Warranty Early Reporters:

While we await the rest of the U.S.-based manufacturers' annual reports, we're taking a look at the early results of companies that have already released their fourth quarter data. Overall, the warranty expense rates haven't varied much, showing that the increased warranty expense totals we've seen are in proportion to increases in revenue.

Annual reports begin trickling in during the end of January, with more released in February, and a critical mass reached sometime in mid-March. So far, we've recorded the 2023 warranty expenses of about 80 U.S.-based manufacturers. In last week's newsletter, we looked at the annual warranty expenses Ford, GM, and Tesla, which were speedy as ever in filing their annual reports.

Most manufacturers tend to need more time to compile and file their 10-K annual reports with the U.S. Security & Exchange Commission. But some follow fiscal years that end earlier than December, so we already have data available from dozens of other manufacturers.

For instance, we have HP Inc., and the spin-off Hewlett Packard Enterprise, which both end their fiscal years on October 31, so their annual reports were already on file by the end of December. We also have Cisco Systems Inc., which has a fiscal year that ends in July. Others end their fiscal years on June 30 or September 30, so the shorter quarterly financial statements are already on file for the period covering the months of October, November, and December.

Along with Ford, GM, and Tesla, other early reporters not discussed in this newsletter include Deere & Co., Boeing Co., Thor Industries Inc., and BorgWarner Inc., since we looked at their warranty expenses and recall news quite recently in the past few editions of Warranty Week.

To keep things fresh, we identified a few other warranty early reporters, beyond the largest five. For this report, we first selected General Electric Co., which only reports annually, along with its recent spin-off GE HealthCare Technologies Inc. The spin-off was finalized at the beginning of January 2023, but GE HealthCare, which reports quarterly, has kindly provided back-data that begins in 2021.

Next we picked three tech manufacturers: HP Inc., Hewlett Packard Enterprise Co., which spun off from the parent in late 2015, and Cisco Systems Inc. They're joined by two new home builders, Lennar Corp. and PulteGroup Inc., along with two HVAC manufacturers, Trane Technologies plc and Carrier Global Corp.

These nine companies are in no way representative of the entire U.S.-based manufacturing base, and though they are each some of the largest in their sector, these results do not represent those industries as a whole. But they may give us an early indication of the trends we can expect to be exploring for the U.S. product warranty industry in the months ahead, as the rest of the top warranty providers file their annual reports.

For each company, we perused their quarterly and annual financial reports, and gathered data on their warranty claims paid and accruals made. We also recorded their quarterly product sales revenue, which is the revenue generated by the sale of a product that comes with a warranty. We combined these data to calculate our two warranty expense rates: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

Since the claims and accrual rates are normalized for each company's revenue, they reveal exactly what proportion of sales revenue is spent on warranty costs. As such, we depict the quarterly warranty expense rates of each company in the following charts.

The General Electric Family

Our first company is GE, which is in the middle of a major restructuring. At the beginning of 2023, GE spun off the first of two planned companies, GE HealthCare.

We were looking forward to the spin-off of GE's power business as GE Vernova, and the subsequent renaming of GE to GE Aerospace, which was announced for early 2024 last year. But the spin-off got pushed back to the second quarter of 2024. Since GE only reports annually, this means it may be another year before we can evaluate the warranty expenses of GE Vernova versus Aerospace. We hope that the new spin-off will follow GE HealthCare's lead and begin reporting warranty expenses quarterly, as opposed to the parent GE, which only includes warranty costs in its annual reports.

Keep in mind that GE stopped manufacturing appliances in 2016, when it sold its division GE Appliances to the Chinese company Haier Group Corp. Haier still produces appliances under the GE brand, but those appliances are not manufactured or maintained by General Electric.

