Solar Power Warranty Expenses:

SunPower just filed for Chapter 11 bankruptcy in August, leaving behind ongoing 25-year product warranties, for which its suppliers are now on the hook. On the industry level, it seems that the claims rate exceeding the accrual rate is becoming a concerning new norm.

To create this warranty report, we first compiled a list of all of the global solar power manufacturers that report their product warranty expenses. We identified 11 solar manufacturers for this report, seven based in the United States, and four based internationally.

From the United States, we have: SunPower Corp., Enphase Energy Inc., First Solar Inc., Babcock & Wilcox Enterprises Inc., FTC Solar Inc., Shoals Technologies Group Inc., and Array Technologies Inc.

SolarEdge Technologies Inc. is based in Israel, but reports its warranty expenses in quarterly financial statements filed with the SEC in U.S. dollars. Then there's three more international solar manufacturers, which file annually: Canadian Solar Inc., based in Canada; JinkoSolar Holding Co. Ltd., based in China; and Maxeon Solar Technologies Ltd., based in Singapore.

For each of these 11 manufacturers, we gathered three key warranty metrics from their annual reports and quarterly financial statements: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund. In addition, we gathered data for each manufacturer's total product sales revenue, which we used to calculate two additional warranty metrics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

10 of the manufacturers report their warranty expenses in U.S. dollars, while JinkoSolar reports in Chinese yuan. Rather than convert the currency, and for ease of comparison between manufacturers of different sizes, we chose to focus on the warranty expense rates for the following charts.

SunPower

We're watching a feared scenario play out in real time with SunPower Corp., which filed for Chapter 11 bankruptcy on August 5, 2024. SunPower provided 25-year product warranties for the solar panels, microinverters, racking, etc. that it installed, many of which will now outlast the company itself.

We've seen very long product warranties in the solar industry before, but this is an example of the worst-case scenario of bankruptcy playing out.

After SunPower spun-off its manufacturing arm as the Singapore-based Maxeon Solar Technologies Ltd. in 2020, SunPower primarily focused on solar system installations in new-build and commercial construction in North America. This means that the manufactured components of the solar systems, for which SunPower provided 25-year product warranties, were all purchased from suppliers. Now, the manufacturers that supplied the specific components of SunPower's systems are all on the hook for fulfilling those warranty claims, potentially for decades to come.

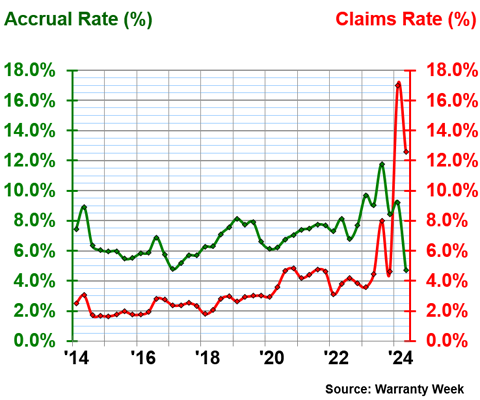

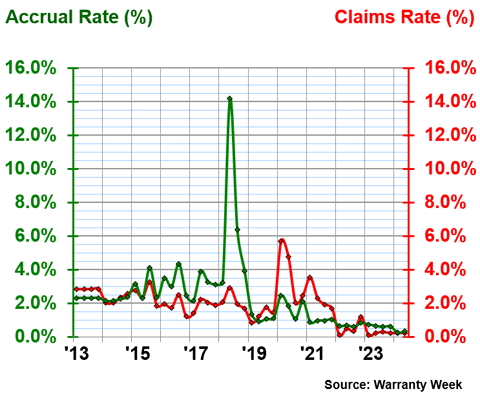

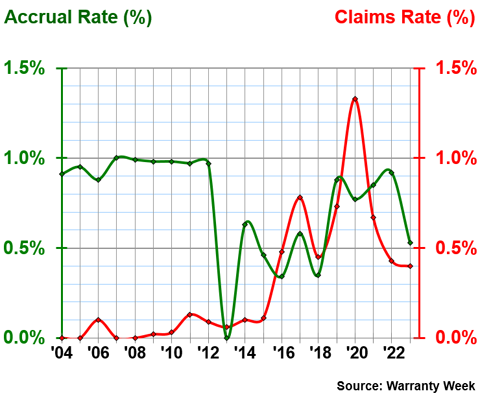

Figure 1 shows SunPower's warranty claims and accrual rates, from 2004, when the company first started reporting, to the third quarter of 2023, when it ceased reporting.

