Electric Vehicle Warranty Expense Rates:

While EV adoption rates have wavered in the United States, they're going steady in China and Europe. We're looking at the warranty expense rates of nine EV pure plays, including the two largest competitors, BYD and Tesla, along with a number of newer startups.

The large global automotive manufacturers are transitioning from internal combustion engine (ICE) vehicles to electric vehicles (EVs) — some faster than others. In addition, there's a growing number of EV-only "pure play" startups that are gaining popularity globally, and one key manufacturer that formerly produced ICE vehicles, but has already fully transitioned to only manufacturing EVs.

Globally, the International Energy Agency (IEA) estimates that electric vehicles accounted for about 18% of all new light-duty cars sold in 2023. About two-thirds of those EVs were battery electric vehicles (BEVs), while the other third were plug-in hybrid EVs (PHEVs).

However, countries and regions are seeing different rates of passenger car electrification. According to the IEA, about 60% of all EVs sold globally in 2023 were sold in China, while 25% were sold in Europe, and 10% in the United States.

According to the International Trade Council (ITC), China surpassed Japan as the largest auto exporter in the world in 2023. China exported over 4 million cars in 2023, of which 1.2 million, about one-third, were EVs. Chinese car exports increased by 65% from 2022 to 2023, and Chinese EV exports increased by 80% over the same period.

While heavy-duty truck electrification is not the focus of this newsletter, China has become a global case study for electric trucks and battery swap technology. China also has the largest public EV charger infrastructure network in the world, according to the International Council on Clean Transportation (ICCT). China has over 1 million EV chargers, a little more than 50% of all global EV chargers. However, China's proportion of EVs to chargers is still lacking, and the country's electrification infrastructure continues to expand rapidly.

Certain European countries have also been leaders in the global EV transition for years. Just recently, Norway was the first in the world to hit the milestone of electric cars outnumbering petrol cars registered in the country. In August 2024, EVs made up 94% of new car registrations in Norway. Elsewhere in Europe, the Netherlands has the most EV chargers in the EU, to the point that, according to the country's tourism board, "range anxiety is not an issue in the Netherlands."

Other countries currently working on expanding their charging infrastructure and EV adoption rates include Germany, the United Kingdom, Sweden, Japan, South Korea, France, Canada, and the United States.

The Manufacturers

For this newsletter, we're focusing in on the warranty claims and accrual rates of manufacturers that only produce electric vehicles. With the exception of BYD, these are all relatively new automakers that have only ever manufactured electric vehicles.

By far, the two largest global EV pure play manufacturers are Tesla and BYD, based in the United States and China, respectively.

BYD Company Ltd. was established in 1995 as a battery manufacturer. In 2003, BYD Auto was founded, after BYD Company acquired Xi'an Qinchuan Automobile. BYD made its first ICE vehicle in 2005, and its first PHEV and BEV in 2009. In 2022, BYD stopped manufacturing ICE vehicles, and now only makes EVs.

Tesla Inc. was founded in 2003 as an EV-only startup, and manufactured its first vehicle, the Roadster, in 2008.

As reported by Rosa de Acosta for CNN, BYD surpassed Tesla as the world's number one seller of BEVs in the fourth quarter of 2023, but Tesla took the lead again in the first and second quarters of 2024. However, a report put out by Counterpoint Research in July 2024 predicts that BYD will overtake Tesla to sell the most BEVs globally by the end of 2024.

Li Auto Inc., Nio Inc., and XPeng Motors are three more EV-only startups based in China.

Li Auto makes extended-range electric vehicles (EREVs), which are a type of hybrid that use a small internal combustion engine to extend their range, but are typically considered more environmentally friendly than PHEVs. Li Auto was founded in 2015.

Nio is a pioneer in passenger vehicle battery swap technology, where a dead battery pack is quickly exchanged for a fully-charged one, rather than waiting for vehicle charging. Nio has about 2,300 battery swap stations globally, and was founded in 2014.

