Worldwide Aviation & Jet Engine Warranty Report:

Claims were up a bit for the aircraft and down for the engines, while accruals were up more dramatically for both groups. Warranty expenses of the jet engine suppliers continue to be higher than those of the airframe OEMs. Sales have been slow to rise post-2020, so the accrual rates were up for both groups.

Something happened in 2020 that dramatically affected the global aviation industry. We'll say the word just once, and refrain from mentioning it again in this newsletter. Just so we're all on the same page, here it is: pandemic.

The thing is, although air travel passenger totals fell by about 95% at its lowest point in 2020, the number of flights only fell by about 60%, because airlines were flying empty planes from airport to airport to ensure they could keep their gates and landing slots.

And things don't move very fast in this industry, not nearly as rapidly as lockdowns spread around the world in the first few months of 2020. So air travel decreased drastically in 2020, but the number of flights fell less, and the revenue of the world's top airframe manufacturers fell by even less, only down by 30%. And the revenues of the world's largest jet engine manufacturers fell by just 6% from 2019 to 2020.

To compile this report, we gathered data on the warranty expenses of the world's top airframe and jet engine manufacturers, from their annual reports and quarterly financial statements. We measured three key warranty metrics: the amount of claims paid, the amount of accruals made, and the year-end balance in the warranty reserve fund. We also gathered data on their product sales revenue, which we used to create our two percentage rates: claims as a percent of sales (the claims rate), and accruals as a percent of sales (the accrual rate).

Worldwide Aviation Industry Structure

The world of civilian aircraft manufacturers can be split into three segments. First are the commercial airliner manufacturers, led by the American Boeing Company and the European Airbus SE. Then there are three manufacturers of the smaller commercial aircraft typically used for shorter regional flights: the Canadian Bombardier Inc., the Brazilian Embraer SA, and the French-Italian Avions de Transport Regional (ATR), created as a joint venture between Airbus and Leonardo S.p.A..

However, in 2018, Airbus acquired a 50.01% stake in Bombardier's CSeries commercial aircraft, which it renamed the Airbus A220. And then in 2020, Airbus acquired an additional 25% stake in the Airbus Canada Limited Partnership, the holding company for the A220, effectively buying Bombardier out of the commercial aviation sector. Bombardier now focuses exclusively on business aviation.

Also in 2018, Boeing announced plans to acquire 80% of Embraer's commercial aviation division, likely in response to Airbus' acquisition of that of Bombardier. However, Boeing canceled this plan in April 2020, so Embraer is still currently engaged in commercial aviation, as well as defense and business. So in effect, we have Airbus and Boeing in a duopoly in the commercial aviation industry, but Embraer is still holding on in a rather distant third.

The second segment of the airframe manufacturing industry are the general aviation manufacturers, who make everything from antique biplanes for air shows to modern business jets that can fly close to the speed of sound. As we mentioned, market leaders include Bombardier, with its Learjets, Challenger, and other aircraft brands; Embraer, Boeing, and Airbus all also dabble in corporate and private jets. There's also Textron Inc., owner of the Cessna and Beechcraft brands, General Dynamics Corp., through its Gulfstream Aerospace Corp. subsidiary, and the Dassault Aviation Group, maker of the Falcon family of business jets.

And then there is a third segment: the military plane manufacturers, led by the U.S. company Lockheed Martin Corp., and by its global superpower arch-rivals the Aviation Industry Corporation of China (AVIC), and United Aircraft Corp. PJSC (UAC) of Russia. The latter two are both majority state-owned, by China and Russia respectively, and as one might expect, neither reports any warranty expense data. For AVIC and UAC, we crafted estimates for inclusion in this report; however, the manufacturers that do publish their warranty expenses accounted for 87% of the industry's worldwide sales in 2022.

Lockheed Martin does report, but in the United States, big-ticket military contracts typically do not come with traditional product warranties, but rather with a distinct type of military service contract. These expenses are not reported. As such, we do not factor revenue generated from military contracts into the segmented product sales revenues we use to calculate our warranty expense rates, including for Boeing, General Dynamics, etc. So Lockheed Martin, as well as its American peer Northrop Grumman Corp., do not make the list of the top nine global airframe OEMs in terms of warranty expenses, and what small warranty expenses they do report are factored into the Other category.

For ease of comparison, we've converted all the worldwide figures to U.S. dollars using the U.S. Internal Revenue Service's Yearly Average Currency Exchange Rates.

