Other U.S. Product Warranties:

Some manufacturers defy categorization into an industry group. Many of them still offer product warranties, for goods including vapes, exercise equipment, jewelry, oil and gas infrastructure, water management, domestic robots, coolers, body cameras, and tactical gear.

Many of us in the warranty industry have had moments at social gatherings where we've had to explain what a warranty is, and why we're so passionate about them. We'll refer to broken electronics or appliances replaced under the manufacturer's or retailer's warranty policy, or to vehicle maintenance performed under an extended service contract, but inevitably we lose the attention of our conversation partner until we move to the next topic. Well, consider this week's edition of Warranty Week a guide to more interesting warranty-related short anecdotes.

That's because this week's newsletter is discussing all of the product warranties provided by U.S.-based manufacturers that don't fit neatly into an industry category or subgroup. The 111 manufacturers discussed in this report provide product warranties on goods including vapes and e-cigarettes, karaoke machines, exercise bicycles, diamond rings, player pianos, insulated coolers, SCUBA diving gear, golf clubs, fire hydrants, red light cameras, breathalyzers, watches, riot gear, cannabis cultivation equipment, and firearms.

So at your next social gathering, grab the interest and attention of everyone in the room with your discussion of the most unexpected and "zany" product warranties out there. Or, at least, discuss this newsletter with your friends in the industry, who you know have an interest in finding out which difficult-to-categorize products come with warranties attached.

The Companies

In order to compile this newsletter, we first identified 111 U.S.-based manufacturers that have ever reported their product warranty expenses in their financial statements. We broke those manufacturers into three categories: Material Handling, Security, and Sports.

For each manufacturer, we perused their annual reports and quarterly financial statements, and extracted three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund. We also gathered data on each manufacturer's total product sales revenue, and used these to calculate two additional warranty metrics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

Material Handling

The Material Handling industry group consists of 51 manufacturers, of which 17 reported their warranty expenses during 2023. These companies deal with infrastructure and specialized systems for controlling, compressing, manipulating, and transporting water, oil, gas, and waste.

The largest manufacturers by warranty expenses in the Material Handling industry are: Xylem Inc., Flowserve Corp., Ingersoll Rand Inc., Mueller Water Products Inc., and Lindsay Corp.

Note that the Ingersoll Rand Inc. we're discussing in this report is a different and distinct company from the former Ingersoll-Rand plc. In early 2020, Gardner Denver Holdings Inc. acquired Ingersoll-Rand plc's Industrial segment in a Reverse Morris Trust transaction. The former Ingersoll-Rand plc first spun off its Industrial Technologies and Services segment into a separate company, and then Gardner Denver acquired that spin-off. The former Ingersoll-Rand plc, left with its HVAC and refrigeration business, renamed itself Trane Technologies plc, while the former Gardner Denver Holdings Inc. renamed itself Ingersoll Rand Inc.

Security

The next industry group in this report is Security, which mainly consists of manufacturers of firearms, security systems, and robots. The group consists of 28 manufacturers, of which nine reported warranty expenses during 2023.

The largest manufacturers by warranty costs in the Security industry are: iRobot Corp., MSA Safety Inc., Allegion plc, Smith & Wesson Brands Inc., Axon Enterprise Inc., Arlo Technologies Inc., Cadre Holdings Inc., and American Outdoor Brands Inc.

iRobot makes the Roomba vacuum, among other domestic cleaning robots, along with military robots. iRobot's PackBot military robots have been used to investigate hazardous sites, including the World Trade Center after 9/11, Deepwater Horizon oil spill, and the Fukushima nuclear disaster.

MSA Safety makes hard hats, gas detection instruments, respirators, gas masks, firefighter breathing apparatus, and thermal imaging cameras. Cadre Holdings Inc. owns several brands that manufacture police uniforms, armor, riot gear, and tactical gear.

Allegion plc spun off from Ingersoll-Rand plc in 2013. The company manufactures biometric and electronic identification products for government and commercial use.

American Outdoor Brands Inc. was formerly known as Smith & Wesson Holding Corp. until 2016. Smith & Wesson was a unit of American Outdoor Brands from 2016 until 2020, when they split into two separate companies, Smith & Wesson Brands Inc. and American Outdoor Brands Inc.

