Japanese Automaker Warranty Expenses:

Honda significantly grew its warranty accruals and reserves during fiscal 2023, due to some large-scale global recalls. Toyota also issued several large recalls during fiscal 2023, but fared better with overall costs. However, the devaluation of the Japanese yen against the U.S. dollar has driven up warranty costs in yen overall.

In early July, Canada celebrates Canada Day, the United States celebrates Independence Day, France celebrates Bastille Day, and Warranty Week celebrates the Japanese auto warranty data. So it's a perfect time to interrupt our series of 21-year charts of the product warranty expenses of U.S.-based manufacturers for this internationally-focused report.

With the exception of Mitsubishi, all of the top Japanese automakers have published their 2023 annual reports. The Japanese fiscal year spans from April to March, with the year ending on March 31, and manufacturers typically publish their annual reports in June.

The amounts in this report will all be presented in Japanese yen, as reported by each manufacturer. In the past, we might have considered converting these amounts to U.S. dollars, but since the Japanese yen has been depreciating against the U.S. dollar for the past few years, converting between the two would muddle the data. We'll convert them to U.S. dollars when we compare them to the rest of the global auto industry in another newsletter later this year.

Keep in mind that the yen's devaluation against the dollar makes some of the increases in the following charts seem a little more drastic. However, fiscal 2023 was a rather difficult year full of huge global recalls for the two largest manufacturers in this report, Honda and Toyota.

For our readers who aren't familiar with the Japanese yen, we'll tell you that the IRS yearly average currency exchange rates table provides average exchange rates of about ¥140 to $1 USD in 2023, ¥130 to $1 in 2022, and ¥110 to $1 in 2021. In early July, 2024, when this newsletter was published, the exchange rate was roughly ¥160 to $1 USD.

To create the following report, we first perused the annual reports of the major Japanese automakers. These manufacturers are: Toyota Motor Corp., Honda Motor Co., Nissan Motor Co., Subaru Corp., Suzuki Motor Corp., Mazda Motor Corp., Mitsubishi Motors Corp., and Isuzu Motors Ltd.

From each manufacturer's annual reports, we gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund. In cases where some of these data were not provided, we fashioned estimates based on the data that was reported.

We also gathered data on each manufacturer's total product sales and number of vehicles sold, and used these to calculate three additional warranty metrics: claims as a percent of sales (the claims rate), accruals as a percent of sales (the accrual rate), and accruals made per vehicle sold (in Japanese ¥ yen).

The Manufacturers and Our Estimates

Toyota, Honda, and Nissan account for about three-quarters of all product warranty expenses among the Japanese automakers, along with three-quarters of the product revenue in the group. Subaru was prompt in its reporting this year (not always the case), so we've provided five years of Subaru's product warranty data in the following charts as well.

We also provide data from Suzuki and Mazda in Figures 1, 3, 5, and 6. We fashioned estimates for the total warranty claims paid and accruals made by these two manufacturers, since they don't report these data, based on their year-end warranty reserve balances, which they both do report.

Isuzu reports its total warranty accruals and year-end warranty reserve balance, but not total claims payments, so we fashioned estimates based on the data available. We did the same for Nissan, which also reports accruals and reserves, but not claims.

The "Other" category in Figures 1, 3, and 6 includes data from Mitsubishi, from 2019 to 2022 (since they haven't published 2023 yet), along with Isuzu. We fashioned estimates for Isuzu for 2023, but not for Mitsubishi, since has not yet published the 2023 data on which we would base our estimates.

Warranty Claims Totals

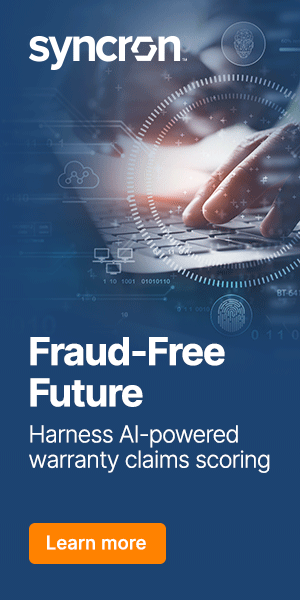

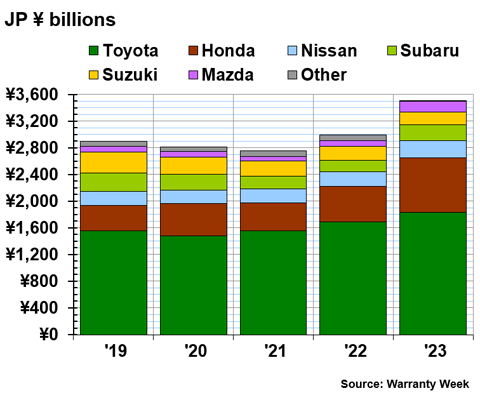

Figure 1 shows total annual product warranty claims payments for the Japanese automakers, in billions of yen, from 2019 to 2023.

