Worldwide Heavy Equipment Warranty Report:

In 2023, the worldwide heavy equipment industry paid $4.6 billion in warranty claims, and set aside $6.6 billion in warranty accruals. The average claims rate was 1.17%, and the average accrual rate was 1.4%.

While the warranties issued for passenger cars and light trucks get all the attention, there is a huge warranty chain management operation on the commercial side, for the heavy equipment used in industries including construction, agriculture, and mining.

We're tracking the top 57 heavy equipment manufacturers worldwide, of which 23 include their warranty expense figures in their annual reports. Together, we estimate, these 23 OEMs accounted for about 83% of the worldwide heavy equipment industry's warranty expenses last year. So it's relatively easy to fashion estimates for the remaining 17%, and to create a report on their global warranty expenses.

Methodology

For each of the 23 manufacturers that reported their warranty expenses in 2023, we perused their annual reports to extract three key warranty metrics: the amount of claims paid, the amount of accruals made, and the amount of reserves held at the end of the fiscal year.

We also collected data on the amount of product sales revenue — meaning revenue generated from the sale of products that come with warranties, excluding revenue generated from services, extended warranty sales, etc. — that each manufacturer made during the fiscal year. Using these data, we calculated two additional warranty metrics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

Among these 23 companies, there are manufacturers reporting their expenses in U.S. dollars, Euro, Japanese yen, South Korean won, Swedish kroner, Canadian dollars, and Chinese yuan. In order to compare these figures, we converted all of the data from their native currencies to U.S. dollars, using the U.S. Internal Revenue Service's Yearly Average Currency Exchange Rates table.

For the remaining 34 manufacturers, we needed to craft estimates for their warranty expenses. Most of these manufacturers are either privately owned, or, in the case of some of the Chinese manufacturers, government-owned, and thus have no obligation to publicly publish their annual reports. For these cases, we gathered each manufacturer's revenue data from International Construction magazine's annual IC Yellow Table.

The Yellow Table isn't a warranty-focused publication, but it does compile a list of the top 50 global construction OEMs, and ranks them based on annual product sales revenue. The Yellow Table calls these figures "construction equipment sales," and presents all data in U.S. dollars, regardless of the currency in which the manufacturer reports. We don't know which currency conversion rates International Construction uses. Although it's called the 2024 Yellow Table, based on the year in which it was published, the data are from the calendar year 2023.

Once we've gathered each OEM's 2023 product sales revenue figure, we craft estimates for their annual warranty expenses based on each company's primary market and closest competitors, as well as the industry average warranty expense rates.

For 2023, the 23 out of 57 total manufacturers for which we have hard data represent 83% of the global heavy equipment product revenue, and we estimate that they represent 83% of the total global warranty expenses as well.

In Figures 1, 2, and 4 in this report, we present the top 11 manufacturers by each warranty metric, with the other 46 companies represented in the "Other" category.

Of the named companies in the following charts, we crafted estimates for four manufacturers: China-based Sany Heavy Industry Co. Ltd., Germany-based Liebherr-International AG, China-based Xuzhou Construction Machinery Group Co. Ltd. (XCMG), and UK-based J.C. Bamford Excavators Ltd. (JCB).

And there are eight heavy equipment manufacturers for which we have hard data: from the United States, we have Deere & Co. and Caterpillar Inc.; from Sweden, Volvo Group AB; from Italy, CNH Industrial N.V.; from Japan, Komatsu Ltd., Kubota Corp., and Hitachi Ltd.; and from South Korea, Doosan Group.

Volvo Group, also known as AB Volvo, owns the Volvo Truck brand, along with Renault Trucks, and Mack Trucks, among others. Although the two still share the same logo, Volvo Group is not to be confused with its former subsidiary Volvo Cars, which was first sold to the U.S.-based Ford Motor Co. in 1999, and subsequently sold to the China-based Geely Auto in 2010.

CNH is the Italy-based parent company of the American agricultural equipment brands New Holland and Case IH; in turn, Case IH was formed in 1985 through the merger of J.I. Case Co. and the former agricultural division of International Harvester.

The landscape of the South Korean heavy equipment industry is slightly confusing these days, due to some spin-offs, naming overlaps, and rebranding. Essentially, there are now three main South Korean heavy equipment manufacturers included in the Yellow Table, and in this warranty report: Doosan Group, HD Hyundai Infracore, and HD Hyundai Heavy Industries.

