U.S. Electronics Warranty Report:

For this report, we're presenting 21 years of warranty expense data for the computer, consumer electronics, semiconductor, data storage, and peripherals industries. All but semiconductors have seen totals fall over the past two decades, due to the growing market share of internationally-based companies, as well as some key players such as Apple, Microsoft, and Google not reporting their warranty costs.

Our regular readers will recall that we suffered a loss in mid-2022, when Apple stopped reporting its warranty expenses. For last year's version of this newsletter, we fashioned estimates for Apple's warranty expenses for the third and fourth quarters of 2022, and all of 2023, in the hopes that the company would change its mind and start reporting warranty expenses in its financial statements once again. By now, we've accepted that Apple has ceased reporting, just as Microsoft did over a decade ago.

It was quite a big loss; five years ago, in 2019, Apple paid $3.8 billion in product warranty claims, and set aside $3.8 billion in accruals. Ceasing reporting doesn't mean that Apple stopped fulfilling product warranty claims; however, the manufacturer has likely found a new accounting strategy, perhaps one that involves a third-party underwriter taking on its warranty liabilities.

The Companies

There are several other computer and consumer electronics manufacturers that have ceased reporting their warranty expenses over the past two decades. Eastman Kodak Co. stopped reporting in the wake of bankruptcy and restructuring back in 2012. Harman International Industries Inc., which makes audio equipment including JBL speakers, was acquired by Samsung in 2017.

There's also one big series of mergers to report: Plantronics Inc. acquired Polycom Inc. back in 2019, and rebranded as Poly, which was subsequently acquired by HP Inc. in 2022. So ostensibly, the warranty expenses of the three companies are all still represented in our data, but now all under the HP banner. Polycom and Plantronics were telecom manufacturers that transitioned into consumer electronics. We classify HP Inc. as a computer manufacturer, although it also makes peripherals such as printers, keyboards, monitors, mice, etc.

In cases like that of HP, where a company engages in more than one of our industry groups, we classify them based on their primary product line.

And then there's the companies that are missing from this report entirely. Two of the largest U.S.-based computer and consumer electronics manufacturers, Apple and Microsoft, stopped reporting their product warranty expenses. There are many others that aren't based in the United States, don't report at all, and never did, such as Samsung, Sony, Panasonic, Nintendo, and LG on the consumer electronics side, and Lenovo, Asus, Toshiba, and Acer on the computer side.

But it's not all bad news. We do have one major computer manufacturer that is new to our dataset, Dell Technologies Inc. As we detailed in our "Twenty-first Annual Product Warranty Report" newsletter, Dell Inc. went private back in 2013, and stopped filing financial reports with the SEC. However, when it acquired EMC Corp. back in 2016, the size of the merger meant that the newly-formed Dell Technologies Inc. needed to start publishing quarterly financial statements once again.

Dell went public again in 2018, only five years after the controversial buyout. However, it did so under the name Dell Technologies, the new parent of Dell and Dell EMC. As such, this change slipped our notice until we conducted our audit of the SEC database this year. The audit resulted in us adding 164 new manufacturers to our database, of which Dell Technologies was by far the largest. So we added in Dell Technologies' data from 2015 to 2023, which shifted our annual totals in comparison to last year's "U.S. Computer Industry Warranty Report."

To compile this report, first we perused the quarterly and annual financial statements of all U.S.-based computer, consumer electronics, semiconductor & PCB, data storage, and peripherals manufacturers. We identified 27 computer manufacturers, of which seven reported their warranty expenses in 2023; 37 consumer electronics manufacturers, of which eight reported in 2023; 163 semiconductor & PCB manufacturers, of which 34 reported in 2023; 44 data storage manufacturers, of which five reported in 2023; and 63 peripherals manufacturers, of which 18 reported in 2023.

So that's 334 manufacturers represented in the following charts, of which 72 were reporting their warranty expenses during 2023. With the exception of the semiconductor & PCB industry, which we'll cover in-depth in next week's newsletter, these industries have seen an overall decline in their warranty costs over the past two decades, mainly due to the growing market share of foreign-based electronics manufacturers in the United States.

This is especially true in consumer electronics. Japanese companies such as Sony, with the Playstation line, and Nintendo, with the Game Boy, DS, Wii, and Switch, have undoubtedly cornered the video game console market, despite Microsoft's best efforts with the Xbox 360, a notorious warranty calamity, and later Xbox One. And we have almost no representation of U.S.-based smartphone manufacturers in these data, with Apple ceasing reporting, Google never reporting despite its popular Pixel line, and Motorola owned by Lenovo. Their competitors Samsung and LG are based in South Korea, and international competitors Xiaomi, Oppo, Vivo, and Realme are based in China.

