U.S. Aerospace Warranties:

Boeing and its supplier Spirit AeroSystems have a tough year of warranty costs ahead of them, and the data indicate they saw at least some of it coming. However, claims and accrual costs didn't change much on an industry level, despite the high profile 737 MAX 9 product failures in the news.

This week, we're looking at the 21-year warranty expenses of the U.S.-based aerospace industry. The aerospace industry saw a huge decline in the pandemic, from which the manufacturers are still recovering several years later.

Aerospace warranties used to be an exception to the trend that suppliers have lower warranty expense rates than the OEMs to which they provide parts. However, the pandemic interrupted this trend, with lockdowns significantly impacting this industry. Boeing's recent warranty troubles also helped to drive up the expense rates for the U.S.-based aerospace OEMs.

We compiled a list of all of the U.S.-based aerospace manufacturers that reported warranty expenses sometime since the beginning of 2003. We found 65 manufacturers, of which 24 were active and reporting in 2023.

We perused the annual reports and quarterly financial statements of each of these 65 manufacturers, and extracted three key warranty metrics: claims paid, accruals made, and the year-end balance of the warranty reserve fund. We also gathered product sales data, and used these to calculate two additional warranty expense metrics: claims as a percentage of sales revenue (the claims rate), and accruals as a percentage of sales revenue (the accrual rate).

We then separated the list of 65 manufacturers into two key groups: OEMs and suppliers. We identified just three OEMs: Boeing Co., General Dynamics Corp., and Textron Inc. General Dynamics owns the Gulfstream brand, and Textron owns the Cessna and Beechcraft brands.

In the aerospace supplier category, the largest manufacturers were: RTX Corp., Honeywell International Inc., Woodward Inc., Teledyne Technologies Inc., Leonardo DRS Inc., Moog Inc., and Spirit AeroSystems Holdings Inc. These are all of the U.S.-based aerospace suppliers that reported more than $10 million in warranty accruals during calendar 2023. RTX, formerly known as Raytheon Technologies Corp. after the 2020 merger with United Technologies, owns subsidiaries Collins Aerospace and Pratt & Whitney.

Taking a look at the names of the ten largest aerospace manufacturers, it may become clear that all of these companies also dabble in military contracts (to say the least). Keep in mind that defense contractors do not report warranty costs associated with military contracts.

We acknowledge that there are other aerospace OEMs based in the United States, such as Lockheed Martin Corp. and Northrop Grumman Corp. However, since the two manufacturers are primarily military contractors, they don't report their warranty costs in their financial statements, so we don't have the necessary data to include them in this report.

There's a few other manufacturers that could possibly fall into the aerospace OEM category, but that we ultimately classified elsewhere, because their primary product line was in another industry. For instance, AeroVironment Inc. and Workhorse Group Inc. both make drones, but we ultimately classified them in the automotive sector, because that's where the bulk of their revenue, and the bulk of their warranty expenses, come from.

General Electric is also not on the list, despite being a major manufacturer of jet engines for aircraft, because the company does not segment its warranty expenses. In the 2023 data, we classified GE in the power generation industry. However, in April 2024, GE finalized the spin-off of its power generation business as GE Vernova, and the parent GE re-branded as GE Aerospace. So GE will be included in next year's version of this newsletter, and we look forward to analyzing the segmented data.

And of course, this newsletter also does not include internationally-based aerospace OEMs such as Airbus, Embraer, Bombardier, or Dassault, nor jet engine manufacturers such as Rolls-Royce, Safran, and MTU Aero Engines.

Before we get to the data, we want to take a moment to discuss one of the largest ongoing warranty problems of a U.S.-based company. Boeing has been experiencing warranty problems and high-profile groundings for the past decade, and has been in especially hot water since the beginning of 2024, just outside of the frame of our data.

Boeing's Warranty Troubles

This newsletter is the first time in 2024 that we're covering the warranty expenses of the U.S.-based aerospace industry. And yet, we've already discussed the largest company in this report, Boeing Co., in three previous articles in the past five months: in early February's "Warranty Adjustments," late February's "Largest Warranty Reserve Capacities," and March's "Top 100 Warranty Providers of 2023." All of these articles highlighted abnormalities and extremes in the 2023 warranty data.

It's no secret that Boeing has been caught in a cascade of high-profile product failures for the past decade or so. First were the 787 Dreamliner groundings in 2013 and 2014, then the 737 MAX 8 groundings in 2019 and 2020. Now, Boeing has been hitting headlines in the first half of 2024 for highly publicized mechanical issues, including a rear door plug flying off of an Alaska Airlines flight leaving Portland, Oregon in early January, which resulted in the FAA grounding 171 737 MAX 9 aircraft for about three weeks.