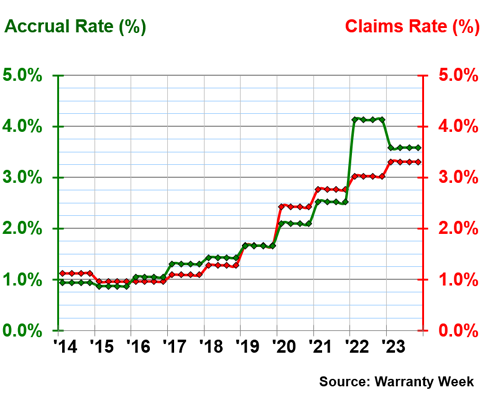

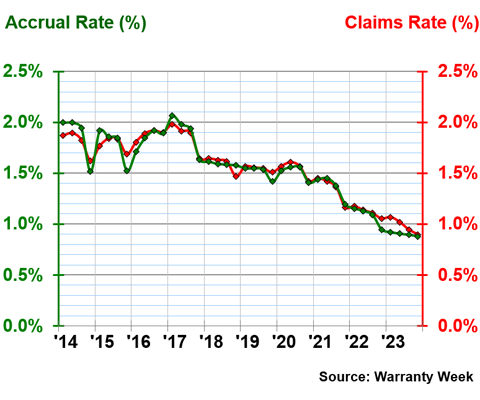

Since GE only reports warranty on an annual basis, Figure 1 was created by dividing the annual data into four equal quarters of warranty expenses.

Figure 1

General Electric

Quarterly Claims and Accrual Rates,

(as % of product revenue, 2014-2023)

We can see that GE's warranty accrual rate dropped in 2023, after increasing by about two-thirds, from 2.5% in 2021 to 4.1% in 2022, likely due to higher-than-expected failure rates for GE's huge wind turbines. As we mentioned in last year's report on the U.S. power generation industry, the company's product revenue generated from wind turbine sales decreased at the same time as repair costs increased, so both total accruals and the accrual rate skyrocketed.

However, although the accrual rate dropped a bit in 2023, it's still unprecedentedly high for the company, averaging 3.6% for 2023. The average claims rate in 2023 was 3.3%, also much higher than it used to be.

In 2023, GE spent an average of $221.5 million on warranty claims per quarter, and accrued an average of $240.3 million per quarter.

GE's gone from warranty expense rates hovering between 1% and 2%, from 2003 to 2018, to these rates increasing in large steps every year for the past five years. It will be very interesting to see if the cause of this truly is wind turbine trouble, which would mean that GE Aerospace (the parent) would see expense rates drop, while GE Vernova (currently GE Renewable Energy) would have much higher warranty expense rates post-spin-off.

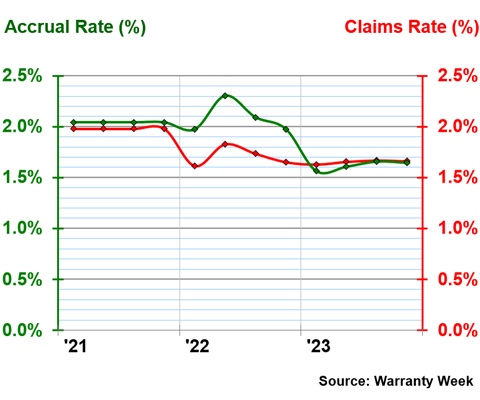

Figure 2 shows the warranty expense rates for the first GE spin-off, GE HealthCare. The Healthcare business spun off at the beginning of 2023, but the first annual report provided annual data back to 2021, and the subsequent quarterly reports have provided quarterly numbers for 2022.

Figure 2

GE HealthCare

Quarterly Claims and Accrual Rates,

(as % of product revenue, 2021-2023)

In the fourth quarter of 2023, GE HealthCare had a warranty claims rate of 1.7%, and an accrual rate of 1.6%. The accrual rate was above 2% during 2022, but fell below the claims rate in 2023.

In the fourth quarter of 2023, GE HealthCare spent $59 million on warranty claims, and accrued $58 million for future warranty expenses.

