U.S. Power Generation Equipment Warranties:

While General Electric used to dominate the U.S.-based power generation equipment industry, many renewable energy manufacturers have emerged into the market in the past decade. Some of them offer warranties longer than they've existed as companies, and they report a lot of changes of estimate and large fluctuations in annual warranty expenses, often without much explanation.

Back in 2003, General Electric accounted for 96% of the product warranty claims paid by any U.S.-based power generation equipment manufacturer. The landscape of not just the industry, but all global power infrastructure, has transformed over the past two decades.

Solar, wind, and hydro power are still far from producing the majority of the world's electricity. But the equipment needs to be manufactured in order for the green energy transition to occur, so the low global adoption rates so far are spurring on the newer manufacturers, rather than deterring them from entering the industry. And relatively new and experimental technology means a higher likelihood of product failures, recalls, and other issues that can drive up warranty costs. So the proportion of U.S. power generation equipment product warranty costs that belong to GE will continue to fall, even as GE itself transitions to renewable energy.

In addition, as we discussed in our recent newsletter "U.S. Aerospace Warranties," GE completed its long-anticipated split into three distinct companies at the beginning of April 2024. In January 2023, GE HealthCare split from the parent General Electric Co. In April, GE's power generation equipment business, formerly known as GE Renewable Energy, split from the parent GE, and became GE Vernova. The parent GE renamed itself GE Aerospace. And of course, the former GE Appliances has belonged to Haier since 2016. So now instead of one huge corporation dabbling in several different industries, we have three separate pure play corporations, separately reporting their revenues and warranty expenses. However, since GE only reports its warranty costs once a year, in its annual report, we likely will have to wait until early 2025 to know exactly what proportion of GE's warranty expenses belonged to each industry.

Since this report includes data up to the end of calendar 2023, there's no separately reported GE Vernova data. So keep in mind that GE's data in this newsletter do include warranty costs from the aerospace industry.

To compose this newsletter, we first perused the annual and quarterly financial reports of all U.S.-based power generation equipment manufacturers that have reported warranty costs from 2003 to 2023. We identified 66 manufacturers, of which 29 reported warranty costs during calendar 2023.

Aside from GE, the top manufacturers in this industry include: SolarEdge Technologies Inc., Generac Holdings Inc., TPI Composites Inc., Enphase Energy Inc., Bloom Energy Corp., Microvast Holdings Inc., Valmont Industries Inc., SunPower Corp., Power Solutions International Inc., First Solar Inc., FTC Solar Inc., Array Technologies Inc., Blink Charging Co., and Babcock & Wilcox Enterprises Inc.

As the names of these manufacturers indicate, many focus on renewable energy, including solar cells, solar panels, and electric vehicle charging infrastructure. It's important to remember that many of these products, especially solar cells, panels, and inverters come with longer-than-typical product warranties, for 10, 15, 20, 25, even up to 50 years. These companies are learning more about the real warranty costs of their products as they go, so it's common to see big changes of estimate to previous accruals, both increases and decreases.

For each manufacturer, we extracted three key warranty metrics: the amount of claims paid, the amount of accruals made, and the amount of reserves held at the end of each calendar year. In addition, we gathered data on each manufacturer's product sales revenue, in order to calculate two additional warranty metrics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

