Mid-Year U.S. Auto Warranty Report:

We've all heard about Ford's recent warranty woes, after the company's stock plummeted due to higher-than-expected warranty costs highlighted in the company's second quarter earnings report. This week, we're analyzing the warranty data behind these headlines, and hearing from Ford's leaders and industry experts on where Ford might have gone wrong.

Ford's stock plummeted after its second quarter earnings were announced in late July, after an earnings miss that the company's leaders blamed on higher-than-expected warranty costs. As reported by Keith Naughton for Bloomberg, Ford's stock fell by 18% the day after its quarterly report was published, the largest single-day drop in the company's stock since 2008.

GM and Tesla both increased their warranty accruals in the second quarter of 2024 as well, with Tesla setting new record highs for quarterly warranty accruals and reserves.

We have a lot to discuss. Luckily for us, Ford's CEO and CFO discussed the warranty problems at length in Ford's second quarter earnings call. Before we get into it, we have a few notes about the data we're presenting in this week's newsletter.

To compile this report, we perused the annual and quarterly financial statements of the three major U.S.-based auto manufacturers, Ford Motor Co., General Motors Co., and Tesla Inc., and extracted three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund. In addition, we collected data on each manufacturer's quarterly product sales revenue, in order to calculate two additional warranty metrics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

Note that we don't consider Chrysler a U.S.-based auto manufacturer, since Stellantis, its parent company since 2021, is based in the Netherlands.

We are taking a look at one additional metric in this newsletter: changes of estimate. In short, changes of estimate are adjustments to warranty accruals made during previous quarters. The majority of changes of estimate are additional funds deposited into the warranty reserves to correct under-estimation of the product's future warranty costs; however, some changes of estimate are excess funds removed from the warranty reserves. We detailed our warranty accrual data collection methodology in our February 2024 newsletter "Warranty Adjustments"; take a look at that newsletter for an in-depth explanation of this warranty metric.

We don't add changes of estimate into our total accrual calculations, since these changes affect funds accrued during previous periods, and we'd run the risk of double-counting the same funds twice if we did this categorically. However, it's necessary to take a look at this metric in order to tell the story of Ford's recent warranty woes. So in Figures 4, 5, and 6, we will look at each manufacturer's quarterly changes of estimate along with regular accruals.

Warranty Claims

First, let's get an update on the two most recent quarters of warranty claims data for the three U.S.-based auto manufacturers.

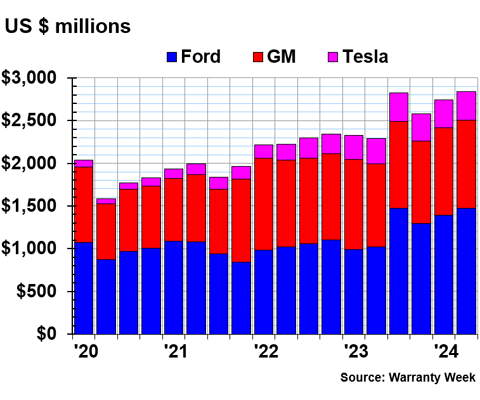

Figure 1 shows the three manufacturers' total quarterly warranty claims paid, from 2020 to the second quarter of 2024.

Figure 1

U.S.-based Auto Manufacturers

Claims Paid per Quarter

(in millions of U.S. dollars, 2020-2024)

Ford paid $2.862 billion in warranty claims during the first two quarters of 2024: $1.391 billion in the first quarter, and $1.471 in the second quarter. Ford's claims costs rose by 42% from the first half of 2023 to the first half of 2024.

However, Ford's total claims only rose by 7% from the fourth quarter of 2023 to the first quarter of 2024, and rose another 6% from the first to the second quarter of 2024. The largest increase of Ford's total accruals in the past two years was a 44% increase from the second to the third quarter of 2023. So although Ford's total claims costs for the first half of 2024 were high compared to the first half of 2023, total claims costs have been just around $1.4 billion per quarter since the third quarter of 2023.

So the higher claims costs weren't new to the most recent quarter, and weren't exactly the concern that caused investors to sell Ford stock and drive the share price down. Instead, these claims data are a symptom of the larger problem, that the warranty costs of older vehicles are turning out to be higher than the company had originally accrued for. We'll look at this more in Figures 3 and 4.

GM paid $2.054 billion in claims during the first half of 2024: $1.024 billion in the first quarter, and $1.030 billion in the second quarter. GM's claims costs rose by just 1% from the first half of 2023 to the first half of 2024.

Tesla paid $668 million in warranty claims during the first half of 2024: $328 million in the first quarter of the year, and $340 million in the second quarter. Tesla's claims costs rose by 16% from the first half of 2023 to the first half of 2024.

