Warranty Consulting:

The Marsh warranty practice helps companies looking to launch protection programs do it right the first time.

In today's market, the availability of extended warranties across many industries, products, and services is a testament to its remarkable growth. Undoubtedly, extended warranties provide peace of mind protection for consumers while also generating revenue for many organizations that offer them. Despite its maturity however, the extended warranty industry is constantly evolving. As a result, businesses looking to create, revamp, or manage their extended warranty portfolios should approach this process with the same mindset as one would when building a home: hiring a skilled contractor. You need someone with the right arsenal of tools -- someone who understands the industry, consumer behavior, risk management, pricing, and has the right expertise in logistics and structure of warranty portfolios.

What you need is a consulting practice that knows everybody and everything.

Troy Lewis, the managing director of the Marsh Warranty Practice, wants to be your partner. The operation, part of the insurance brokerage giant Marsh McLennan, has quietly been working in the background for the past decade, and has relationships with many of the sources of warranty expertise as well as the companies that need it.

"We're in a unique position of being partners with both clients and administrators and insurers," Lewis said. "So we have a behind the scenes look at both. We get to see things from both perspectives."

The Marsh Warranty Practice was formed almost ten years ago, with Lewis joining shortly after inception. Over the years, the practice has grown in size and breadth of expertise. In fact, Lewis said, counting his 33 years in the warranty business, the team, which also now includes Greg Gadbois, Sanja H.Abdic, Paul Ruyle, Jennifer Blacklock, Matt Ferriola, and Dana Bahlinger, have about 160 years of combined experience in the warranty industry.

Lewis said the reason Marsh has kept such a low profile until now about its Warranty Practice was by design. "We've been a little bit quiet on purpose, wanting to make sure we focus on the right opportunities while exceeding expectations of both internal and external clients. We are at a point now where we're assembled an excellent team, and have a decade of success stories and proven experience to reflect on. I am excited to see where our industry will go in the next decade, and Marsh Warranty Practice is very much ready for the journey", he said.

Word of Mouth

During its first decade, the Marsh Warranty Practice relied heavily on word of mouth to get its story into the market. Client executives working with manufacturers, retailers, and service providers on insurance brokerage would bring the practice into the conversation whenever those clients asked for help with their warranty or service plan programs. Now, Marsh is advertising in Warranty Week, and will tell its story next week at a warranty and service contract conference happening in Nashville.

Lewis described how the Marsh account executives helped guide clients such as BSH Home Appliances (part of a Bosch-Siemens joint venture) and BowFlex Inc. to the Marsh Warranty Practice. Bosch was already a Marsh client, he said, primarily in the realm of property and casualty insurance brokerage. And Bosch already ran its own in-house extended warranty program in Europe. But they wanted to launch a service contract program in the US, and they didn't want to simply expand the existing program to a new territory. So their risk manager reached out to their account executive at Marsh, and asked if they had any expertise in that area.

"That's when our team got involved," Lewis said. "We followed our tested diagnostic approach and looked at the goals that they had, designed the program, scoped a comprehensive RFP, and then we took it to market."

BowFlex came on board essentially the same way. The company was already using Marsh for property and casualty insurance brokerage services, and asked its account executive for help to launch a service contract program. Marsh helped them write an RFP and brought in additional outside expertise to help with product registrations, direct marketing, analytics, and even equipment repair services.

And there have been many others that came to Marsh in essentially the same way: client is looking for warranty expertise, reaches out to its insurance broker for advice, and next they're on the phone with the company's team of warranty experts.

Bosch Turns to Marsh

The BSH Home Appliances Corp. is the US subsidiary of the BSH Home Appliances Group, Europe's largest home appliance manufacturer, and a joint venture between Robert Bosch GmbH and Siemens AG (the BSH stands for Bosch-Siemens Hausgerate, the latter word meaning home appliances in German). Major brands include Bosch, Thermador, and Gaggenau, and between them they sell everything from high-end refrigerators to ovens to dishwashers and clothes dryers.

BSH had its own service contract program in other countries, but in 2016 it decided to add a program in North America. BSH already relied on Marsh for insurance brokerage services, so when they made inquiries about service contracts, they were connected with the Marsh Warranty Practice.

Jennifer Reiss, the manager of customer service and consumer extended services at BSH, has worked for the company since 2008, and in 2016 she was assigned to help set up the program. None of her team had ever launched a program before, so they reached out to Marsh for assistance.