Figure 1

Solar Power Warranties:

SunPower, Claims and Accrual Rates,

(as % of product revenue, 2004-2023)

[filed Chapter 11 on Aug. 5, 2024]

We can see in Figure 1 that SunPower's warranty claims rate jumped up to 6.3% in the first quarter of 2021. The accrual rate peaked in the fourth quarter of 2021, at 3.7%. The claims and accrual rates both fell back below 1% in the first quarter of 2022, but quarterly accrual rates rose again to about 2.2% in the first three quarters of 2023.

We're not going to point to this chart and say that a specific warranty statistic foreshadowed the bankruptcy. However, in broad strokes, higher warranty claims can reflect product failures, higher warranty accruals can reflect an organization anticipating future trouble, and higher warranty expense rates can also reflect decreases in product sales revenue.

As for the fate of SunPower's 25-year product warranties? According to SunPower's website, Maxeon Solar Technologies "will meet its warranty obligations for these [SunPower-branded] solar panels at this time." Maxeon and SunPower had an exclusive relationship up until March 2024, so the majority of SunPower systems installed between 2020 and 2023 likely use SunPower-branded solar panels manufactured by Maxeon.

Additionally, Italian solar inverter supplier Fimer S.p.A. will "honor the terms of the product warranty for the Aurora PVI [photovoltaic inverter] model units used in SunPower solar systems, and ensure product availability to service warranty claims at this time."

Enphase Energy Inc., a fellow U.S.-based solar manufacturer, "will continue to honor the terms of the product warranty for Enphase microinverters used in SunPower solar systems, and ensure product availability to service warranty claims, as well as support expansion of systems, at this time."

Fronius International GmbH, an Austrian-based photovoltaic manufacturer, "will honor the terms of the product warranty for Fronius IG Plus A inverters and SunPower SPR inverters (manufactured by Fronius) and its power stages, which are used in SunPower solar systems, and ensure product availability to service warranty claims, as per the terms outlined in the Fronius terms of warranty, at this time."

Qcells North America, a wing of the South Korean-based Hanwha Q Cells Co., which in turn is owned by the Korean conglomerate Hanwha Group, is on the hook for the "product and performance warranty," which SunPower says "is tied to the serial number and will continue to apply at this time."

And REC [Renewable Energy Corp.] Solar Pte. Ltd., a Singapore-based solar power subsidiary of the Indian mega-conglomerate Reliance Industries Ltd., "will honor the terms of the product warranty for the REC420AA Pure-R solar panels used in SunPower solar systems to service accepted warranty claims at this time."

Furthermore, SunPower notes that there are consumers in the United States purchasing new homes that have already-installed SunPower solar systems, which are yet to be activated. The onus seems to be on the new homeowners to make warranty claims with the manufacturer of the specific faulty system component, or to file a claim with the homebuilder, which in turn could file a claim with the relevant supplier manufacturer.

In short, there's a warranty quagmire that has formed in the wake of SunPower's bankruptcy, with a myriad of supplier manufacturers now on the hook for 25 years of product warranty claims made for aspects of SunPower-installed solar systems. There's manufacturers in the United States, Singapore, South Korea, Italy, Austria, and India that now have product warranty obligations to North American homeowners, commercial buildings, and even homebuilders, passed to them from SunPower, which offered one of the longest product warranties in the U.S. solar industry.

Enphase Energy

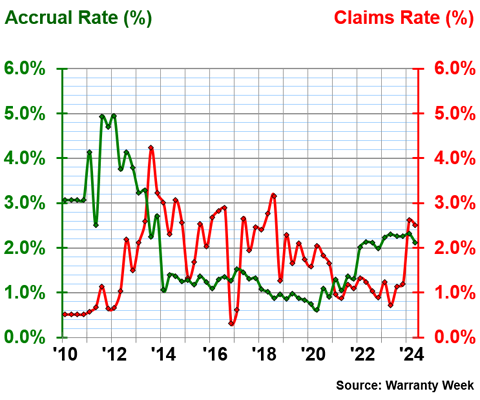

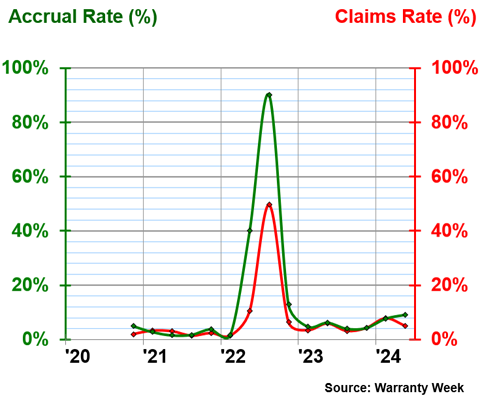

Figure 2 shows the warranty expense rates of Enphase Energy, an American manufacturer of solar microinverters, battery energy storage, and residential EV charging stations, from 2010 to the second quarter of 2024.

