Worldwide Aviation Warranty Expenses:

In 2023, the global airframe OEMs paid $1.18 billion in warranty claims, set aside $1.07 billion in warranty accruals, and held a collective $6.76 billion in warranty reserves. It's remarkable that claims paid exceeded accruals made, a finding that would be more concerning if we hadn't taken a closer look at Boeing's expenses to find additional hundreds of millions deposited as changes of estimate to accruals made in previous years.

Worldwide civilian aircraft sales have just about returned to their pre-pandemic level, and so have the warranty expenses of the top manufacturers in this industry. At the same time, the industry average claims and accrual rates both fell in 2023, showing that airframe OEMs are spending a smaller proportion of that product sales revenue on warranty costs overall.

In fact, warranty claims costs were materially unaffected by the pandemic, despite airframe sales taking a huge hit in 2020. It makes sense, because that year, many commercial planes still flew their routes empty to avoid losing gate slots at airports, and others pivoted to the transport of cargo. And even airliners parked on tarmacs need to be kept in flying condition.

On the other hand, warranty accruals made by the global airframe industry did plummet in 2020. However, it's important to note that Boeing accrued an additional $455 million in 2020 as changes of estimate to accruals made during previous quarters. If we had added those changes of estimate to total accruals, as we did in the 2021 version of this report, total accruals would have stayed at the same level for the industry as a whole.

To create this warranty report, first we identified the world's top airframe manufacturers. For each manufacturer, we gathered data on their warranty expenses from their annual reports. We measured three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund.

In addition, we gathered data on each airframe OEM's product sales revenue, which we used to calculate two additional warranty expense rates: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

We identified 21 global airframe OEMs, which report their warranty expenses in seven different currencies: U.S. and Canadian dollars, roubles, yuan, pounds, Euro, and Swiss franc. For consistency and ease of comparison, we converted all data to U.S. dollars using the Internal Revenue Service's Yearly Average Currency Exchange Rates table.

Worldwide Airframe Industry

The global civilian aircraft industry can be split into three main segments.

First are the commercial airliner manufacturers, led by the U.S.-based Boeing Co. and the France-based Airbus SE. They are joined by two manufacturers of smaller commerical aircraft used for shorter regional flights: Brazil-based Embraer SA, and French-Italian Avions de Transport Regional (ATR), which was created as a joint venture between Airbus and Leonardo S.p.A.

It's important to note that in 2020, Airbus bought Bombardier out of the joint venture Airbus Canada Limited Partnership, which was the holding company for the Bombardier CSeries commercial aircraft, later renamed the Airbus A220. Bombardier also sold its rail division to Alston SA in 2020, and now focuses solely on business aviation.

We should also note that in 2018, Boeing announced that it would be acquiring 80% of Embraer's commercial aviation division through a joint venture, seemingly to rival Airbus' deal with Bombardier. If the deal had gone through, it would've consolidated the global commercial aviation sector to just the two rivals, Boeing and Airbus. However, Boeing canceled the acquisition in 2020, in the aftermath of the warranty crisis of the 737 MAX groundings. So Embraer remains the third-largest global civil aircraft manufacturer, behind Airbus and Boeing.

The second segment of the airframe industry is the general aviation manufacturers, who make everything from antique biplanes for air shows to modern business jets. Canada-based Bombardier is a global leader in this category, with the Global and Challenger corporate jets. Bombardier also owns the Learjet brand, but ceased production of all new Learjet aircraft in 2021.

There's also France-based Dassault Aviation Group, which makes the Falcon family of corporate jets, and two major U.S.-based business jet OEMs, Textron Inc., owner of the Cessna and Beechcraft brands, and General Dynamics Corp., which owns Gulfstream. In addition, Boeing, Airbus, and Embraer dabble in private jets as well.

And then the third segment is military and defense aerospace corporations, led by the newly-renamed RTX Corp., known as Raytheon Technologies Corp. from 2020 until 2023. Raytheon Technologies was formed through the 2020 merger of Raytheon Co. and United Technologies Corp. We'll take a look at the warranty expenses of RTX next week, since RTX deals more in jet engine sales than in airframe sales.

Naturally, RTX is rivaled abroad by the major defense contractors of other global superpowers, including the Aviation Industry Corporation of China (AVIC), and United Aircraft Corp. PJSC (UAC) of Russia. As one might expect, neither of these two report their warranty expenses.

Because AVIC and UAC are such large global airframe OEMs, we crafted estimates for their warranty expenses based on the average industry-wide warranty expense rates and global average aircraft revenue data.

We also crafted estimates for ATR, the joint venture between Airbus and Italian defense contractor Leonardo S.p.A., and the Switzerland-based specialty aircraft manufacturer Pilatus Aircraft Ltd. However, these two OEMs did tell us their annual product sales revenue, which we used along with industry average warranty expense rates in order to craft our estimates for their annual warranty costs.

RTX is not the only major defense aerospace contractor based in the United States. Of the OEMs we've already mentioned, Boeing has a Defense, Space, & Security division, and General Dynamics is primarily a defense contractor. Along with Gulfstream corporate jets, General Dynamics manufactures land assault vehicles, tanks, nuclear submarines, avionics systems, merchant marine ships, and more.