In the wake of that door plug failure, Alaska Airlines and United Airlines inspected their new fleets of 737 MAX 9 jets, and found that many of them had loose parts related to the door plug. A week after the incident, Spirit AeroSystems Holdings Inc., the parts supplier that manufactured the fuselage and door plug on that Alaska Airlines plane, was hit with a class action lawsuit filed by shareholders, alleging that its leaders were mismanaging the company. Spirit is a former Boeing subsidiary, which was spun off in 2005, and included in the aerospace suppliers group in the warranty data in this newsletter.

In March, the FAA's six-week investigation of 737 MAX manufacturing processes found that the company failed on 33 of 89 aspects of production. The FAA stated that it "found multiple instances where the companies [Boeing and Spirit AeroSystems] allegedly failed to comply with manufacturing quality control requirements."

Since January, several whistleblowers from Boeing and Spirit AeroSystems have come forward, stating that the manufacturers were knowingly bypassing quality control inspections, and that employees were punished for flagging safety and quality issues. In May, a former quality manager for Spirit AeroSystems told CBS News, "It was very rare for us to look at a job and not find any defects." Two of these whistleblowers were found mysteriously dead soon after coming forward to the media with their concerns.

These issues have skewered Boeing in the court of public opinion in recent months. In March, a LATAM 787 Dreamliner "dropped abruptly" midflight, causing dozens of injuries; in May, a Singapore Airlines 777 hit extreme turbulence, resulting in one death. In reality, these two incidents were unrelated to quality control, the 737 MAX, door plug failures, or missing bolts; scientists have stated that we're likely to see this kind of extreme turbulence become more common as a result of climate change. But Boeing's already-tarnished name being attached to these two incidents has further instilled distrust and apprehension in consumers, and the media are piling on to the negative press associated with the Boeing brand name by highly publicizing these stories. Internet memes with the phrase "If it's Boeing, I'm not going" have been circulating for months, and this sentiment could start affecting consumer behavior, possibly cascading to airlines becoming reluctant to take on future contracts with Boeing. Not to mention, the airlines that use Boeing aircraft have experienced three different groundings in the past decade alone.

With that context in mind, some of the warranty data representing 2020 to 2023 in the following charts may be a surprise in its normality. It is essential to keep in mind that Boeing used a different method of warranty accounting during the 787 Dreamliner and 737 MAX groundings. As you can see in Figure 6 of our 2021 newsletter "World's Largest Warranty Problems," Boeing reported the funds for the 737 MAX repairs as changes of estimate to previous accruals, whereas it reported the accruals for the 787 Dreamliner repairs as regular accruals, with some changes of estimate. Since Figure 2 in this newsletter does not include the changes of estimate data, only regular accruals, as is our norm, it almost looks like Boeing's been saving money in the warranty department in recent years, rather than hemorrhaging it. The picture totally changes when analyzing the changes of estimate between 2019 and 2023. We depicted these changes of estimate up to the third quarter of 2023 in Figure 3 of our February 2024 newsletter "Warranty Adjustments."

As always, we can only report the data as they are presented in each manufacturer's 10-Q and 10-K reports. But in this case, it's equally important to remember what's missing, and to contemplate why Boeing may have changed its warranty accounting style in recent years.

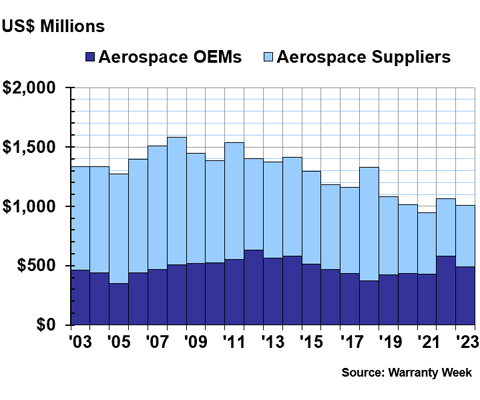

Warranty Claims Totals

Figure 1 shows the amounts spent on warranty claims by the aerospace OEMs and suppliers, from 2003 to 2023.

Figure 1

Aerospace Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2023)

The U.S.-based aerospace industry as a whole spent $1.008 billion on warranty claims during calendar 2023, down -6% from 2022.

The three aerospace OEMs collectively spent $490 million on claims during 2023, while the suppliers spent $518 million. Claims costs fell by -15% for the OEMs, but rose by 7% for the suppliers.

Boeing reported spending $320 million on warranty claims during 2023, down -21% from 2022. General Dynamics spent $101 million on claims, down -13% from the year prior. And Textron spent $69 million on claims, up 15%.

Raytheon reported spending the most of any of the U.S.-based aerospace manufacturers. Raytheon spent $308 million on claims, up 8% from 2022. Honeywell spent $106 million on claims, down -8%.

