U.S. Semiconductor Warranties:

Total warranty claims and accruals were down for the semiconductor & PCB industry after reaching record-breaking highs in 2022. However, the industry set a new record high for warranty reserves.

Last week's newsletter, "U.S. Electronics Warranty Report," set the stage for this week's in-depth look at the warranty expenses of the U.S.-based semiconductor & printed circuit board (PCB) industry.

Semiconductor product warranties are more relevant than ever these days, since artificial intelligence (AI) is powered primarily by graphics processing units, or GPUs, a type of semiconductor. Data mining centers are basically giant warehouses full of GPUs and cooling equipment, conducting the complex calculations needed to power AI and cryptocurrency mining.

By the way, as stated in this recent report from NPR, AI has a profound environmental impact. According to a recent report from the International Energy Agency (IEA), a ChatGPT query uses nearly 10 times the amount of electricity as a regular Google search query. The IEA estimates that global data centers' total electricity consumption has the potential to double between now and 2026. According to Google's 2024 environmental report, Google's greenhouse gas emissions have risen by 48% since 2019.

About 33% of the world's over 8,000 data mining centers are located in the United States. Northern Virginia contains the largest number and highest concentration of these data centers; other data mining epicenters in the U.S. include California, Texas, Ohio, Illinois, New York, Florida, and Oregon.

As reported by the Washington Post, antiquated coal power plants that were scheduled to go offline will now continue to run in order to power data mining centers in Virginia. In the area of Northern Virginia colloquially known as Data Center Alley, located primarily in Loudoun County near Dulles Airport, enough extra energy to power six million homes will be needed by 2030, just to power data centers.

Dominion Energy, a public utility in Virginia, predicts that by 2035, the data centers it powers will require 11,000 megawatts of energy, nearly quadruple their energy consumption in 2022. That's enough energy to power 8.8 million homes. Furthermore, the smaller Northern Virginia Electric Cooperative stated that the data centers it serves account for 59% of its energy demand. The energy demands of data centers in northern Virginia are far outpacing new renewable energy infrastructure projects, such as offshore wind farms and solar projects. Coal power plants in West Virginia and fracked gas plants in Pennsylvania, among other fossil fuel plants, will undoubtedly be the stopgaps to keep powering AI while renewable energy projects are tied up in bureaucratic red tape.

The charts in last week's newsletter include the product warranty data for the semiconductor & PCB industry as part of the larger electronics sector. This week's charts are zoomed in on the semiconductor portion of those charts.

To create this report, first we compiled our list of every U.S.-based semiconductor manufacturer that has ever reported product warranty expenses, from 2003 to 2023. We identified 163 semiconductor & printed circuit board manufacturers, of which 34 reported warranty expenses in 2023. These companies all create parts that are foundational to computers and other electronic devices, including chips and microprocessors, high-performance computing, graphics processing units (GPUs), flat panel displays (FPDs), wafer fabrication, lasers, artificial intelligence, software, robotics, autonomous vehicles, and more.

From the annual reports and quarterly financial statements of these 163 manufacturers, we extracted three key warranty metrics: the amount of claims paid, the amount of accruals made, and the year-end balance of the warranty reserve fund. We also gathered data on each manufacturer's segmented product sales revenue, and used these to calculate two additional warranty metrics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

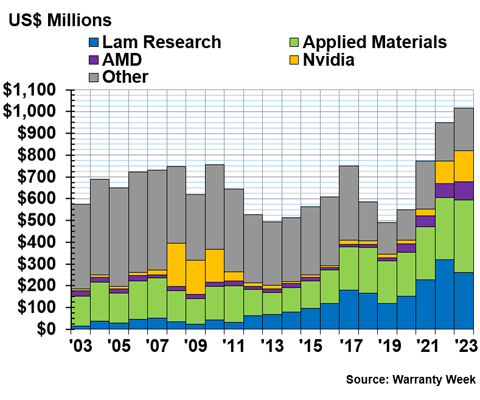

To create the following charts, we identified the top four U.S.-based semiconductor manufacturers in 2023, based on their product warranty expenses. These four largest manufacturers are: Lam Research Corp., Applied Materials Inc., Advanced Micro Devices (AMD) Inc., and Nvidia Corp.

Only a small portion of the 163 semiconductor manufacturers in this report make GPUs or are associated with artificial intelligence. However, two of the top four companies, AMD and Nvidia, both produce the discrete GPUs that power data centers. Lam Research is a supplier of wafer-fabrication equipment to other manufacturers in the semiconductor industry. And Applied Materials manufactures equipment used to produce chips and flat panel displays for electronics.

As we will see in Figures 3 and 4, there is a dichotomy in this industry between the warranty expense rates of the producers of semiconductor manufacturing equipment, such as Lam Research and Applied Materials, and the warranty expense rates of the semiconductor & PCB manufacturers, such as AMD and Nvidia. Usually, we'd expect the suppliers to have lower expense rates than the OEMs. However, in this industry, the suppliers of semiconductor manufacturing equipment have much higher warranty expense rates than the manufacturers of semiconductors and PCBs.

