U.S. Telecom Equipment Warranty Report:

Many of the familiar names in the U.S.-based telecom equipment industry have gone bankrupt, been acquired, or gone private in the past decade, leading to a decline in the industry's total warranty expenses. However, based on the dropping warranty expense rates since 2018, it seems that the companies that remain are spending a lower proportion of their sales revenue on warranty expenses than ever before.

There used to be a thriving U.S.-based telecommunications equipment industry that included hundreds of companies manufacturing products covered by warranties. But two decades after the warranty expense reports began, almost three-quarters of them have been acquired or gone out of business.

As with consumer electronics, much of the global telecom manufacturing industry has moved overseas, especially in the telephone and satellite sectors.

To create this report, we started with a list of 200 U.S.-based telecom hardware manufacturers that reported warranty expenses between 2003 and 2023. To get a better sense of industry trends, we subdivided the 200 companies into four groups based on their dominant market: internet and data communications, landline and mobile phone, broadcast and cable television, and satellite and microwave.

Of the 200, 71 were in the internet and data communications category, of which 17 were active and reporting in 2023; 59 were in landline and mobile phone, of which just five were active in 2023; 41 were in broadcast and cable television, of which eight were active in 2023; and 29 were in satellite and microwave, of which seven were active in 2023.

So 38 of the 200 total manufacturers, or just one-fifth, were still active and reporting in 2023. This is including the new companies that were added to our roster when we conducted our audit of the SEC's database to compose our "Twenty-first Annual Product Warranty Report" newsletter earlier this year.

For each of the 200 manufacturers, we perused their annual reports and quarterly financial statements, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the year-end balance of the warranty reserve fund. We also gathered data on each manufacturer's product sales revenue, and we used these to calculate two additional metrics: claims as percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

The decline in the number of U.S.-based telecom manufacturers reporting their warranty expenses has affected all four of these industry subgroups, but one more so than the others. The landline and mobile phone category has seen 90% of its manufacturers cease reporting warranty expenses since we started gathering these data and compiling these reports back in 2003.

The Companies

The number of telecom manufacturers that were still based in the U.S. and reporting their warranty expenses in 2023 is so few that we can name all of them, rather than just the top companies.

The manufacturers from the internet and data communications industry subgroup were: Cisco Systems Inc., Juniper Networks Inc., EnerSys, Vertiv Holdings Co., Extreme Networks Inc., Itron Inc., Lumentum Holdings Inc., Netgear Inc., Calix Inc., Sonim Technologies Inc., Airspan Networks Holdings Inc., Cambium Networks Corp., Applied Optoelectronics Inc., Amtech Systems Inc., CSP Inc., Socket Mobile Inc., and Neonode Inc.

The manufacturers from the landline and mobile phone subgroup were: Ciena Corp., Adtran Inc., Preformed Line Products Co., DZS Inc., and PowerFleet Inc.

The manufacturers from the broadcast and cable television group were: CommScope Holding Co. Inc., Infinera Corp., SPX Corp., Viavi Solutions Inc., CalAmp Corp., Avid Technology Inc., Vislink Technologies Inc., and Optical Cable Corp.

And the manufacturers from the satellite and microwave subgroup were: L3Harris Technologies Inc., Comtech Telecommunications Corp., ViaSat Inc., Aviat Networks Inc., KVH Industries Inc., Frequency Electronics Inc., and BK Technologies Corp.

Note that L3Harris, the IT services provider and defense contractor formed in 2019 by the merger of L3 Technologies Inc. and Harris Corp., did not report its warranty expenses in its 2023 annual report, so the company's data is as recent as the end of 2022. We remain hopeful that the manufacturer will commence reporting its warranty expenses once again.

Once-familiar names in the telecom manufacturing industry that we won't see in this report include Nortel, Lucent, Avaya, 3Com, and Motorola. Nortel went bankrupt back in 2009. 3Com was acquired by Hewlett-Packard in 2010, and is now part of Hewlett Packard Enterprise.

Motorola split into two companies, Motorola Solutions and Motorola Mobility, back in 2011. Mobility was acquired by Google in 2012, then by Lenovo in 2014; Solutions, the telecom business, remains independent, publicly-traded, and based in the United States, but is inconsistent in reporting its warranty expenses, and didn't report at all in 2023.