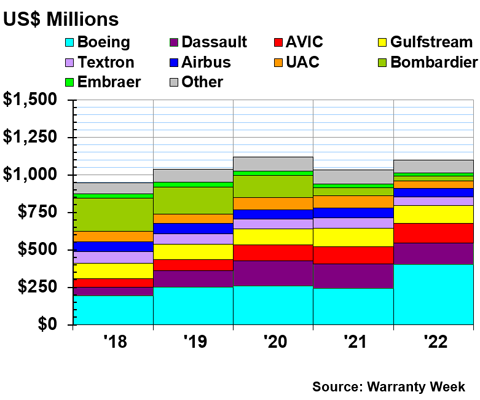

Warranty Claims Totals

Without any further ado, Figure 1 shows the total claims payments reported by the global airframe manufacturers over the past five years, as well as the estimates we've fashioned for AVIC and UAC. We estimate the industry claims total was $1.097 billion in 2022, up 6% from 2021.

Figure 1

Top Airframe Makers Worldwide

Claims Paid per Year

(in millions of U.S. dollars, 2018-2022)

The worldwide claims total rose in 2022, but is still lower than the total reported in 2020. Part of this high figure in 2020 was Boeing's heightened expenses from the 737 MAX groundings, which were mandated by the U.S. Federal Aviation Administration (FAA) along with the regulatory bodies of over 80 other countries, from March 2019 to November 2020. For a more in-depth discussion of the 737 MAX groundings and associated costs, as well as Boeing's costs from the grounding of the 787 Dreamliner a decade ago, take a look at our 20-year U.S. Aerospace Warranty Report from earlier this year.

Boeing's total claims didn't rise dramatically in 2019 or 2020 because the extra accruals were put into a separate, 737 MAX-only fund, and not reported as warranty expenses. So we were especially surprised to find that Boeing's total claims payments rose by two-thirds from 2021 to 2022, from $241 million to $403 million.

We can see in Figure 1 that Bombardier's claims total fell significantly in 2019, when Airbus acquired the 50% stake in the A220, and again in 2021, when Airbus acquired another 25% (the final 25% is owned by private equity, and Bombardier no longer has a stake in the A220). However, Airbus' claims total barely budged over the past five years. It's possible that Airbus really did solve the problems with the A220 that brought Bombardier to the brink of bankruptcy.

Among the companies for which we have hard data, Boeing was the only one to see its claims total rise from 2021 to 2022. Claims fell the most for Bombardier, -34%, and for all the other OEMs by around -15% on average.

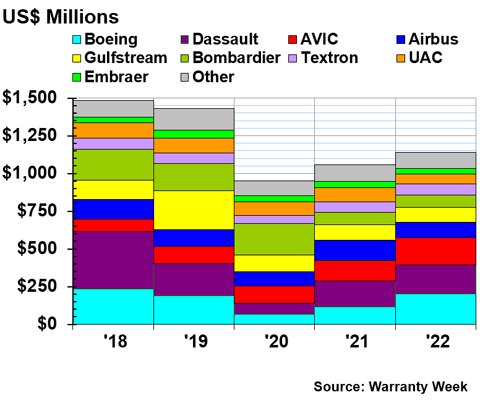

Warranty Accrual Totals

Figure 2 shows the total warranty accruals for the airframe OEMs from 2018 to 2022. Accruals fell by one-third in 2020, coinciding with the drop in revenues.

Figure 2

Top Airframe Makers Worldwide

Accruals Made per Year

(in millions of U.S. dollars, 2018-2022)

Accruals among the airframe manufacturers totaled an estimated $1.14 billion in 2022, an 8% rise from 2021. Based on Figure 2, one could assume that accruals, and perhaps thus revenues, have been very slow to rebound since 2020. In fact, Dassault had extremely high accruals in 2018, and Gulfstream had very high accruals in 2019, which brought the industry totals for those two years higher than normal. Total accruals for the industry in 2022 were at the same level as they were in 2017, meaning the dip in 2020 wasn't as dramatic as it might look, and the recovery was swifter than it seems on first glance.

The biggest change in total accruals from 2021 to 2022 was again Boeing, which rose its accruals by three-quarters to $202 million. A 67% increase in claims and 74% increase in accruals over the course of one year is huge, and it's definitely intriguing that Boeing didn't offer any explanation for these changes in its 2022 annual report.

Airbus had the biggest decrease in accruals, down -23% to $104 million.

