U.S. EV-Only Warranty Expense Rates:

The U.S.-based, EV-only OEMs are still mastering their warranty expenses and accounting practices. They should follow the example of market-leader Tesla, which has had amazingly consistent claims and accrual rates since 2018. But even Tesla reveals that it can take years for startups to get there, especially while experimenting with innovative new technology.

In last week's newsletter, we featured five Chinese electric vehicle (EV) manufacturers, four of which only started reporting their warranty expenses during the last five years. This week, we're doing the same thing for the U.S.-based, EV-only OEMs. Like their Chinese counterparts, only one of the companies in this report is older than a decade; the rest only started reporting recently, though only half report at all.

Last week, we identified the trend that all of the EV-only OEMs consistently had accrual rates much higher than their claims rates, meaning that they were spending just a fraction of what they put aside for possible warranty costs. In other words, they were erring on the side of caution, to an extreme. This makes sense for companies that, in most cases, have been manufacturing their vehicles for less than a decade. Though these high accruals can seem excessive, we'll see with the American EV-only OEMs that fears can come true, and product failures and recalls can be extremely costly, especially when so few units are manufactured and sold in the first place.

Though the trend holds for the American EV manufacturers, it's not nearly as neat. Our formulas produced some very weird and wonky numbers, which we double- and triple-checked because they just seemed impossible. In two quarters, one of these OEMs reported negative vehicle sales revenue, so it ended up with negative claims and accrual rates. And then in the two quarters after that, that same OEM had positive vehicle sales revenue, but it was so low that total claims and accruals both exceeded it, and it ended up with an accrual rate of 600% and a claims rate of 2500%. Generally, auto OEMs should want their warranty expense rates to average around 2.5%. The data doesn't lie.

To produce this report, first we identified 15 EV-only manufacturers based in the United States. Seven of those 15 do not currently report their warranty expenses in their annual or quarterly reports. We'll give them a mention here, so they know we're thinking of them, and a little nudge to begin following FTC reporting guidelines, assuming they're currently manufacturing units that come with warranties. Those companies are: Rivian Automotive Inc., Mullen Automotive Inc., Faraday Future Intelligent Electric Inc., Lordstown Motors Corp., Fisker Inc., Ideanomics Inc., and Volcon Inc.

That leaves us with eight U.S.-based EV manufacturers for which we have revenue and warranty expense data. Five of those companies had data that were complete and made sense to visualize for this report: Tesla Inc., Proterra Inc., Lucid Group Inc., Lightning eMotors Inc., and Hyliion Holdings Corp. Note that Proterra filed for Chapter 11 bankruptcy earlier this week, but since we have the data, we'll still present them.

The three remaining companies are Workhorse Group Inc., Nikola Corp., and Phoenix Motor Inc. These three do report their warranty expenses, but they're new companies, and some of the data are incomplete or just do not make much sense. Phoenix only reports its claims totals, but not its accruals. Nikola Corp.'s CEO was recently found guilty of fraud, and we only have three quarters of complete data for the company anyway. Workhorse Group is the company we mentioned earlier with the claims rates in the negatives and in the thousands due to troubles generating product revenue.

For each of the eight companies, we gathered three key warranty metrics from their annual reports and quarterly financial statements: total claims paid, total accruals made, and the balance held in the warranty reserve fund at the end of each quarter. In addition, we gathered data for each OEM's segmented vehicle product sales revenue. We used these to calculate the two expense rates we present for each company in this report: claims as a percentage of product sales (the claims rate), and accruals as a percentage of product sales (the accrual rate).

EVs in the USA

As we will see in this report, the Chinese EV-only OEMs have lower average claims and accrual rates, though they are about the same age as their American counterparts in the industry.

One exception to the rule is Tesla Inc., which is the EV-only startup success story, and a top player in the global EV market right now. Tesla's global EV sales are comparable to those of BYD, China's largest EV-only OEM (note that BYD also makes plug-in hybrids). In addition, Lucid Group is a promising EV startup, though the scale of the number of units they manufacture and sell annually is much smaller than its direct competitors in China, Nio, Li Auto, and XPeng.

EV adoption is lagging in the United States compared to China and Europe, though recent policy aims to accelerate this. In our June 22 newsletter, we discussed the new United States tax credits that incentivize the purchase of electric vehicles, but only specifically those produced in assembly plants in North America, using American raw materials. But of the 20 U.S.-based, EV-only manufacturers we identified for this report, only Tesla and Rivian currently have vehicles that meet both criteria for the full tax credit.

Certainly, the EV-only startups in this report are facing several obstacles that their Chinese counterparts are not. There's a lot of federal and state laws that impede the EV transition, and the fossil fuel industry has a tight grip on both major American political parties. National charging infrastructure is much less developed, and direct-to-consumer sales are limited in many states, limiting sales of passenger cars from EV startups, since they don't have dealerships.