"We met with them," Reiss said, "and they explained to us the consulting support they could offer, and we entered into an agreement for them to help BSH build a service plan program."

The Warranty Practice team, she said, seemed to know all the insurance underwriters in the business, and indeed some of the team members had worked for those very same companies before joining Marsh. Reiss said Marsh helped guide BSH through the RFP process, with BSH eventually settling on the choice of The Warranty Group -- then an independent company, but now part of Assurant Inc.

The Warranty Group quickly assigned Kenny Zielberg as account manager, and Marsh took on the role of a liaison and assisted with the design, creation, and implementation of the program. Marsh also helped facilitate introductions between BSH and Registria, whose QR code decals and website help boost the product registration rates for new appliances and other products.

Bringing In Outside Expertise

Reiss said Marsh was the perfect partner to bring in at the beginning, when the BSH team didn't really know what they didn't know about the industry. "No one on the team had any experience launching a warranty program. None of us were familiar with the legal requirements or administrative requirements. So it was good to have someone working with us, to educate us," she said. "We would not have known which companies to go to, or where to start. We would have had to spend a lot of time investigating, researching, and evaluating. And we were able to cut all of that out of the timeline."

"Having them involved from the beginning had a significant impact for the BSH team. But having their support throughout the life of the program to this point has been invaluable. They've been able to help us work through issues here and there with our other partners, and they've been able to bring my attention to certain things that are going on in the industry -- changes that might help grow our program -- things that I hadn't even thought of," Reiss added.

In contrast, Reiss said one of her current team members recently came to BSH from an unnamed manufacturer that decided to launch a service contract program the hard way, with no internal expertise, and no external consulting help along the way. Suffice it to say it did not turn out so well.

"I would say if a company is looking to launch a service plan program, and they don't know where to start, and they don't have any experience in the warranty business, go to Marsh, and let them guide you through the process, because it will save a lot of time and headache, and reduce the number of mistakes that could be made when trying to do it on their own," Reiss said.

"If I had to do it all over again, I would not do it any differently. Honestly, the process was so much smoother with Marsh. And building the program was easier than I had originally envisioned it to be. Just having that support -- knowing that I had someone to rely on. Because I didn't know the warranty business. I had not been involved with a service plan program before, and was responsible for building a program and launching it, and making it successful. And I had no idea where to start."

Nashville Conference

Reiss will be a panel member next week at a kickoff discussion at the Warranty & Service Contract Innovations for Vehicle, Home, Smart Products & Consumer Goods conference in Nashville. Entitled "Creating and Managing a Service Contract Program from the Ground Up -- Program Manager Case Study Success Stories," the discussion will also include panelists Lari Stone from Meta Platforms Inc., Victor Andrade from Henry Schein Inc., and Nick Calcanes from Hendrick Autoguard Inc., and will be moderated by Sanja H.Abdic, senior vice president of the Marsh Warranty Practice.

H.Abdic said the goal is to let the audience hear directly from executives who have created and managed extended warranty portfolios at their respective organizations. Meta is the parent company of Facebook, Instagram and WhatsApp, which grew up as a social media pioneer but which has also now grown into equipment sales through acquisitions such as Oculus and Jio Platforms. Henry Schein is a value added reseller of dental equipment and home medical supplies. Hendrick Autoguard sells and provides administration for a whole suite of vehicle protection products -- everything from vehicle service contracts and GAP programs to paintless dent repair and tire & wheel protection.

"One of the more unique aspects of this panel is the diversity of industries, distribution channels, and program longevity that each panelist represents," H.Abdic said. "We really believe this discussion will set the tone for the rest of the conference and will truly be the one that audience will be able to reflect on and walk away with actionable items. Organizations that are looking to create or optimize their warranty portfolios will walk away better prepared and with insights that will help guide that process, and industry partners will walk away with insights and tools they can implement next time they engage with a client or a prospect."

Reiss said she has attended a few Extended Warranty Innovations conferences in Nashville over the past few years, but never as a speaker on a panel discussion. She said she looks forward to talking with other appliance manufacturers that have gone through their own process launching their service plan programs.

"But the other industries, even though the business is different, some of the ideas are transferable," she added. "And now that I've been managing this program for so long, I worry about tunnel vision. So I think having exposure to other industries, and hearing how they're managing warranties, I always take away something I can apply to our program."

