U.S. Medical & Scientific Equipment Warranties:

GE HealthCare spun off in early 2023, and provided historical data back to 2020, transforming the dynamics between X-Ray and other medical equipment manufacturers. X-Ray manufacturers used to have lower totals but higher expense rates, while other medical equipment manufacturers were the opposite; now, trend's been broken, and the gaps between the totals and expense rates of the two groups have closed significantly.

The warranty expenses of U.S.-based medical and scientific equipment manufacturers have undergone a transformation in the past five years, due to some key manufacturers ceasing reporting, and others commencing.

A decade ago, the vast majority of the industry's warranty costs came from manufacturers that did not make X-Ray or laser medical equipment, but the few X-Ray manufacturers had much higher expense rates. Now, however, the gaps between the totals and expense rates of the two groups have narrowed.

In 2013, X-Ray & Laser Equipment manufacturers accounted for about 15% of the industry's total warranty expenses, while the others accounted for the remaining 85%. On the other hand, in 2023, X-Ray manufacturers accounted for 40%, while the others accounted for 60%.

To compile this report, first we identified 210 U.S.-based medical & scientific equipment manufacturers that reported product warranty expenses between 2003 and 2023. We then split those manufacturers into two subgroups, Laser & X-Ray Equipment and Other Medical Equipment, depending on each company's primary product lines.

There were 180 manufacturers in the Other Medical Equipment group, of which 47 were active and reporting in 2023, and 30 manufacturers in the Laser & X-Ray Equipment group, of which 14 were reporting in 2023.

For each manufacturer, we perused their annual reports and quarterly financial statements, and extracted three key warranty metrics: the amount of claims paid, the amount of accruals made, and the balance of the warranty reserve fund at the end of each calendar year.

In addition, we gathered data on the amount of capital equipment sold, which in this industry is usually product revenue minus consumables. Some companies were very good about segmenting their data in this way; others, not so much. Whenever possible, all service, licensing, royalties, and investment revenue was similarly subtracted. The goal was to get as close as possible to the revenue generated just from the sale of goods that carry product warranties and generate claims costs.

Using these product sales revenue totals, we calculated two additional metrics: warranty claims as a percentage of sales (the claims rate), and warranty accruals as a percentage of sales (the accrual rate).

The Companies

Major players in this industry have ceased reporting their warranty expenses in recent years, while one large company has come onto the scene.

As we detailed in our recent newsletter "U.S. Power Generation Equipment Warranties," General Electric has now split into three companies. The first of the three was GE HealthCare Technologies Inc., which spun off from the parent GE in January 2023. GE HealthCare manufactures MRI, CT, and X-Ray machines, among other medical equipment.

Although the spin-off was finalized in January 2023, GE HealthCare helpfully published a 2022 annual report at that time, which provided historical data starting at the beginning of 2020.

A few key players in the industry ceased reporting their warranty expenses over the same three-year span, from 2020 to 2023.

Danaher Corp. ceased reporting its warranty accruals in 2022, and ceased reporting claims costs as well in 2023. Additionally, Danaher spun off Veralto Corp. in 2023, and that new subsidiary does not report its warranty expenses. After the change in accounting from 2021 to 2022, Danaher's reported warranty expenses fell by three-fourths.

Thermo Fisher Scientific Inc. ceased reporting its warranty expenses in 2021, with no explanation. Varian Medical Systems Inc., Hill-Rom Holdings Inc., and MTS Systems Corp. all also ceased reporting in 2021, because they were acquired. Varian was acquired by Siemens Healthineers, based in Germany; Hill-Rom was acquired by Baxter International Inc., which is based in the U.S. but has not reported its warranty expenses since 2005; parts of MTS were acquired by Illinois Tool Works Inc. and Amphenol Corp, neither of which is primarily engaged in the medical equipment field.

More recently, Berkeley Lights Inc. and IsoPlexis Corp. merged to form PhenomeX in March 2023, and then Bruker Corp. acquired PhenomeX in August 2023. Since Bruker does report, these three manufacturers are now all represented under the parent.

In February 2023, Invacare Corp. filed for Chapter 11 bankruptcy, and did not report its warranty expenses for the second, third, or fourth quarters of the year. Similarly, HTG Molecular Diagnostics Inc. filed for Chapter 11 bankruptcy in June 2023. The company formerly only reported its warranty expenses in its annual reports, but did not file one for 2023.