In fact, the eight U.S.-based companies in the consumer electronics industry that are currently reporting their warranty expenses aren't makers of televisions, gaming consoles, or smartphones at all. These companies are: Garmin Ltd., maker of GPS navigation systems; GoPro Inc., maker of action cameras; VOXX International Group, maker of sound systems; Universal Electronics Inc., maker of smart home technology; Knowles Corp., maker of microphones and speakers, FG Group Holdings Inc., formerly Ballantyne Strong Inc., which makes theater projection screens; Genasys Inc., which makes emergency alert communication systems; and Moving Image Technologies Inc., which makes entertainment systems for movie theaters and stadiums.

The seven computer companies that reported in 2023 are: HP Inc., Dell Technologies Inc., Hewlett Packard Enterprise Co., IBM Corp., Super Micro Computer Inc., Corsair Gaming Inc., and Unisys Corp.

The top semiconductor & PCB manufacturers include: Nvidia Corp., Advanced Micro Devices (AMD) Inc., Lam Research Corp., Applied Materials Inc., Coherent Inc., Teradyne Inc., Kulicke and Soffa Industries Inc., and Onto Innovation Inc.

The five data storage manufacturers are: Western Digital Corp., Seagate Technology Holdings plc, NetApp Inc., Quantum Corp., and Intevac Inc.

And the top peripherals manufacturers are: Dover Corp., Diebold Nixdorf Inc., Zebra Technologies Corp., Daktronics Inc., NCR Corp., and Xerox Inc.

For each of the 334 manufacturers, we perused their quarterly and annual financial reports and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the year end-balance of the warranty reserve fund. In addition, we gathered data on each manufacturer's revenue from product sales, and used these to calculate two additional warranty metrics: claims as a percent of sales (the claims rate), and accruals as a percent of sales (the accrual rate).

Warranty Claims Totals

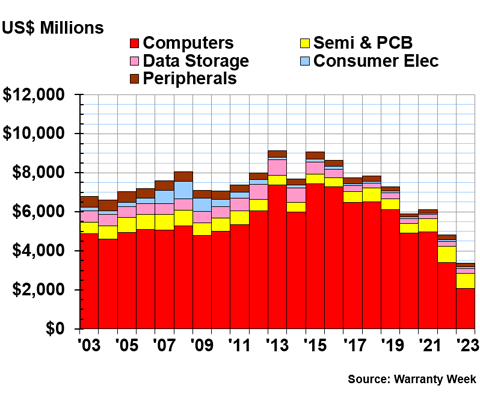

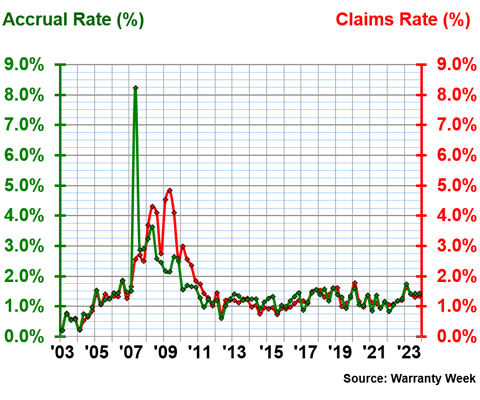

Figure 1 shows the total claims paid by manufacturers in each of the five electronics industries, from 2003 to 2023.

Figure 1

Electronics Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

In 2023, the manufacturers in the computers industry spent $2.08 billion on warranty claims, down -39% from 2022. This steep drop is due to the departure of Apple in mid-2022. Apple reported its claims costs for the first two quarters of 2022, but not the third or fourth. So the industry's total claims costs fell by -31% from 2021 to 2022, and an additional -39% from 2022 to 2023, as each half of Apple's annual claims costs disappeared from the data.

In 2023, HP paid $876 million in warranty claims, down -11% from 2022. Dell spent $873 million on warranty claims, down -11% from the year prior. Hewlett Packard Enterprise spent $208 million, up 2%. IBM spent $83 million, up 2%. Super Micro Computer spent $38 million, up 16%. And Corsair Gaming spent $6 million, down -11%.

The U.S.-based semiconductor industry spent a total of $761 million on product warranty claims in 2023, down -8% from 2022.

The data storage industry paid $248 million in claims during 2023, down -2% from the year prior. Western Digital Corp. spent $158 million, up 8%. Seagate paid $84 million in claims, down -10%. NetApp paid just $2 million, down -80% from 2022. And Quantum Corp. spent $3 million, down -6%.