Note that Intel is not included in this report, although it's a U.S.-based direct competitor of AMD and Nvidia, because it does not report its warranty expenses.

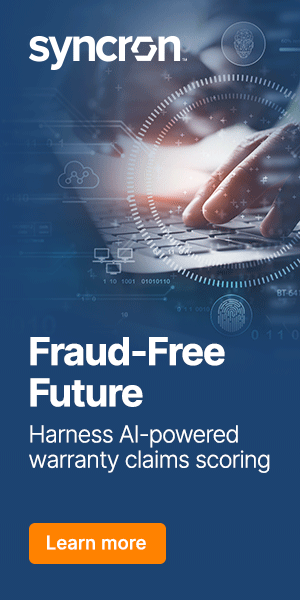

Warranty Claims Totals

Figure 1 shows the total product warranty claims costs of the U.S.-based semiconductor & PCB industry, from 2003 to 2023.

Figure 1

Semiconductor Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

In 2023, the U.S.-based semiconductor industry paid $761 million in warranty claims, down -8% from 2022. As we can see in Figure 1, 2022's total of $827 million was the largest the industry had seen since 2003.

In 2023, Lam Research paid $216 million in warranty claims, a decrease of -20% from its total claims payments made in 2022. Applied Materials paid $210 million in claims during 2023, down -5% from the year prior.

AMD paid $106 million in claims during 2023, up 5% from 2022. Nvidia paid $71 million in claims, down -20% from 2022.

Coherent Inc. paid $40 million in claims in 2023, up 54% from 2022's total of $26 million. Teradyne Inc. paid $19 million in claims, down -30% from the year prior. Kulicke and Soffa Industries Inc. paid $15 million in claims, down -11%. Onto Innovation Inc. paid $12 million in claims, down -14%. And Axcelis Technologies Inc. paid $10 million in claims, up 50% from the year prior.

The remaining 25 semiconductor manufacturers all paid less than $10 million in claims during calendar 2023.

A few of these manufacturers saw significant increases in their total warranty claims payments during 2023. Azenta Inc. paid $4 million in claims, double its 2022 payments. ACM Research Inc. paid $7 million, double its 2022 total. Alpha & Omega Semiconductor Ltd. paid $4 million, triple its 2022 total. And Vicor Corp. paid $1 million, sextuple its 2022 total.

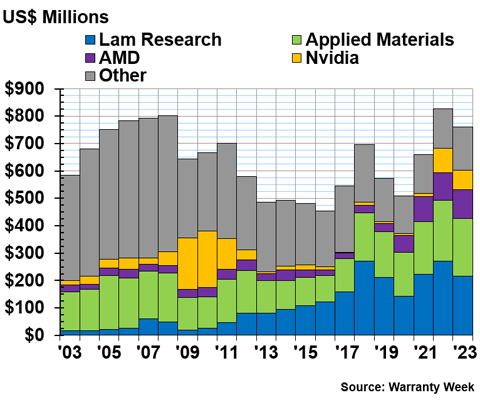

Warranty Accrual Totals

Figure 2 shows the total warranty accruals made by the U.S.-based semiconductor & PCB industry, from 2003 to 2023.

Figure 2

Semiconductor Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

In 2023, the U.S.-based semiconductor & PCB industry accrued a total of $846 million for future warranty expenses, a decrease of -16% from 2022. 2022's total of $1.009 billion is the 21-year record high for the industry.

Applied Materials accrued $254 million for future warranty expenses during 2023, the same amount it accrued the year prior. Lam Research accrued $197 million in 2023, a decrease of -39% from 2022.

AMD accrued $126 million during 2023, an increase of 10% from 2022. Nvidia accrued $109 million in 2023, down -32% from the year prior.

Coherent Inc. accrued $40 million in 2023, an increase of 68% from 2022. Teradyne accrued $22 million, down just -1% from the year prior. Kulicke and Soffa Industries accrued $14 million, up 24%. Axcelis Technologies accrued $13 million, up 22%. And Onto Innovation accrued $10 million, down -41%.

The remaining 24 U.S.-based semiconductor manufacturers that reported warranty accruals during 2023 each set aside less than $10 million.

A few of these manufacturers made significant increases in their total warranty accruals during 2023. Azenta Inc. accrued $9 million, quadruple its warranty accruals in 2022. Alpha & Omega Semiconductor Ltd. accrued $4 million, more than double its 2022 accruals. And Vicor Corp. accrued $1 million, more than triple its 2022 accruals.