Presumably, all of the 15 U.S.-based EV-only manufacturers we identified for this report are vying to manufacture new vehicles that qualify for the $7,500 tax credit, and capitalize on consumers' growing familiarity with and demand for EVs. However, right now in the United States, Ford and GM actually have more EV passenger car models readily available for purchase than all of the EV-only OEMs combined.

As we've previously reported, GM took a big hit from the recall of the electric battery in its 2017-2022 Chevrolet Bolt EVs, which cost the company about $2 billion back in 2021. But GM's warranty claims and accrual rates are already back to normal, both around 2.5%, and it managed to recover $1.9 billion of that $2 billion back from its battery supplier. In April, GM announced it was discontinuing the Chevy Bolt after all the bad press, but two weeks ago, it reversed that decision. And if you saw the new Barbie movie, you may have noticed some big product placement moments for the company's EV lineup.

Unfortunately, Ford, GM, and all of the other global traditional automotive OEMs do not report their warranty costs for ICE vehicles and EVs separately. The Chevy Bolt story is a unique case that gave us some insight into the costs of a specific EV battery recall, and inspired us to look further into the burgeoning industry.

First, we're going to take a look at the warranty expense rates of Tesla, which is the only one of these companies large enough to show up on a chart with Ford and GM. Once we set the baseline, we'll work our way to the smaller manufacturers.

Tesla

Tesla Inc., formerly Tesla Motors, was founded in 2003, and is headquartered in Austin, Texas, United States. Tesla sold 1.3 million vehicles worldwide during 2022, and probably has the most global brand-name recognition of any EV manufacturer. The company sells four passenger EVs, as well as electric heavy-duty trucks.

Like the Chinese EV OEMs, Tesla also has its own EV charger network. However, GM recently announced they're teaming up with BMW, Honda, Hyundai, Kia, Stellantis, and Mercedes-Benz to build their own chargers to rival Tesla's in North America. These public charging stations usually fall under corporate warranties, but it's possible we'll be hearing about EV charger warranty costs in the future, especially if there's any major technological issues.

This will also be great news for some of the startups, since concerns about range and lack of charging is a huge barrier to EV adoption for large swaths of the United States.

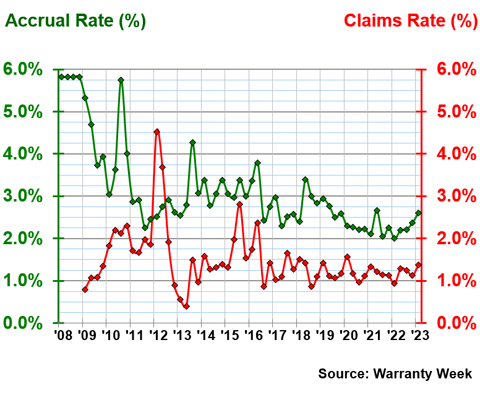

Figure 1 shows Tesla's warranty claims and accrual rates from 2009 to the first quarter of 2023.

Figure 1

Electric Vehicle Manufacturer Warranties:

Tesla, Claims and Accrual Rates,

(as % of product revenue, 2008-2023)

We see in Figure 1 that with the exception of 2012, Tesla's claims rates always fall below its accrual rates. 2012 was the year that Tesla released the Model S, its sedan; before that, it only made the Roadster sports car. It seems that the release of that second vehicle arose challenges, especially with the electric motor and battery. The 2012-2016 Model S was also affected by the Takata airbag recall, which led to the higher claims rates in 2015 and 2016.

The gap between the two rates started off huge in 2009, and has narrowed to about a 1% difference since 2016. Tesla clearly brought new talent into its warranty department around then, and its expense rates have stabilized since. The accrual rate has fallen over the years, but is rising again lately.

Still, the claims rate hovers around 1%, while the accrual rate stays between 2% and 3%. Claims and accrual totals continue to increase each quarter, but so does product revenue. The company has figured out exactly what amount to accrue per vehicle to keep this rate so steady. But it still begs the question, why accrue twice as much money as you spend?

The answer basically seems to be, "Just in case." It's more comfortable to accrue extra funds for a rainy day, especially because the technology is still relatively new, and continually advancing and evolving.

Take a look at our June 22 article U.S. Auto OEM Update for more discussion of the data from the first quarter of 2023, and our March 23 article U.S. Auto Warranty Expenses for discussion of all 14 years of data.

Lucid Group

Our second OEM is Lucid Group, also known as Lucid Motors. Founded in 2007, the company has made electric sports cars and other luxury EVs since 2016. This summer, Lucid signed an agreement with Aston Martin to create the electric motors, powertrains, and batteries for Aston Martin's upcoming line of EVs.

