Nine-Month Large Vehicle & Powertrain Warranty Trends:

Claims payments are up for all but one of the top twelve large vehicle manufacturers, and most increased their accruals too. In fact, four companies, Allison Transmission, BorgWarner, Winnebago, and Terex, all paid more in claims than they put aside in accruals, and relied on the warranty reserve fund to cover the difference. Inflation is driving up warranty costs across the board in the vehicle industry.

Ever since mid-2021, when Traton SE (formerly Volkswagen Truck & Bus AG) completed its acquisition of Navistar, we've struggled a bit with how to present the following data. With Navistar now based in Europe, and its data reported alongside Volkswagen's passenger car numbers, the list of publicly trading, U.S.-based on-highway truck manufacturers is down to just two that pay more than roughly $10 million in warranty claims quarterly: Paccar Inc., which owns the Kenworth and Peterbilt brands, and Oshkosh Corp. Mack Trucks has been owned by Volvo AB since 2000. And Daimler Truck owns not just Mercedes-Benz Trucks, but also the American brands Freightliner and Western Star.

For this newsletter, we decided that rather than group Paccar and Oshkosh with the heavy equipment manufacturers, we would group them with other makers of large, heavy-duty on-highway vehicles, namely recreational vehicles and buses. So Figures 5-8 feature ten years of quarterly warranty expenses for Paccar, Oshkosh, Thor Industries Inc., Winnebago Industries Inc. There is a bit of overlap with our newsletter "Recreational Vehicle Warranty Expenses" from early December, so we won't dwell on the data for the two RV manufacturers too much. But these four companies are the four largest U.S.-based manufacturers of on-highway heavy vehicles.

We created similar top four lists for two other subsets of the large vehicle manufacturing sector: heavy equipment, and powertrain. Our top four heavy equipment manufacturers, featured in Figures 1-4, are Deere & Co., Caterpillar Inc., AGCO Corp., and Terex Corp. For a global perspective on the heavy equipment warranty data, take a look at our newsletter "Worldwide Heavy Equipment Warranty Report" from last November. Keep in mind that the 2023 data are not included in that report, since the internationally-based companies report annually, not quarterly. For similar reasons, we were not able to include Deere's fourth quarter 2023 data in this newsletter, although the company already filed its 2023 annual report in mid-December, since its fiscal year is from November to October.

Our third industry subset is the powertrain manufacturers, led by Cummins Inc. Cummins has had some unfortunate warranty and recall news recently. First, the U.S. Department of Justice announced at the end of December that Cummins will be required to pay over $1.67 billion in fines for violation of the Clear Air Act. The DOJ accuses Cummins of installing devices that can bypass or defeat emissions controls on over 600,000 2013-2019 Dodge Ram 2500 and 3500 pickup truck engines, as well as "undisclosed auxiliary emission control devices" on over 300,000 2019-2023 Ram engines.

The $1.67 billion was already the largest fine ever secured under the Clean Air Act. But it was announced earlier this month that the DOJ is fining Cummins an additional $325 million for pollution remedies, in partnership with the Environmental Protection Agency (EPA) and the California Air Resources Board. And furthermore, Cummins is being required to recall all 600,000 Ram trucks manufactured from 2013 to 2019 with the illegal software installed. California AG Rob Bonta stated, "Let this settlement be a lesson: We won’t let greedy corporations cheat their way to success and run over the health and wellbeing of consumers and our environment along the way."

Of course, this story is too recent to show up in the data in this newsletter. We expect massive warranty accruals from Cummins over the course of 2024, as we watch the numbers behind this story unfold in the warranty data. In Figure 10, we'll be able to look back at Cummins' relatively minor run-in with costs associated with failing emissions standards back in 2018, which can give us a bit of insight into what we can expect from them in the coming year.

Cummins is by far the largest U.S.-based powertrain manufacturer. But three more pay roughly $10 million or more in warranty claims per quarter, and round out the top four in Figures 9-12: BorgWarner Inc., Dana Inc., and Allison Transmission Holdings Inc.

For each of the 12 manufacturers in this report, we gathered three key warranty metrics from each quarterly and annual report: the amount of claims paid, the amount of accruals made, and the amount of reserves held. We also gathered data on total product sales revenue, in order to fashion our two warranty expense rates: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

We'll start with the nine-month 2023 data for the top U.S.-based heavy equipment manufacturers, primarily makers of construction and agricultural equipment.