The U.S.-based consumer electronics industry paid $100 million in claims during 2023, up 8% from 2022. Garmin paid $75 million in claims, up 11% from 2022. GoPro spent $19 million, up 1%. And VOXX spent $5 million, up 7%.

The peripherals industry spent $183 million on warranty claims in 2023, down -18% from 2022. Dover Corp. paid $63 million in claims, up 6% from the year prior. Diebold Nixdorf spent $37 million, up 38%. Zebra Technologies spent $28 million, down -3%. Daktronics spent $27 million, down -54% following a recall in 2022. And NCR spent $14 million, down -55%.

Warranty Accrual Totals

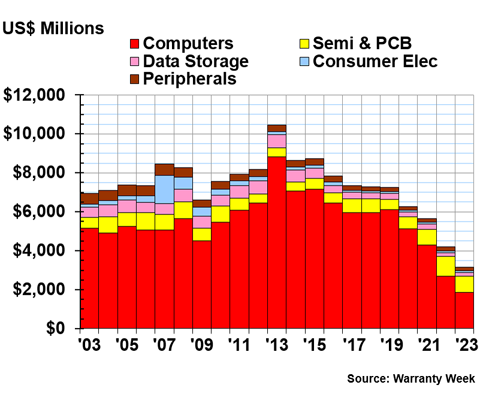

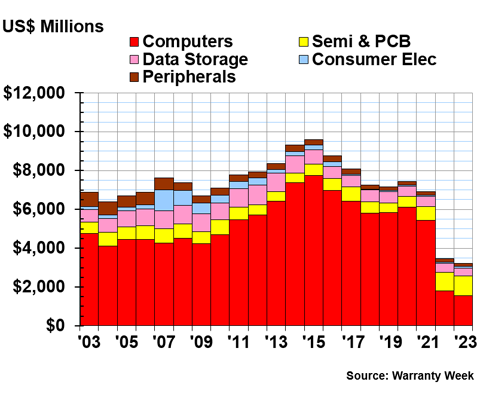

Figure 2 shows the total warranty accruals made by each industry, from 2003 to 2023.

Figure 2

Electronics Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

In 2023, the U.S.-based computer industry set aside $1.86 billion in warranty accruals, down -31% from 2022. Again, this drop is due to Apple ceasing reporting its warranty expenses.

Dell accrued $852 million in 2023, down -10% from 2022. HP accrued $689 million in 2023, down -27% from the year prior. Hewlett Packard Enterprise accrued $184 million, a -23% decrease from the year prior. IBM accrued $84 million in 2023, the same amount it accrued in 2022. Super Micro Computer accrued $41 million, up 23%. And Corsair Gaming accrued $9 million, more than double 2022's total of $4 million.

The semiconductor & PCB industry accrued $846 million in 2023, down -16% from the year prior.

The data storage industry accrued $159 million in 2023, down -21% from 2022. Western Digital accrued $97 million, a decrease of -24% from the year prior. Seagate accrued $55 million, down -13%. NetApp accrued $3 million, less than half 2022's total of $7 million. And Quantum Corp. accrued $3 million, down -2% from the year prior.

The consumer electronics industry accrued $107 million in 2023, up 8% from 2022. Garmin accrued $80 million, up 9% from the year prior. GoPro accrued $20 million, up 6% from the year prior. VOXX accrued $7 million, up 8%. And Knowles Corp. accrued $1 million, down -17%.

The peripherals industry accrued $180 million for future warranty costs during 2023, down -17% from the year prior. Dover accrued $65 million, up 7% from the year prior. Zebra Technologies accrued $29 million in 2023, the same amount it accrued in 2022.

Diebold Nixdorf accrued $35 million in 2023, up 80% from 2022. While Diebold Nixdorf almost doubled its accruals in 2023, two peripherals manufacturers cut their accruals in half. Daktronics accrued $26 million in 2023, down -59% from the year prior. And NCR accrued $11 million, down -56%.

