Top Korean & Indian Automaker Warranty Expenses:

Hyundai and Kia had another tough year, marked by recalls of millions of their vehicles. On the back of a 2022 also filled with recalls, the warranty expenses of the two South Korean vehicle manufacturers are higher than ever. Tata, on the other hand, has become consistent in its warranty accounting, years after its acquisition of Jaguar Land Rover.

The anticipation of our Worldwide Auto Warranty Report grows. We recently announced that we'll be presenting the results of that upcoming newsletter at the MapConnected Service & Warranty Lifecycle Summit in October. We'll also be presenting our industry news flashes at the 15th Annual Extended Warranty & Service Contract Innovations conference in Chicago in two weeks. We're excited to connect with many of our subscribers at these conferences this autumn.

This week, we're taking a look at the annual warranty expenses of the top automakers based in South Korea and India. We already analyzed the 2023 data for their Japanese neighbors back in July.

Based in South Korea, we have two major global automakers, Hyundai Motor Co. and Kia Motors Corp. Hyundai owns one-third of Kia, so some technically consider Hyundai to be Kia's parent company. However, the two manufacturers function independently, have different product lines, and report their annual expenses separately, so we treat them as two distinct manufacturers for the purposes of this analysis.

Hyundai also owns the Genesis Motor luxury vehicle brand, and the Ioniq electric vehicle brand, both of which are fully-owned subsidiaries.

Hyundai didn't always own part of Kia. During the 1997 Asian financial crisis, Kia declared bankruptcy. Hyundai acquired 51% of Kia in order to keep it in business, outbidding Ford, which had previously partnered with and owned a stake in Kia during the 80's and 90's. Hyundai has since divested some of its stake in Kia, down to one-third ownership, but remains the company's largest shareholder.

Our third top manufacturer in this report is Tata Motors Ltd., based in India. Tata purchased the Land Rover and Jaguar Cars brands from Ford back in 2008, later consolidating them into the U.K.-based subsidiary holding company Jaguar Land Rover. Tata has also owned the South Korean-based Daewoo Commercial Vehicles Division, now known as the Tata Daewoo Commercial Vehicle Co., since 2004. Tata also manufactures buses, under the Tata, Hispano, and Marcopolo brands, and some construction equipment in a joint venture with Japanese-based Hitachi Construction Machinery Co.

Although Jaguar Land Rover and Daewoo Commercial Vehicles are technically subsidiaries of Tata, the company reports all of the warranty expenses of all of its global brands collectively, unlike the relationship between Geely Auto, Volvo Cars, and Polestar. Thus all of these subsidiaries of Tata are represented in the following data.

For this newsletter, we decided to exclude the warranty expenses of Tata's Indian compatriot Mahindra. Although Mahindra does make some passenger vehicles, it primarily manufactures medium- and heavy-duty trucks, along with heavy equipment used for agriculture and construction. Mahindra's reported warranty expenses are also on a much smaller scale than those of Hyundai, Kia, and Tata, so the data would struggle to show up in our charts anyway. Nevertheless, we appreciate Mahindra's reporting, and we'll see them in the upcoming Worldwide Auto Warranty Report.

Hyundai and Kia both report their annual expenses in South Korean won, while Tata reports in Indian rupee. So we used the U.S. Internal Revenue Service's Yearly Average Currency Exchange Rates table to convert all the data into U.S. dollars for ease of comparison.

We should note that Tata reports using the Indian numbering system, which uses lakhs and crores. So we first converted these data to Western numbers, and then converted from rupees to U.S. dollars.

We'll also note that Tata follows the Japanese convention of having a fiscal year that ends on March 31, while Hyundai and Kia use the calendar year system. So we'll refrain from comparing these manufacturers to each other, and rather focus on comparing each of them to their past selves.

We perused the annual reports of these three manufacturers, and extracted three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund.

We also gathered data on total automotive product sales revenue, and total unit sales, in order to calculate three additional warranty metrics: claims as a percent of sales (the claims rate), accruals as a percent of sales (the accrual rate), and accruals made per vehicle sold (in U.S. dollars).

Warranty Claims Totals

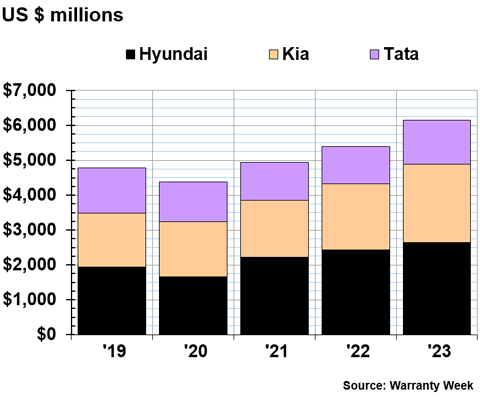

Figure 1 shows the total warranty claims paid by Hyundai, Kia, and Tata from 2019 to 2023, converted to U.S. dollars.