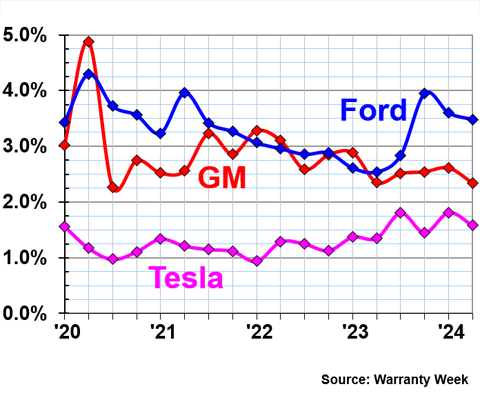

Figure 2 shows the quarterly claims rates of these three manufacturers from 2020 to the second quarter of 2024.

Figure 2

U.S.-based Auto Manufacturers

Warranty Claims Rates

(as a % of product sales, 2020-2024)

Ford's claims rate rose in the fourth quarter of 2023, and fell a bit during the first two quarters of 2024, but not enough to be at the same level from before the spike. In the second quarter of 2024, Ford had a claims rate of 3.48%. In contrast, Ford's claims rate was 2.54% in the second quarter of 2023.

GM had a claims rate of 2.34% in the second quarter of 2024, on par with the most recent few quarters for the company. We're sure GM's warranty department feels refreshed after the company's trouble with the Chevy Bolt EV battery recall back in 2020 and 2021.

Tesla had a claims rate of 1.58% during the second quarter of 2024.

Warranty Accrual Totals

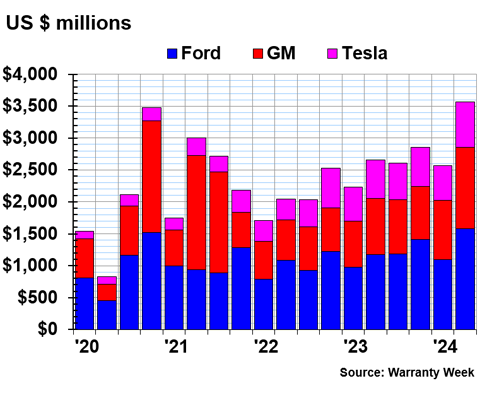

Figure 3 shows the total amount of warranty accruals each manufacturer made quarterly, from 2020 to the second quarter of 2024.

Figure 3

U.S.-based Auto Manufacturers

Accruals Made per Quarter

(in millions of U.S. dollars, 2020-2024)

GM accrued $2.212 billion in the first half of 2024: $934 million in the first quarter, and $1.278 billion in the second quarter. GM's total accruals rose by 38% from the first two quarters of 2023 to the first two quarters of 2024.

Tesla accrued $1.257 billion in the first two quarters of 2024: $547 million in the first quarter, and $710 million in the second quarter. Tesla's total accruals rose by 10% from the first half of 2023 to the first half of 2024.

Ford's Warranty Accruals

Ford accrued $2.671 billion in the first two quarters of 2024: $1.091 billion in the first quarter, and $1.580 billion in the second quarter. Ford's accruals rose by 24% from the first half of 2023 to the first half of 2024.

Ford's total accruals rose by 45% from the first to the second quarter of 2024. $1.580 billion is the largest amount of warranty accruals Ford has set aside in a single quarter since we started tracking these data at the beginning of 2003. However, the figure doesn't set the record by a large margin; Ford accrued $1.515 billion in the fourth quarter of 2020, and $1.412 billion quite recently in the fourth quarter of 2023.

These figures are not great news for Ford, but we'll admit that the data aren't exactly as world-shattering as the gloomy headlines and 18% single-day drop in stock value make it seem. Based on the data, it looks like this is a trend that's been happening for about a year, but investors finally caught wind of it in the most recent quarter.

During Ford's second quarter earnings call in July, CEO James Farley stated, "We put a lot of new technology in our vehicles. And that new technology is difficult for the dealers to diagnose when customers come in and say, 'Something is wrong with my SYNC system.' They replace modules unnecessarily, etc., and that hits our warranty reserves. What we have found, though, is that this kind of fixing is different than mechanical fixes, where that OTA capability redirected to these defects can really reduce our cost outlays for the warranty — against the warranty reserves."

Ford SYNC is Ford's in-vehicle communications and entertainment system, operated from the center console. Ford's been using a form of the Sync system since 2007, but the most recent version, Sync 4, was first unveiled in the 2021 model year Mustang Mach-E.