Figure 2

Solar Power Warranties:

Enphase Energy, Claims and Accrual Rates,

(as % of product revenue, 2010-2024)

Enphase's claims rate dropped in 2021, but rose again in 2024. In the second quarter of 2024, Enphase had a claims rate of 2.5%, and an accrual rate of 2.1%.

Enphase has been rather consistent with its accrual rate on a quarterly basis, though it rose from around 1% in 2020 to around 2% in 2022.

Enphase increased its total accruals in the first and second quarters of 2023. According to Enphase's 10-Q report for the quarter ended June 30, 2024, these extra accruals consisted of "$6.1 million for increasing the warranty period for the Enphase IQ Battery from 10 years to 15 years, and $9.9 million related to continuing analysis of field performance data and diagnostic root-cause failure analysis, primarily for Enphase IQ Battery storage systems and prior generation products."

SolarEdge

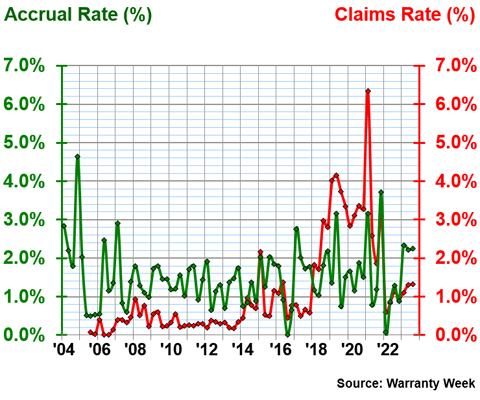

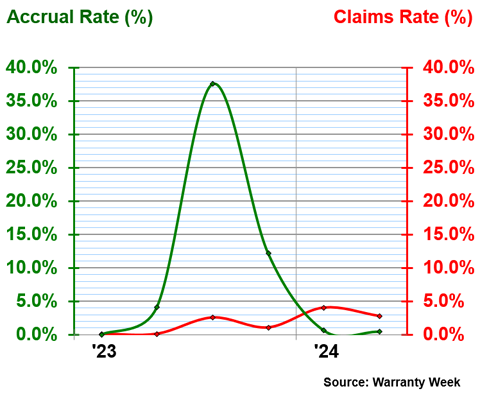

Figure 3 shows the warranty expense rates of the Israeli solar inverter manufacturer SolarEdge, from 2014 to the second quarter of 2021.

SolarEdge's warranty expense rates rose in 2023, and the claims rate rose even further in the first two quarters of 2024. The company has had some financial trouble recently. The company's stock price fell by over 80% from January 1 to mid-October, 2024. In SolarEdge's 10-Q report from the second quarter of 2024, the company stated that it saw a decrease in cost of revenue, in part due to "a decrease in warranty expenses and warranty accruals of $137.9 million, associated primarily with a decrease in revenues."

When we look at the numbers, total warranty claims paid and accruals made actually significantly decreased in the first two quarters of 2024. So the huge increases in the warranty expense rates that we see in Figure 3 are the result of decreases in revenue, rather than an increase in the product failure rate or more expensive repairs.

Figure 3

Solar Power Warranties:

SolarEdge, Claims and Accrual Rates,

(as % of product revenue, 2014-2024)

In the second quarter of 2024, SolarEdge had a claims rate of 12.6%, and an accrual rate of 4.7%. In the first quarter of the year, the claims rate was 17.0%, and the accrual rate was 9.2%.

But even before SolarEdge was having trouble with its stock price, back in 2022 and earlier, the company still had an accrual rate that hovered between 6% and 8%, which is rather high, even for this industry.

First Solar

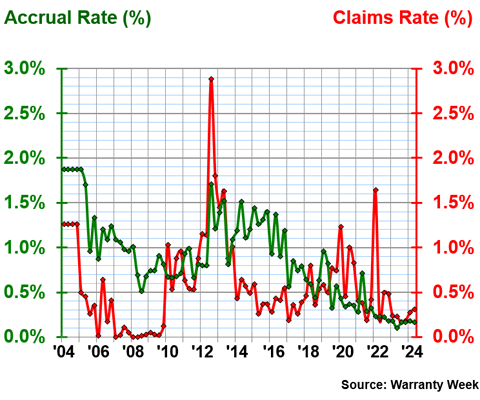

Keep in mind the differing y-axis scales of these charts. The lines in Figure 3 look much smoother than those in Figure 4, for example, but that's just because Figure 3 is on a y-axis scale of 0% to 18%, while Figure 4's y-axis scale is much smaller, from 0% to 3%.