Lucent, which spun off from AT&T in 1996 and included the Western Electric and Bell Labs businesses, was acquired by the French company Alcatel in 2006; Alcatel-Lucent was subsequently acquired by Nokia in 2016. Avaya, which spun off from Lucent in 2000, went private in 2007, and has filed for Chapter 11 bankruptcy twice since, once in 2017, and again in 2023.

In the broadcast and cable TV category, the biggest players were once Scientific Atlanta and JDS Uniphase. Scientific Atlanta was acquired by Cisco Systems in 2015, so it's still represented in this report, though in a different category. JDS Uniphase split into two companies, Lumentum Holdings and Viavi Solutions, back in 2015. Lumentum is now in the internet and data communications category, while Viavi remains in broadcast and cable TV.

More recently, Plantronics Inc. was acquired by HP Inc. in 2022. And just last month, in June 2024, Infinera Corp. was acquired by Nokia. As such, we have data from Plantronics from the first two quarters of 2022, but not the second half of the year, and we have data from Infinera for the first three quarters of 2023. Infinera was late to file its 2023 annual report, perhaps anticipating the upcoming deal.

Warranty Claims Totals

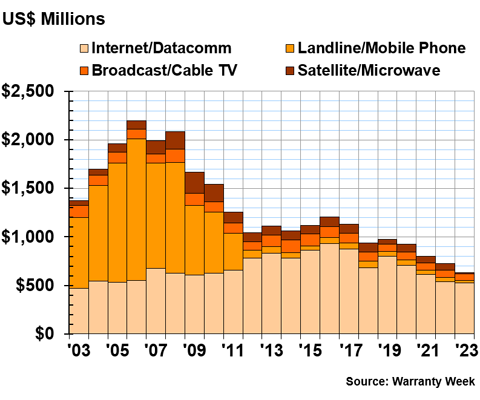

Figure 1 shows the total product warranty claims payments of the U.S.-based telecom manufacturing industry, split into the four industry subcategories, from 2003 to 2023.

Figure 1

Telecom Equipment Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

During calendar 2023, the U.S.-based telecom hardware manufacturers paid a total of $630 million in warranty claims, a decrease of -14% from 2022.

In 2023, the U.S.-based internet and data communications manufacturers paid $528 million in warranty claims, down -2% from 2022.

The largest manufacturer by far, not just in this subcategory, but in the whole telecom industry, was Cisco Systems Inc. Cisco paid $400 million in claims during 2023, down -4% from 2022.

Juniper Networks, another mainstay of the industry that's been around since we started gathering these data in 2003, paid $32 million in claims during 2023, down -5% from the year prior. EnerSys paid $30 million in claims during 2023, an increase of 35% from the year prior. Vertiv paid $22 million in claims, up 9%, Extreme Networks paid $15 million, up 4%, and Itron paid $11 million, up 15%.

The landline and mobile phone subcategory paid a total of $25 million in claims, down -83% from 2022's total of $45 million. Plantronics previously had the largest warranty expenses in the phone subcategory, before it was acquired by HP in mid-2022, contributing to this significant drop in the subcategory's totals in 2023. In addition, Motorola Solutions reported claims costs in 2022, but not in 2023, dropping the subcategory's totals even further.

There are only five manufacturers in the phone subcategory that actually reported their warranty claims costs from 2023. Ciena Corp. paid $20 million in claims during 2023, up 1% from the year prior. Adtran Inc. paid $4 million, down -30%. Preformed Line Products Co. paid $70,000 in claims, down -92%; PowerFleet Inc. paid $37,000, down -23%; and DZS Inc. paid $11,000, down -84%.

The broadcast and cable TV subcategory paid a collective $69 million in claims, down -9% from the year prior.

CommScope Holding Co. Inc. paid $34 million, down -6% from 2022. Infinera Corp. paid $16 million, down -29%. SPX Corp. paid $15 million, an increase of 35% from the year prior. Viavi Solutions Inc. paid $2 million, down -24%. And CalAmp Corp. paid $2 million, down just -1% from the year prior.