Heavy Equipment Warranties

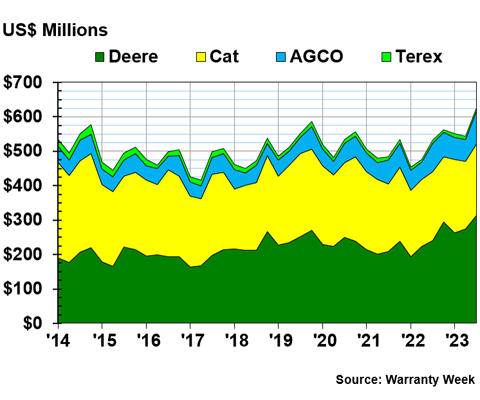

Figure 1 depicts the total warranty claims paid by each of the four manufacturers over the past ten years.

Figure 1

Heavy Equipment Warranties:

Claims Paid by Top U.S.-based Manufacturers

(in US$ millions, 2014-2023)

The nine-month claims total rose for all four manufacturers in this group. Deere paid $851 million in claims during the first three quarters of fiscal 2023, up 30% from the same period the year prior. Caterpillar paid $617 in the first three quarters of 2023, up 5% from the same period in 2022. AGCO paid $223 million, up 18% from the year prior, and Terex paid $30 million in claims, up 9%.

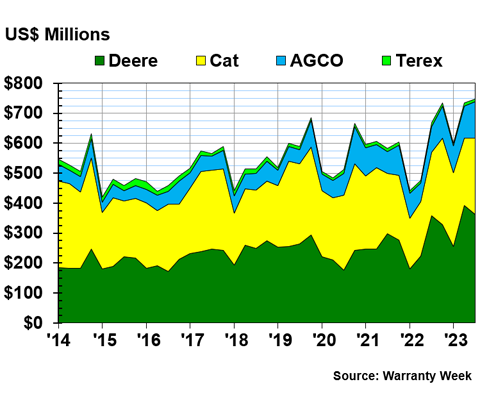

Figure 2 show these four manufacturers' total warranty accruals over ten years.

Figure 2

Heavy Equipment Warranties:

Accruals Made by Top U.S.-based Manufacturers

(in US$ millions, 2014-2023)

All but Terex grew their accruals rather significantly in the first nine months of 2023, compared to the same period of 2022. Deere accrued $1.01 billion in the first three quarters of 2023, up 33% compared to the same period of 2022. Caterpillar accrued $724 million, up 29% compared to the first nine months of the year prior. AGCO accrued $321 million, up 39% from 2022. Terex accrued $28 million, down just -6%.

Oddly, this decrease in accruals means that Terex actually paid more in claims than it set aside in accruals during the same nine-month period. Luckily, there's a bit of padding in the warranty reserves, but not enough padding that this could be sustainable for more four quarters before the funds are depleted.

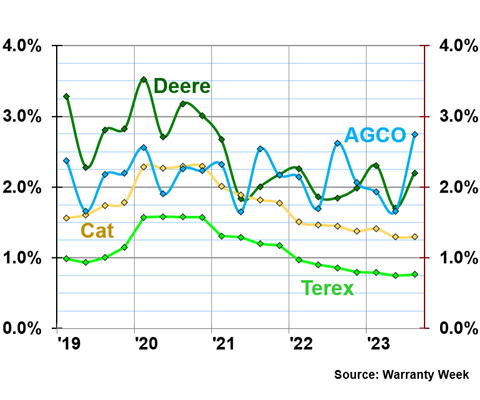

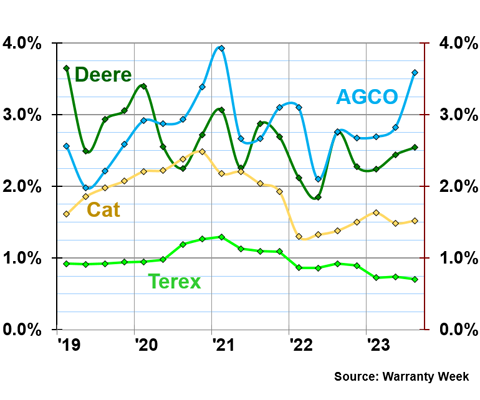

Figure 3 shows five years of warranty claims rates for each of these four heavy equipment manufacturers.

Figure 3

Heavy Equipment Warranties:

Claims Rates for Top U.S.-based Manufacturers

(as % of product revenue, 2019-2023)

AGCO has the highest claims rate of the bunch, meaning it spends the highest proportion of sales revenue on warranty claims. In the third quarter of 2023, AGCO had a claims rate of 2.7%, the highest we've seen from the company over five years.

Deere has the next-highest claims rate, at 2.2% in the third quarter of 2023. While this is a little higher than last year, these claims rates are much lower than what we saw from the company in 2019 and 2020.