Woodward Inc. spent $42 million on claims, tripling its spending from $14 million in calendar 2022. The manufacturer didn't offer an explanation for this in its financial statements, except that its increased accruals in 2022, and subsequent increased claims costs in 2023, are "related to product liabilities expected to be fully recoverable from insurance."

Teledyne spent $15 million on claims during 2023, up 4% from 2022. Leonardo DRS, a U.S.-based subsidiary of the Italian aerospace manufacturer Leonardo S.p.A. that reports separately, spent $12 million on claims during 2023, up 9% from 2022. Moog Inc. spent $10 million on claims, down -10% from the year prior.

Among the manufacturers that spent less than $10 million on warranty claims during 2023, Crane Co. saw the largest decrease in claims costs. Crane spent $0.4 million on claims during 2023, down -93% from 2022's $5.5 million. OSI Systems also saw a large drop, down -58% to $4.1 million in 2023. Hexcel Corp. saw the largest increase in claims costs, up 33% to $3.6 million in 2023. Notably, our company of interest, Spirit AeroSystems, saw no change in its claims costs from 2022 to 2023; the manufacturer spent $2.7 million on claims during both years.

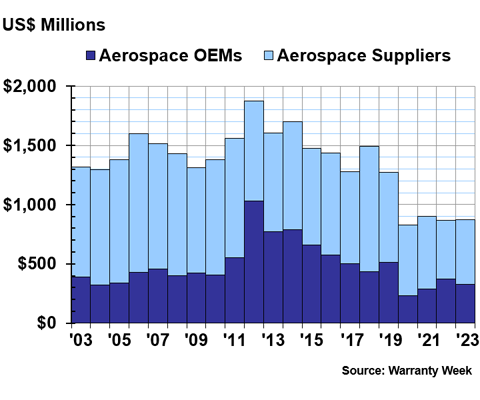

Warranty Accrual Totals

Figure 2 shows the amounts set aside in warranty accruals by the U.S.-based aerospace manufacturers, from 2003 to 2023.

Keep in mind that this chart would look very different if Boeing's changes of estimate had been included. Take a look at Figure 6 of our 2021 newsletter "World's Largest Warranty Problems" for Boeing's quarterly changes of estimate from 2011 to the second quarter of 2021, and Figure 3 of our February 2024 newsletter "Warranty Adjustments" for the company's changes of estimate from 2018 to the third quarter of 2023.

Figure 2

Aerospace Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2023)

The U.S.-based aerospace industry as a whole set aside $871 million for future warranty costs. That's a $137 million deficit separating the industry's claims costs and regular accruals.

The three OEMs collectively set aside $330 million in accruals during 2023, while the suppliers accrued $541 million. Warranty accruals fell by -12% for the OEMs, but rose by 10% for the suppliers.

Boeing reported accruing $164 million on claims during 2023, down -19% from 2022. However, the company added an extra $329 million in changes of estimate during 2023, and an extra $576 million during 2022. For both years, the changes of estimate exceeded the regular accruals.

General Dynamics set aside $90 million in 2023, down -9% from the year prior. And Textron accrued $76 million, up just 4%.

Raytheon accrued $305 million during 2023, up 16% from 2022. Honeywell accrued $139 million, up 19%. Woodward accrued $14 million, down -70%, due to the extra product liabilities described in our discussion of Figure 1.

Teledyne accrued $14 million in 2023, up 7% from 2022. Leonardo DRS accrued $20 million during 2023, double its accruals during 2022. The company didn't offer an explanation of this sharp increase in accruals in its annual report.

Moog Inc. accrued $13 million, up 19% from 2022. And Spirit AeroSystems accrued $10 million, up 52% from 2022, showing that the company does anticipate higher future warranty costs related to the 737 MAX failures.

A few other aerospace suppliers sharply increased their accruals as well. Park-Ohio Holdings Corp. more than doubled its accruals, from $1.0 million in 2022 to $2.4 million in 2023. Gogo Inc. accrued $3.1 million in 2023, double its 2022 accruals. And Astronics Corp. accrued $6.3 million, up 84% from 2022. On the other hand, Crane Co. decreased its accruals by -74%, from $6.1 million in 2022 to $1.6 million in 2023.