Saudi Arabia's Public Investment Fund owns more than 60% of Lucid Group. Last year, the Saudi Arabian government announced plans to buy anywhere from 50,000 to 100,000 EVs from Lucid. Lucid also plans to open a manufacturing plant in Saudi Arabia in coming years.

Lucid produced about 7,000 EVs during 2022. In its financial report from the fourth quarter of 2022, the company stated it aims to produce 10,000-14,000 EVs during 2023, or around 2,500-3,500 per quarter.

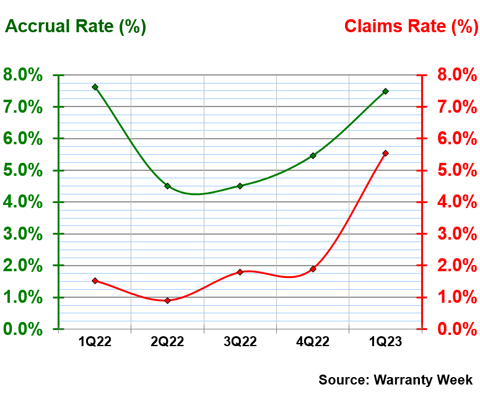

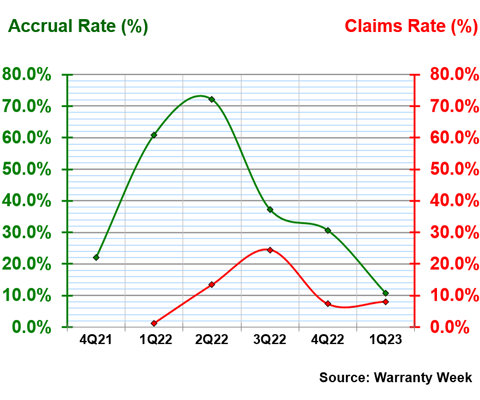

Figure 2 shows Lucid's warranty expense rates for all four quarters of 2022 and the first quarter of 2023. Since Lucid only started reporting at the beginning of last year, there's not too much we can say about these data, but we can note the same pattern of the accrual rate sitting higher on the chart than the claims rate.

Figure 2

Electric Vehicle Manufacturer Warranties:

Lucid Group, Claims and Accrual Rates,

(as % of product revenue, 2022-2023)

Lucid's claims rate jumped at the beginning of 2023. In the fourth quarter of 2022, its claims rate was 1.90%, but in the first quarter of 2023, it was 5.53%. It looks like product sales spiked in the fourth quarter of 2022, and claims totals rose proportionally, keeping the claims rate around the same. In the first quarter of 2023, product revenue dropped back to normal levels, but claims totals stayed relatively the same, causing the claims rate to increase.

The accrual rate jumped as well, from 5.46% at the end of 2022 to 7.49% in the first three months of 2023, for a similar reason.

Proterra

Next is Proterra, which makes electric buses, mainly city buses and school buses. The company has had a partnership with Daimler Truck's subsidiary Thomas Built Buses since 2018. Proterra manufactured around 1,300 electric buses between 2010 and 2022.

On Monday of this week, Proterra announced that it is filing for Chapter 11 bankruptcy. Shares of the company fell 88% on Tuesday.

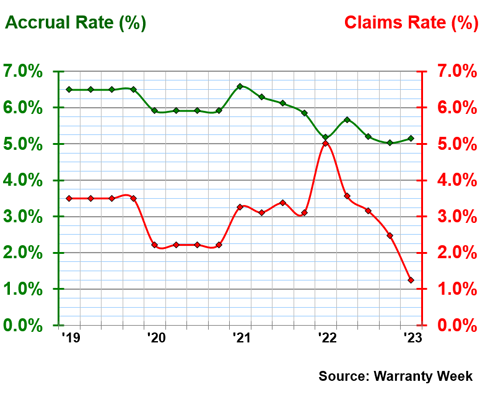

Figure 3 shows annual warranty expense rate data for Proterra for 2019 and 2020, and quarterly data starting in 2021, up until the first quarter of 2023.

Figure 3

Electric Vehicle Manufacturer Warranties:

Proterra, Claims and Accrual Rates,

(as % of product revenue, 2019-2023)

Proterra generally accrued between 5% and 6% of its sales revenue for future warranty costs, but typically paid claims that totaled around 3% of revenue. However, this claims rate dropped in the first quarter of 2023, to just 1.24%. The accrual rate in the first quarter of 2023 was 5.15%.