Warranty Claims Totals

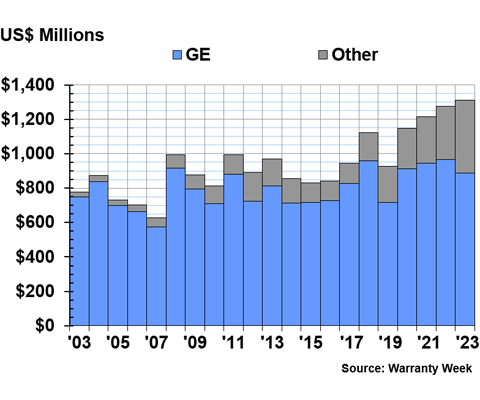

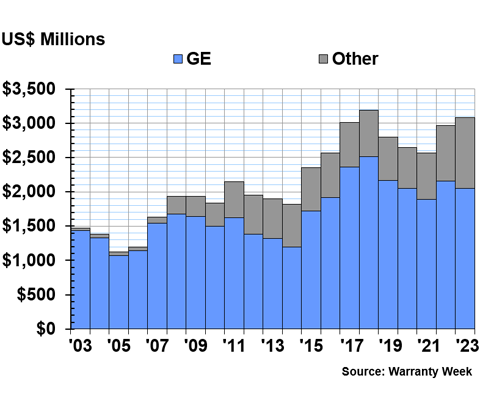

Figure 1 shows the total warranty claims paid by the U.S.-based power generation equipment industry annually, from 2003 to 2023.

Figure 1

Power Generation Equipment Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

In 2023, the power generation industry spent a total of $1.314 billion on warranty claims, a -3% decrease from 2022.

As we mentioned above, in 2003, GE accounted for 96% of the U.S.-based power generation equipment industry's total warranty claims payments. In 2013, GE accounted for 84% of all claims in the industry. In 2023, however, GE accounted for just 68%, even before the split between GE Aerospace and GE Vernova. As we can see in Figure 1, it was between 2018 and 2019 that the proportions between GE and the other manufacturers in the industry really started to shift more rapidly.

In 2023, GE spent $886 million on warranty claims, a decrease of -8% from the year prior.

The next-largest company in terms of warranty claims costs was SolarEdge Technologies, which spent $137 million on warranty claims during 2023, an increase of 15% from the year prior. 2023 was only SolarEdge's tenth year of reporting its warranty costs, but it's had the second-highest costs in the industry for the past three years.

Generator manufacturer Generac Holdings Inc. spent $92 million on claims during 2023, up 19% from 2022. Generac's claims costs have risen meteorically in the past few years, related to a legal dispute with a solar panel installation company. We discussed that story in last year's version of this newsletter. In addition, Generac was hit with another lawsuit in mid-2023, alleging that the company violated the Magnusson-Moss Warranty Act. Both lawsuits allege that Generac refused to fulfill warranty claims made for its SnapRS technology for solar storage systems, blaming the failures on user error or incorrect installation rather than faulty components. Generac said that the solar installers should be responsible for the claims, while the installers said Generac should be responsible. Although both lawsuits are still ongoing, it's interesting to note that Generac's claims costs rose another 19% from 2022 to 2023, after rising by 82% from 2021 to 2022.

TPI Composites Inc., which makes wind turbine blades, spent $48 million on warranty claims, up 34% from 2022. Enphase Energy, a solar micro-inverter and home EV charging station manufacturer, spent $27 million on claims, up 31% from the year prior.

Bloom Energy Corp., which manufactures solid oxide fuel cells, saw its claims costs more than double from 2022 to 2023. Bloom Energy spent $26 million on claims in 2023, up 113% from the year prior. Microvast Holdings Inc. spent $18 million on claims, down -32%. And Valmont Industries Inc. spent $17 million, up 62%.

SunPower Corp. spent $17 million on claims in 2023, up just 1% from 2022. Power Solutions International Inc. spent $16 million, down -26%. First Solar Inc. spent $6 million, a little less than half of what it spent in 2022. FTC Solar spent $4 million, up 5%. And Array Technologies also spent $4 million, a little more than double its claims costs in 2022.

Warranty Accrual Totals

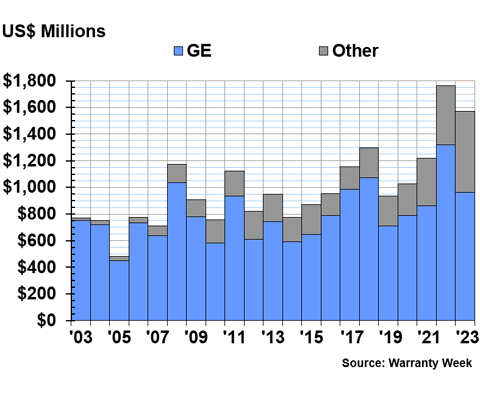

Figure 2 shows the total warranty accruals of the U.S.-based manufacturers in the power generation equipment industry, from 2003 to 2023.

