U.S. Auto Parts & Powertrain Warranties:

Cummins is headed for more emissions trouble, but the 2023 warranty data doesn't show it. The auto parts industry set new record highs in claims and reserves, but not in accruals, thanks to Cummins' 2018 emissions scandal.

Last week, we explored the twenty-one year data in our newsletter "U.S. Truck & Heavy Equipment Warranties." These were the product warranty expenses of the truck and heavy equipment OEMs, which primarily sell directly to end-users, typically commercial entities. The nature of the end-user as a commercial entity sets the product warranty expenses of trucks and heavy equipment apart from those of passenger vehicle OEMs, which we explored two newsletters ago in "U.S. Small Vehicle Warranty Expenses."

This week, we're looking at a much larger roster of companies, but these manufacturers are not typically dealing directly with the end-user of the product. Instead, these manufacturers are auto parts suppliers, which often sell to other OEMs that use these components in the end product vehicle. However, while many of the manufacturers in this report are tier one suppliers, some are aftermarket parts suppliers that sell to auto shops, and some are parts retailers.

The parts manufacturers' general lack of contact with the end-user means that they're also dealing with a much smaller volume of warranty claims. As such, we can break the "auto parts" industry from our "Twenty-first Annual Product Warranty Report" down into two main groups: powertrain manufacturers, and manufacturers of other auto parts. The dichotomy between the two is typified by how much they come into contact with the end-user; while powertrain manufacturers like Cummins sell directly to heavy duty truck owners, other parts suppliers usually deal with OEMs, auto shops, and other intermediaries between the manufacturer and the end-user.

We'll find in this report that the powertrain manufacturers, although fewer in number, account for a larger proportion of warranty expenses among the auto parts manufacturers, because of this difference in the amount of contact with the end-user.

In short, OEMs usually don't think it's worth it to file all of the paperwork, send the emails, send the follow-up emails, and so on, just to ask their suppliers to reimburse them for one or two warranty claims. At a certain point, the OEM becomes willing to eat the cost of a few faulty parts. Although, we've seen more recently that GM is starting to pursue supplier recovery at a much higher rate than we usually see from auto OEMs, seemingly prompted by its highly successful supplier recovery endeavor from its battery supplier during the Chevy Bolt EV battery recall. We remarked more on this specific situation in our December 2023 newsletter, "U.S. Auto OEM & Supplier Warranty Update."

Of course, the Bolt battery recall was a huge, multi-billion dollar case of supplier recovery. But since then, it seems that GM is much more likely to pursue smaller-scale instances of supplier recovery, and becoming more meticulous in its accounting of what parts they're replacing, and who supplied them with the faulty parts to begin with. This could be a new facet of the industry, and if other OEMs catch on to this cost-saving measure, we could see a big difference in the warranty expense rates of the auto parts suppliers. Well, assuming that this meticulous method of supplier recovery actually is profitable, considering the labor and many steps going into the process of recovering what ultimately could be just a few hundred dollars.

To compose this warranty report, we identified 136 auto parts manufacturers based in the United States, that reported warranty expenses in the last 21 years. Of the 136, 55 were actively reporting warranty expenses during calendar 2023.

We perused their annual and quarterly financial reports, and extracted three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund. In addition, we gathered data on product sales revenue, which we used to calculate two additional warranty metrics: claims as a percentage of product sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

The Manufacturers

In Figures 1, 2, and 5, we highlight the top eight manufacturers for each warranty metric, and then incorporate the rest of the companies in the "Other" category. The large manufacturers named in the following charts are: Cummins Inc., O'Reilly Automotive Inc., Standard Motor Products Inc., BorgWarner Inc., Westinghouse Air Brake Technologies Corp., Eaton Corp. plc, LKQ Corp., Brunswick Corp., LCI Industries, and Dana Inc.

These top companies do a good job of representing the different types of auto parts suppliers present in this report. We have Cummins, which sells powertrain and engines both directly to consumers and to other OEMs; aftermarket parts distributors, such as Standard Motor Products; tier one suppliers, such as BorgWarner and Dana; and retailers, such as O'Reilly.

We have a few mergers and acquisitions to report: Tenneco Inc. was acquired by private equity firm Apollo Global Management in late 2022, and thus ceased reporting at the end of that year. Meritor Inc. was acquired by Cummins in mid-2022, and stopped reporting in the middle of that year. So Meritor's warranty expenses are still represented in this report, but are now part of Cummins' total warranty expenses. Cummins also acquired Westport Fuel System Inc.'s stake in the partnership Cummins Westport Inc. in early 2022.