Later in the call, CFO John Lawler said:

These are issues that are popping up in the field on these older models. The largest one coming through is on a rear axle bolt for vehicles that were engineered for the 2021 model year was when they were introduced. And if these things come through at a higher time in service, we're made aware of them, we need to take care of our customers, we go out to fix them.

And we have several of those types of things popping up on our older models. We got a failed oil pump issue that's popping up on 2016 launched vehicles. And so it's clear that we had a period of time where the robustness wasn't what it needed to be, and that's showing up. And it is hard to predict on some of these units that have been out in the field for quite a while that one of these issues is going to show up, these longer-term durability, and quality issues, but we need to work through that.

And we do believe that overall, as we improve our near-term quality and that starts to show up in the field, that will allow us to, based on the rules that we have around how we do our accruals, bring down that overall accrual level so these types of issues, if they pop up, will have less of an impact overall, because our run rate on quality will be improving.

So Farley and Lawler offer two explanations for the high warranty costs. Farley blames dealer mechanics for having trouble fixing problems with the newer high-tech screens and electrical components of Ford's vehicles, opting to replace the whole system rather than fix a specific issue. Blaming the dealers for doing unnecessary repairs and driving up warranty costs is a classic in the world of warranty; it happens, but it's also a nice way to defer blame away from corporate.

Lawler later admits that they have also seen higher-than-expected warranty costs for vehicles earlier than model year 2021. The "rear axle bolt" issue and "oil pump issue," the two examples Lawler provided, don't have anything to do with the Sync system. So Farley says it's the Sync system replacements that are driving up warranty costs, while Lawler says that it's defects from vehicles from model year 2021 and earlier that are just now popping up years down the line.

Lawler offers a bit of hope to investors. He states that Ford's newer software stack enables the company to find warranty issues before they become recalls:

"With the connected vehicle, and having the digital electrical architecture, and us controlling the software across all of the operating domains, we would be able to get signals off the vehicle early to tell us whether or not we're having an issue in certain components. And if we understand that early, we can understand the cause of that, and then we can go out and minimize, reduce, get out there earlier, and reduce the number of vehicles that are impacted, and actually either do an over-the-air update if we can fix it that way, or do a preventative maintenance type program for folks, which will be much cheaper than a field service action recall where you're replacing components and modules, etc. So there's a lot of advantages through that connected data that we'll be able to run through the warranty system. That's more on the physical side. On the software side, we'll be able to understand when things are an issue much earlier, and we'll be able to fix them through over-the-air updates, which will be a much lower cost as we move forward."

So Lawler is saying that all of the software in Ford's newer vehicles is beneficial overall, despite the cost of replacing the faulty Sync systems, because Ford can remedy certain issues with a software update, rather than requiring a dealer visit. In addition, the software is able to detect issues earlier, and help prevent large-scale recalls by enabling dealers to do preventative maintenance before problems arise.

Earlier in the call, Farley also gave the higher warranty costs an optimistic spin: "As painful it is quarter after quarter to have all these great launches, we do not release them until we're happy with the quality and that we've done all the testing. And it makes our quarters lumpy and it's challenging, but it will reduce warranty over time. When you look at the root causes for these issues, and I can go through the hundreds that we go through, it's very clear that these are issues, many of which we could have caught at launch. And that is what's happening now at Ford."

So Farley is saying that Ford is becoming more rigorous in its vehicle product testing, and that while these tests can delay launches, they're going to save Ford money in the long run by catching potential defects before the vehicles are on the market. In other words, they've realized that these defects on older vehicles that are just arising now are costing them billions in additional changes of estimate to previous accruals, so they're testing vehicles in a most robust manner to try to prevent this from happening in the future.

In Ford's first quarter earnings call in April 2024, Farley stated,

"We've taken a lot of new testing regimens. Actually, we ended the quarter with 60,000 units in our plant stock, which hurt our first quarter, but we'll benefit because we're shipping those now in our second quarter for all those quality processes. And what we're so far seeing is we avoided about 12 recalls on F-150, and we're seeing the best performance on three MIS after launch in a long time. And I'd like to be specific here.

Normally, after a launch, we've seen about — in the last five years, about a 70% spike in our defects. The industry average is about 20%. In the Super Duty and Mustang launches, we're about that industry average 20% spike. And now, we're seeing with the F-150 even better performance at industry average.

And boy, do we have a lot of launches in the second half to prove out this new launch process. What we're going to see long term is fewer recalls and lower warranty costs because of this new process. I'm really proud of the team's progress on quality, and we have so much more to do."

So that's Ford's warranty woes, in the company's own words. Despite the CEO and CFO's optimism, some industry experts and leaders are a little more skeptical. We spoke to thought leaders in the warranty industry to get their take on this story.