Finally, the satellite and microwave subcategory paid a total of just $9 million in claims during 2023, a decrease of -689% from 2022's total of $67 million. The huge decrease is because L3Harris Technologies Inc. did not report its warranty expenses in its 2023 annual report, or in the corresponding quarterly financial statements. L3Harris paid $57 million in claims during 2022, but didn't report a total for 2023.

Aside from L3Harris, the subcategory is comprised of just a few relatively small companies. Comtech Telecommunications Corp. paid $2 million in claims, down -52%. ViaSat Inc. paid $3 million, up 5%. Aviat Networks Inc. paid $2 million, up 6%. And KVH Industries Inc. paid $1 million, up 52%.

Warranty Accrual Totals

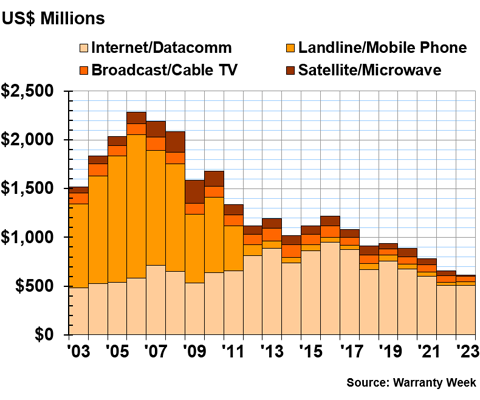

Figure 2 shows the total warranty accruals of the U.S.-based telecom manufacturers in these four industry subcategories, from 2003 to 2023.

Figure 2

Telecom Equipment Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

The telecom equipment manufacturers set aside a total of $612 million for future warranty costs during 2023, down -6% from 2022.

The internet and data communications subgroup accrued $509 million during 2023, an increase of just 0.3% from 2022.

Cisco accrued $387 million in 2023, down -3% from 2022. Juniper Networks accrued $32 million, up 6%. EnerSys accrued $33 million, up 32%. Vertiv accrued $23 million, up 42%. And Extreme Networks accrued $14 million, down -3%.

The landline and mobile phone subgroup accrued $36 million during 2023, up 11% from 2022.

Ciena accrued $32 million, an increase of 82% from 2022's total of $17 million. Adtran accrued $3 million, down -5% from 2022. None of the other manufacturers in this subgroup accrued more than $1 million.

The broadcast and cable TV subgroup accrued $56 million, down -23% from the year prior.

CommScope accrued $21 million in 2023, down -15% from 2022. Infinera accrued $15 million, down -45% from 2022's total of $27 million. And SPX accrued $17 million, up 59% from 2022's total of $11 million.

The satellite and microwave subgroup accrued $10 million during 2022, down -338% from 2022. This huge decrease is again due to L3Harris failing to report its warranty costs during 2023.

L3Harris accrued $39 million in 2022, but didn't report in 2023. Comtech accrued $4 million, sextuple 2022's total accruals of $725,000. And ViaSet accrued $3 million, the same as the year prior.

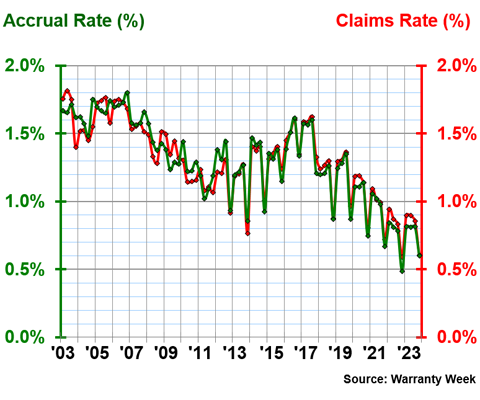

Warranty Expense Rates

Figure 3 shows the average warranty claims and accrual rates of the entire telecom industry, from 2003 to 2023.

Since several of the subcategories have so few manufacturers still reporting, the charts of the expense rates of the four subcategories didn't shine much light on their warranty trends. Thus we opted to join the four groups together for these metrics, and calculate the average expense rates and standard deviations for the telecom equipment industry as a whole.