Keep in mind that the South Korean won depreciated against the U.S. dollar rather steeply in 2022, which can affect the totals, since we converted them to U.S. dollars based on annual exchange rates. However, the won remained relatively stable in 2023.

Figure 1

Top Korean & Indian Auto Manufacturers

Claims Paid per Year

(in billions of U.S. dollars, 2019-2023)

Hyundai paid $2.635 billion in warranty claims during 2023, an increase of 9% from the year prior. This was the highest total annual claims costs the company has ever seen. 2023 was the third year in a row that Hyundai's claims costs increased.

Kia paid $2.253 billion in claims during 2023, an increase of 19% from 2022. This was the highest total we've ever seen from Kia, and the first time that the company's claims costs exceeded $2 billion in a single year. Amazingly, Kia's total claims costs have increased every year from 2011 to 2023; that's 14 years in a row that Kia's claims costs rose.

Hyundai and Kia have both been embroiled in huge, lengthy, and difficult recalls. There's the Theta 2 engine recall, which was announced for the first time all the way back in September 2015, and has lasted for nearly a decade. Hyundai and Kia's Theta 2 engines have a risk of setting fire.

The two manufacturers have expanded the Theta 2 recall several times over the years, notably in 2017, 2019, 2020, and most recently in September 2023. In some cases, the remedy for this recall is to replace the entire vehicle engine; in other vehicles, if the defect that can cause a fire isn't detected, the Knock Sensor Detection System software is installed as a preventative measure. So in addition to being a very lengthy recall, it's an expensive repair that requires a dealer visit and inspection of each vehicle. There's currently a class action lawsuit in progress for owners of Hyundai and Kia vehicles with engine fire issues, including the Theta 2 engine.

In addition to the Theta 2 engine recall, Hyundai and Kia recalled 1.64 million and 1.73 million vehicles, respectively, for an issue with the Anti-Lock Brake System (ABS), which could spill brake fluid internally and cause an electrical short, potentially leading to an engine compartment fire while parked or driving. As such, the U.S. National Highway and Traffic Safety Administration (NHTSA) urged owners to park their vehicles "outside and away from homes until their vehicles have been repaired."

Furthermore, Hyundai recalled an additional 585,000 2019-2023 Santa Fe models in March 2023, due to an issue with the tow hitch harness. According to the NHTSA recall, "Debris and moisture accumulation on the tow hitch harness module printed circuit board (PCB) may cause an electrical short, which can result in a fire."

In addition to these, several months into 2023, Hyundai and Kia were still fulfilling claims from a September 2022 recall of 3.3 million vehicles, also related to the ABS module. The September 2023 ABS recall was an expansion of the initial 2022 recall.

Tata also saw an increase in its claims payments, but nothing record-breaking. Tata paid $1.264 billion in warranty claims during fiscal 2023, an 18% increase from fiscal 2022.

Warranty Claims Rates

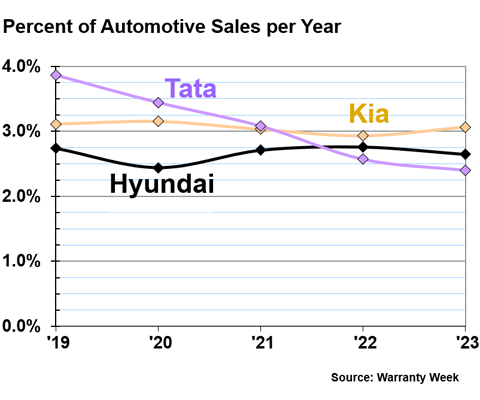

Figure 2 shows the annual claims rates of these three manufacturers, from 2019 to 2023.

Figure 2

Top Korean & Indian Auto Manufacturers

Warranty Claims Rates

(as a percentage of sales, 2019-2023)

We can see in Figure 2 that Tata's claims rate has steadily fallen for five years in a row. In fiscal 2023, Tata had a claims rate of 2.40%. In contrast, Tata's claims rate was 3.86% in 2019. This is great news for Tata after a decade of warranty expenses higher than the global industry average, ever since the company acquired Jaguar Land Rover in 2008.

Hyundai's claims rate fell a bit from 2022 to 2023. In 2023, Hyundai had a claims rate of 2.65%.

Kia's claims rate rose a bit from 2022 to 2023. In 2023, Kia had a claims rate of 3.07%.