And we have to talk about Cummins, which got some very bad news at the end of 2023 and beginning of 2024. First, the U.S. Department of Justice announced at the end of December that Cummins will be required to pay over $1.67 billion in fines for violation of the Clear Air Act. The DOJ accuses Cummins of installing "defeat devices" that can bypass or defeat emissions controls on over 600,000 2013-2019 Dodge Ram 2500 and 3500 pickup truck engines, as well as "undisclosed auxiliary emission control devices" on over 300,000 2019-2023 Ram engines.

If the term "defeat device" sounds familiar to you, you're probably well-versed in "VW's Emissions Warranty Scandal," which we covered all the way back in 2015.

The $1.67 billion fine levied against Cummins was already the largest fine ever secured under the Clean Air Act. But it was announced in January that the DOJ is fining Cummins an additional $325 million for pollution remedies, in partnership with the Environmental Protection Agency (EPA) and the California Air Resources Board (CARB). And furthermore, Cummins is being required to recall all 600,000 Ram trucks manufactured from 2013 to 2019 with the illegal defeat devices installed. California AG Rob Bonta stated, "Let this settlement be a lesson: We won’t let greedy corporations cheat their way to success and run over the health and wellbeing of consumers and our environment along the way."

Of course, this story is too recent to show up in the data presented in this newsletter, which is as recent as December 31, 2023. In Figure 2, we'll be able to look back at Cummins' relatively minor run-in with costs associated with failing emissions standards back in 2018, which can give us a bit of insight into what we can expect from them in the coming year.

Without further ado, let's take a look at 21 years of warranty expenses in the auto parts industry.

Warranty Claims Totals

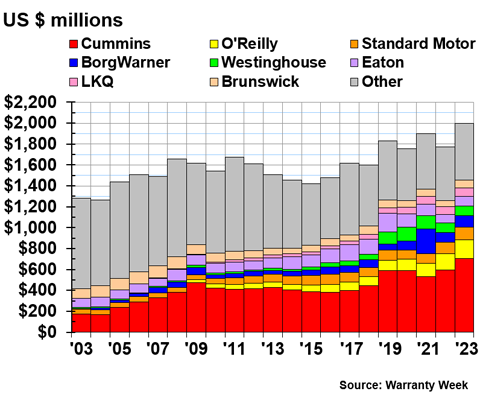

Figure 1 shows the total warranty claims costs of the auto parts manufacturers from 2003 to 2023.

Figure 1

U.S.-based Auto Parts & Powertrain Manufacturers

Claims Paid per Year

(in millions of U.S. dollars, 2003-2023)

Just as we saw with the passenger car and heavy truck manufacturers, the auto parts industry also set some record highs for warranty costs in 2023. In 2023, the auto parts manufacturers spent a total of $1.996 billion on warranty claims, the highest the U.S.-based industry has seen since 2003.

Cummins spent $705 million on warranty claims during 2023, up 18% from 2022. And speaking of supplier recovery, it's not just vehicle OEMs recovering costs from their tier one suppliers. In its 2023 annual report, Cummins notes, "We recognized supplier recoveries of $36 million, $39 million and $170 million for the years ended December 31, 2023, 2022 and 2021, respectively." So Cummins supplies Ford, for example, with diesel engines for Ram pickup trucks. But Cummins also has its own parts suppliers, from which it can endeavor to recover warranty costs. And that's how the ladder goes all the way down.

O'Reilly spent $181 on warranty claims, also up 18% from the year prior. Standard Motor Products spent $119 million, up 8%. And BorgWarner spent $110 million, up 14% from the year prior.Westinghouse Air Brake spent $93 million on warranty claims during 2023, up just 2% from 2022. Eaton spent $91 million, up 12%. LKQ spent $83 million, up 15%. And Brunswick spent $72 million, up 14%.

Comprising the "Other" category are 47 more manufacturers that reported paying product warranty claims during 2023. LCI Industries spent $68 million, up 55%. Dana Inc. spent $56 million, up 22%. Illinois Tool Works Inc. spent $51 million, up 24%. Aptiv plc spent $47 million, up 9%. Allison Transmission Holdings Inc. spent $41 million, up 32%. Regal Rexnord Corp. spent $23 million, down -5%.

Yes, you're following us correctly: Regal Rexnord, fourteenth on the list of highest claims payments among the U.S.-based auto parts manufacturers, was the first to see its claims costs decrease from 2022 to 2023. 2023, by and large, a year of increased warranty expenses, almost across the board.

A few other exceptions are Goodyear Tire & Rubber Co., which spent just $19 million on claims during 2023, down -56% from 2022. Lear Corp. spent $13 million on claims, down -33% from 2022. Visteon Corp. spent $17 million, down -6% from 2022. And Garrett Motion Inc. spent $14 million, down -18% from 2022.