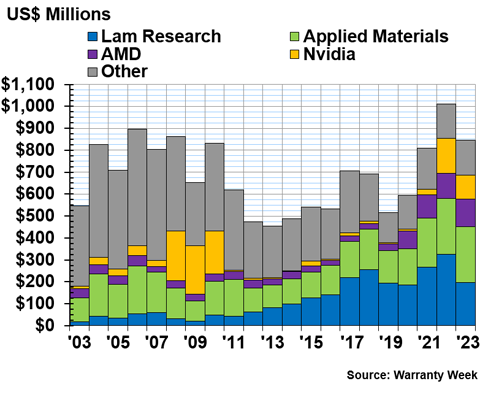

Warranty Expense Rates

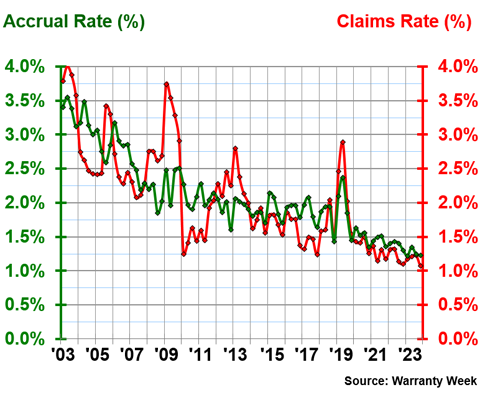

Figures 3 and 4 show the average warranty expense rates of the two key segments of the U.S.-based semiconductor industry. The majority of the manufacturers in this report are represented in Figure 3, which shows the average warranty expense rates of the semiconductor & PCB manufacturers. Roughly one-sixth of the companies in this report are represented in Figure 4, which shows the average warranty expense rates of the manufacturers of equipment used to produce semiconductors.

Figures 3 and 4 are shown on the same y-axis scale for ease of comparison.

Figure 3 shows the average warranty expense rates of the semiconductor & PCB OEMs, from 2003 to 2023.

Figure 3

Semiconductor Devices & Printed Circuit Board Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the semiconductor & PCB manufacturers had an average warranty claims rate of 0.37%, with a standard deviation of 0.16%, and an average warranty accrual rate of 0.40%, with a standard deviation of 0.18%.

In 2023, the semiconductor & PCB manufacturers had an average warranty claims rate of 0.34% and an average warranty accrual rate of 0.41%.

Figure 4 shows the average warranty expense rates of the producers of semiconductor manufacturing equipment, from 2003 to 2023.

Figure 4

Semiconductor Manufacturing Equipment

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the producers of semiconductor manufacturing equipment had an average warranty claims rate of 2.06%, with a standard deviation of 0.75%, and an average warranty accrual rate of 2.10%, with a standard deviation of 0.58%.

In 2023, the producers of semiconductor manufacturing equipment had an average claims rate of 1.17%, and an average accrual rate of 1.26%.

Warranty Reserve Balances

Figure 5 shows the year-end balances of the warranty reserve funds in the semiconductor & PCB industry, from 2003 to 2023. These are funds that have already been set aside in warranty accruals, but have yet to be spent as claims payments.

Figure 5

Semiconductor Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

At the end of calendar 2023, the semiconductor & PCB industry held a collective $1.018 billion in warranty reserves, an increase of 7% from the year prior. This is the highest reserve balance we've seen from this industry, and the first time this metric has surpassed the threshold of $1 billion.

At the end of 2023, Applied Materials held the largest warranty reserve fund in the semiconductor industry. The company held $332 million, a 16% increase from the year prior.

Lam Research held $261 million, down -18% from the end of 2022. Nvidia held $142 million, an increase of 37% from the year prior. And AMD held $85 million, up 31%.

Coherent Inc. held $63 million, almost double 2022's year-end balance of $33 million. Monolithic Power Systems Inc. held $17 million, down -30% from the year prior. Axcelis Technologies Inc. held $17 million, up 60% from the year prior. Teradyne Inc. held $16 million, up 11%. Kulicke and Soffa Industries Inc. held $10 million, down -11%. And Azenta Inc. held $10 million, double 2022's end-balance of $5 million.

We are pleased to announce the all-new agenda for The 15th Annual Extended Warranty & Service Contract Innovations, September 23-25, 2024, Palmer House Hilton, Chicago, Illinois. This year's event takes a deep-dive into new frontiers in extended warranty and service contract innovations!

Get in-depth insights on all key ingredients for creating winning warranty & service contracts for vehicle, home, appliance, mobile, electronics & other consumer markets. Hear top industry leaders discuss tools and strategies for end-to-end lifecycle solutions for product design, marketing, sales, customer service, operations, technology & compliance.

The conference features riveting case studies and timely panel discussions. Plus, you'll want to participate in the always-popular industry-specific roundtable discussion groups and hot off the press market news flashes from Warranty Week.

New for 2024: The Inaugural Warranty & Service Contract 101 Pre-Conference Workshop: An A-Z Primer to Understanding & Successfully Navigating the Complexities of Service Contracts!

Early Bird ends on August 9th so register now at: www.warrantyinnovations.com. Register today using Discount Code WW300 to save an additional $300!

Click here to take a look at the preliminary conference agenda. We look forward to seeing you in Chicago!

Catch up on our series of 21-year charts here:

- Twenty-first Annual Product Warranty Report

- U.S. Small Vehicle Warranty Expenses

- U.S. Truck & Heavy Equipment Warranties

- U.S. Auto Parts & Powertrain Warranties

- U.S. Aerospace Warranties

- U.S. New Home & Building Materials Warranty Report

- U.S. HVAC & Appliance Warranty Report

- U.S. Power Generation Equipment Warranties

- U.S. Electronics Warranty Report