Guangzhou Xiaopeng Motors Technology Co., Ltd., which does business as XPeng Motors, was founded in 2014 by former executives from the GAC Group. XPeng makes BEVs and owns its own charging network around China.

XPeng and BYD have both been developing lithium iron phosphate (LFP) batteries for their vehicles, which negates the need for cobalt in a battery.

Polestar Automotive Holding UK PLC is based in Sweden, and is a fully-owned subsidiary of Volvo Car, which in turn is majority-owned by the Chinese-based Geely Holding Group. Polestar reports separately from both Volvo Car and Geely Auto, and does so in U.S. dollars, despite being based in Sweden. Polestar is a luxury EV manufacturer that was founded in 2017.

VinFast Auto Ltd. is a Vietnam-based EV manufacturer founded by Vingroup in 2017. VinFast exported its first vehicles to Russia in 2018, and now has vehicles available in the United States, Canada, Germany, France, and the Netherlands. VinFast also manufactures electric scooters, motorcycles, and transit buses. VinFast has two factories in Vietnam, one of which it purchased from General Motors. The company has announced plans to open a factory in North Carolina, United States, in 2028. VinFast sold 21,747 units globally during the first two quarters of 2024.

Lucid Group Inc., also known as Lucid Motors, is a U.S.-based EV manufacturer that was founded in 2007. Lucid produced 3,838 vehicles in the first half of 2024. Lucid is majority-owned by the Saudi Arabia Public Investment Fund (PIF), the sovereign wealth fund controlled by the Crown Prince of Saudi Arabia.

And for the first time, we have enough warranty data available from Rivian Automotive Inc. to make charts. Rivian is a U.S.-based EV manufacturer that was founded in 2009, which produced 23,592 units in the first half of 2024. Amazon owns somewhere between 15% and 20% of Rivian. Ford owned 13% of Rivian until 2023, when it sold its shares. For more information about the ownership and profitability of Lucid and Rivian, take a look at Andrew J. Hawkins' article "Rivian and Lucid are still burning a lot of cash, but thankfully, they have rich backers."

The Data

To gather the following data, first we perused the annual reports and quarterly financial statements of each global EV-only manufacturer. We extracted three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund.

We also collected data on each manufacturer's total automotive sales revenue, in order to calculate two additional warranty metrics: claims as a percent of sales (the claims rate), and accruals as a percent of sales (the accrual rate).

Since the 10 manufacturers in this newsletter vary in size, and report their expenses in four different currencies, we decided to leave the data in their original forms, and focus instead on the warranty expense rates.

BYD, Li Auto, Nio, and XPeng all report in renminbi, also known as Chinese yuan (¥). Tesla, Rivian, Lucid, and Polestar report in U.S. dollars ($). And VinFast reports in Vietnamese dong (VND).

The Two Industry Leaders

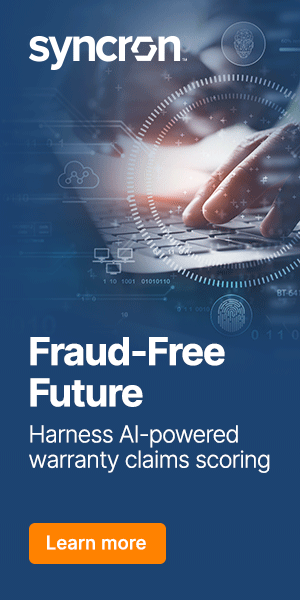

BYD and Tesla have been jostling to outsell each other globally. Figures 1 and 2, respectively, show the warranty claims and accrual rates of these two manufacturers since they started reporting their warranty expenses.