Caterpillar's claims rates have been steadily falling over the past few years. In the third quarter of 2023, the claims rate was 1.3%, the lowest we've seen from them in the past five years.

Terex has the lowest claims rate of the bunch. In the third quarter of 2023, the company paid just 0.8% of sales revenue in warranty claims.

Figure 4 shows five years of warranty accrual rates for each manufacturer.

Figure 4

Heavy Equipment Warranties:

Accrual Rates for Top U.S.-based Manufacturers

(as % of product revenue, 2019-2023)

AGCO also has the highest accrual rate of the bunch, at 3.6% in the third quarter of 2023. This is a rather high proportion of sales revenue to spend on warranty accruals, especially compared to the global industry-wide average of 1.2%.

Deere had an accrual rate of 2.5% during the third quarter of 2023. Caterpillar's accrual rate was 1.5% during the same quarter, and Terex had an accrual rate of 0.7%.

Large On-Highway Vehicle Warranties

The next four companies are equally divided between on-highway truck manufacturers and recreational vehicle and bus manufacturers. All make heavy-duty vehicles intended for road use, as opposed to the heavy equipment used for construction, mining, agriculture, etc.

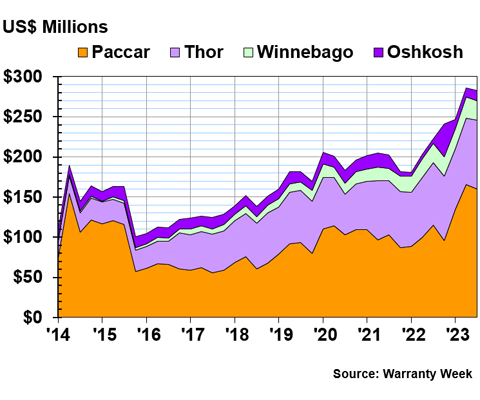

Figure 5 shows the total warranty claims payments for the four largest U.S.-based on-highway heavy duty vehicle manufacturers over the past ten years.

Figure 5

Large On-Highway Vehicle Warranties:

Claims Paid by Top U.S.-based Manufacturers

(in US$ millions, 2014-2023)

Once again, all four manufacturers saw their warranty claims totals rise from the first nine months of 2022 to the first nine months of 2023. Paccar, the largest U.S.-based truck manufacturer, has seen warranty claims rise significantly in 2023. The company spent $460 million in claims during the first three quarters of 2023, up 52% from the same period the year prior.

Thor paid $244 million in claims during the first three quarters of 2023, up 11% from the same period in 2022. Winnebago paid $75 million in claims, up 10%. And Oshkosh paid $37 million in claims during the first nine months of 2023, up a whopping 132% from the same period of 2022.

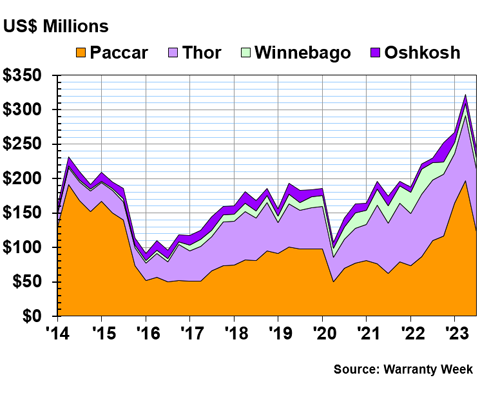

Figure 6 shows these four manufacturers' warranty accruals over the same period.

Figure 6

Large On-Highway Vehicle Warranties:

Accruals Made by Top U.S.-based Manufacturers

(in US$ millions, 2014-2023)

We can see that Paccar's accruals spiked during the second quarter of 2023, to almost double the accruals of a typical quarter. So although accruals dropped in the third quarter, the nine-month total of $484 million is 80% higher than the nine-month total from 2022.

Thor's accruals technically increased, with the nine-month total of $258 million in 2023 1% higher than the nine-month total from 2022. Oshkosh nearly doubled its warranty costs, with the nine-month accrual total up 93% to $42 million.

Winnebago almost halved its accruals to $49 million in the first three quarters of 2023, down -47% compared to the same period of 2022. Remember that Winnebago paid $75 million in claims; the company seems to be in the process of depleting its warranty reserve fund. As with Terex, it's not sustainable in the long-term. Winnebago has five more quarters like this before it runs out of reserve funds.