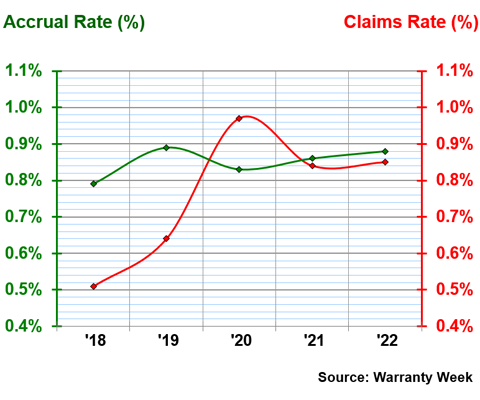

Warranty Expense Rates

We estimate that across the industry, sales rose by 5% from 2021 to 2022, claims rose by 6%, and accruals rose by 8%. As such, the industry average claims and accrual rates both remained proportional to each other from 2021 to 2022.

In 2022, the industry's average claims rate was 0.85%, and the average accrual rate was 0.88%. There isn't necessarily an issue with these two averages being so close together, but it is notable that the gap between the two used to be much wider.

Figure 3

Top Airframe Makers Worldwide

Average Claims & Accrual Rates

(as a % of product sales, 2018-2022)

The most interesting trend that emerges in Figure 3 is the significant narrowing of the gap between the claims rate and the accrual rate, pre- and post-2020. The accrual rate has remained steady, meaning that the industry has been accruing the same amount per aircraft sale for years. On the other hand, the claims rate has risen, so a much larger proportion of product sales revenue is being spent on warranty claims payments. And yet costs from the 737 MAX groundings, the highest-profile product failure in this industry in recent years, are not factored in.

Among the individual top nine companies, Dassault has the highest claims rate, at 4.1% in 2022. Compared to 2019, Gulfstream and Boeing both also have claims rates higher than they used to.

Dassault also had the highest accrual rate in 2022, at 5.6%. Dassault's claims and accrual rates are both currently about double what used to be their norm.

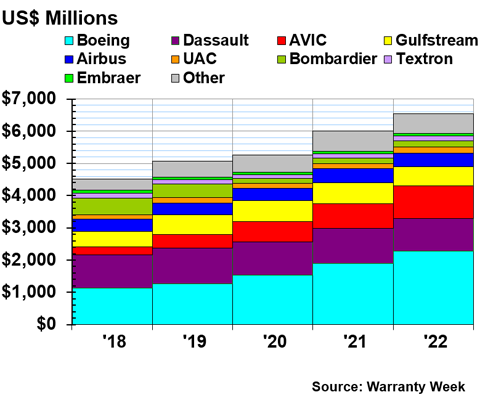

Warranty Reserve Balances

As we see in Figure 4, despite the average accrual and claims rates coming closer together, warranty reserve balances in the industry have been on the rise consistently for the last five years. So this industry is spending a higher proportion of sales revenue on claims than it used to, and is accruing the same amount proportional to sales, but surplus funds are still getting deposited into warranty reserves at the end of each year.

Figure 4

Top Airframe Makers Worldwide

Reserves Held per Year

(in millions of U.S. dollars, 2018-2022)

Warranty reserve balances have risen for the industry every year since 2018. The largest increase was from 2020 to 2021, when the industry's collective reserve balance increased by 14%. From 2021 to 2022, reserves increased by 9%, to a total of $6.54 billion.

Among those for which we have hard data, Boeing's warranty reserves increased the most, by 20% to $2.275 billion. Textron's reserves increased by 17%, and Bombardier's increased by 11%. Dassault, Gulfstream, Airbus, and Embraer all saw slight decreases in their reserves, all by less than 7%.

Jet Engine Market

The jet engine market is of comparable size to the aircraft market; in 2022, airframe manufacturers generated an estimated $129 billion in revenue, compared to the jet engine manufacturers' $137 billion. However, the jet engines generate a lot more warranty expenses than the aircraft they're attached to, as the following charts will illustrate.

The list of the world's top jet engine manufacturers includes Rolls-Royce Holdings plc; General Electric Co.'s subsidiary GE Aerospace, which is scheduled to split from GE's power division (now known as GE Vernova) at the beginning of 2024; Raytheon Technologies Corp., which merged with United Technologies Corp. in 2020 and gained the Pratt & Whitney brand; the French Safran Group SA's subsidiary Safran Aircraft Engines; Honeywell Aerospace, a division of Honeywell International Inc.; the German MTU Aero Engines AG; and the privately-held Williams International.