Note that while all have a fiscal year from April to March, some of the manufacturers refer to the fiscal year that spanned April 1, 2023 to March 31, 2024 as fiscal 2023, while others call it fiscal 2024. For our purposes, that year was fiscal 2023, and is labeled as 2023 in the following charts.

In Figure 1, the data for Nissan, Suzuki, and Mazda are our own estimates, fashioned based on data these three manufacturers do provide.

Figure 1

Japanese Auto Manufacturers

Claims Paid per Year

(in billions of ¥ yen, fiscal 2019-2023)

During fiscal 2023, all but Nissan and Subaru saw their annual warranty claims costs rise in Japanese yen.

Toyota spent ¥341 billion on warranty claims during fiscal 2023, up 48% from 2022's total. Part of this steep rise is undoubtedly due to the yen's depreciation against the U.S. dollar. However, Toyota also experienced large-scale recalls in both Japan and the United States during fiscal 2023.

In October 2023, Toyota recalled 750,000 Highlander SUVs due to an issue with the front bumper. In November 2023, the company recalled 1.8 RAV4 SUVs due to an issue with 12-volt batteries that could increase the risk of fire in specific circumstances. And then in December 2023, Toyota announced a recall of 1.1 million vehicles worldwide, including one million in the U.S., due to an issue with airbag sensors. The remedies for all three of these recalls require a dealer visit. These three rather large and costly recalls definitely drove up Toyota's total warranty claims paid and accruals made in fiscal 2023.

Honda has a similar story, where recalls drove up warranty costs in 2023, and the yen's devaluation makes the situation look especially dire and dramatic on the charts.

Honda spent ¥221 billion on warranty claims during fiscal 2023, up 38% from fiscal 2022.

Honda had a tough fiscal 2023 full of recalls. In June 2023, the company recalled 1.2 million vehicles in the United States due to an issue with the rearview camera. In December 2023, the company recalled 4.5 million vehicles globally, including 2.5 million in the U.S., due to a possible fuel pump failure, which could cause vehicles to stall while driving. And then in February 2024, Honda recalled 750,000 vehicles due to faulty vehicle sensors, the same part from the same supplier that prompted the recall of 1.1 million Toyota vehicles in December 2023.

Subaru spent ¥142 billion on warranty claims during fiscal 2023, down -10% from the year prior.

We estimate Nissan spent about ¥107 billion on warranty claims during fiscal 2023, down -8% from our estimate for 2022. We estimate Suzuki spent ¥99 billion on claims, up 11% from the year prior. And we estimate Mazda spent ¥54 billion on claims in fiscal 2023, up 43% from fiscal 2022. According to our estimates, 2022 was a year of lower-than-usual warranty costs for Mazda, so this rise represents a return to normal.

Warranty Claims Rates

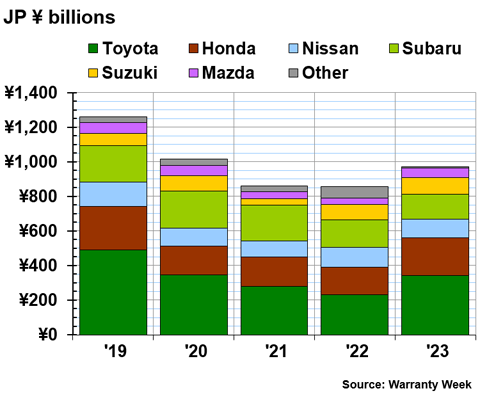

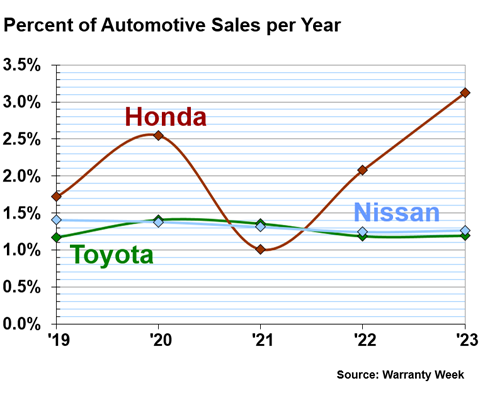

Figure 2 shows five years of annual warranty claims rates for the top three largest manufacturers in the Japanese auto industry, Honda, Toyota, and Nissan.

The warranty expense rates are especially useful metrics in this newsletter, to help us understand the impact of the yen's devaluation against the dollar on these data. The claims rate is calculated by dividing total claims costs by total product sales revenue over a given fiscal year.