Doosan Group, which is named in the top 11 in Figures 1 and 4 below, owns the Bobcat brand, and is commonly known as Doosan Bobcat. However, back in 2018, Doosan split into two companies, Doosan Infracore and Doosan Bobcat. Then, in 2021, Doosan Infracore was acquired by Hyundai Heavy Industries (now known as HD Hyundai after a 2022 rebrand), and renamed HD Hyundai Infracore, alternately known as Develon. The newly-renamed HD Hyundai Infracore and HD Hyundai Heavy Industries are both subsidiaries of the larger HD Hyundai conglomerate. While Doosan Bobcat does report its warranty expenses, neither HD Hyundai nor its subsidiaries does, so we rely on the Yellow Table, which presents the revenue data for the two Hyundai subsidiaries separately.

The Japanese manufacturers use a fiscal year that spans from April 1 to March 31, rather than using the calendar year system. Following the Yellow Table's lead, we standardize these dates to the corresponding calendar year in which the majority of the fiscal year occurred. For instance, the Japanese fiscal year that spanned April 1, 2023 to March 31, 2024 is considered 2023 in our data.

Worldwide Claims Totals

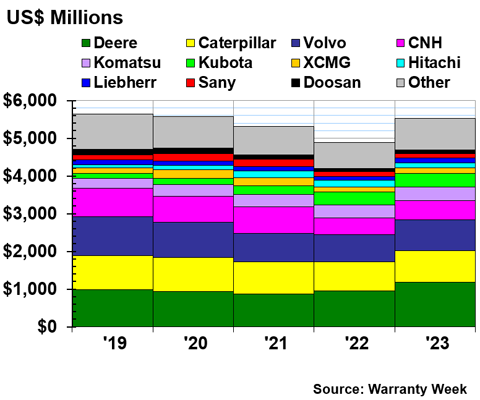

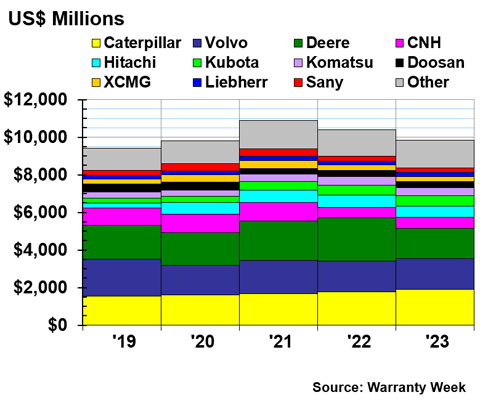

Our first warranty metric is the total amount of claims paid by the global heavy equipment industry. Figure 1 shows total warranty claims paid, from 2019 to 2023.

Figure 1

Top Heavy Equipment Makers Worldwide

Claims Paid per Year

(in US$ millions, 2019-2023)

We estimate that the global heavy equipment industry paid $5.525 billion in warranty claims during calendar 2023, an increase of 13% from 2022's sum. Of that $5.525 billion, $4.605 billion is from hard data, while the remaining $920 million is estimated.

In 2023, Deere & Co. paid $1.181 billion in warranty claims, the most among the global heavy equipment OEMs. Deere's claims costs rose by 24% from 2022 to 2023.

Caterpillar paid $835 million in claims during 2023, a 7% increase from the year prior. Volvo Group paid $822 million in claims during 2023, up 15% from 2022. CNH paid $510 million, up by 16%.

Komatsu paid $365 million in claims during fiscal 2023, up 7% from the year prior. Japanese compatriot Kubota paid $350 million in claims, up by just 1%. And Hitachi paid $132 million, a decrease of -26% from fiscal 2022.

Doosan Bobcat paid $99 million in warranty claims during 2023, an increase of 30% from the year prior.

We estimate that XCMG paid about $152 million in claims during 2023, while Liebherr paid $121 million, and Sany paid $120 million.

Among the "Other" category, Oshkosh Corp. paid $51 million in claims, a decrease of -11%, and Terex paid $44 million, an increase of 25%.

The Finland-based Metso Corp. paid $31 million in claims, an 87% increase from 2022's total. This steep increase came just a few years after the 2020 merger of Metso Minerals and Outotec.