Similarly Axon Enterprise Inc. was known was TASER International Inc. until 2017. At the time of the rebranding, the company was increasingly emphasizing its police body camera sales.

Arlo Technologies Inc. was spun-off from Netgear Inc. in 2018. The company makes video doorbells, security cameras, baby monitors, and other surveillance equipment.

Sports

The final industry group included in this newsletter is called Sports, but it's ended up also being our "other" category for manufacturers that defy classification.

Some of these manufacturers make items that would traditionally fall under the sports umbrella, such as exercise equipment, camping gear, golf clubs, swimming pools, skis, and bicycles. Additionally, there are manufacturers in this category that make products that are used for recreation, but not exactly the sporting kind. These include makers of vapes, cannabis cultivation equipment, crafting machines, jewelry, and stock ticker displays for national stock markets.

The Sports industry includes 32 manufacturers, of which 16 reported warranty expenses during 2023. The top manufacturers based on warranty expenses are: Philip Morris International Inc., Peloton Interactive Inc., Signet Jewelers Ltd., Johnson Outdoors Inc., Fossil Group Inc., Cricut Inc., and BowFlex Inc.

Philip Morris International Inc. is a U.S.-based company, but only engages in business outside of the United States, while Altria Group Inc. does business within the country. Philip Morris International spun off from Altria in 2008. Philip Morris International's website states that the company aims for a "smoke-free future," but not a nicotine-free one, so the company manufactures vapes and e-cigarettes that come with product warranties. So far, it's the only major nicotine product manufacturer that reports its warranty expenses, but we assume that almost all of the electronic vapes on the global market come with warranties attached.

Peloton Interactive makes the eponymous luxury exercise equipment. Signet Jewelers owns the Jared and Kay jewelry brands. Fossil Group owns a variety of fashion accessory brands, and makes licensed accessories for mid-luxury brands. Cricut makes the eponymous crafting and cutting machines.

BowFlex Inc. was known as Nautilus Inc. until 2023, and owns the BowFlex exercise equipment brand along with Schwinn bicycles. BowFlex Inc. filed for Chapter 11 bankruptcy in March 2024, and the Taiwan-based Johnson Health Tech Co. Ltd. has announced it will acquire all of BowFlex's assets. So this will likely be the last time we see BowFlex in this report.

Now that we have a grasp on the wide range of manufacturers represented in the following charts, let's take a look at 21 years of warranty data for these three industry groups.

Warranty Claims Totals

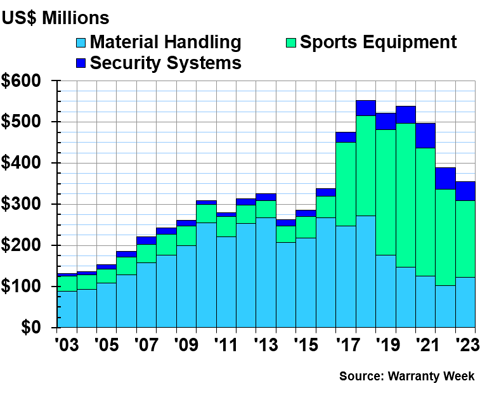

Figure 1 shows the total warranty claims payments made by the manufacturers in these three industry groups, from 2003 to 2023.

Figure 1

Other Product Warranties by Industry

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

Philip Morris International paid $83 million in claims during 2023, a decrease of -27% from 2022's total of $114 million. Philip Morris' total warranty expenses were the largest of the group of 111 manufacturers by far.

Peloton Interactive Inc. paid $36 million in claims during 2023, down -33% from the year prior. Xylem Inc. paid $32 million, an increase of 28% from 2022.

Ingersoll Rand Inc. saw its claims costs more than double from 2022 to 2023. Ingersoll Rand paid $31 million in claims during 2023, an increase of 111% from 2022's total of $15 million. We assume that these are just growing pains as the company settles after the significant restructuring in 2020.

Flowserve Corp. paid $22 million in claims during 2023, up 14% from the year prior. iRobot paid $21 million, down -20%. Signet Jewelers paid $12 million, up 6%. Lindsay Corp. paid $11 million, an increase of 27% from the year prior.