The HP Family

Many of us are familiar by now with the split between HP Inc. and Hewlett Packard Enterprise Co.. In late 2015, the Hewlett-Packard Company spun off its IT business, including servers, data storage, cloud computing, tech support, and artificial intelligence, as HP Enterprise (HPE), and renamed the parent business to HP Inc. HPE has made about 24 acquisitions since that spin-off, working to define itself in the cloud computing, software, and networking space, beyond the printer and computer business that HP Inc. retained.

Although the split between the two occurred in November 2015, HPE retroactively provided annual warranty data for the fiscal years 2014 and 2015. The warranty data presented in Figures 3 and 4 are quarterly beginning in the first quarter of 2016.

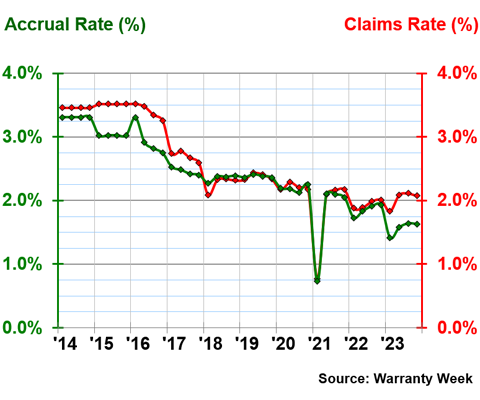

Figure 3 shows the past ten years of HP Inc.'s warranty expenses, with no overlap with those of HPE.

Figure 3

HP Inc.

Quarterly Claims and Accrual Rates,

(as % of product revenue, 2014-2023)

We can see that HP Inc.'s warranty expense rates have steadily fallen in the decade since the spin-off of HPE. HP Inc. averaged a 3.5% claims rate and 3.3% accrual rate in 2014. By contrast, the company had a 2.1% claims rate and 1.6% accrual rate in the fourth quarter of 2023.

The accrual rate fell well below the claims rate in 2023. The company paid for the difference between the two by depleting some of the money held in its warranty reserve fund. The company's claims rate has remained higher than the accrual rate ever since the large dip in both rates, which we can see in the first quarter of 2021. It's been funding the difference with money that was already sitting in the warranty reserves.

The warranty reserve that HP Inc. held at the end of 2023 is less than half what it held at the end of 2013. And combined with HPE's reserves, we're still only at half of the total warranty reserves held by HP Co. right before the split began.

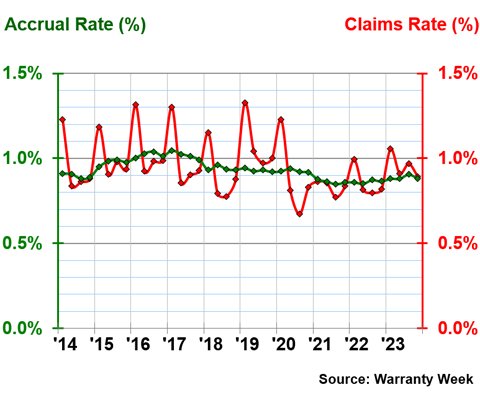

Figure 4 shows HPE's warranty expense rates since 2014, the first year for which we have data available for the company.

Figure 4

Hewlett Packard Enterprise

Quarterly Claims and Accrual Rates,

(as % of product revenue, 2014-2023)

HPE spent $51 million on warranty claims in the fourth quarter of 2023, while HP Inc. spent $216 million on claims during the same quarter. Like the former parent, HPE also has a claims rate higher than its accrual rate, though the gap between the two isn't as wide for HPE.

With the exception of late 2022 and early 2023, HPE has oddly kept its accrual rate lower than its claims rate since early 2018. In the fourth quarter of 2023, HPE's claims rate was 1.1%, and its accrual rate was 1.0%.