The Swedish-based Sandvik Group paid $29 million in claims during 2023, a 69% increase from the year prior. Germany-based Wacker Neuson paid $17 million in claims, an amazing 246% increase from 2022's total of $5 million. And the Canadian Linamar Corp. paid $11 million, an increase of 57%.

Clearly, the overall trend of 2023 was increased warranty claims costs among the global heavy equipment manufacturers. However, there was one rather large decrease in claims paid in 2023 among the "Other" category: the China-based Lonking Holdings Ltd. paid $16 million in claims during 2023, a decrease of -39% from 2022.

Worldwide Accrual Totals

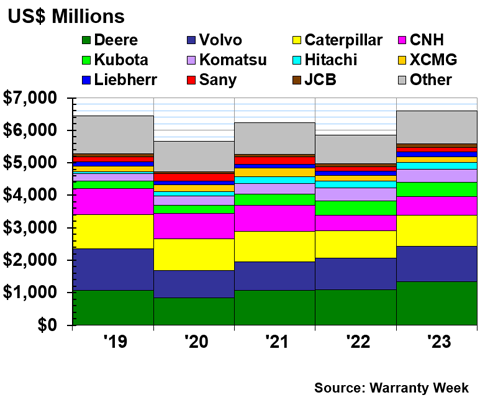

Our next warranty metric is the amount of warranty accruals made by the global heavy equipment industry. Figure 2 shows total warranty accruals made, from 2019 to 2023.

Figure 2

Top Heavy Equipment Makers Worldwide

Accruals Made per Year

(in US$ millions, 2019-2023)

We estimate that the global heavy equipment industry set aside a total of $6.590 billion in warranty accruals during 2023, an increase of 13% from the year prior. Of that total, $5.493 billion is hard data, while the remaining $1.097 billion is from our estimates.

In 2023, Deere accrued a total of $1.347 billion, a 23% increase from 2022. Volvo Group accrued $1.077 billion, an increase of 11%. Caterpillar accrued $968 million, up by 14% from the year prior. And CNH accrued $566 million in 2023, up by 19%.

The three Japanese OEMs in the top 11 modified their accruals by much more modest percentages. Kubota accrued $439 million in fiscal 2023, a decrease of just -1% from the prior fiscal year, Komatsu accrued $402 million, an increase of 4%. And Hitachi accrued $204 million, a decrease of -9%.

The remaining four manufacturers in the top 11 are companies for which we crafted estimates. We estimate that XCMG accrued $181 million in 2023, Liebherr accrued $145 million, Sany accrued $143 million, and JCB accrued $113 million.

Just outside of the top 11 in the "Other" category is Doosan, which accrued $106 million in 2023, a decrease of -22% from the year prior. Metso accrued $55 million, an increase of 35%. And Sandvik accrued $42 million, an increase of 54%.

In the U.S., Oshkosh accrued $52 million, an increase of 6%. Terex accrued $40 million, an increase of just 1%. And Manitowoc accrued $29 million, an increase of 6%.

Along with its claims payments tripling from 2022 to 2023, Wacker Neuson tripled its warranty accruals as well. Wacker Neuson accrued $26 million in 2023, an increase of 243% from the year prior.

Sweden-based Epiroc accrued $21 million, an increase of 54%. Linamar accrued $20 million, an increase of 64%. France-based Manitou accrued $19 million, an increase of 48%. And U.S.-based Astec accrued $18 million, an increase of 40%.

And once again, Lonking had one of the few decreases. Lonking accrued $13 million in 2023, down -36% from 2022.

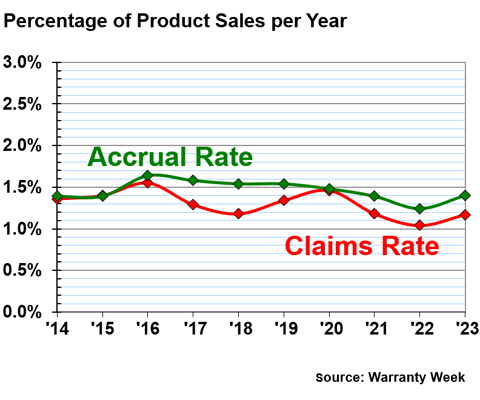

Warranty Expense Rates

According to the IC Yellow Table, global construction equipment revenue increased by 6% to $243.4 billion in 2023.