There's also major U.S.-based defense contractors Lockheed Martin Corp. and Northrop Grumman Corp. Both report their warranty expenses in their financial reports, because they're both publicly traded and thus mandated to do so.

However, big-ticket military contracts typically do not come with traditional product warranties, but rather with a distinct type of military service contract. As such, we do not factor revenue generated from defense contracts into the segmented product sales revenue figures that form the denominator of the warranty expense rates for Boeing or General Dynamics.

Thus, Lockheed Martin and Northrop Grumman do not make the list of the top eleven global airframe OEMs, in terms of total warranty expenses. The small amount of product warranty expenses that they do report are factored into the "Other" category.

Airframe Sales

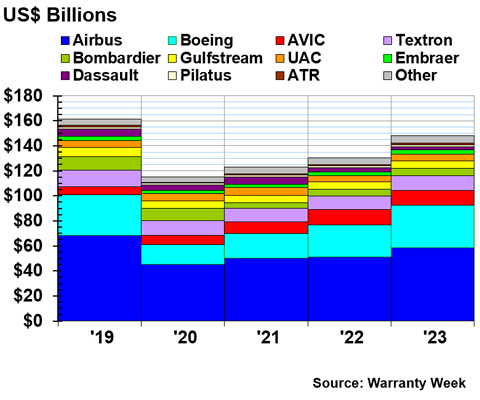

Before we delve into the warranty data, we want to take a quick look at the five-year chart of civilian aircraft sales revenue. In Figure 1, we see that in 2023, airframe revenue returned to just about the same level as where it was pre-pandemic, after a few years of gradual recovery from that initial plummet in 2020.

Figure 1

Top Airframe Makers Worldwide

Civilian Aircraft Sales

(in billions of U.S. dollars, 2019-2023)

Warranty Claims Totals

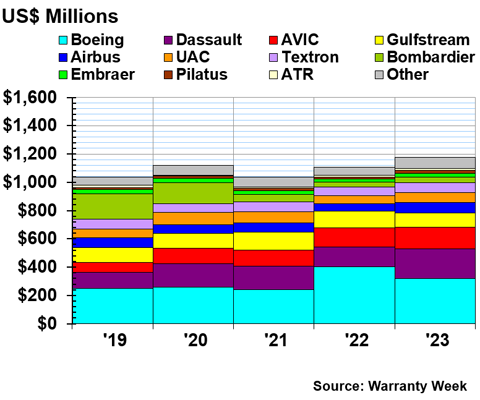

One might expect that warranty claims and accruals would also have fallen in 2020, and gradually recovered in the years that followed, in the same pattern as Figure 1. However, we'll see a different story in Figures 2 and 3.

Instead, as we'll see in Figure 2, total warranty claims payments were materially unaffected by the pandemic, and as we'll see in Figure 3, total warranty accruals did fall in 2020, but haven't seen the same step-like gradual recovery that we saw from product sales revenue in Figure 1.

Figure 2

Top Airframe Makers Worldwide

Claims Paid per Year

(in millions of U.S. dollars, 2019-2023)

In 2023, the top global airframe OEMs paid a total of $1.175 billion in warranty claims, a 6% increase from the year prior.

In 2023, Boeing paid $320 million in claims, a decrease of -21% from 2022.

Dassault paid $211 million in 2023, an increase of 50% from 2022. Gulfstream paid $101 million, a decrease of -13%. And Airbus paid $77 million, an increase of 38%.

It's notable that Airbus exceeded Boeing in sales in Figure 1, but Boeing by far exceeds Airbus in the totoal amount of warranty claims paid in Figure 2. In 2023, Boeing had a warranty claims rate of 0.94%, while Airbus had a claims rate of just 0.13%.

Textron paid $69 million in claims in 2023, an increase of 15% from the year prior. Bombardier paid $41 million, an increase of 17%. And Embraer paid $27 million, an increase of 31%.

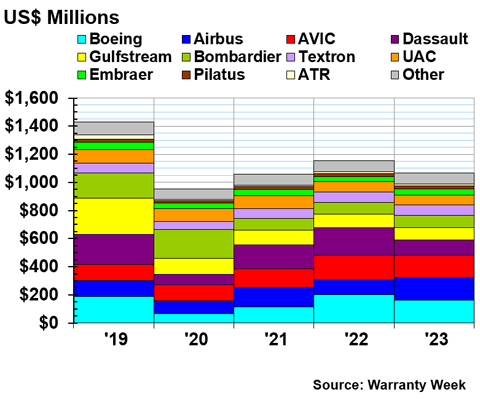

Warranty Accrual Totals

Figure 3 shows the amount of warranty accruals made by each top global airframe OEM, from 2019 to 2023.

Figure 3

Top Airframe Makers Worldwide

Accruals Made per Year

(in millions of U.S. dollars, 2019-2023)

In 2023, the top global airframe OEMs set aside $1.067 billion in warranty accruals, a decrease of -8% from the year prior.