Both Kia and Hyundai have been quite consistent on the proportion of their vehicle sales revenue that goes to paying warranty claims. Although we saw steadily increasing total claims costs for both manufacturers in Figure 1, the claims rates in Figure 2 show that the manufacturers are still spending the same proportion of revenue on warranty claims from year to year. So the increases in total claims payments are proportional to increases in vehicle sales. However, it's not the same story for the warranty accruals made by the two manufacturers, which have fluctuated much more in the past five years, both in total and in proportion to revenue.

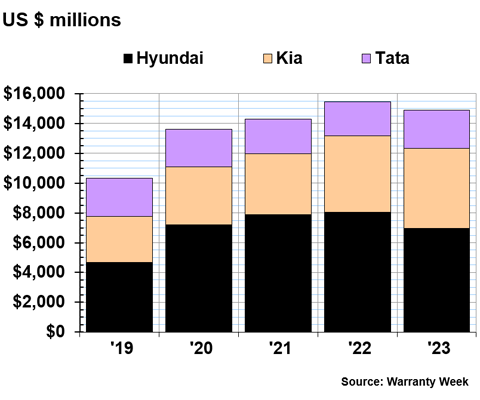

Warranty Accrual Totals

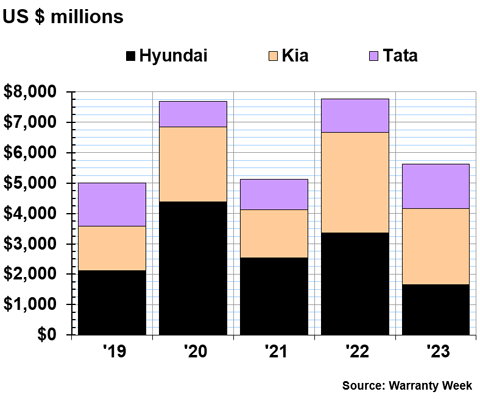

Figure 3 shows the total amount of warranty accruals made by each manufacturer, from 2019 to 2023.

Figure 3

Top Korean & Indian Auto Manufacturers

Accruals Made per Year

(in billions of U.S. dollars, 2019-2023)

We can see in Figure 3 that Hyundai and Kia both decreased their warranty accruals from 2022 to 2023, despite the rising claims payments over the same period that we saw in Figure 1.

In 2023, Hyundai accrued $1.665 billion, a -51% decrease from 2022's total of $3.366 billion. So Hyundai halved its total warranty accruals from 2022 to 2023. This figure is a bit puzzling, since Hyundai paid nearly $1 billion more in claims than it set aside in accruals during 2023.

Hyundai's annual warranty accruals have fluctuated wildly over the last five years. Hyundai doubled its total accruals from 2019 to 2020, then cut its accruals by two-fifths from 2020 to 2021, then increased its accruals by one-third from 2021 to 2022, and then halved accruals from 2022 to 2023. Those are huge inconsistencies, especially for a large global manufacturer.

Based on these data, we would suggest that Hyundai is struggling to predict the future warranty costs of its vehicles.

Unsurprisingly, since the Theta 2 recall has affected both Hyundai and Kia, Kia has also had very inconsistent warranty accruals from one year to the next. In 2023, Kia accrued $2.498 billion for future warranty costs, a decrease of -24% from the year prior.

Kia increased its accruals by about three-quarters from 2019 to 2020, then decreased its accruals by about one-third from 2020 to 2021, then more than doubled accruals from 2021 to 2022, and decreased accruals by one-quarter from 2022 to 2023.

The directions of the fluctuations in warranty accruals for Hyundai and Kia are the same, but the intensity varies between the two companies. Over the last five years, Hyundai's most challenging year based on this metric was 2020, when it more than doubled its total warranty accruals. In contrast, Kia's most challenging year for warranty was 2022, when it in turn more than doubled its accruals. In the year Hyundai doubled its accruals, Kia increased its accruals by 70%, and in the year Kia doubled its accruals, Hyundai increased its accruals by one-third.

Tata accrued $1.459 billion during fiscal 2023, a 33% increase from its total accruals during fiscal 2022. Tata's total warranty accruals were at about this level in 2019, but dropped in 2020, and stayed comparatively low in 2021 and 2022. So this increase marks a return to the manufacturer's typical total accruals from before the pandemic.

These data presented in Figure 3 take a very interesting shape when shown in proportion to total vehicle sales revenue, which is depicted in Figure 4.

Warranty Accrual Rates

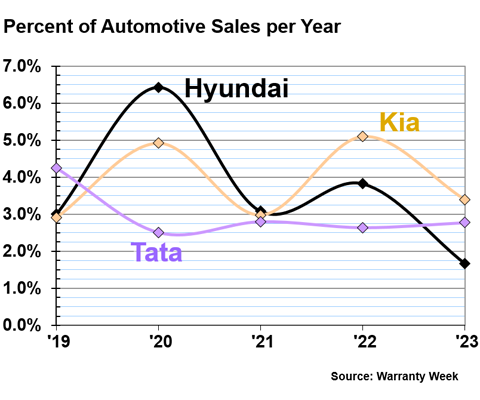

Figure 4 shows the warranty accrual rates of the three automotive manufacturers, from 2019 to 2023.