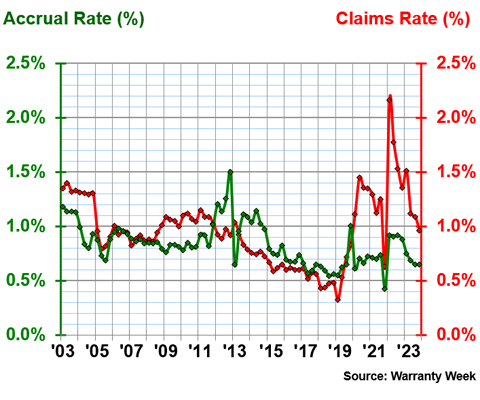

Warranty Expense Rates

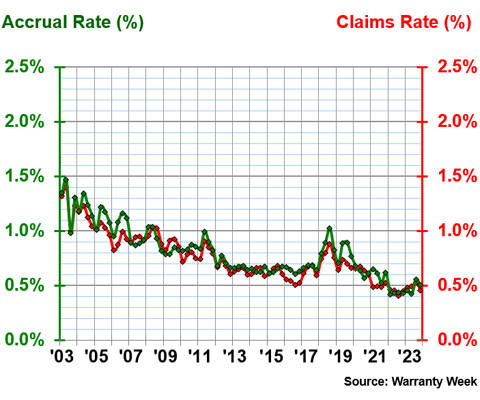

Figures 3 and 4 show the claims and accrual rates of the U.S.-based aerospace manufacturers, divided into the two groups, OEMs and suppliers.

Figure 3 shows the average quarterly warranty expense rates among the three aerospace OEMs.

Figure 3

Aerospace OEM Warranties

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the aerospace OEMs had an average warranty claims rate of 0.96%, with a standard deviation of 0.32%, and an average accrual rate of 0.84%, with a standard deviation of 0.19%.

In 2023, the OEMs had an average claims rate of 1.17%, and an average accrual rate of 0.86%.

We can see in Figure 3 that the OEMs' claims rates have exceeded the accrual rates since early 2019, when the 737 MAX groundings began. Claims rates also exceeded accrual rates from 2009 to 2012, the rough timeframe of the 787 Dreamliner groundings.

Figure 4 shows the average warranty expense rates among the aerospace suppliers.

Figure 4

Aerospace Supplier Warranties

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2023)

We can see a lot more uniformity and closeness between the claims and accrual rates in Figure 4, compared to Figure 3.

Over 21 years, the aerospace suppliers had an average claims rate of 0.76%, with a standard deviation of 0.22%, and an average accrual rate of 0.80%, with a standard deviation of 0.24%.

In 2023, the suppliers had an average claims rate of 0.49%, and an average accrual rate of 0.48%.

Warranty Reserve Balances

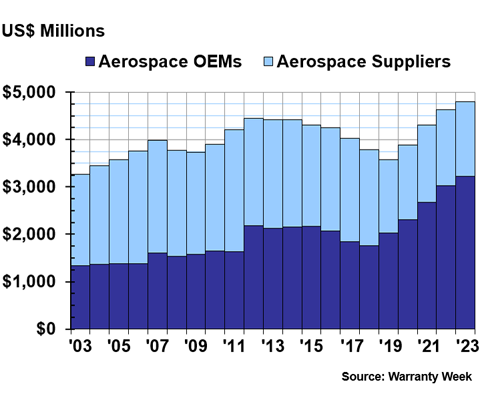

Our final warranty metric is the end-balance of each manufacturer's warranty reserve fund. Figure 5 shows the warranty reserve balances at the end of each calendar year from 2003 to 2023.

Figure 5

Aerospace Warranties

Reserves Held by U.S.-based Companies

(in US$ millions, 2003-2023)

At the end of 2023, the aerospace manufacturers held a collective $4.798 billion in their warranty reserves, a new record high for the industry.

The OEMs held a collective $3.217 billion, up 6% from the end of 2022, while the suppliers held a collective $1.581 billion, down -2% from 2022.

The largest warranty reserve fund in the industry belongs to Boeing, which held $2.448 billion at the end of 2023. Since Boeing's changes of estimate are deposited into the warranty reserve fund along with regular accruals, the increased totals shown in Figure 5 among the OEMs from 2019 to 2023 help tell a fuller story of the 737 MAX groundings and Boeing's subsequent warranty costs.

Interestingly enough, Boeing also had a separate table in its 2023 annual report summarizing "737 MAX customer concessions and other considerations," describing a separate fund set aside for negotiations and settlements with 737 MAX customers. That fund, which is completely separate from the warranty reserve fund, held $1.327 billion at the end of 2023.

At the end of 2023, Raytheon held $1.091 billion in reserves, down -2% from the end of 2022. General Dynamics held $597 million, down -1% from 2022. Honeywell held $219 million, up 3%. Textron held $172 million, up 15%. Spirit AeroSystems held $83 million, up 10%. Teledyne held $49 million, down -2%.

Woodward's reserve fund was cut in half, from $50 million at the end of 2022 to $22 million at the end of 2023. And Leonardo DRS increased its reserves by 44%, to $26 million at the end of 2023.