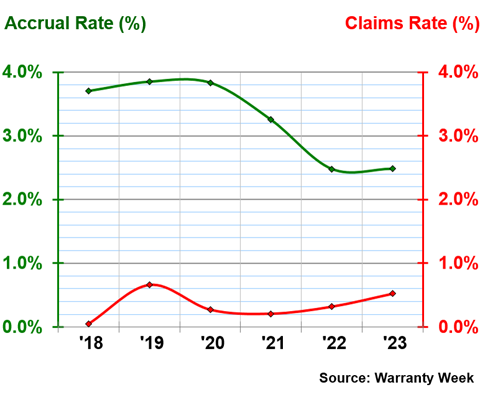

Figure 1

Electric Vehicle Manufacturer Warranties:

BYD, Claims and Accrual Rates,

(as % of product revenue, 2006-2023)

In 2023, BYD had a warranty claims rate of 0.75%, and a warranty accrual rate of 2.65%.

It's a quite low claims rate, especially since BYD has had a couple of recent recalls, albeit rather small ones.

In 2022, BYD recalled more than 60,000 units due to an issue with its pouch-type batteries, where leaking electrolytes could cause the battery to combust or explore. BYD's claims rate rose from 0.58% in 2022 to 0.75% in 2023, but was still lower than the rates from before the company stopped producing ICE vehicles.

Recently, BYD recalled 16,666 EVs in China during the spring of 2024, due to an issue with the backup cameras. This recall was issued after the scope of our annual data, but could drive up warranty expenses for 2024.

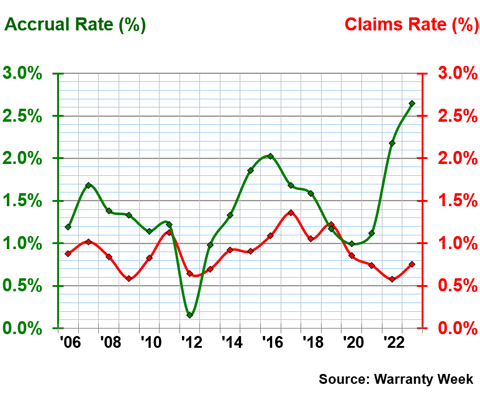

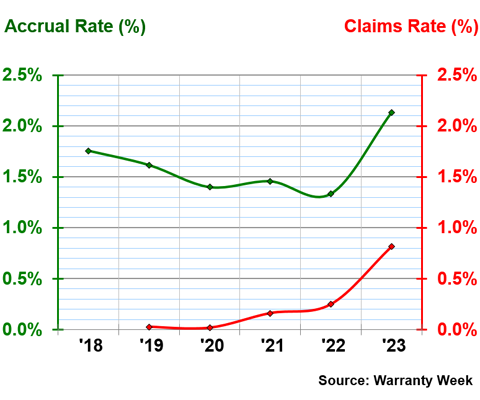

Figure 2

Electric Vehicle Manufacturer Warranties:

Tesla, Claims and Accrual Rates,

(as % of product revenue, 2008-2024)

In the second quarter of 2024, Tesla had a warranty claims rate of 1.58%, and an accrual rate of 3.30%.

In 2023, Tesla had an average claims rate of 1.49%, and an average accrual rate of 2.81%.

Tesla had a late 2023 and early 2024 riddled with major recalls. In December 2023, the National Highway Traffic Safety Administration (NHTSA) issued a recall of over 2 million Tesla vehicles sold in the United States, and in January 2024, China's State Administration for Market Regulation mandated that Tesla recall more than 1.6 million vehicles sold in China. Both of these recalls were related to safety issues associated with Tesla's Autopilot and Autosteer technology.

And then in February 2024, the NHTSA announced the recall of 2.2 million Tesla vehicles, more or less every vehicle the manufacturer has ever sold in the United States, because "an incorrect font size is displayed on the instrument panel for the Brake, Park, and Antilock Brake System (ABS) warning lights." The remedy for both the warning light font size and Autopilot recalls are over-the-air software updates, but they've still driven up Tesla's claims rate. Take a look at our February 2024 newsletter "U.S. Auto Warranty Annual Reports" for more in-depth information about these Tesla recalls.

Three More Chinese EV Pure Plays

Figures 3, 4, and 5 show the annual warranty expense rates of Li Auto, Nio, and XPeng, respectively.