BowFlex Inc., formerly known as Nautilus Inc., paid $10 million in claims during 2023, an increase of 47% from the year prior. The company's fiscal year ends on March 31, so although the data from the first quarter of calendar 2024 aren't included in this newsletter, we can tell you that in that report, BowFlex partially blamed the shrinking of its gross profit margin on "increased warranty costs." As we mentioned above, since the company filed for Chapter 11 bankruptcy in March 2024 and was subsequently acquired by the Taiwan-based Johnson Health Tech, this will likely be the last time we see BowFlex in this annual newsletter. This just goes to show that warranty costs (and, by extension, a product's reliability) can be a small, yet essential, aspect of a manufacturer's expenses and profitability.

Warranty Accrual Totals

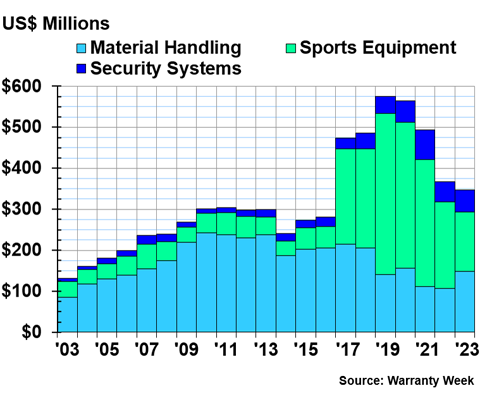

Figure 2 shows the total warranty accruals made by the manufacturers in these three industry groups, from 2003 to 2023.

Figure 2

Other Product Warranties by Industry

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

Philip Morris International accrued $60 million during calendar 2023, a decrease of -44% from the year prior.

On the other hand, Ingersoll Rand Inc. more than doubled its accruals from 2022 to 2023. Ingersoll Rand accrued $44 million during 2023, an increase of 118% from the year prior.

Among the material handling manufacturers, Xylem accrued $29 million, an increase of 21%. Flowserve accrued $27 million, an increase of 53%. Mueller Water Products accrued $15 million, up by 34%. And Lindsay accrued $11 million, up by 15%.

Peloton Interactive accrued $19 million, down by -57%. Alongside the company's decrease in claims costs, Peloton seems to have had a good year of reducing the product warranty expenses associated with their exercise equipment, though we'll see in Figure 4 that the company's warranty expense rates are still a little wonky.

iRobot accrued $19 million, down by -16% from the year prior. Signet Jewelers accrued $16 million, down by just -3%. Allegion accrued $13 million, an increase of 43%.

And Johnson Outdoors almost doubled its accruals, from $6 million in 2022 to $11 million in 2023. In its most recent annual report, the company blames "higher warranty expense" for increasing the operating costs of its fishing segment, so there was likely a defect found in some of the company's fishing equipment.

Warranty Expense Rates

Since our industry groups for this newsletter, especially the Sports category, are a rather loosely associated group of companies, we did not calculate the industry-wide average warranty expense rates. Instead, we'll present the quarterly warranty expense rates of two of the top manufacturers from this report: Philip Morris International in Figure 3, and Peloton Interactive in Figure 4.

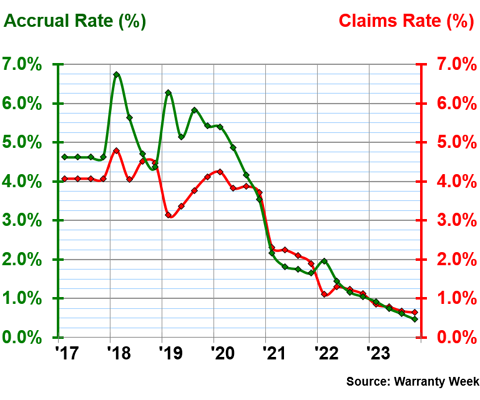

Figure 3

Philip Morris International Inc.

Quarterly Warranty Claims & Accrual Rates

(as a % of product sales, 2017-2023)

Philip Morris International started reporting its product warranty expenses annually in 2017, and quarterly in 2018. We can see in Figure 3 that the company really started to master its warranty expenses in 2021, and reduced costs even further in the subsequent two years.