An anonymous industry expert told us,

"Ford's additional warranty expense on older vehicles indicates issues with accruals on warranty costs for previous years, unexpected quality issues, and the potential for larger recalls. The significant impact on the bottom line underscores the criticality of maintaining predictable warranty costs. As Ford rolls out new Electric Vehicle models, there’s a risk that these quality issues could escalate. It's crucial for Ford and other automakers to prioritize quality improvements during the transition to new products to keep warranty costs under control. Companies need to ensure the dealers are properly trained and equipped to resolve any warranty issues cost-effectively.

This industry expert has a great point. If dealers aren't qualified to fix the electrical components of the Sync systems without doing costly and unnecessary repairs, how will they manage to fix the entirely electrical components of Ford's growing line of electric vehicles? Dealers will soon need licensed electricians to carry out repairs on EVs, and perhaps on the Sync systems and diagnostic software as well. While it's great that Ford is doing more rigorous testing to find potential recalls before they happen, the warranty costs of electrical repairs could snowball in the future if left unchecked.

Overall, this industry expert's comments underscore many warranty professionals' concerns that Ford's warranty expenses are getting increasingly unpredictable.

Changes of Estimate to Warranty Accruals

We were intrigued about Farley's and Lawler's comments about warranty costs to repair older model vehicles being higher than Ford originally expected. As our dedicated readers are undoubtedly aware, quarterly warranty accruals are made only for vehicles sold during that particular quarter. Accruals made for vehicles sold during previous quarters are known as changes of estimate to previous accruals, and are a different line item separate from regular accruals.

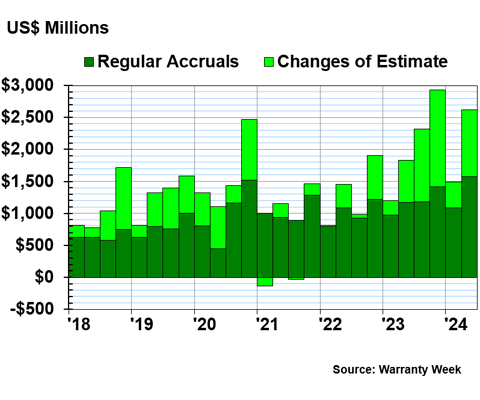

Since there was so much discussion of warranty costs for older vehicles being higher than what was previously accrued, we decided to chart Ford's regular quarterly accruals along with the quarterly changes of estimate to previous accruals, in order to get a fuller story of these warranty woes. Figure 4 shows Ford's regular accruals and changes of estimate from 2018 to the second quarter of 2024.

Figure 4

Ford Motor Co.

Accruals & Changes of Estimate Made per Quarter

(in US$ millions, 2018-2024)

Figure 4 really highlights the higher-than-expected warranty costs of older model year vehicles that have arisen in the past two years.

In the first two quarters of 2024, along with the $2.671 billion in regular accruals, Ford set aside an additional $1.438 billion in changes of estimate to previous accruals. During 2023, Ford accrued $4.743 billion in regular accruals, and another $3.530 billion in changes of estimate.

It's almost unheard of that the changes of estimate would equate to three-quarters of the regular accruals in a single year. These are monumental changes of estimate, even for a company like Ford that's been prone to larger adjustments, a trend we observed back in 2014.

Ford's largest quarterly change of estimate in recent years came in the fourth quarter of 2023, when the company set aside an additional $1.514 billion as an adjustment to previous accruals. During that quarter, the changes of estimate actually exceeded regular accruals, which totaled $1.412 billion.

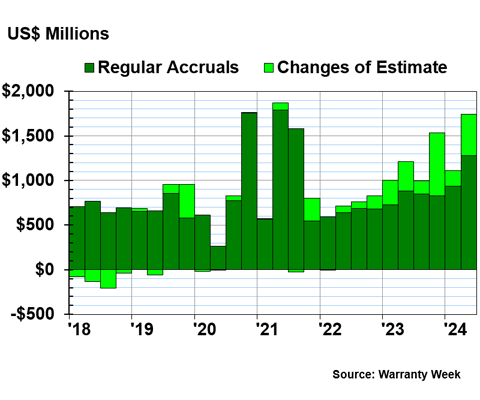

In the spirit of fairness, and for ease of comparison, we also charted GM's and Tesla's changes of estimate from 2018 to 2024 in Figures 5 and 6, respectively.

Figure 5

General Motors Co.