In terms of large increases in claims costs among the milieu of the "Other" category, we have Carlisle Cos. Inc., which spent $15 million on claims during 2023, up 40% from 2022. Timken Co. spent $14 million on claims, up 390% from 2022's total of just $3 million. Wabash National Corp. spent $5 million, up 61%. AeroVironment Inc. spent $2.3 million, almost doubling from 2022's total of $1.2 million. L.B. Foster Co. spent $0.9 million on claims, more than doubling from 2022's total of $0.4 million. LiqTech International Inc. spent $0.4 million on claims, quadrupling from 2022's total of $0.1 million. And we have a newcomer, Shoals Technologies Group Inc., which spent $5 million on claims during 2023, despite reporting $0 in warranty claims costs during 2022.

Warranty Accrual Totals

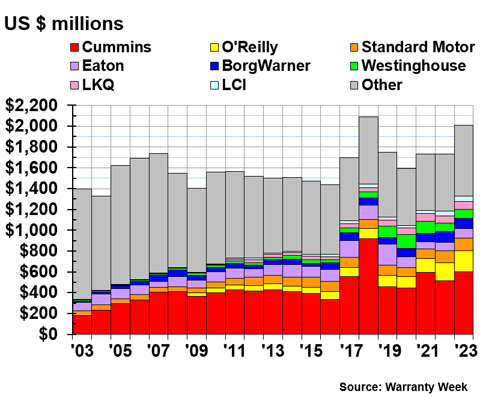

Figure 2 shows the U.S.-based auto parts manufacturers' warranty accrual costs, from 2003 to 2023.

Figure 2

U.S.-based Auto Parts & Powertrain Manufacturers

Accruals Made per Year

(in millions of U.S. dollars, 2003-2023)

During 2023, the auto parts manufacturers set aside $2.142 billion for future warranty costs, up 14% from 2022. However, this wasn't a record high for the industry, by virtue of Cummins' heightened costs back in 2018, from its last emissions scandal. For more information on that bit of trouble with the EPA and CARB, take a look at our 2021 newsletter "World's Largest Warranty Problems." It's likely that Cummins will deal with this impending scandal the same way it did back in 2018.

In 2023, Cummins accrued $602 million for future warranty costs, up 17% from the year prior. O'Reilly accrued $200 million, up 15% from 2022. Standard Motor Products accrued $120 million, up 7%. Eaton accrued $100 million, up 20%. And BorgWarner accrued $98 million, down -5% from 2022.

Westinghouse Air Brake accrued $95 million, also up 20% from 2022. LKQ accrued $86 million, up 16%. And LCI accrued $84 million, up an amazing 82% from 2022.

Among the "Other" category, nine more manufacturers set aside more than the $20 million threshold. Brunswick accrued $78 million, down -6% from the year prior. Shoals Technologies Group, our newcomer to the report, accrued a shocking $60 million, despite only accruing $1 million during 2022. That's a 11,845% increase, a number so high it ceases to have any meaning beyond, "wow, that's a huge increase."

Illinois Tool Works accrued $56 million during 2023, up 40% from 2022. Dana accrued $51 million, up 16% from 2022. American Axle & Mfg. Holdings accrued $36 million, more than doubling from 2022's total of $14 million. Visteon accrued $32 million, up 52%. Aptiv accrued $31 million, down -30%. Allison Transmission accrued $28 million, up 65%. And Regal Rexnord accrued $22 million, down -29% from the year prior.

Among the biggest increases, along with Shoals, American Axle, and LCI, we have L.B. Foster Co., which increased warranty accruals by 313% to $0.9 million. ITT Inc. increased accruals by 200% to $5 million. Donaldson Co. Inc. also tripled accruals to $0.5 million. AeroVironment increased accruals by 185% to $4 million. Gentherm Inc. increased accruals by 150% to $4 million. Kimball Electronics Inc. increased accruals by 129% to $0.1 million. And Crawford United Corp. increased accruals by 128% to $0.4 million.

Among the largest decreases in accruals, along with Aptiv and Regal Rexnord, we have FreightCar America Inc., which decreased accruals by -75% to $0.9 million. Goodyear decreased accruals by -66% to $12 million. Timken decreased accruals by -60% to $6 million. CBAK Energy Technology Inc. decreased accruals by -47% to $0.07 million. Gates Industrial Corp. plc decreased its accruals by -44% to $6 million. And Enerpac Tool Group Corp. decreased its warranty accruals by -41% to $0.5 million.

Warranty Expense Rates

As we posited at the beginning of this newsletter, the powertrain suppliers tend to have higher warranty expense rates than the other auto parts suppliers, because of differences in how they conduct business and interact with end-users. Of course, there are more nuances within the other auto parts category, such as the differences between tier two suppliers, retailers, and aftermarket parts makers. However, the overarching dichotomy stands, as we will see in Figures 3 and 4.