The BowFlex Story

Exercise equipment manufacturer BowFlex Inc. has been going through a lot of changes recently. Last year, the company changed its name to BowFlex from Nautilus Inc., to more closely realign with the brand name it has been using since 1986 for its line of treadmills, exercise bikes, stair climbing machines, and other home gym gear. Last month, the company declared Chapter 11 bankruptcy, and has entered into a purchase agreement with Johnson Health Tech. As of the time of this article, the transaction has not been finalized.

BowFlex started its engagement with the Marsh Warranty Practice in 2016. Mary Clark, currently the BowFlex manager of direct sales, started with the company a year later, and since 2021 has been the manager of its service plan program. Like many of the people who now depend on Marsh for it service contract expertise, Clark said she didn't have a background in warranty when she found herself in the position of being a warranty professional.

"They were crucial," Clark said of Marsh. "They really are the ones with the deep expertise, to help guide us and help us make informed decisions. They have taught me a lot -- about not only the industry, but also about extended warranties as an overall practice, as an overall element of a business. I don't know if I could have done it without them."

Clark said Marsh's input has been invaluable. "They answer the questions I didn't know I had," Clark said. The BowFlex and Marsh teams have been checking in with each other just about every week for the past several years, and more often via email, she added.

Reiss at BSH echoed the same sentiment. "I can't tell you how much I rely on their expertise" Reiss said. "They've been in the business for a long time. And their knowledge has been instrumental in helping to grow our program."

Clark said Marsh seems to intuitively know where BowFlex will want to go next. One time, she said, the Marsh crew came into the office with a detailed competitive analysis of not only the extended warranty offerings and price plans of some of BowFlex's equipment competitors, but also those of the retailers that sell its and other manufacturers' exercise gear.

"They really do anticipate our needs," Clark said. "Of course they are looking at the health of our portfolio, and then they are looking at opportunities -- things they believe I would want to have eyes on. That's how they enable us to make informed decisions, whether it's price testing our current offerings, looking for ways to protect our margins, or just to ensure that our portfolio is healthy, while also giving us some flags of things to look out for. They understand what we want to accomplish as a company. They know that I want to be competitive with our pricing, but I also want to do what's right for the needs of our consumers. They're very supportive. They're very quick to respond, and to help."

Changing Your Genes

Octaviant Financial Inc. (OFX) is perhaps the most unique client of the Marsh Warranty Practice. Co-founded by Emad Samad, who serves as its president and CEO, the company has designed a program that allows drug companies to include a warranty with the sale of very expensive but very effective gene therapies.

Single doses of these gene therapies, which can cure (not just treat) maladies such as hemophilia and sickle cell anemia, can cost anywhere from $1 to $3 million. Health plans are reluctant to cover them, and the employers who typically provide such coverage to their employees are reluctant to allow them, for a myriad of reasons. First is their enormous cost. Second is their known failure rate during the clinical trial process. And third is the simple fact that there's nothing preventing an employee from leaving the company soon after the treatment has succeeded.

There's also a more principled reason, which is where the warranty comes in. When you purchase a car or appliance and it doesn't work, you're eligible for a refund, repair, or replacement. A repair or replacement doesn't work for drug treatments, and a straight refund isn't allowed under regulations set forth by the Centers for Medicare & Medicaid Services (CMS) to prevent conflicts of interest.

Warranty in the Middle

Enter the OFX Warranty. Octaviant, Marsh, and Oliver Wyman Actuarial Services (Oliver Wyman is a Marsh McLennan Company) worked together to develop the only warranty program available for these expensive gene therapy treatments that could cure ailments such as hemophilia, sickle cell anemia, Duchenne muscular dystrophy, and perhaps soon even macular degeneration and type 1 diabetes, but which might not work in all cases.

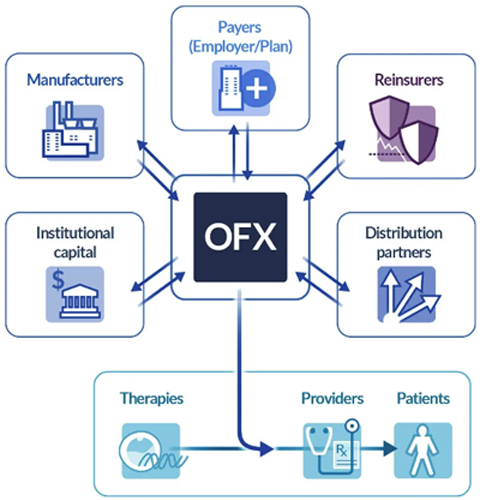

Figure 1

OFX Warranty in the Middle

The OFX Warranty is issued directly to health plan sponsors, which are most often employer groups who are the end payers for healthcare. The OFX Warranty can also be issued to government plans, like Medicare and state Medicaid programs. Octaviant pays the claims, and collects a premium for coverage from its clients: the pharmaceutical companies. As such, Octaviant is designated as the program manager of the warranty policy, serving both pharmaceutical companies and end payers.

