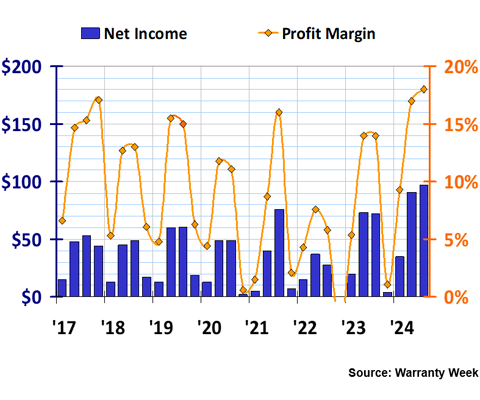

Figure 5 gives us a glimpse into Frontdoor's profitability, by showing net income, and the profit margin those amounts represent. As we saw in Figure 4, there's a clear seasonal pattern to the data.

Figure 5

Frontdoor Inc.

Net Income & Profit Margin

(in US$ millions and percent, 2017-2024)

Frontdoor set a new record high for its profit margin in the third quarter of 2024, at 18%. It's a significant improvement from 2022's evident profitability challenge.

Year over year, net income grew by 35% from the first nine months of 2023 to the first nine months of 2024. In the first three quarters of 2024, Frontdoor generated $223 million in net income.

Lowe's

Lowe's Companies Inc. is the world's second-largest hardware retail chain, with 1,746 outlets in the U.S. and Canada as of the end of their second fiscal quarter on July 30, 2024. At the end of that quarter, the home improvements and appliance retailer broke its own record for quarterly service contract sales, which it set in 2020 during the depths of the pandemic, and exceeded again in 2021.

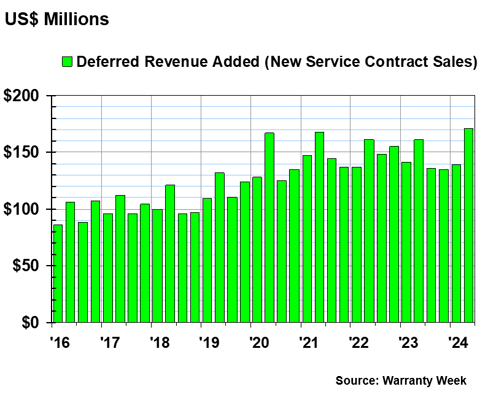

Figure 6

Lowe's Companies Inc.

New Service Contract Sales per Quarter

(in US$ millions, 2016-2024)

In the second quarter of 2024, Lowe's recorded $171 million in deferred revenue added, a metric which can also be described as new service contract sales.

In the first half of 2024, Lowe's sold $310 million of service contracts, a 3% increase from the first half of 2023.

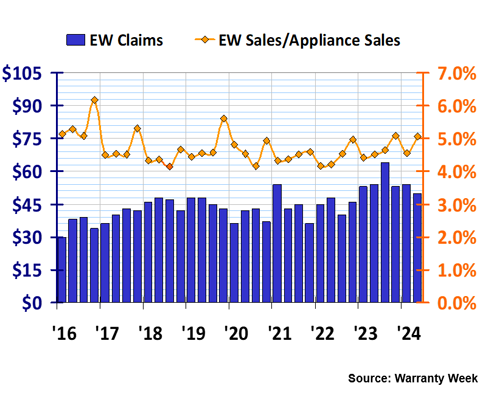

Lowe's conveniently tells us how much it spends per quarter on extended warranty claims. In Figure 7, we're comparing the amounts of quarterly service contract sales in Figure 6, to total appliance sales, in order to calculate an approximate service contract attach rate.

Figure 7

Lowe's Companies Inc.

Extended Warranty Claims per Quarter

& Extended Warranty Sales/Appliance Sales %

(in US$ millions and percent, 2016-2024)

Claims costs soared for Lowe's in the third quarter of 2023, to a peak of $64 million, and have fallen since. In the second quarter of 2024, Lowe's paid $50 million in extended warranty claims. In the first half of 2024, Lowe's paid a total of $104 million in extended warranty claims.

The sale of extended warranties, meanwhile, compared to the sale of the products that they protect, was 5.07% in the second quarter of 2024. The metric tends to hover around 4.9%, plus or minus around 0.15%. So the second quarter of 2024 had a slightly high service contract attach rate than usual. By contrast, the first quarter of 2024 had an attach rate of just 4.55%, rather lower than the average.