Cisco

Next, we're looking at the warranty expenses of another computer manufacturer, Cisco Systems Inc. Dell and Apple don't report their warranty expenses, nor does Microsoft, so Cisco is rising through the ranks as one of the larger U.S.-based computer software and hardware companies that still reports its warranty expenses.

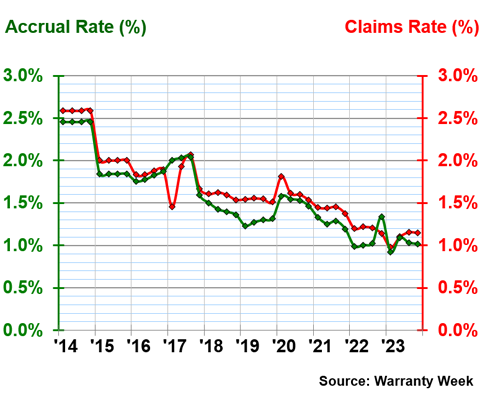

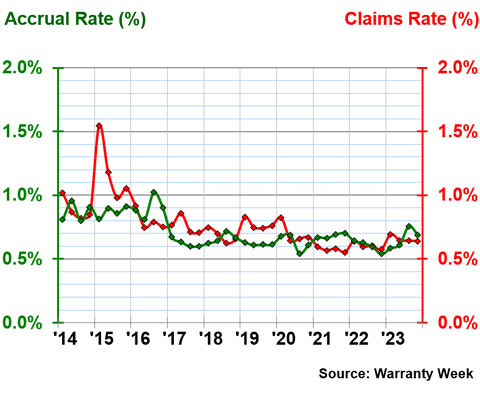

Figure 5 shows Cisco's warranty expense rates over the past decade.

Figure 5

Cisco Systems Inc.

Quarterly Claims and Accrual Rates,

(as % of product revenue, 2014-2023)

It's striking that Cisco's warranty expense rates follow the same pattern as those of HP Inc. and HPE. They all make the same types of things, and it's possible that the transition to more cloud- and network-based technology has helped lower the proportion of revenue that goes towards warranty expenses in recent years. Software doesn't come with a product warranty the same way hardware does. Cisco does both, but seems to be moving more into the software and server side, like HPE, rather than the physical computers and printers, like HP Inc.

Cisco has managed to bring down both its total warranty expenses over the past five years, and those totals' proportion of product sales revenue. In the fourth quarter of 2023, Cisco spent $100 million on claims, with a claims rate of 0.9%. The company accrued $98 million, with an accrual rate of 0.9% as well.

Two New Home Builders

Figures 6 and 7 show the warranty expense rates of two new home builders, Lennar Corp. and PulteGroup Inc., respectively. Both manufacturers produce custom-built and pre-fabricated homes that would fit in housing developments across the United States.

Figure 6

Lennar Corp.

Quarterly Claims and Accrual Rates,

(as % of product revenue, 2014-2023)

Lennar is a fascinating example of the rare homebuilder that's diligent about warranty accruals, despite the seasonal variations of warranty claims. Each year, the company sees the highest warranty claims cost in the first quarter, with a drop in the second and third quarter, then a slight rise again in the fourth quarter. And yet, despite these seasonal changes, Lennar accrues a consistent proportion of its revenue in each quarter.

While the claims rate exceeds the accrual rate in some quarters, and vice versa in others, it all seems to even out at the end of the year. It's a very interesting accounting strategy, and a very revealing chart.

In the fourth quarter of 2023, Lennar had both a claims and accrual rate of 0.9%. In the first quarter of the year, the claims rate was 1.1%, while the accrual rate was 0.9%. The last time Lennar's accrual rate was anything other than 0.9% was in the second quarter of 2018, when it was 1.0%.

Figure 7 shows the warranty expense rates of PulteGroup, another homebuilder.

Figure 7

PulteGroup Inc.