In this way, the pharmaceutical companies are buying insurance, or a warranty, or a performance guarantee, rather than just issuing refunds directly to customers whose treatments didn't work. It's not a discount in price; it's a bona fide warranty claim. And in that way, it doesn't go against CMS pricing regulations. In turn, a payout from an OFX Warranty allows the end payer to recoup those dollars to use for other medical treatments or to keep future healthcare premiums low for beneficiaries.

The innovation is inserting a warranty into the transaction, and spreading the risk using an insurance premium and a claims payment instead of a refund. That assurance, in turn, should prompt more employer groups and their health plans to deem more of these multi-million-dollar gene therapies to be "covered" by employer-provided health insurance policies.

Samad, who has a long history in both the banking and pharmaceutical industry, founded Octaviant LLC in 2010 as both a merchant bank and specialized holding company dedicated to the life sciences and healthcare. At first he was advising biotech clients for routine tasks such as financing, going public, mergers, and acquisitions. But in 2018 he was asked by gene therapy companies for advice about overcoming some of these market access challenges. Armed with some novel finance and insurance strategies, Samad and his co-founders formed Octaviant Financial, Inc. in 2020.

Once they had designed a warranty program for their gene therapy clients, Octaviant began looking for expertise in the warranty industry. An RFP was issued, and the Marsh Warranty Practice was chosen.

"The hardest thing is convincing people to be first to do something different," Samad said. "We realized early on that we would need a partner in insurance, whether in brokerage or otherwise, to help us operationalize our warranty programs, to make our ideas better, to conform to industry standards, and to bring them to market. When you have a partner that knows all of that -- that has your back -- you're creating the best possible product. And you're getting the validation and the credibility as well."

"I'm not alone," he added. "It's not just me. It's not just Octaviant. There are entire organizations and their people that are mobilizing around our ideas and making them better. Some of those people are at Marsh and Oliver Wyman. And some of those people are at the pharmaceutical companies that we're working with."

It's not as if the size of the risk or the rate of failure isn't known, Samad said. "We are setting the standard on how to model this type of risk. We start with the same data that got the drug approved for the market -- the clinical trial data -- and we're tabulating future risk using disease information and proprietary methods we've pioneered. The goal is to mitigate the concerns of payers entering the bargain with the pharmaceutical company." And that's not all that different from the actuarial data that service plan providers use to help them price the risk of the contracts they're selling.

"The experience that we've had with Marsh has been extraordinary, even in all my years in banking and finance," he said. "This is an $84 billion market cap company that is paying serious attention to the ideas that our company brought to them. Because usually it's just about the status quo -- it's about how can we just grow our revenues in the same way, or increase whatever we have going on. But with Marsh, we have a very large company that wants to help us innovate."

Business With a Handshake

Samad said Octaviant chose Marsh not only for the company's reach across industries, but also because Marsh seemed to be the right partner to bring an entirely new insurance product to market. "It's about the people," he said. "They still rely on their handshake to do business. They shared our vision of realigning incentives in the drug distribution channel, and the impact it could have on patients." And after spending decades working with the giants of the banking and finance industry, Samad said simply, "Most large companies aren't like that."

Troy Lewis took the compliment in stride, and said it reflects the way Marsh likes to do business. "In other words, you do what you say you're going to do," he said. "At Marsh, we have a saying called the Greater Good. And we try to live by that. We're going to help our clients out. We're here for the greater good, and that's a part of the value-add that you get from Marsh. We have expertise in dozens of verticals, and while warranty is a small niche, it brings a different conversation to a lot of our client executives with their clients."

"We used to joke internally, you know," Lewis said. "We're in the warranty business. It's not like we're curing cancer. We're not saving lives. Well, in this program, we actually are saving lives. I don't say that tongue in cheek. I think it's going to revolutionize that industry. I mean, if you now create a warranty program that gets payers more willing to prescribe it, CMS to allow it, and a patient to receive it, that potentially is saving lives, right?"