Figure 2

Japanese Auto Manufacturers

Warranty Claims Rates

(as a percentage of sales, fiscal 2019-2023)

In fiscal 2023, Toyota had a warranty claims rate of 0.83%, which is a little higher than the year prior, but still much lower than the company's claims rates from 2019 to 2021.

2023 was the first year that Toyota's claims rate rose since 2019. So the company did spend a higher proportion of product revenue on warranty claims payments during fiscal 2023 than it did during fiscal 2022, but this rise still leaves Toyota spending a lower proportion of sales revenue on claims now than it used to pre-pandemic.

Similar to Toyota, Honda's claims rates make the recent spate of recalls seem not as bad as it looked in Figure 1. Honda had a claims rate of 1.29% in fiscal 2023, up a bit from the year prior, but also lower than the rates from 2019 to 2021. 2023 was also the first year the Honda's claims rate increased since 2019. So while Honda spent a higher proportion of product revenue on claims during fiscal 2023 than it did the year prior, it was still spending a lower proportion of sales than it used to a few years ago.

Nissan has also seen its claims rates fall over the past five years. However, keep in mind that the numerator for Nissan's claims rates is our estimate. We estimate that Nissan had a claims rate of 0.92% during fiscal 2023. Nissan's estimated claims rates decreased every year from 2019 to 2023.

While we only included the claims rates of the top three Japanese automakers in Figure 2, we do have the claims rates of Subaru available as well. In fiscal 2023, Subaru had a claims rate of 3.09%, higher than is typical for the other three manufacturers, but actually much lower than Subaru's usual claims rates. Over the five years shown in Figure 2, Subaru had a maximum claims rate of 7.74%, recorded in 2021. In last year's version of the "Worldwide Auto Warranty Expenses" newsletter, which presented the 2022 data, Subaru had the highest warranty claims rate among the entire global auto industry.

Warranty Accrual Totals

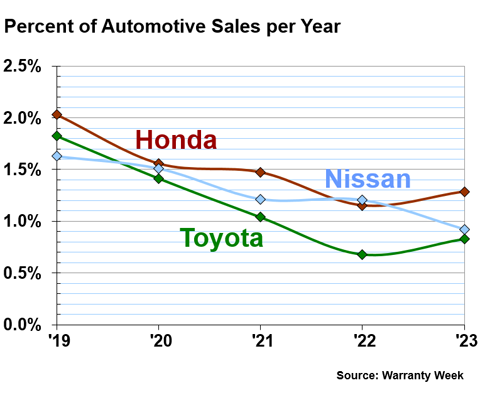

Figure 3 shows the total warranty accruals of all of the top Japanese automakers, from 2019 to 2023. Nissan provided hard data for this metric, but we fashioned estimates for Suzuki and Mazda.

Figure 3

Japanese Auto Manufacturers

Accruals Made per Year

(in billions of ¥ yen, fiscal 2019-2023)

Honda seems to be expecting its ongoing recalls to be quite costly during fiscal 2024. Honda accrued ¥537 billion during fiscal 2023, almost double its fiscal 2022 accruals of ¥290 billion. It seems that Honda anticipates more recall and warranty trouble on the horizon.

Toyota accrued ¥490 billion during fiscal 2023, up 22% from fiscal 2022. Subaru accrued ¥204 billion during fiscal 2023, up 39% from the year prior. And Nissan accrued ¥147 billion, up 23%.

We estimate that Suzuki accrued about ¥81 billion during fiscal 2023, up 16% from fiscal 2022. And we estimate that Mazda accrued ¥73 billion, up 27%.

Isuzu accrued ¥11 billion during fiscal 2023, up 68% from fiscal 2022's total of just ¥6 billion.

Warranty Accrual Rates

Figure 4 shows the warranty accrual rates of Toyota, Honda, and Nissan, from 2019 to 2023.

Figure 4

Japanese Auto Manufacturers

Warranty Accrual Rates

(as a percentage of sales, fiscal 2019-2023)

We can see that Honda's increased accruals during fiscal 2023 were quite significant, beyond just currency changes. Honda had an accrual rate of 3.12% during fiscal 2023, an increase of one-half from fiscal 2022's rate of 2.08%.

Toyota had an accrual rate of 1.19% during fiscal 2023, just about the same as the year prior. Nissan had an accrual rate of 1.27%, also quite level with its accrual rates during the last four years. Toyota and Nissan had impressively consistent accrual rates over this five-year period.

During fiscal 2023, Subaru had an accrual rate of 4.44%, triple its fiscal 2022 accrual rate of 1.51%. However, it's more or less a return to normal for Subaru, which previously saw its accrual rate drop significantly, from 6.35% in 2020 to 1.37% in 2021.

Isuzu had an accrual rate of just 0.31% during fiscal 2023.