Hearing aid manufacturer Eargo Inc. went private in January 2024, but did not report its warranty expenses from calendar 2023 either.

The departures of Thermo Fisher Scientific and Danaher caused the totals for the Other Medical Equipment group to drop over recent years. At the same time, GE HealthCare providing historical data starting in 2020 caused the totals for the Laser & X-Ray Equipment group to more than double from 2019 to 2020. Thus, the dynamics between these two groups have transformed over the five-year span from 2019 to 2023.

Warranty Claims Totals

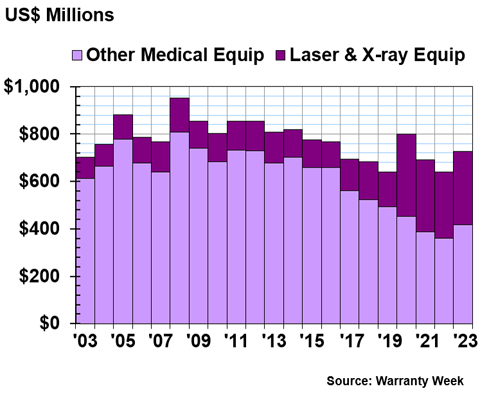

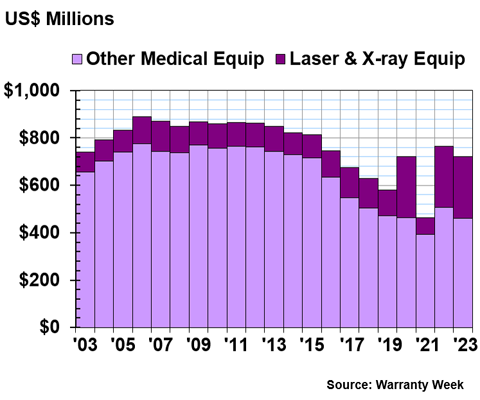

Figure 1 shows the total amount of warranty claims paid by each of the two subgroups in the U.S.-based medical and scientific equipment industry, from 2003 to 2023. Figure 1 is a great illustration of this shift in the dynamics between the two groups since 2019.

Figure 1

Medical & Scientific Equipment Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

The U.S.-based medical and scientific equipment manufacturing industry paid a total of $727 million in warranty claims during calendar 2023, up by 14% from 2022.

The Laser & X-Ray Equipment subgroup paid $310 million in claims, while the Other Medical Equipment subgroup paid $417 million.

In the Laser & X-Ray Equipment category, GE HealthCare spent the most on warranty claims by far. GE HealthCare paid a total of $218 million in warranty claims during 2023, rising by 10% from 2022's total. GE HealthCare had the highest warranty claims costs not just of the X-Ray manufacturers, but of the entire U.S.-based medical & scientific equipment industry.

Also in the X-Ray and Laser category, Dentsply Sirona Inc. paid $46 million in claims during 2023, up 39% from the year prior. Varex Imaging Corp. paid $13 million, up 7%. Envista Holdings Corp. paid $13 million, a decrease of -13% from 2022. And Hologic Inc. paid $7 million in warranty claims during 2023, up 3% from 2022.

In the Other Medical Equipment category, Insulet Corp., maker of insulin pumps, paid $59 million in claims in 2023, more than triple the $18 million it paid during 2022. This isn't a surprise, since we noticed last year that Insulet raised its warranty accruals eightfold from 2021 to 2022.

In our March 2024 newsletter "Top 100 Warranty Providers of 2023," we observed that Insulet's accruals fell back to a normal rate in 2023, but its claims rose. This was a one-time lump sum accrual of $69 million made during 2022, in anticipation of incoming warranty claims costs for, in the company's own words, "voluntary Medical Device Corrections ('MDCs') for its Omnipod DASH PDM related to its battery, and for its Omnipod 5 Controller related to its charging port and cable."

Agilent Technologies Inc. paid $58 million in claims during 2023, up 16% from 2022. DexCom, maker of continuous glucose monitors (CGMs), which collaborates with Insulet to form the Omnipod system, paid $52 million in claims during 2023, up 20% from 2022.

Illumina Inc. paid $39 million in claims during 2023, up 44% from 2022. National Vision Holdings Inc., the optical retailer that owns the National Vision Center and Eyeglass World brands, paid $37 million in claims, up 2% from the year prior. And Tandem Diabetes Care Inc., another insulin pump manufacturer, paid $33 million in claims, up 28% from the year prior.