Figure 2

Power Generation Equipment Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

In 2023, the power generation equipment industry accrued a total of $1.576 billion for future product warranty expenses.

In 2003, GE accounted for 97% of the industry's total accruals. In 2013, GE accounted for 79% of accruals. And in 2023, GE was responsible for just 61% of the industry's warranty accruals.

GE accrued $961 million in 2023, down -27% compared to 2022. This was likely in anticipation of the 2024 split.

SolarEdge accrued $329 million in 2023, a 37% increase from the year prior. In its 2023 annual report, the company notes that there was

"an increase in warranty expenses and warranty accruals of $70.5 million associated primarily with an increased number of products in our install base, which increases our actual spending on product warranty, and an increase in costs related to the different elements of our warranty expenses, which include the cost of the products, shipment and other related expenses, which impacts our remaining obligations for all units under warranty, including those sold in previous years."It's likely that this is the case for many of our companies: a combination of growing sales of renewable energy infrastructure, along with inflation raising the cost of parts and components, has driven up warranty claims costs, leading to manufacturers raising their accruals as well. SolarEdge's longest product warranty is for 25 years, but it was only founded in 2006, so it's never seen certain products to the end of their product warranty lifespan.

Generac accrued $67 million in 2023, down -16% from the year prior. So perhaps Generac anticipates warranty costs falling in years to come, despite the ongoing lawsuits.

Enphase Energy accrued $52 million, up 12% from the year prior. SunPower Corp. doubled its accruals to $31 million. Bloom Energy accrued $28 million, up 57% from 2022. Valmont Industries accrued $24 million, up 87%. Microvast Holdings accrued $13 million, down -10%.

Relative newcomer Fluence Energy Inc., which started reporting in 2022, accrued $12 million, an increase of 650% from the year prior. Its 2023 annual report states,

"Effective March 31, 2023, the Company updated its estimation model for calculating the recurring warranty reserve rate, which is a key input into our estimated assurance warranty liability. We then subsequently updated the presentation effective September 30, 2023, to present the full warranty liability and record a corresponding asset for recoverable warranty costs from suppliers."So the company changed its formula for calculating accruals, and accruals rose quite a bit as a result. Makes sense for such a new company, but it's nice that they tell their investors this explicitly, unlike many of the others we see in this newsletter with huge changes in their warranty costs from 2022 to 2023.

TPI Composites accrued $12 million, down -11% from 2022. Power Solutions International accrued $7 million, down -18%. Array Technologies Inc. accrued $6 million, up 20%. Babcock & Wilcox Enterprises Inc. accrued $6 million, down -14%. First Solar accrued $5 million, up 15%. And EV charger manufacturer ChargePoint Holdings Inc. accrued $5 million, up 42% from the year prior.

Warranty Expense Rates

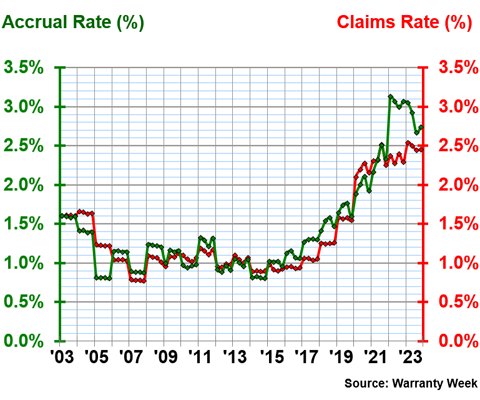

Figure 3 shows the industry average quarterly warranty expense rates from 2003 to 2023. In Figure 4, we'll look just at GE's annual expense rates, in order to get a sense of GE's impact on the expense rates of the industry as a whole.

Figure 3

Power Generation Equipment Warranties

Average Claims & Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the U.S.-based power generation equipment manufacturers had an average claims rate of 1.36%, with a standard deviation of 0.53%, and an average accrual rate of 1.43%, with a standard deviation of 0.63%.