Figure 4 shows First Solar's warranty expense rates from 2004 to the second quarter of 2024.

Figure 4

Solar Power Warranties:

First Solar, Claims and Accrual Rates,

(as % of product revenue, 2004-2024)

In the second quarter of 2024, First Solar had a warranty claims rate of 0.3%, and an accrual rate of 0.2%.

Babcock & Wilcox

Babcock & Wilcox started out as a manufacturer of steam boilers, which powered naval ships, including Theodore Roosevelt's Great White Fleet, and the first New York City subway. After World War Two, Babcock & Wilcox transitioned to the nuclear business, first developing components and materials for the Manhattan Project, then building the world's first nuclear submarine. Babcock & Wilcox built the nuclear reactor at Three Mile Island. The company still makes nuclear reactors, but has also branched out to solar energy, mainly building mass infrastructure solar projects.

So Babcock & Wilcox differs from SunPower, Enphase, SolarEdge, and First Solar, because it's not a solar pure-play, and it has a much longer company history, founded in the mid-19th century.

Figure 5 shows the warranty expense rates of Babcock & Wilcox Enterprises Inc., from 2013 to the second quarter of 2024. The company only started reporting its warranty expenses after it was formally spun-off from BWX Technologies Inc., which is a military contractor providing nuclear components, in 2015, to form two independent companies.

Figure 5

Solar Power Warranties:

Babcock & Wilcox, Claims and Accrual Rates,

(as % of product revenue, 2013-2024)

In the second quarter of 2024, Babcock & Wilcox had a claims rate of 0.2%, and an accrual rate of 0.3%. These rates have both stayed below 1% since the beginning of 2023.

Babcock & Wilcox saw its highest accrual rate in the second quarter of 2018, when it quadrupled its total accruals from $5 million to $23 million, and the accrual rate spiked to 14.2%. According to the company's 10-Q report from that quarter, that was caused by a $20.4 million increase in expected warranty costs from renewable energy infrastructural projects in Europe.

FTC Solar

FTC Solar Inc. is a small solar startup founded in 2017, which manufactures solar trackers that can increase energy production by programming solar panels to change their orientation with the sun. The company started reporting its warranty expenses in 2021, but provided data starting in the fourth quarter of 2020.

FTC Solar provides product warranties generally ranging from five to ten years for its solar trackers, so even some of the company's oldest products are likely still under warranty.

Figure 6 shows the warranty expense rates of FTC Solar from the fourth quarter of 2020 to the second quarter of 2024.

Figure 6

Solar Power Warranties:

FTC Solar, Claims and Accrual Rates,

(as % of product revenue, 2020-2024)

It's a startup in the renewable energy sector, so it's not surprising to see rather high expense rates. In the second quarter of 2024, FTC Solar had a claims rate of 5.1%, and an accrual rate of 9.1%.

However, even for a startup, FTC Solar had astronomical warranty expense rates in the third quarter of 2022 in particular. In that quarter, the claims rate was 49.6%, and the accrual rate was 90.0%. It's a reminder that no matter how much product sales revenue a manufacturer generates, or doesn't generate, in a given quarter, warranty costs will still arise. It just so happened that in the third quarter of 2022, 90% of FTC Solar's total product sales revenue was the $3.2 million set aside in warranty accruals. It's not a crazy amount of accruals — in fact, FTC Solar accrued $5.7 million in the fourth quarter of 2021, and that was only 3.8% of the total product sales revenue from that quarter.

Shoals Technologies

Shoals Technologies Group Inc. was founded in 1996 as a supplier for the automotive industry, and pivoted to solar in 2002, first as a component supplier to First Solar. It now makes Electrical Balance of Systems (EBOS) components, which are all of the components of a solar system beyond the panels, inverters, trackers, and racking. The company went public in 2021, and started reporting its warranty expenses in 2023.

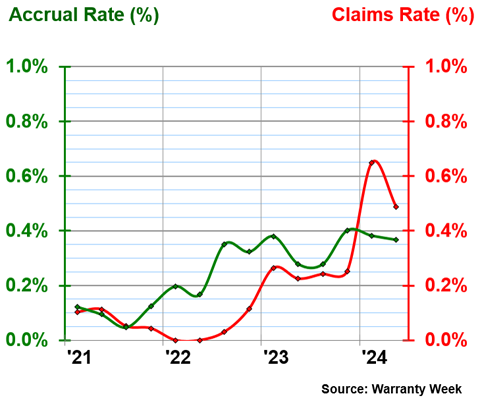

Figure 7 shows Shoals' warranty expense rates from the first quarter of 2023 to the second quarter of 2024.