The recently falling claims seemed to be too little, too late. For one thing, the company was still putting aside a large percentage of its quarterly product revenue in warranty accruals. In addition, there was a recall in mid-2021, and another in 2022, which drove up the claims rate. As we will see with some of the other companies in this report, when you're selling so few units, and have only been around for a few years, it can be very costly to have a big malfunction in all vehicles of a particular make and model year.

Lightning eMotors

Next, we have Lightning eMotors, which makes electric vans, trucks and buses. The company has identified electrifying medium-duty shuttle buses, short school buses, and cargo vans as its niche, though it also makes electric city and coach buses, and electric powertrains to retrofit existing buses.

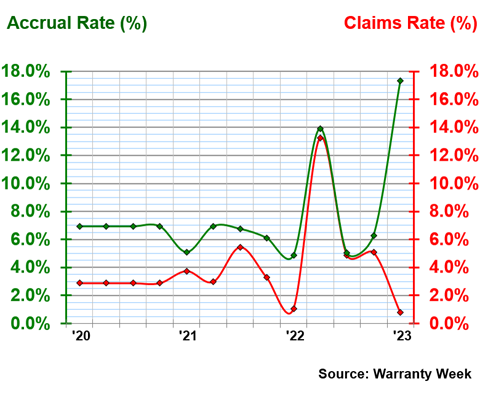

Figure 4 depicts its claims and accrual rates; it started reporting its warranty expenses quarterly in 2021, but provided annual data for 2020.

Figure 4

Electric Vehicle Manufacturer Warranties:

Lightning eMotors, Claims and Accrual Rates,

(as % of product revenue, 2022-2023)

Lightning eMotors is a really interesting case; Figure 4 doesn't nearly tell the whole story. At the very end of 2022 and beginning of 2023, the company faced a huge recall of all of the vehicles equipped with its Romeo Power battery packs. However, since the company did not readily have a fix available, it allowed all affected customers to return their vehicles for a full refund. In its 2022 annual report, the company stated, "The potential remedies for the recall remain under development." It also stated, "Because the remedy is still being developed, and due to the uncertainty of Romeo Power's performance of its warranty obligation to the Company, the Company is unable to reasonably estimate a range of the potential losses associated with the recall."

So although Lightning eMotors has seen astronomical recall costs this year, its warranty totals and expense rates don't reflect that reality, because those costs aren't technically classified as warranty claims expenses, but as full refunds.

During the first quarter of 2023, the claims rate fell to 0.8%, while the accrual rate soared to 17.3%. That spike in the accrual rate is mainly due to a drop in product sales, because reported warranty accruals only totaled $558,000, while the recall cost millions.

The company produced exactly 381 units in 2022, more than double the 156 it manufactured during 2021. With that few vehicles out there, we assume that a huge chunk of them were returned because of this recall. We don't have the exact number of vehicles recalled, but we do know how much this cost the company.

Here's an excerpt from the "Returns and Refunds" section of Lightning eMotors' quarterly report from the first quarter of 2023:

The Company initially recorded, on a gross basis, a refund liability in the amount of $5.037 [million] and inventory in the amount of $2.171 [million]. The total refund liability associated with ZEV4 recalls was $3.228 [million] as of March 31, 2023, which is included in accrued expenses and other current liabilities on the consolidated balance sheets. In some instances, the refund paid to customers exceeded the original transaction price and value of goods to be received (“Accommodation”), representing consideration payable to the customer.

Lightning eMotors held $1.85 million in its warranty reserve fund at the end of the first quarter of 2023, so it seems safe to say these recall/ return costs exceed anything the company may have anticipated.

Hyliion

Our fifth and final company for which we had enough data to make a chart is Hyliion Holdings Corp. The name Hyliion is a portmanteau of hybrid, lithium, and ion.

Hyliion makes electrified powertrains for commercial vehicles, especially class-8 semi-trucks. Hyliion is also partnering with Peterbilt and Hyzon to build a hydrogen-powered truck prototype. This Hypertruck is the model on which the company seems to be pinning its future. It's expected to start being produced by the end of 2023.

Hyliion only went public at the beginning of 2022, so we have five quarters of complete data, plus reported accruals from the fourth quarter of 2021. These data are depicted in Figure 5.

Figure 5

Electric Vehicle Manufacturer Warranties:

Hyliion, Claims and Accrual Rates,

(as % of product revenue, 2022-2023)

The company's accrual rate in the first quarter of 2022, the first in which it reported its warranty expenses, was 61%. Segmented vehicle sales revenue was only $340,000 in that quarter, but accruals totaled $207,000. The company was barely selling any units, and barely paying any claims, but was still putting aside a chunk of its money to establish a warranty reserve fund.

A year later, during the first quarter of 2023, product revenue stayed the same, but total accruals dropped significantly. As a result, the accrual rate fell to a more reasonable, though still high, 10.6%. The claims rate was 8.1% during the same quarter.