Quarterly Claims and Accrual Rates,

(as % of product revenue, 2014-2023)

PulteGroup's warranty expense rates don't reveal this same seasonal pattern, with the year 2015 being an exception. Instead, PulteGroup's claims and accrual rate stay rather flat, and quite close together.

In the fourth quarter of 2023, Pulte had a claims rate of 0.6%, and an accrual rate of 0.7%.

Two HVAC Companies

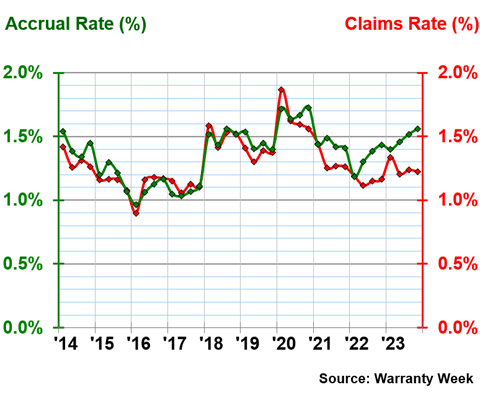

Since we presented the early results of two new home builders, we're also presenting the results of two HVAC manufacturers, Trane Technologies plc and Carrier Global Corp., in Figures 8 and 9, respectively.

Trane was acquired by Ingersoll Rand in 2008, and subsequently spun-off again in 2020. Well, to be precise, Ingersoll Rand sold its non-HVAC business to Gardner Denver, which renamed itself Ingersoll Rand, while the former Ingersoll Rand renamed itself Trane Technologies. Trane also owns the Thermo King brand of refrigerated transport trailers. Figure 8 shows the past ten years of the company's warranty expenses, including data from back when it was called Ingersoll Rand.

Figure 8

Trane Technologies

Quarterly Claims and Accrual Rates,

(as % of product revenue, 2014-2023)

We'll note that Trane's total warranty claims and accruals didn't change much from 2019 to 2020. But those totals' proportion of total sales revenue did change, resulting in a rise of the two expense rates when this restructuring took place.

Since then, the company's expense rates have fallen back to just about where they were before the process of restructuring began. In the fourth quarter of 2023, Trane's claims rate was 1.2%, while the accrual rate was 1.6%. Trane has been growing its accruals recently, resulting in a rise in the accrual rate over 2022 and 2023 as well.

Carrier Global Corp., depicted in Figure 9, is also the child of a series of spin-offs and mergers of a large conglomerate. United Technologies, while mainly an aerospace company, used to own Carrier Global. But as part of the 2020 merger with Raytheon, United Technologies spun off two extraneous businesses, the HVAC business as Carrier Global Corp., and the elevator and escalator business as Otis Worldwide Corp. United Technologies and Raytheon then merged into Raytheon Technologies Corp., which recently rebranded to RTX Corp. Carrier Global started reporting in 2020, but provided back-data to the beginning of 2019.

Figure 9

Carrier Global Corp.

Quarterly Claims and Accrual Rates,

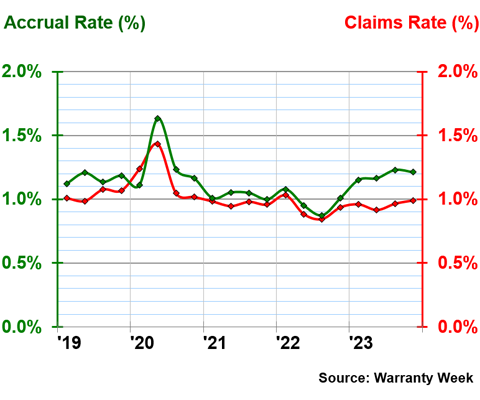

(as % of product revenue, 2019-2023)

Carrier's warranty expense rates have hovered around 1%, with the exception of early 2020, when the spin-off actually occurred.

In the fourth quarter of 2023, Trane had a claims rate of 1.0%, and an accrual rate of 1.2%.