Figure 7

Solar Power Warranties:

Shoals Technologies Group, Claims and Accrual Rates,

(as % of product revenue, 2023-2024)

In the second quarter of 2024, Shoals had a claims rate of 2.8%, and an accrual rate of 0.4%. In the third quarter of 2023, the accrual rate jumped to 37.6%. In 2023, Shoals added an extra $55 million in warranty accruals because "a subset of wire harnesses used in its EBOS solutions is presenting unacceptable levels of pull back of wire insulation at connection points," also called "wire insulation shrinkback."

Array Technologies

Array Technologies Inc. is a solar tracker manufacturer founded in 1992, which went public at the end of 2020, and thus started reporting its warranty expenses in 2021.

Figure 8 shows Array Technologies' warranty expense rates from 2021 to the second quarter of 2024.

Figure 8

Solar Power Warranties:

Array Technologies, Claims and Accrual Rates,

(as % of product revenue, 2020-2024)

Since it started reporting, neither of Array's warranty expense rates has exceeded 1%. In the second quarter of 2024, Array had a claims rate of 0.5%, and an accrual rate of 0.4%.

Canadian Solar

Finally, we'll take a look at the warranty expense rates of three internationally-based solar manufacturers that report on an annual basis.

Figure 9 shows the warranty expense rates of Canadian Solar, a photovoltaic cell manufacturer founded in 2001, which operates large-scale solar projects across six continents.

Figure 9

Solar Power Warranties:

Canadian Solar, Claims and Accrual Rates,

(as % of product revenue, 2004-2023)

In 2023, Canadian Solar had a warranty claims rate of 0.4%, and an accrual rate of 0.5%.

JinkoSolar

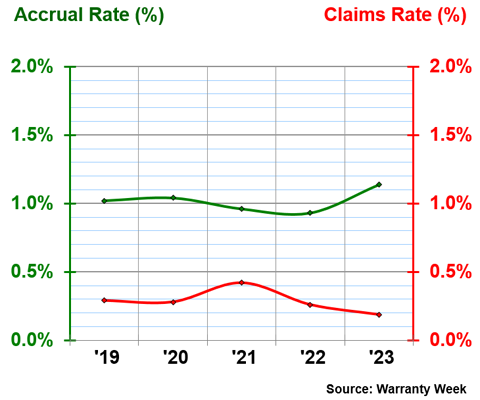

Figure 10 shows the warranty expense rates of JinkoSolar Holding Co. Ltd., a Chinese solar module manufacturer, from 2019 to 2023.

Figure 10

Solar Power Warranties:

JinkoSolar, Claims and Accrual Rates,

(as % of product revenue, 2019-2023)

In 2023, JinkoSolar had a claims rate of 0.2%, and an accrual rate of 1.1%.

Maxeon Solar

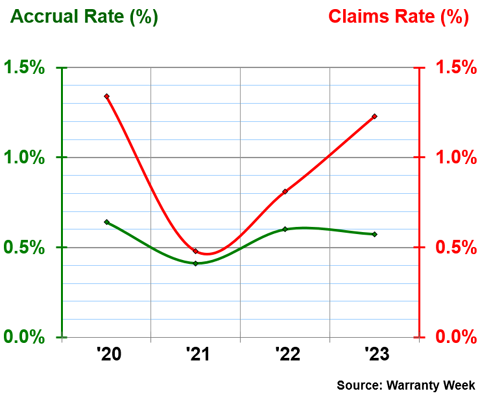

Figure 11 shows the warranty expense rates of Maxeon Solar Technologies Ltd., the former solar panel manufacturing wing of SunPower, which was spun-off in 2020, and is based in Singapore.

Figure 11

Solar Power Warranties:

Maxeon Solar, Claims and Accrual Rates,

(as % of product revenue, 2020-2023)

In 2023, Maxeon had a claims rate of 1.2%, and an accrual rate of 0.6%.

While these rates are low, especially compared to comparably-aged U.S.-based startups, it's a red flag that Maxeon's claims rate has exceeded its accrual rate every year since the company was formed. If the claims rate continues to increase, Maxeon will need to increase its annual warranty accruals to avoid depleting the warranty reserve fund.

However, Maxeon isn't alone in having its claims rate exceed its accrual rate in the most recent period for which we have data. Enphase Energy, SolarEdge, First Solar, Shoals Technologies, and Array Technologies all saw their claims rate exceed their accrual rate in the second quarter of 2024. That's five out of the seven U.S.-based solar manufacturers on this report. This is a precarious new industry standard, especially troubling for a sector where decade-long product warranties are typical.