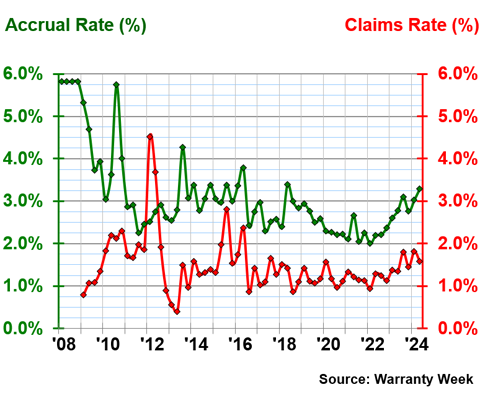

Figure 3

Electric Vehicle Manufacturer Warranties:

Li Auto, Claims and Accrual Rates,

(as % of product revenue, 2019-2023)

In 2023, Li Auto had a claims rate of 0.11%, and an accrual rate of 1.89%. The company has kept its warranty expense rates very consistent. In 2022, Li also had a claims rate of 0.11%, and an accrual rate of 1.82%.

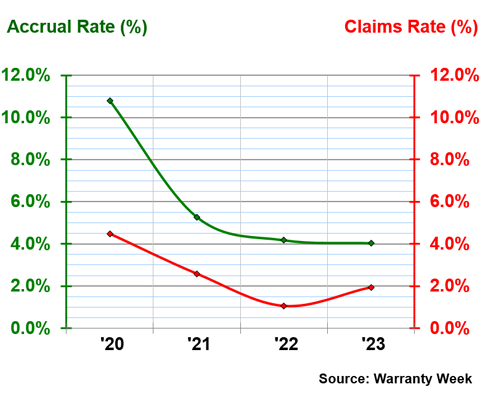

Figure 4

Electric Vehicle Manufacturer Warranties:

Nio, Claims and Accrual Rates,

(as % of product revenue, 2018-2023)

In 2023, Nio had a claims rate of 0.52%, up a bit from 2022's claims rate of 0.32%. Nio had an accrual rate of 2.48% in 2023, the same level as 2022.

Figure 5

Electric Vehicle Manufacturer Warranties:

XPeng, Claims and Accrual Rates,

(as % of product revenue, 2018-2023)

XPeng's claims and accrual rates both increased rather sharply in 2023, compared to Nio and Li Auto. XPeng's claims rate rose from 0.25% in 2022 to 0.82% in 2023, and its accrual rate rose from 1.33% in 2022 to 2.13% in 2023.

Polestar

We've seen gaps of about 2% between the claims and accrual rates of the first five manufacturers, and Polestar adheres to this trend as well, as shown in Figure 6.

Figure 6

Electric Vehicle Manufacturer Warranties:

Polestar, Claims and Accrual Rates,

(as % of product revenue, 2020-2023)

In 2023, Polestar had a claims rate of 1.94%, and an accrual rate of 4.03%. Polestar's claims rate increased by about 1% from 2022 to 2023, while the accrual rate decreased slightly over the same period.

Polestar has been decreasing its accrual rate every year since it started reporting in 2020, when it had a very high accrual rate of 10.81%, along with a rather high claims rate of 4.49%. The company seems to have gotten a better handle on its warranty expenses since then.

VinFast

As we saw in 2020 from Polestar, new EV pure play startups can struggle to master their warranty expenses in their early days. Several of the startups from last year's newsletter "U.S. EV-Only Warranty Expense Rates" with particularly wonky warranty expense rates are already out of business or no longer reporting their warranty expenses, showing the importance of mastering warranty costs in the early days of manufacturing. Warranty might not make or break a company's profitability, especially since many of these startups lose money on each vehicle they sell, but it is definitely a telling symptom of larger issues at play.

The next four manufacturers are the newest to warranty reporting in this newsletter. We're not here to speculate about these companies' futures, so we'll simply let the warranty data speak for itself.