Figure 4

Top Korean & Indian Auto Manufacturers

Warranty Accrual Rates

(as a percentage of sales, 2019-2023)

Hyundai's accrual rate fell in half from 2022 to 2023, consistent with the company halving its total accruals over the same period. Similarly, Kia's accrual rate fell by about one-third, while its total accruals fell by about one-fourth, from 2022 to 2023.

In 2023, Hyundai had an accrual rate of 1.67%, and Kia had an accrual rate of 3.40%.

In fiscal 2023, Tata had an accrual rate of 2.77%. Figure 4 helps highlight just how consistent Tata's warranty expenses have been since 2020.

Accruals per Vehicle Sold

Global automotive manufacturers conveniently disclose the number of units they sell worldwide each year in their annual reports, so we calculate one additional warranty metric: the amount of warranty accruals per vehicle sold.

We know that Tata also makes buses and trucks. Tata also makes luxury vehicles under the Jaguar and Land Rover brands. So we won't compare Tata's accruals per vehicle sold to those of Hyundai and Kia, but we will compare it to itself in past years.

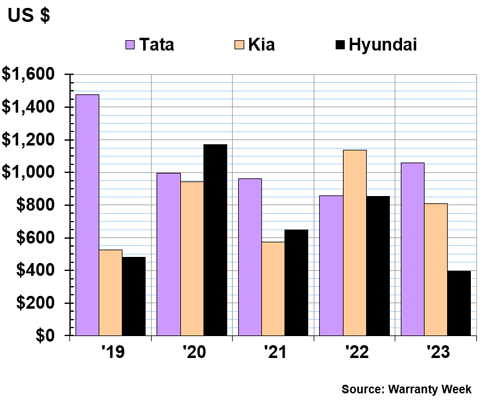

Figure 5

Top Korean & Indian Auto Manufacturers

Accruals Made per Vehicle Sold

(in U.S. dollars, 2019-2023)

In fiscal 2023, Tata accrued an average of $1,057 per vehicle sold, a 23% increase from the year prior. However, this is still a lower amount of accruals per vehicle sold than we saw from the company back in 2019. 2019's average of $1,478 accrued per vehicle sold was the highest we've seen this metric from Tata.

Hyundai's accruals per vehicle sold dropped back down in 2023 after rising for a few years. In 2023, Hyundai accrued an average of $395 per vehicle sold, a -54% decrease in this metric from 2022.

Up until 2018, Hyundai tended to have relatively low accruals per vehicle sold, usually between $200 and $350 per vehicle. In contrast, its accruals per vehicle sold soared to $1,171 in 2020, and again to $853 in 2022. So 2023's $395 seems to be a return to normal, although, as we saw in Figures 1 and 3, Hyundai's total accruals were much lower than its claims payments in 2023, so it's unclear if this is sustainable for the manufacturer.

Kia accrued an average of $809 per vehicle sold in 2023, a -29% decrease from 2022. Up until 2017, Kia's accruals per vehicle sold never exceeded $400, so this drop still hasn't brought this metric down to what we had once come to expect from Kia. Kia's record high for this metric came in 2022, when the company accrued an average of $1,137 per vehicle sold.

Warranty Reserves Balances

Our final warranty metric is the balance of each manufacturer's warranty reserve fund at the end of each fiscal year. Figure 5 shows the three manufacturers' warranty reserve end-balances from 2019 to 2023.

Figure 6

Top Korean & Indian Auto Manufacturers

Reserves Held at Year's End

(in billions of U.S. dollars, 2019-2023)

Hyundai's warranty reserve balance fell by a little over $1 billion from 2022 to 2023, which is unsurprising considering the similarly-sized deficit between the company's claims paid and accruals made. At the end of 2023, Hyundai held $6.980 billion in its warranty reserves, a decrease of -13% from the year prior.

Kia grew its warranty reserves just slightly from 2022 to 2023. At the end of 2023, Kia held a total of $5.337 in its warranty reserves, a 4% increase from the year prior.

Tata also grew its reserves a bit from the end of fiscal 2022 to the end of fiscal 2023. At the end of fiscal 2023, Tata held $2.596 billion in warranty reserves, a 15% increase from the year prior.

Can't wait until we release the 2023 Worldwide Auto Warranty Report? Catch up on the 2023 regional auto warranty data:

- U.S. Auto Warranty Annual Reports

- European Automaker Warranty Expenses

- Japanese Automaker Warranty Expenses

- Mid-Year U.S. Auto Warranty Report