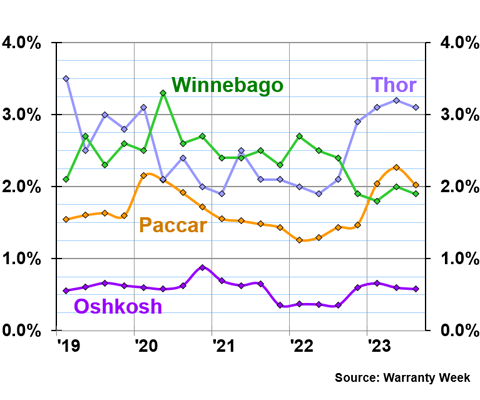

Figure 7 shows five years of quarterly claims rates for these four manufacturers.

Figure 7

Large On-Highway Vehicle Warranties:

Claims Rates for Top U.S.-based Manufacturers

(as % of product revenue, 2019-2023)

Thor has the highest claims rate of the bunch, at 2.9% in the third quarter of 2023. The claims rate has spiked up compared to where it was a year ago. So although total claims only rose 11%, as we saw in Figure 5, the claims rate increased by around two-thirds, meaning that warranty claims costs are now a higher proportion of total product sales revenue. It makes sense, considering the RV sales boom of 2020 and 2021. Sales have waned, and many of those vehicles sold a few years ago are now coming in for repairs under warranty, after a few camping trips and national parks visits.

Winnebago has a similar story, with the claims rate rising more steeply than the claims total. The company's claims rate was 2.8% during the third quarter of 2023.

Paccar had a claims rate of 1.9% in the third quarter of 2023. The rate has been falling for the company since 2020, because the increases in total claims are exceeded by increases in revenue.

Oshkosh's claims rate remains under 1%, at 0.5% in the third quarter of 2023. Still, that's almost double what the rate was just a year prior, meaning that the huge increases in warranty expenses we saw in Figures 5 and 6 cannot be explained by increases in revenue.

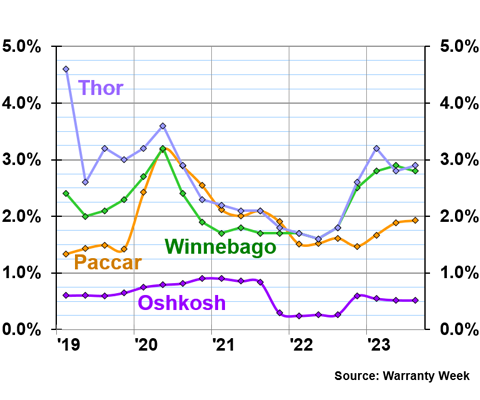

Figure 8 shows the accrual rates for these four companies over the same period.

Figure 8

Large On-Highway Vehicle Warranties:

Accrual Rates for Top U.S.-based Manufacturers

(as % of product revenue, 2019-2023)

Thor has the highest accrual rate too, at 3.1% in the third quarter of 2023. Thor's accrual rate increased by about one-half over the last year, but we can see in Figure 8 that this is not the first time the company's accrual rate has exceeded 3%.

Paccar's accrual rate was 2.0% during the third quarter of 2023, up by about one-half from the year prior, but about on par with where the rate was back in early 2020. Winnebago had an accrual rate of 1.9%. And Oshkosh has the lowest accrual rate of the bunch, at 0.6% in the third quarter, though this rate also rose by about two-thirds over one year.

Powertrain Warranty Expenses

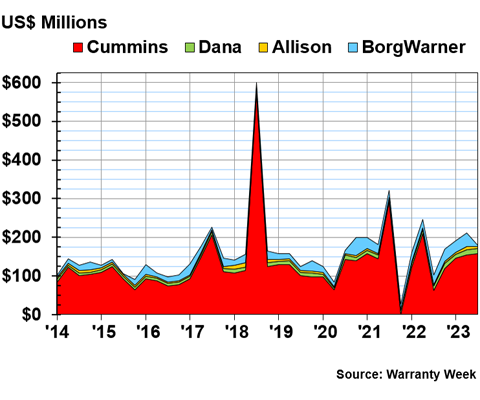

Our final grouping of charts shows the warranty expenses of the four top U.S.-based powertrain manufacturers. Figure 9 shows their total quarterly warranty claims over ten years.

Figure 9

Powertrain Warranties:

Claims Paid by Top U.S.-based Manufacturers

(in US$ millions, 2014-2023)

Cummins is actually the only one of the twelve manufacturers in this newsletter that saw its total claims fall from the first three quarters of 2022 to the same period of 2023. The company paid $429 million in claims during the first nine months of 2023, down -10% from the first nine months of 2022.

BorgWarner paid $79 million in claims in the first nine months of 2023, up 12% from the same period the year prior. Dana paid $40 million, up 21% from the year prior. And Allison paid $30 million, up 25% from the year prior.