In 2023, the power generation equipment manufacturers had an average claims rate of 2.48%, and an average accrual rate of 2.84%. The claims rates ranged from 2.44% in the third quarter to 2.53% in the first quarter, and the accrual rates ranged from 3.05% in the first quarter to 2.66% in the third quarter.

Since we've broken down Figures 1, 2, and 5 into the categories of GE and other, we're providing GE's warranty expense rates separately as well. However, keep in mind that GE's data are factored into Figure 3.

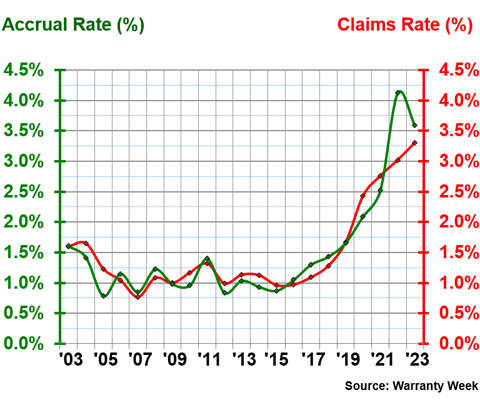

Figure 4 shows GE's warranty expense rates from 2003 to 2023. The company reports annually rather than quarterly.

Figure 4

General Electric Co.

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2023)

We can see that the shapes of the two charts, Figures 3 and 4, closely map each other. But notice that the two charts are on different y-axis scales, because the other data tempered GE's astronomically rising expense rates in Figure 3.

In 2023, GE had a claims rate of 3.3%, and an accrual rate of 3.6%. This was the company's highest claims rate since we started recording these data in 2003. But the highest accrual rate came the year prior, in 2022, at 4.1%.

In contrast, as recently as 2019, both rates were below 2%, with a claims and accrual rate of 1.7%. GE's rapidly rising warranty expense rates are likely a product of product failures in its wind turbine division, which we discussed in our 2023 newsletter "Wind Turbine Warranty Report." It's likely that this was a major driving factor in the recent split between GE Aerospace and GE Vernova.

Warranty Reserve Balances

Figure 5 shows the total amounts collectively held in the industry's warranty reserve funds at the end of each calendar year.

Figure 5

Power Generation Equipment Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2023)

At the end of 2023, GE held $2.053 billion in its warranty reserve fund, a -5% decrease from the end of the year prior.

SolarEdge held $518 million, a 35% increase in its reserve fund balance from the end of 2022. Enphase held $189 million, an increase of 78% from the year prior. And Generac held $116 million, down -16%.

After Generac, it's a sharp drop to the size of the next-largest warranty reserve fund. It doesn't seem to be particularly common for manufacturers in this industry to keep large reserves, despite the length of many of their product warranties.

TPI Composites held $38 million, an increase of 68% from the end of 2022. Microvast Holdings held $35 million, down -16%.

First Solar held $26 million, although it only paid $6 million in claims during 2023. Aside from the larger SolarEdge, First Solar seems to be the only solar manufacturer with a large amount of padding sitting in its warranty reserves.

Valmont Industries held $22 million at the end of 2023, up 13% from the end of the year prior. Bloom Energy held $19 million, up 12%. Power Solutions International also held $19 million, down -11%. FTC Solar held $11 million, also down -11%.

Babcock & Wilcox Enterprises held $8 million, down -20%. BWX Technologies Inc. held $6 million, down -3%. Eos Energy Enterprises Inc. held $6 million, up 62%. Array Technologies held $6 million, up 13%. And American Superconductor Corp. held $2 million, up 2%.

Catch up on our series of 21-year charts here:

- Twenty-first Annual Product Warranty Report

- U.S. Small Vehicle Warranty Expenses

- U.S. Truck & Heavy Equipment Warranties

- U.S. Auto Parts & Powertrain Warranties

- U.S. Aerospace Warranties

- U.S. New Home & Building Materials Warranty Report

- U.S. HVAC & Appliance Warranty Report