Warranty Accrual Totals

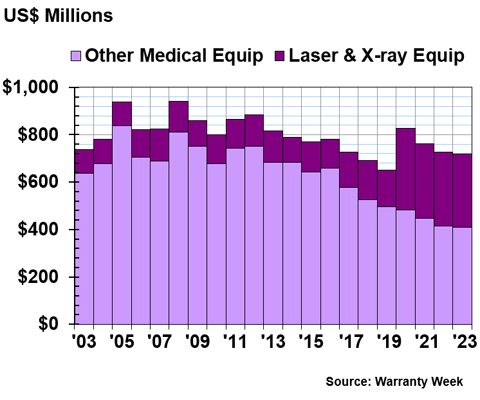

Figure 2 shows the total warranty accruals made by the U.S.-based medical and scientific equipment manufacturers, from 2003 to 2023.

Figure 2

Medical & Scientific Equipment Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

The medical & scientific equipment manufacturing industry as a whole set aside $719 million in warranty accruals during calendar 2023, down by -1% from 2022.

The Laser & X-Ray Equipment subgroup accrued $310 million, while the Other Medical Equipment subgroup accrued $409 million.

In the Laser & X-Ray Equipment group, GE HealthCare accrued $216 million during 2023, down by -9% from 2022. Dentsply Sirona accrued $48 million, up by 78% from 2022.

Varex Imaging accrued $14 million, up by 5% from the year prior. Envista Holdings accrued $13 million, down by -16%. And Hologic accrued $7 million, up by 4%.

In the Other Medical Equipment group, Agilent Technologies had the highest total accruals; the company accrued $57 million during 2023, up by 14% from 2022. DexCom accrued $52 million in 2023, up by 20% from 2022. Illumina accrued $42 million, up by 83%; the company didn't provide an explanation for the increase in its annual report.

National Vision Holdings accrued $37 million in 2023, up by 3% from 2022. Tandem Diabetes Care accrued $36 million, up by 9%. ResMed Inc. accrued $21 million, up 64% from 2022. Insulet accrued just $19 million, down by -79% from the year prior.

Align Technology Inc. accrued $18 million, up by 11% from 2022. Steris plc accrued $17 million, up by 43%. Bruker Corp. accrued $17 million, up by 30%, after the acquisition of PhenomeX in mid-2023. And Inogen Inc. accrued $10 million in 2023, down by -6% from the year prior.

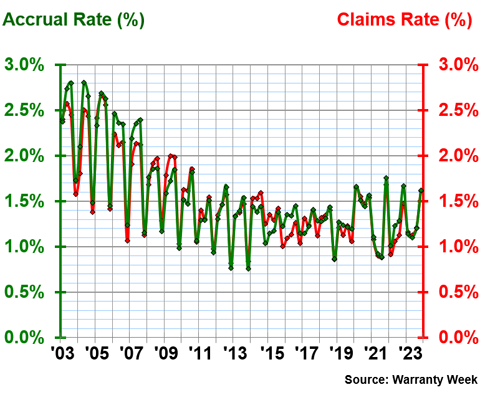

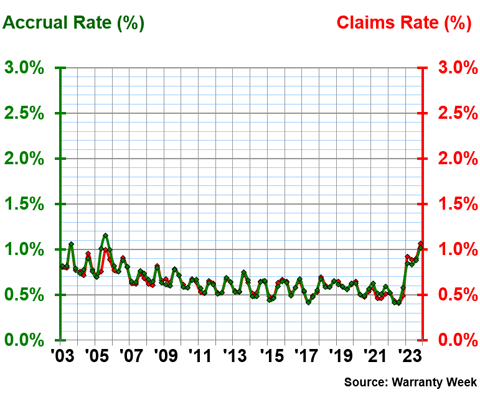

Warranty Expense Rates

Figures 3 and 4 show the average quarterly warranty expense rates for the two industry subgroups, from 2003 to 2023. Both charts are presented on the same y-axis scale for ease of comparison.

As we can see in Figures 3 and 4, the previous trend was that Medical X-Ray & Laser Equipment manufacturers had higher average warranty expense rates than the Other Medical Equipment manufacturers, despite having much lower total warranty costs.