In its first year of reporting, 2017, Philip Morris International had an annual claims rate of 4.07%, and an annual accrual rate of 4.62%. In stark contrast, in 2023, the manufacturer had quarterly claims rates ranging from 0.85% to 0.65%, and quarterly accrual rates ranging from 0.92% to 0.47%.

Going from spending 5% of your product revenue on warranty accruals to less than 1% in seven years is no small feat. The manufacturer's claims and accrual rates were reduced in six subsequent quarters, from the second quarter of 2022 to the fourth quarter of 2023.

Figure 4 shows the quarterly expense rates of Peloton Interactive, from when the company started reporting in mid-2019 until the fourth quarter of 2023.

Figure 4

Peloton Interactive Inc.

Quarterly Warranty Claims & Accrual Rates

(as a % of product sales, 2019-2023)

In contrast to Philip Morris International, Peloton's warranty expense rates have gotten more volatile as the company's experience with warranty progresses.

Notably, in the third quarter of 2022, Peloton's claims rate shot up to 5.83%, while the accrual rate fell to zero. The company's claims rate exceeded its accrual rate every subsequent quarter until the fourth quarter of 2023. In the fourth quarter of 2023, the two expense rates moderated to a reasonable 2.26% claims rate and 2.48% accrual rate. However, with this level of volatility, we can't predict where the rates will go from there.

According to our calculations, Peloton hasn't held more than a year's worth of warranty reserves since the second quarter of 2021. Take a look at our newsletter "Smallest Warranty Reserve Capacities" from earlier this year for more information on this metric. In that newsletter, we calculated that Peloton had the tenth-smallest warranty reserve capacity of any U.S.-based manufacturer, with an average of 9.3 months over the eight quarters of 2022 and 2023.

Warranty Reserve Balances

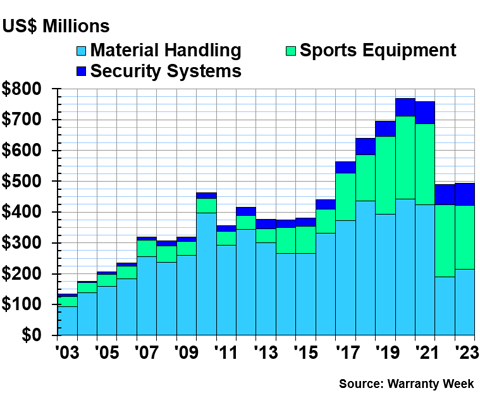

Our final warranty metric is the amount of warranty reserves held by each manufacturer at the end of each calendar year. Figure 5 shows the collective year-end reserve balances for the three industry groups, from 2003 to 2023.

Figure 5

Other Product Warranties by Industry

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

We can see in Figure 5 that the reserves of the Sports industry grew signficantly in 2017, when Philip Morris International started reporting its warranty expenses. At the end of 2023, Philip Morris International held $80 million in warranty reserves, a decrease of -23% from the year prior.

Xylem had the next-largest warranty reserve fund at the end of 2023, with $63 million held, an increase of 17% from the year prior. Ingersoll Rand Inc. held $62 million, an increase of 34% from the year prior. Signet Jewelers held $43 million, up 9%. Flowserve held $27 million, up by 21%.

iRobot held $25 million, down by -10%. Peloton held $22 million, down by -41% from the end of 2022. Allegion held $21 million, up by 14%. Mueller Water Products held $17 million, up by 40%. MSA Safety held $14 million, down by -6%. Lindsay held $14 million, up by 5%.

A few manufacturers with claims and accrual totals under $10 million still held reserves exceeding that figure at the end of 2023. Callaway Golf Co. held $13 million, up by 20% from the year prior. Johnson Outdoors held $11 million, up 13%. Fossil Group Inc. held $10 million, down by -26$. And YETI Holdings Inc. held $10 million in its first year of reporting warranty expenses.

The nominees for the 2024 Warranty Innovation Awards have been announced! Vote now at www.warrantyawards.org!

Winners will be announced at the 15th Annual Extended Warranty & Service Contract Innovations conference on September 24, 2024, at the Palmer House Hilton in Chicago.