Boeing set aside $164 million in warranty accruals during 2023, a decrease of -19% from 2022. Effectively, this means that Boeing only accrued half of the amount it paid in claims during 2023. Typically, a manufacturer would want to set aside more money for future warranty expenses than it paid in a given year, in order to have sufficient funds for future warranty costs, and enough padding in the reserves in case of emergency.

However, we want to point out that Boeing's accruals were this low only because of a creative bit of accounting. As we noted in our June 2024 newsletter "U.S. Aerospace Warranties," Boeing changed the way it accrues funds for major product recalls. Back in 2013 and 2014, Boeing set aside extra funds associated with the 737 Dreamliner groundings as regular warranty accruals. However, in 2019 and 2020, and again in 2022 and 2023, Boeing has accrued funds for issues associated with the 737 MAX by making adjustments to previous accruals.

So in 2023, Boeing set aside $164 million in regular accruals, and added in an additional $329 million in changes of estimate to accruals made in previous years. Similarly, in 2022, Boeing set aside $202 million in regular accruals, and an additional $576 million in changes of estimate. It's not typical for changes of estimate to be double the amount of regular accruals, especially not two years in a row, so we wanted to highlight this metric in addition to the data shown in Figure 3 in order to tell the full story of Boeing's current warranty situation. Based just on Figure 3, one wouldn't guess that Boeing went through global groundings, high-profile product failures, and major recalls associated with the 737 MAX over this five-year timespan.

In 2023, Airbus set aside $160 million in warranty accruals, a 54% increase from 2022. Dassault accrued $110 million, a decrease of -43%. Gulfstream accrued $90 million, down -9%. Bombardier accrued $84 million, up 1%. Textron accrued $76 million, up 4%. And Embraer accrued $41 million, an increase of 14% from the year prior.

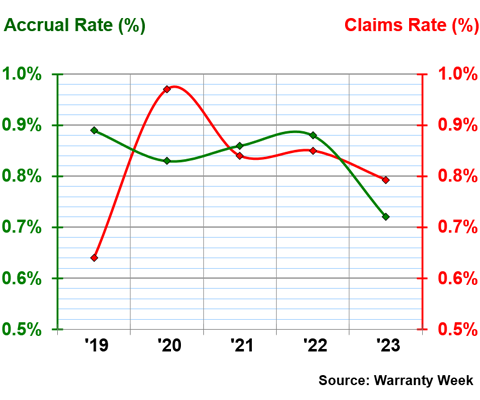

Warranty Expense Rates

Figure 4 shows the industry-wide average warranty expense rates from 2019 to 2023.

Figure 4

Top Airframe Makers Worldwide

Average Claims & Accrual Rates

(as a % of product sales, 2019-2023)

In, 2023 the airframe OEMs had an average warranty claims rate of 0.79%, and an average warranty accrual rate of 0.72%.

At the high end of the spectrum, in 2023 Dassault had a claims rate of 8.29%, and an accrual rate of 4.33%.

Dassault's warranty expense rates exceeded those of its top competitors by far in 2023. The next-highest expense rates belong to Gulfstream, which in 2023 had a claims rate of 1.77%, and an accrual rate of 1.58%.

At the low end of the spectrum is Airbus, with a claims rate of 0.13% and an accrual rate of 0.27% in 2023.

Warranty Reserve Balances

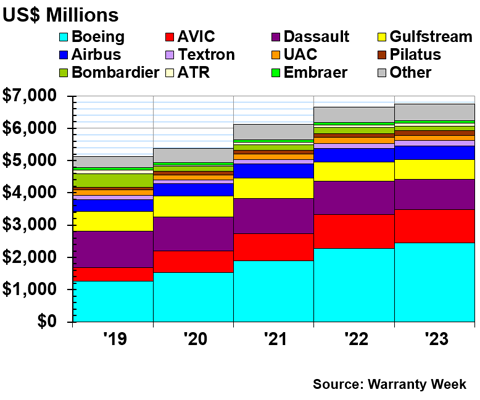

Our final metric is the end-balance of each manufacturer's warranty reserve fund. Figure 5 shows the top global airframe OEMs' warranty reserve end-balances, from 2019 to 2023.

Figure 5

Top Airframe Makers Worldwide

Reserves Held per Year

(in millions of U.S. dollars, 2019-2023)

At the end of 2023, the global airframe OEMs held a collective $6.756 billion in warranty reserves, a 1% increase from the end of 2022.

Boeing had the largest warranty reserve fund of the group, despite its claims payments exceeding its regular accruals by a ratio of about two to one in 2023. At the end of 2023, Boeing held $2.448 billion in its warranty reserve fund, an increase of 8% from the end of 2022.

At the end of 2023, Dassault held $951 million in reserves, a decrease of -7% from the end of the year prior. Gulfstream held $597 million, a decrease of -1%. Airbus held $427 million, an increase of 2%.

Textron held $172 million in reserves at the end of 2023, an increase of 15%. Bombardier held $140 million, a decrease of -24%. And Embraer held $73 million, a decrease of -6%.