With revenue figures, we diverge a bit from the IC Yellow Table, because we count each company's total heavy equipment revenue — not just for construction equipment, but also for agricultural equipment, mining equipment, and in the case of a few companies such as Volvo Group, even for some on-highway trucks. This is because no manufacturers segment their warranty expense data in the same way that they segment revenue data, and we need to keep the scope wider to ensure the numbers in the numerator and denominator are describing the same thing.

On that basis, the pool of product sales revenue we're looking at is about twice as large: $471.5 billion in fiscal 2023, just barely up from 2022 by a miniscule 0.002%.

So $471.5 billion is the denominator we use to calculate the total warranty claims and accrual rates for the global heavy equipment industry as a whole. Anything else, such as an attempt to produce numbers just for construction equipment warranty, without the OEMs themselves providing warranty data segmented by industry or product type, would occlude the data with far too much conjecture.

For similar reasons, we only calculate the averages depicted in Figure 3 using data from the 23 OEMs for which we have warranty hard data, excluding those for which we crafted warranty estimates using the Yellow Table revenue figures.

So Figure 3 is an attempt to take the total claims from Figure 1, along with the total accruals from Figure 2, and divide them by the total product revenue figures for 23 heavy equipment manufacturers we're tracking worldwide.

Figure 3 includes 10 years of industry-wide warranty expense rate data, from 2014 to 2023.

Figure 3

Top Heavy Equipment Makers Worldwide

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2019-2023)

In 2023, the average warranty claims rate for the global heavy equipment industry was 1.17%, and the average warranty accrual rate was 1.40%.

While the majority of the OEMs had below-average claims rates in 2023, the largest OEMs, which were included in the top 11 shown in Figure 1, all had claims rates above the average.

CNH had the highest claims rate of the group in 2023, at 2.31%. Deere had a claims rate of 2.13% in 2023, and Volvo Group had a claims rate of 1.64%. Kubota, at 1.52%, Manitowoc, at 1.39%, Caterpillar, at 1.31%, and Komatsu, at 1.26%, all had claims rates above the industry average in 2023.

At the other end of the spectrum, Haulotte had the lowest claims rate of the bunch in 2023, at 0.09%. Linamar had a claims rate of 0.12%, and Hitachi had a claims rate of 0.18%.

Doosan had a claims rate of 0.67%.

There was a similar trend for the accrual rates, with the largest OEMs above the average, while the majority fell below the average.

CNH had an accrual rate of 2.56%, Deere had an accrual rate of 2.42%, and Volvo had an accrual rate of 2.14%.

Also above the average was Metso, with an accrual rate of 2.04%. And just barely below average was Komatsu, at 1.39%. Doosan had an accrual rate of 0.73%.

At the bottom of the list, Linamar had an accrual rate of 0.20%, Hitachi had an accrual rate of 0.28%, and Haulotte had an accrual rate of 0.39%.

Warranty Reserve Balances

Our final warranty metric is the balance of each manufacturer's warranty reserve fund at the end of each fiscal year. Figure 4 shows the warranty reserve end-balances for the global heavy equipment manufacturers from 2019 to 2023.

As we mentioned, the Japanese use a fiscal year that spans from April to March. In addition, other manufacturers, such as Oshkosh Corp., use a fiscal year that ends on September 30.

Figure 4

Top Heavy Equipment Makers Worldwide

Reserves Held per Year

(in US$ millions, 2019-2023)

At the end of 2023, we estimate that the global heavy equipment industry held a collective $9.824 billion in warranty reserves, down by -6% from the end of 2022.

Caterpillar had the largest warranty reserve fund in the industry at the end of 2023, with a total of $1.894 billion, an increase of 8% from the end of the year prior.

Volvo held $1.633 billion, down by -2%, and Deere held $1.610 billion, down by -30% from the end of 2022.

CNH held $610 million, an increase of 12%. Hitachi held $591 million, down by -9%. Kubota held $537 million, down by -1%. Komatsu held $436 million, just slightly down by -0.4%. And Doosan held $338 million, up by 3%.

In the "Other" category, Manitou held $37 million at the end of 2023, an increase of 27% from the end of the year prior. And Lonking held $13 million, a decrease of -25%.