Accruals per Vehicle Sold

Global vehicle manufacturers always disclose the number of units they sell worldwide each year, so we calculate one additional warranty metric: the amount of warranty accruals per vehicle sold.

Of course, many of these manufacturers sell more than just passenger cars. Toyota also makes boats and buses. Honda makes motorcycles, planes, and generators. Nissan makes trucks and boat engines. And Suzuki makes motorcycles, ATVs, and boat engines.

For the purposes of this exercise, let's assume that each manufacturer's main product line is passenger cars and light trucks, and that everything averages out to be comparable. It's not a huge leap; for example, 80% of Honda's product sales revenue comes from cars. So even if the expenses of its motorcycles or generators are different, it won't change the averages tremendously.

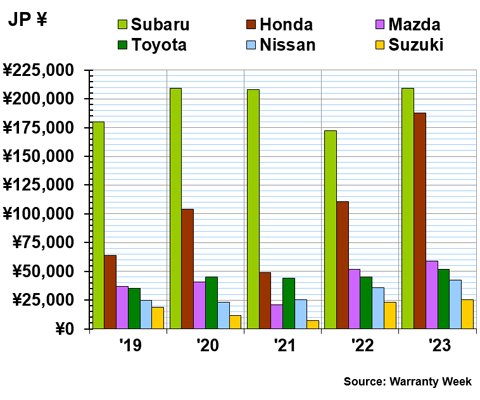

Figure 5 shows the average accruals per vehicle sold for six top Japanese automakers, from fiscal 2019 to fiscal 2023.

Figure 5

Japanese Auto Manufacturers

Accruals Made per Vehicle Sold

(in ¥ yen, fiscal 2019-2023)

During fiscal 2023, Toyota sold 9.4 million units, Nissan sold 3.4 million units, Suzuki sold 3.2 million, Honda sold 2.9 million, Mazda sold 1.2 million, and Subaru sold 0.98 million.

We can see in Figure 5 that Honda's average warranty accruals per vehicle rose significantly from fiscal 2021 to fiscal 2023. During fiscal 2023, Honda accrued an average of ¥187,882 per vehicle sold, up 70% from fiscal 2022.

However, Subaru leads the pack with the highest accruals per vehicle sold. During fiscal 2023, Subaru accrued an average of ¥208,999 per vehicle sold, up 21% from fiscal 2022.

Toyota accrued an average of ¥51,887 per vehicle sold during fiscal 2023, up 14%. Nissan accrued an average of ¥42,574 per vehicle sold, up 18%.

Our average accruals per vehicle sold for Mazda and Suzuki were calculated based on our estimates for their total warranty accruals. We estimate that Mazda accrued an average of ¥58,669 per vehicle sold during fiscal 2023, up 13% from the year prior. And we estimate that Suzuki accrued an average of ¥25,578 per vehicle sold during fiscal 2023, up 10%.

Warranty Reserve Balances

Our final metric is the amount of money the Japanese automakers held in their warranty reserve funds at the end of each fiscal year. The last day of the Japanese fiscal year is March 31; i.e., the end-date for fiscal 2023 was March 31, 2024.

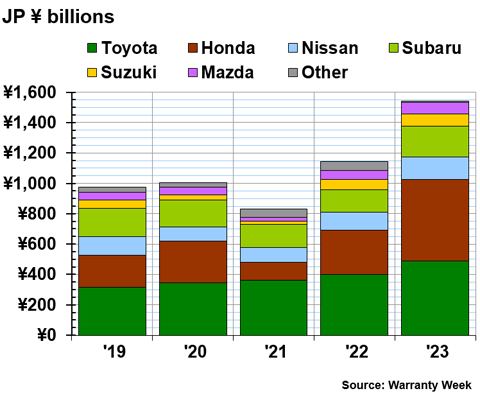

Figure 6

Japanese Auto Manufacturers

Reserves Held at Year's End

(in billions of ¥ yen, fiscal 2019-2023)

Toyota holds the largest warranty reserve fund in the Japanese auto industry, although Honda's extra accruals during fiscal 2023 have grown its reserves rather significantly.

At the end of fiscal 2023, Toyota held ¥1.84 trillion in warranty reserves, up 9% from the end of the year prior. Honda held ¥816 billion in reserves at the end of fiscal 2023, up 52% from the end of fiscal 2022.

Nissan held ¥257 billion in reserves at the end of fiscal 2023, up 20% from the year prior. Subaru held ¥238 billion, up 35%. Suzuki held ¥190 billion, down -9%. Mazda held ¥156 billion, an increase of 83% from the end of fiscal 2022. And Isuzu held ¥15 billion in reserves at the end of fiscal 2023, up 37% from the end of fiscal 2022.