With the addition of GE HealthCare to the dataset, the disparity between the total warranty costs of the two groups shrunk, starting in 2020. The trend of the X-Ray & Laser manufacturers having higher warranty expense rates held until 2023.

Figure 3

U.S. Medical X-Ray & Laser Equipment Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the Medical X-Ray & Laser Equipment manufacturers had an average warranty claims rate of 1.51%, with a standard deviation of 0.46%, and an average warranty accrual rate of 1.54%, with a standard deviation of 0.51%. These standard deviations are on the higher side for warranty expense rates, meaning that this industry has seen more volatility in these metrics than is typical of a product warranty-generating industry.

In 2023, the Medical X-Ray & Laser Equipment manufacturers had an average warranty claims rate of 1.28%, and an average warranty accrual rate of 1.26%.

These averages represent a rather wide range of values. The average claims rates in 2023 ranged from 1.13% in the second quarter, to 1.61% in the fourth quarter. The average accrual rates ranged from 1.10% in the second quarter, to 1.62% in the fourth quarter. However, the fourth quarter values are higher in part due to manufacturers that only report their warranty costs once a year in their annual reports.

Keep in mind the lower end of that range, around 1%, as we take a look at the average warranty expense rates of the Other Medical Equipment manufacturers in Figure 4.

Figure 4

U.S. Other Medical Equipment Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the Other Medical Equipment manufacturers had an average warranty claims rate of 0.65%, with a standard deviation of 0.14%, and an average warranty accrual rate of 0.66%, with a standard deviation of 0.15%.

In 2023, the Other Medical Equipment manufacturers had an average claims rate of 0.94%, and an average accrual rate of 0.89%. These averages representing just 2023 are much higher than the 21-year averages, and are twice the average expense rates of 2022. It was a sharp rise in the warranty expense rates from 2022 to 2023 for this industry subgroup.

As such, the differentiation between the warranty expense rates doesn't really exist anymore. The lowest average quarterly claims rate for the Laser & X-Ray Equipment manufacturers in 2023 was 1.13%, while the highest average quarterly claims rate for the Other Medical Equipment manufacturers in 2023 was 1.06%.

So the two overarching trends within the U.S.-based Medical & Scientific Equipment industry have been turned on their heads in the past few years. The total warranty expenses for both industry subgroups have become quite similar, as have the average warranty expense rates.

Warranty Reserve Balances

Our final warranty metric is the year-end balance of each manufacturer's warranty reserve fund, from 2003 to 2023.

Figure 5

Medical & Scientific Equipment Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

At the end of calendar 2023, the U.S.-based medical & scientific equipment industry collectively held a total of $720 million in warranty reserves, down -6% from the end of 2022.

The Laser & X-Ray Equipment manufacturers held $258 million in reserves, while the Other Medical Equipment manufacturers held $462 million.

In the Laser & X-Ray subgroup, GE HealthCare held $192 million at the end of 2023, down -1% from the end of 2022. Dentsply Sirona held $24 million, up by 9%. No other manufacturers in this subgroup held more than $10 million in reserves at the end of 2023.

In the Other Medical Equipment subgroup, ICU Medical Inc. held $65 million in reserves at the end of 2023, up by 15% from the end of 2022. Tandem Diabetes Care held $37 million, up by 2%. ResMed held $31 million, up by 20%. Bruker held $30 million, up by 21%. And Agilent held $29 million, down by -3%.

Inogen Inc. held $24 million at the end of 2023, up by 18% from the end of 2022. Align Technology held $22 million, up by 25%. Illumina held $21 million, up by 17%. Steris held $15 million, up by 11%. DexCom held just $13 million, down by -2%. Waters Corp. held $12 million, up by 1%. And Insulet held just $10 million, down by -83% after spending the lump sum accrual made in 2022 on claims paid during 2023.

Catch up on our series of 21-year charts here:

- Twenty-first Annual Product Warranty Report

- U.S. Small Vehicle Warranty Expenses

- U.S. Truck & Heavy Equipment Warranties

- U.S. Auto Parts & Powertrain Warranties

- U.S. Aerospace Warranties

- U.S. New Home & Building Materials Warranty Report

- U.S. HVAC & Appliance Warranty Report

- U.S. Power Generation Equipment Warranties

- U.S. Electronics Warranty Report

- U.S. Semiconductor Warranties

- U.S. Telecom Equipment Warranty Report