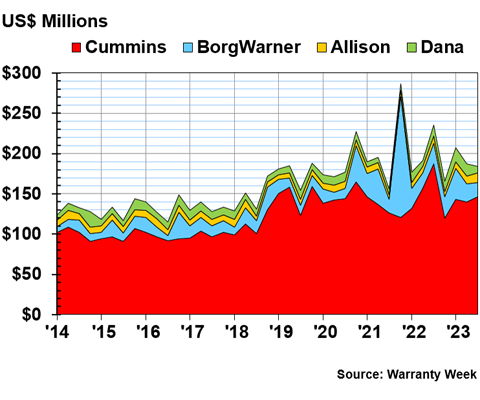

Figure 10 shows these four manufacturers' total warranty accruals over ten years.

Figure 10

Powertrain Warranties:

Accruals Made by Top U.S.-based Manufacturers

(in US$ millions, 2014-2023)

Cummins evidently dominates this chart, largely in thanks to the huge lump sum accrual of $571 million it made back in the third quarter of 2018 in response to some struggles with meeting EPA and California emissions standards. More recently, it zig-zagged in 2021, accruing double in the third quarter, and then zero in the fourth. In the first nine months of 2023, Cummins accrued $458 million for warranty expenses, up 16% from the same period the year prior.

BorgWarner is the only one of the group that managed to drop its accruals in the first three quarters of 2023, because the company dropped accruals by -89% from the second to the third quarter. The company accrued $68 million over nine months, down just -4% compared to the same period of 2022. Note that the company's claims total of $79 million exceeds its total accruals. The company has more wiggle room here, though, with almost three years' worth of funds currently sitting in the warranty reserves.

Dana's nine-month accruals were up by 19% to $37 million in 2023.

Allison's accruals were up 54% to $20 million in the first three quarters of 2023. Strangely, despite this sharp increase in accruals, the nine-month claims total in Figure 9 exceeds this nine-month accrual total. In fact, we looked into it, and the last time that Allison's total quarterly accruals exceeded its claims was at the end of 2018. So the company has been spending more than its accrues for nearly five full years, depleting its warranty reserve fund to make up for the difference. We calculate that Allison only has enough buffer money sitting in its warranty reserve fund for this accounting methodology to be sustainable for about five more quarters.

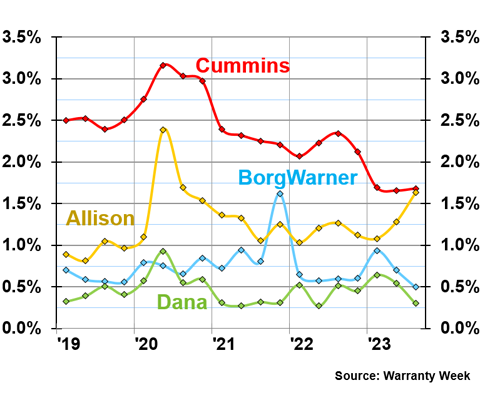

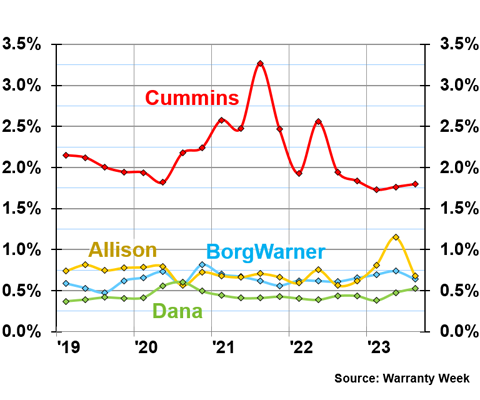

Figure 11 shows the four manufacturers' quarterly warranty claims rates over five years.

Figure 11

Powertrain Warranties:

Claims Rates for Top U.S.-based Manufacturers

(as % of product revenue, 2019-2023)

Cummins' claims rate fell by an even larger proportion than total claims did in 2023. In the third quarter, Cummins had a claims rate of 1.7%, down about one-quarter compared to the third quarter of 2022.

In the third quarter of 2023, Allison Transmission had a claims rate of 1.6%, BorgWarner had a claims rate of 0.5%, and Dana had a claims rate of 0.3%.

Figure 12 shows the four companies' accrual rates over the same period.

Figure 12

Powertrain Warranties:

Accrual Rates for Top U.S.-based Manufacturers

(as % of product revenue, 2019-2023)

In the third quarter of 2023, Cummins had an accrual rate of 1.8%. Allison had an accrual rate of 0.7%, BorgWarner was at 0.6%, and Dana was at 0.7%.