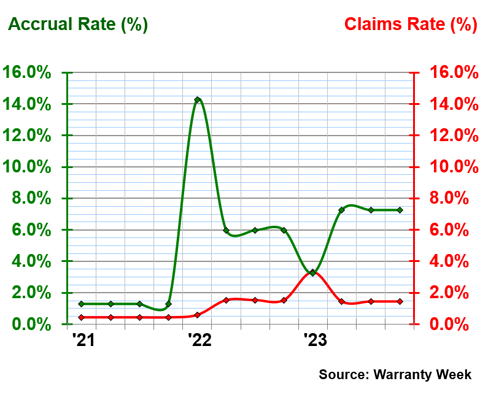

Figure 7 shows VinFast's warranty expense rates from 2021 to 2023.

Figure 7

Electric Vehicle Manufacturer Warranties:

VinFast, Claims and Accrual Rates,

(as % of product revenue, 2021-2023)

In the fourth quarter of 2023, VinFast had a claims rate of 1.44%, and an accrual rate of 7.25%. VinFast's accrual rate peaked at 14.29% in the first quarter of 2022.

Two U.S.-based EV Pure Plays

Figures 8 and 9 show the warranty expense rates of Lucid and Rivian, respectively.

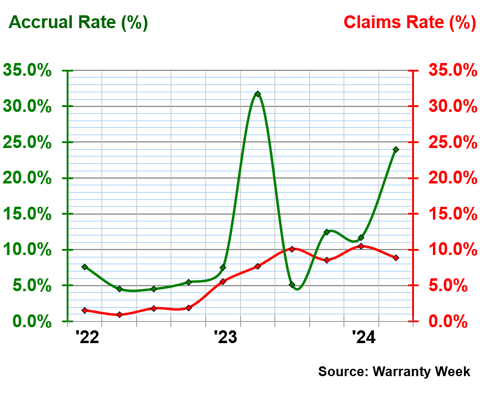

Figure 8

Electric Vehicle Manufacturer Warranties:

Lucid Group, Claims and Accrual Rates,

(as % of product revenue, 2022-2024)

In the second quarter of 2024, Lucid had a claims rate of 8.88%, and an accrual rate of 24.01%. These are by far the largest warranty expense rates we've seen from any of the EV pure plays that report their warranty expense data. We'd be very concerned for Lucid's future if it wasn't majority owned by the PIF.

Lucid's accrual rate peaked at an amazing 31.74% in the second quarter of 2023. That means that in the second quarter of 2023, Lucid deposited almost one-third of its total vehicle sales revenue into its warranty reserve fund. It's a quite staggering statistic, when global manufacturers usually accrue around 2.5% of their sales revenue for future warranty costs.

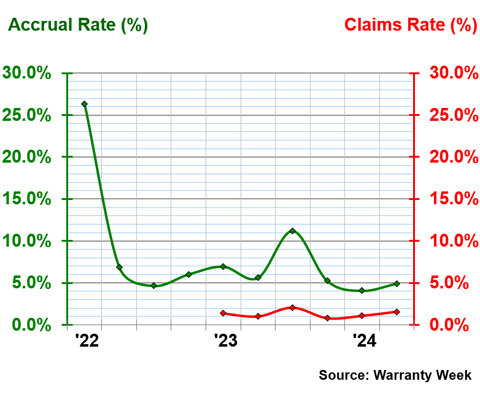

Figure 9

Electric Vehicle Manufacturer Warranties:

Rivian Automotive, Claims and Accrual Rates,

(as % of product revenue, 2022-2024)

In the second quarter of 2024, Rivian had a claims rate of 1.55%, and an accrual rate of 4.92%.

Rivian's accrual rate peaked at 26.32% in the first quarter of 2022. That means that there was a point at which Rivian was accruing one-quarter of its vehicle sales revenue for future warranty expenses.

Can't wait until we release the 2023 Worldwide Auto Warranty Report? Catch up on the 2023 & 2024 regional auto warranty data:

- U.S. Auto Warranty Annual Reports

- European Automaker Warranty Expenses

- Japanese Automaker Warranty Expenses

- Mid-Year U.S. Auto Warranty Report

- Top Korean & Indian Automaker Warranty Expenses