Figure 3

Telecom Equipment Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the telecom equipment manufacturers had an average warranty claims rate of 1.30%, with a standard deviation of 0.29%, and an average warranty accrual rate of 1.29%, with a standard deviation of 0.31%.

In 2023, the telecom industry had an average claims rate of 0.81%, and an average accrual rate of 0.76%. So interestingly, although we've seen overall decline in this industry, the companies that remain are spending a smaller proportion of their product sales revenue on warranty costs than they used to.

This means that it isn't all doom and gloom for the U.S.-based telecom hardware industry. Yes, the industry is shrinking, but those that remain have actually managed to save money on warranty expenses over the past six years or so. So the decreases in Figures 1, 2, and 4 are not just due to a dwindling number of manufacturers; those that remain have managed to find overall savings on product warranty.

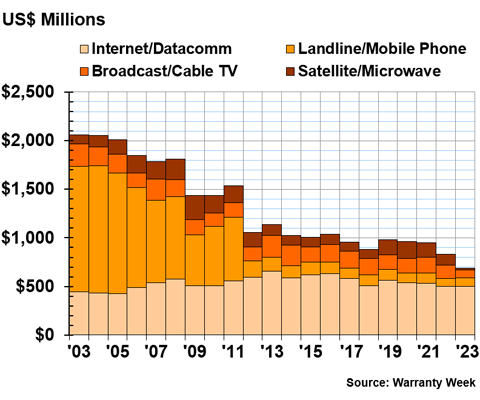

Warranty Reserve Balances

Our final warranty metric is the year-end balance of each manufacturer's warranty reserve fund. These are funds that have been accrued for future warranty costs, but have yet to be paid out in the form of warranty claims.

Figure 4

Telecom Equipment Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

At the end of calendar 2023, the telecom hardware manufacturers held a collective $688 million in their warranty reserve funds, a decrease of -17% from the year prior.

The internet and data communications subcategory held the majority of these funds, $504 million, an increase of just 1% from the year prior.

Cisco held $330 million in reserves at the end of 2023, an increase of 2% from the year prior. EnerSys held $59 million, up 6% from the year prior. Juniper Networks held $30 million, down just -0.3%. Vertiv held $26 million, up 2%. Itron held $22 million, down -14%. Extreme Networks held $11 million, down -4%. And Lumentum Holdings Inc. held $10 million, up 20%.

The landline and mobile phone subcategory held $87 million at the end of 2023, up 6% from the year prior.

Ciena held $57 million, an increase of 25% from the end of the year prior. Motorola Solutions carried over a balance of $22 million from the year prior, although it did not report new accruals or claims costs in 2023. And Adtran held $6 million, down -10% from the end of the year prior.

The broadcast and cable TV category held $75 million, down -84% from the year prior.

CommScope held $27 million, half of its 2022 end-balance of $55 million. Infinera didn't report a 2023 end-balance in time to make this report. Its reserve balance at the end of 2022 was $37 million.

SPX held $38 million at the end of 2023, up 9% from the end of the year prior. And Viavi held $9 million, down -10%.

The satellite and microwave subgroup held $19 million, down -478% from the year prior, due to L3Harris not reporting in 2023. L3Harris held $90 million at the end of 2022.

Comtech held $9 million at the end of 2023, down -2% from the end of the year prior. ViaSat held $5 million, down -1%. And Aviat held $3 million, up 8% from the end of 2022.

Have you signed up for the 15th annual Extended Warranty & Service Contract Innovations conference yet? It will be held at the Palmer House Hilton in Chicago, IL, on September 23-25, 2024. Click here to take a look at the preliminary conference agenda.

Early bird registration ends on August 9th, so register now! Use our exclusive discount code WW300 to save an addtional $300!

Catch up on our series of 21-year charts here:

- Twenty-first Annual Product Warranty Report

- U.S. Small Vehicle Warranty Expenses

- U.S. Truck & Heavy Equipment Warranties

- U.S. Auto Parts & Powertrain Warranties

- U.S. Aerospace Warranties

- U.S. New Home & Building Materials Warranty Report

- U.S. HVAC & Appliance Warranty Report

- U.S. Power Generation Equipment Warranties

- U.S. Electronics Warranty Report

- U.S. Semiconductor Warranties