There are also several joint ventures amongst and between some of the top industry players. The Engine Alliance is a joint venture between GE Aerospace and Pratt & Whitney. CFM International is a joint venture between GE Aerospace and Safran Aircraft Engines. Safran also has a joint venture with Boeing Co. to produce auxiliary power units for aircraft.

PowerJet is a joint venture between Safran and the Russian UEC NPO Saturn, though information about it is not currently forthcoming from either company, likely due to the war in Ukraine. International Aero Engines AG, also known as IAE, is a joint venture of Pratt & Whitney, MTU Aero Engines, and the consortium Japanese Aero Engine Corp. Rolls-Royce and spaceship manufacturer Avio S.p.A., formerly Fiat Avio, are previous IAE shareholders. However, those two along with MTU and ITP Aero, a Spanish subsidiary of Rolls-Royce, are also partners in a military aerospace engine consortium called EuroJet Turbo GmbH.

There's also several manufacturers in Russia and China, but as one would expect, there's no publicly available warranty data for these companies, and we might be on a list after a lot of research on Chinese and Russian defense manufacturers for this report.

The following charts include data from the top six jet engine manufacturers, without conjecture or estimates about the size of the global industry, especially those manufacturers owned by international governments, but also the few small, privately-held manufacturers such as Williams.

None of the six companies segment their warranty expenses, and GE, Honeywell, Raytheon, and Rolls-Royce all manufacture much more than just jet engines. But since we have no data about the rate at which warranty expenses arise in their aviation product lines, as opposed to automotive, appliances, power generation, etc., we will avoid conjecture and present the numbers we are given.

Engine Warranty Claims Totals

First we'll take a look at the total annual claims payments reported by each of the world's top six jet engine manufacturers.

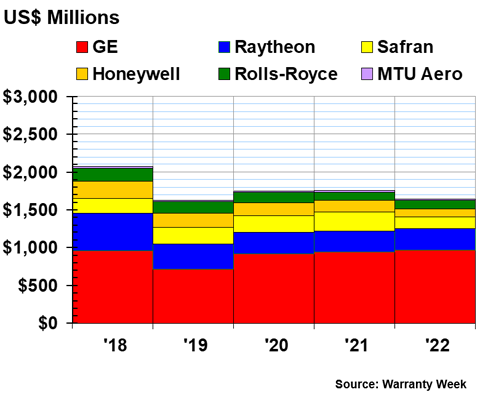

Figure 5

Top Jet Engine Makers Worldwide

Claims Paid per Year

(in millions of U.S. dollars, 2018-2022)

These six companies paid a collective $1.638 billion in claims in 2022, down -6% from the year prior. Safran had the biggest drop of -40%, from $251 million in 2021 to $150 million in 2022. Honeywell's claims total dropped by -28% to $115 million, and MTU's total dropped by -27% to $15 million. GE, Raytheon, and Rolls-Royce all saw very slight increases in their claims totals, none exceeding 5%.

Engine Warranty Accrual Totals

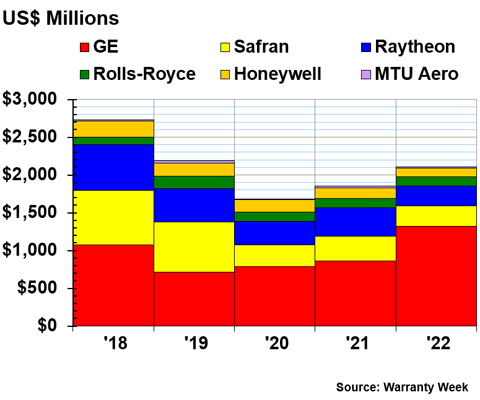

Total accruals for these six jet engine manufacturers increased by 14% from 2021 to 2022, while product sales revenue only rose by 2%. As we will see in Figure 7, this helped drive up the accrual rate, while the claims rate fell a bit.

Accruals totaled $2.109 billion in 2022, broken down by company in Figure 6.

Figure 6

Top Jet Engine Makers Worldwide

Accruals Made per Year

(in millions of U.S. dollars, 2018-2022)

GE increased its accruals by 53% from 2021 to 2022. Now, it's possible that these increased accruals are a response to wind turbine failures, and isn't associated with the jet engine business. Hopefully, if the GE split really happens, we'll finally have segmented data and a better sense of this.

Total accruals actually fell for all of the others, with the exception of Rolls-Royce, which increased its accruals by 5%, or just $5 million total.