These awards are peer-nominated industry awards to recognize and showcase innovation and excellence in the warranty and extended warranty/service contract industries.

With the assistance of the Awards Steering Committee comprising experienced leaders in warranty, the following are the shortlisted nominees for the 2024 Warranty Innovation Awards.

The industry will now vote on one winner per category on the awards website www.warrantyawards.org. Voting deadline is August 30, 2024.

Category 1: Innovative Product Design

- Bolt Solutions & Choice Home Warranty: Transforming the device protection industry by distributing through home warranty and covering all phones in a household.

- Dodge: Offering an extended warranty for performance vehicles that includes a day long visit to a performance driving center.

- ProGuard Warranty: CAD Protection for agricultural vehicles that are currently unserved or underserved.

- One80 Intermediaries: AI Warranty that protects companies from unreliable AI models - a new category of coverage for increasingly emerging needs.

Category 2: Transformative Technology Innovation

- Daimler Truck & Tavant: Integration of AI into the warranty system process to ease coding and data entry.

- NSA IRIS: A platform that allows manufacturers to bring service administration in house and use one system that connects to all aspects of the service process.

- Pfizer: Offering a warranty for their Beqvez Hemophilia drug.

- QMerit: EV Charger warranty support and maintenance.

Category 3: Customer Experience Excellence

- Apple: The AppleCare program has maintained excellent customer services since the introduction of the iPhone and has been exceptionally successful.

- Marcone: Deploying DoorDash to offer same day delivery of parts for repairs.

- FordDirect: "The Shop" warranty processing platform streamlines the customer experience for dealers, and ultimately, for end customers.

- Guard Home Warranty: Created a program where the homeowner gets to select their own contractor.

Category 4: Operational Performance & Administrative Excellence

The following Companies have had the most significant reductions in their claims and accrual rates from 2022 to 2023.

- Woodward, Inc.

- Daktronics, Inc.

- Brunswick Corporation

Category 5: "Warranty Industry Champion"

To recognize one individual who, in the eyes of their peers, contributed the most to the Warranty/Service Contract industry.

- Lansdon Robbins, Founder & Chairman, Armadillo

Lansdon is currently the Founder and Chairman of Armadillo, a position they have held since March 2021. Prior to this, they served as the Principal at Simply Waste. Lansdon was also the Co-Founder and Chairman of PetFirst Healthcare. During their time at AIG from 2012 to 2015, they held the role of Vice Chairman and Senior Vice President - Strategy. Before that, Lansdon founded and served as the Chairman and CEO of Service Net. Lansdon also served as the President of ACCENT Marketing. - Tim Meenan, Managing Partner, Meenan, P.A.

Tim's practice focuses on regulatory law before numerous state agencies, with an emphasis on insurance company regulation. Tim has helped vehicle service contract, home service contract, and consumer goods service contract companies become licensed and compliant to offer service contracts nationwide. He has assisted specialty insurers and other regulated entities with obtaining licensure. As General Counsel for several insurer trade associations, Tim has worked on regulatory and legislative matters affecting the insurance, home warranty, and consumer goods, home, and vehicle service contract industries in Florida and nationally. - Jim Mostofi, CEO, Rely Home

Jim brings a wealth of expertise to this role, having served in a number of senior leadership capacities over the past 17 years at American International Group (AIG) and Service Net Holdings. His capabilities include extensive Warranty and Insurance industry experience, strong financial acumen, and experience operating in regulated markets in the US.

The voting deadline is August 30, 2024. To vote, visit www.warrantyawards.org/vote.php.

Find all of the other newsletters from our series of 21-year charts here:

- Twenty-first Annual Product Warranty Report

- U.S. Small Vehicle Warranty Expenses

- U.S. Truck & Heavy Equipment Warranties

- U.S. Auto Parts & Powertrain Warranties

- U.S. Aerospace Warranties

- U.S. New Home & Building Materials Warranty Report

- U.S. HVAC & Appliance Warranty Report

- U.S. Power Generation Equipment Warranties

- U.S. Electronics Warranty Report

- U.S. Semiconductor Warranties

- U.S. Telecom Equipment Warranty Report

- U.S. Medical & Scientific Equipment Warranties