Accruals & Changes of Estimate Made per Quarter

(in US$ millions, 2018-2024)

GM's changes of estimate totaled $637 million in the first two quarters of 2024: $174 million in the first quarter, and $463 million in the second quarter. The company's largest change of estimate in its recent history came in the fourth quarter of 2023, when the company set aside $704 million as an adjustment to previous accruals.

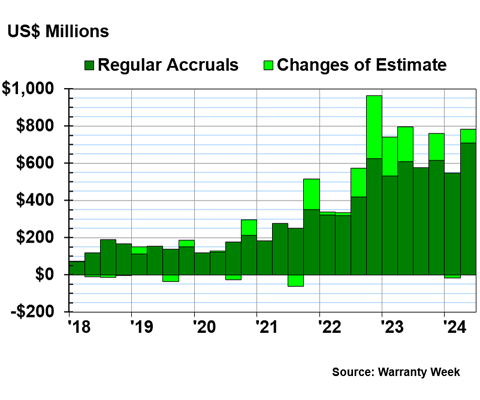

Figure 6

Tesla Inc.

Accruals & Changes of Estimate Made per Quarter

(in US$ millions, 2018-2024)

Tesla's changes of estimate totaled just $54 million in the first two quarters of 2024, with $18 million of excess removed from the reserves in the first quarter, and $72 million in changes of estimate made in the second quarter. However, Tesla had some larger changes of estimate at the end of 2022 and beginning of 2023. The company accrued an additional $337 million in changes of estimate in the fourth quarter of 2022, the company's largest change of estimate in the past six years.

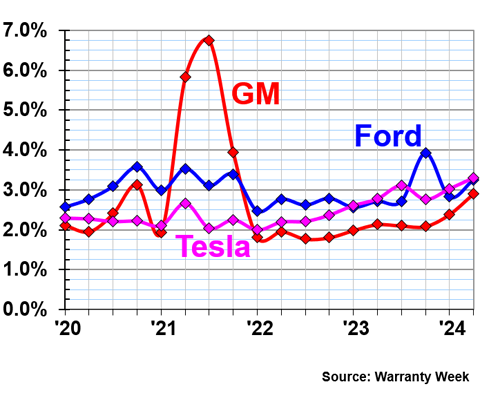

Warranty Accrual Rates

Figure 7 shows the quarterly warranty accrual rates of Ford, GM, and Tesla, from 2020 to the second quarter of 2024. These expense rates are calculated by dividing total regular accruals by total product sales revenue.

Figure 7

U.S.-based Auto Manufacturers

Warranty Accrual Rates

(as a % of product sales, 2020-2024)

In the second quarter of 2024, Ford set aside 3.2% of its sales revenue as regular warranty accruals. However, the company's highest accrual rate of the past five years was during the fourth quarter of 2022, when Ford accrued 3.9% of its product sales revenue for future warranty costs.

GM had an accrual rate of 2.9% in the second quarter of 2024, and Tesla had an accrual rate of 3.3%. The accrual rates for these two manufacturers have increased three quarters in a row.

Warranty Reserve Balances

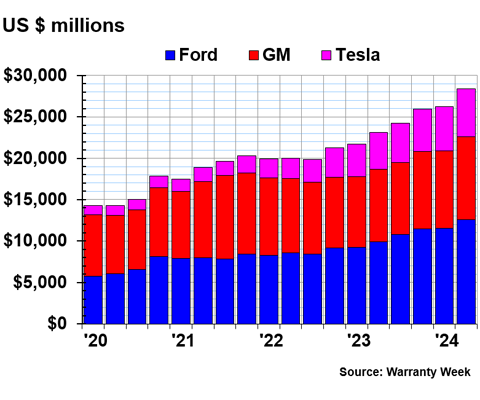

Our final warranty metric is the balance of each manufacturer's warranty reserve fund at the end of each quarter, from 2020 to the second quarter of 2024.

Figure 8

U.S.-based Auto Manufacturers

Reserves Held per Quarter

(in millions of U.S. dollars, 2020-2024)

At the end of the second quarter of 2024, Ford held $12.553 billion in warranty reserves. This is by far the largest warranty reserve end-balance we've ever seen from Ford. Ford's warranty reserves grew by 9%, or $1.013 billion, from the first to the second quarter of 2024.

GM had a reserve balance of $10.043 billion at the end of the second quarter of 2024, up by 7% from the first quarter of the year. It's not quite the largest reserve balance we've seen from GM; the record high is $10.528 billion, which we saw in the second quarter of 2014 amidst the manufacturer's big ignition switch recall.

Tesla had a reserve balance of $5/795 billion at the end of the second quarter of 2024, up 8% from the first quarter. This is also the largest reserve balance we've ever seen from Tesla, since the company started reporting its warranty expenses back in 2008.