Raytheon decreased its accruals the most, by -31% to $264 million. Honeywell decreased accruals by -20% to $117 million. Safran decreased its accruals by -18% to $268 million, and MTU decreased its accruals ever so slightly, by -1%.

Engine Warranty Expense Rates

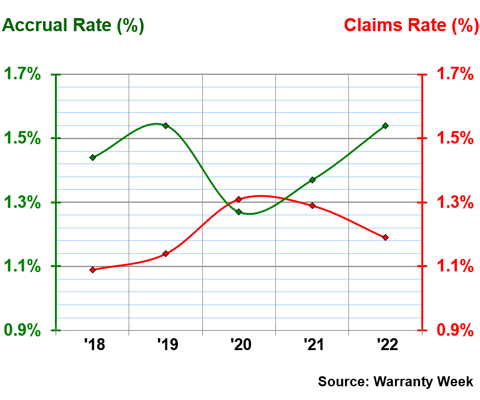

Figure 7 shows the total claims in Figure 5 and the total accruals in Figure 6 in proportion to total product sales revenue.

Figure 7

Top Jet Engine Makers Worldwide

Average Claims & Accrual Rates

(as a % of product sales, 2018-2022)

The industry's average claims rate was 1.19%, down a bit from the year prior. The average accrual rate was 1.54%, up for this metric but not outside of its historical range.

GE saw increases in its claims and accrual rates. In 2022, its accrual rate was 4.12%, and its claims rate was 3.02%, both much higher than the average.

Also above average is Rolls-Royce, which had a claims rate of 1.50% and an accrual rate of 1.69% in 2022.

Safran, MTU, Raytheon, and Honeywell all saw their accrual rates decrease, and three of the four, with the exception of Raytheon, saw their claims rates decrease as well. This means they spent a smaller proportion of their product sales revenue on warranty expenses than the year prior, and on average, have been spending less than is typical for the industry.

This industry is unique in that the suppliers, in this case the jet engine manufacturers, actually spend a higher proportion of their revenue on warranty expenses, as opposed to the OEMs, the airframe makers. Typically, we see the OEMs, who usually have direct contact with consumers, taking on more warranty expenses than their suppliers. It makes sense that this industry is different, because the vast majority of aircraft sales are between corporations, or between corporations and governments. This also explains the relatively low expense rates for both the airframe and jet engine makers, compared to, for example, average automotive warranty expense rates, which are usually around 2.5%.

Engine Warranty Reserve Balances

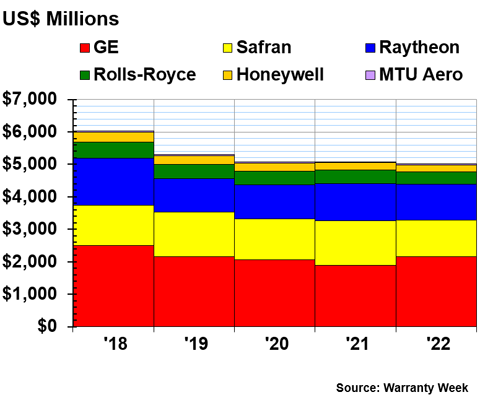

Our final metric, charted in Figure 8, is the year-end balance in the warranty reserve fund of each of the six top jet engine manufacturers.

Overall, reserves stayed just about the same, decreasing by just -1% to $5.009 billion at the end of 2022. However, within that total, the proportions represented by each company shifted a little.

Figure 8

Top Jet Engine Makers Worldwide

Reserves Held per Year

(in millions of U.S. dollars, 2018-2022)

Five of the six manufacturers saw their warranty reserve balances decrease from the end of 2021 to the end of 2022. Proportionally, MTU had the largest decrease in reserves, by -30%, though it has the lowest total by far, at only $20 million. Safran had the next-largest drop in its reserve balance, down by -18% to $1.12 billion. Rolls-Royce, Raytheon, and Honeywell all saw their reserve balances decrease by less than -10%.

GE was the only company to see reserves increase, up by 14% to $2.15 billion. But since GE is so much larger than the others, that increase was about the same size as all of the other decreases combined.

We are eager to see GE Aerospace's warranty reserve balance and other metrics after the split, supposedly coming at the beginning of next year. Now that Raytheon has divested elevator brand Otis and HVAC company Carrier Global, former United Technologies subsidiaries, we have a much better idea of Raytheon's warranty expenses in aerospace. If GE follows through with this as planned, we may soon get a better sense of the warranty expenses for jet engines specifically, separate from other ventures.