Figure 3 shows the warranty expense rates of the powertrain manufacturers, and Figure 4 shows the expense rates of the other auto parts manufacturers. Please note that Figures 3 and 4 have different y-axis scales when comparing the two.

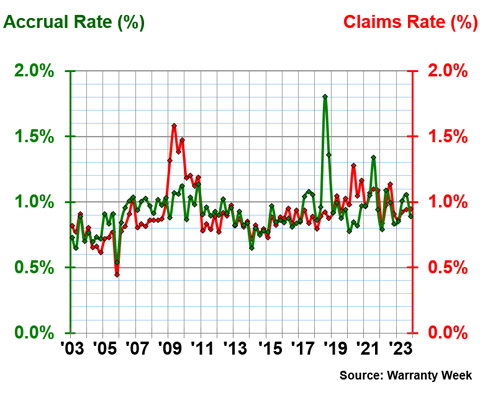

Figure 3

U.S.-based Powertrain Manufacturers

Average Claims and Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the powertrain manufacturers had an average warranty claims rate of 0.91%, with a standard deviation of 0.18%, and an average accrual rate of 0.92%, with a standard deviation of 0.17%.

The claims rate deviated from this average during 2009, while the accrual rate spiked in 2018 due to Cummins' EPA emissions troubles.

During 2023, the powertrain manufacturers had an average claims rate of 0.92%, and an average accrual rate of 0.95%. So 2023 was a fairly on-average year for the powertrain manufacturers.

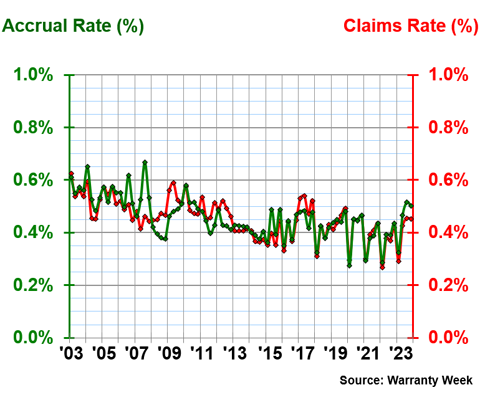

Figure 4

U.S.-based Auto Parts Manufacturers

Average Claims and Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the other auto parts manufacturers had an average warranty claims rate of 0.45%, with a standard deviation of 0.07%, and an average accrual rate of 0.46%, with a standard deviation of 0.08%.

Clearly, we see a lot more consistency in the expense rates from the other auto parts manufacturers as compared to the powertrain manufacturers, as exemplified by the lower standard deviations for the other auto parts manufacturers. Interestingly, though, we've seen a pattern of both expense rates dropping for the other auto parts manufacturers during the first quarter of each year, in 2016, 2018, 2020, 2021, 2022, and 2023. It seems to have become a consistent pattern in the past few years.

During 2023, the other auto parts manufacturers had an average claims rate of 0.41%, and an average accrual rate of 0.45%. However, during the first quarter of the year, the industry average claims rate was just 0.29%, while the accrual rate was 0.32%.

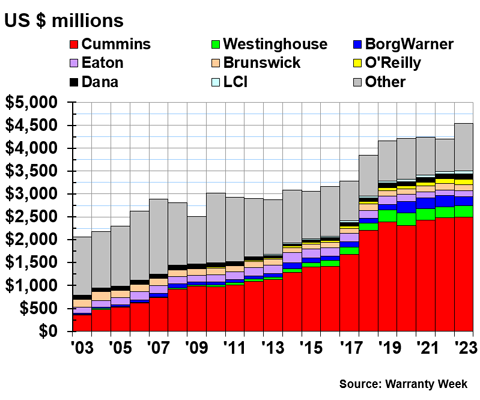

Warranty Reserve Balances

Our final metric is the year-end balance of each manufacturer's warranty reserve fund, from 2003 to 2023.

Figure 5

U.S.-based Auto Parts & Powertrain Manufacturers

Reserves Held per Year

(in millions of U.S. dollars, 2003-2023)

During 2023, the auto parts manufacturers held a collective $4.351 billion in their warranty reserve funds, a new record high for the industry.

At the end of calendar 2023, Cummins held $2.497 billion in its warranty reserve fund, up just 1% from the end of 2022. Westinghouse Air Brake held $248 million, up 2%. BorgWarner held $196 million, down -20% from 2022. Eaton held $136 million, up 9%. Brunswick held $127 million, down -13%. O'Reilly held $118 million, up 20%. Dana held $116 million, up 7%. And LCI held $72 million in reserves, up 31% from the year prior.