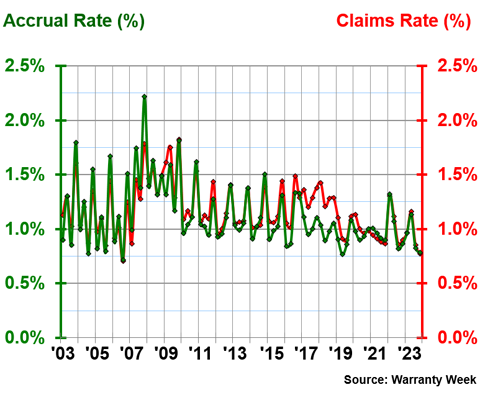

Warranty Expense Rates

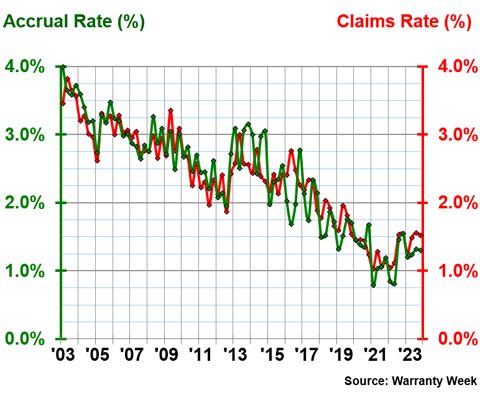

Figure 3 shows the average warranty claims and accrual rates for the U.S.-based computer manufacturers, from 2003 to 2023.

Figure 3

U.S.-based Computer OEMs

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the U.S.-based computer manufacturers had an average warranty claims rate of 2.36%, with a standard deviation of 0.69%, and an average accrual rate of 2.37%, with a standard deviation of 0.79%.

In 2023, the computer industry had an average claims rate of 1.46%, and an average accrual rate of 1.26%.

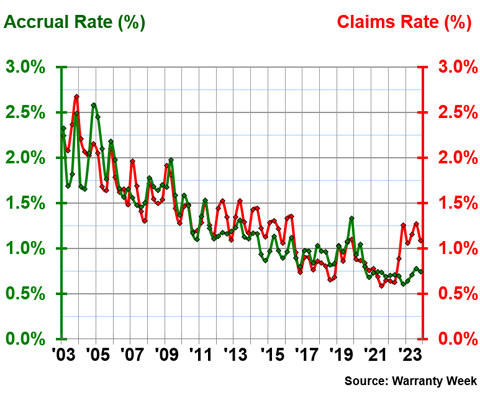

Figure 4 shows the average claims and accrual rates of the data storage manufacturers.

Figure 4

U.S.-based Data Storage Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the data storage industry had an average claims rate of 1.32%, with a standard deviation of 0.46%, and an average accrual rate of 1.27%, with a standard deviation of 0.48%.

In 2023, the data storage industry had an average claims rate of 1.14%, and an average accrual rate of 0.72%.

Figure 5 shows the average claims and accrual rates of the U.S.-based consumer electronics industry, from 2003 to 2023.

Figure 5

U.S.-based Consumer Electronics Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the U.S.-based consumer electronics industry has had an average claims rate of 1.52%, with a standard deviation of 0.94%, and an average accrual rate of 1.46%, with a standard deviation of 0.96%.

This industry had the highest standard deviations for the two warranty expense rates of any of the 18 industries we track. This large amount of fluctuation is mainly due to the spike in the average accrual rate of the industry in mid-2007, as we can see in Figure 5. This was Microsoft's "red ring of death" product failure issue with the original Xbox 360, one of the largest warranty problems of the 21st century so far.

In 2023, the consumer electronics industry had an average claims rate of 1.43%, and an average accrual rate of 1.50%.

Figure 6 shows the average claims and accrual rates of the peripherals industry.

Figure 6

U.S.-based Peripherals Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the peripherals industry had an average claims rate of 1.17%, with a standard deviation of 0.24%, and an average accrual rate of 1.12%, with a standard deviation of 0.29%.

In 2023, the peripherals industry had an average accrual rate of 0.94%, and an average claims rate of 0.93%.

Warranty Reserve Balances

Our final warranty metric is the amount held in each manufacturer's warranty reserve fund at the end of each calendar year. Figure 7 shows year-end warranty reserve balances for the five industries, from 2003 to 2023.

Figure 7

Electronics Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

In 2023, the computers industry held a collective $1.56 billion in warranty reserves, a -13% decrease from the end of the year prior. The semiconductor & PCB industry held $1.02 billion, up 7% from the year prior. The data storage industry held $397 million, down -15%. The consumer electronics industry held $74 million, up 10%. And the peripherals industry held $162 million, a very slight -0.3% decrease from 2022.

Catch up on our series of 21-year charts here:

- Twenty-first Annual Product Warranty Report

- U.S. Small Vehicle Warranty Expenses

- U.S. Truck & Heavy Equipment Warranties

- U.S. Auto Parts & Powertrain Warranties

- U.S. Aerospace Warranties

- U.S. New Home & Building Materials Warranty Report

- U.S. HVAC & Appliance Warranty Report

- U.S. Power Generation Equipment Warranties