Top Japanese Automaker Warranty Expenses:

Toyota, Honda, and Nissan continue to have lower claims and accrual rates than is typical of the global auto industry. With the exception of Honda doubling its accruals, most warranty metrics remained consistent from 2021 to 2022, though the depreciation of the Japanese yen complicates these numbers a bit.

Claims totals dropped for both Toyota and Honda at the onset of the pandemic, but unlike many other major manufacturers, claims totals and rates fell even further during 2022. Meanwhile, Honda more than doubled its accruals, though this came after an even bigger cut to accruals the year prior.

However, these results are all diluted by the depreciation of the Japanese yen in the past year, from a conversion of roughly ¥115 to $1 in March 2022, to roughly ¥140 to $1 in March 2023. For our purposes, this means that all of the increases seem a little more drastic, and the decreases are muddled a bit. Keeping this in mind, the totals in this report are presented in billions of yen.

We mention the exchange rate figures from March to March because the Japanese auto manufacturers end their fiscal years on March 31, and usually publish their annual reports during June. For this report, we're adopting the convention that the year ended March 31, 2023 will be called fiscal 2022, though some companies call it fiscal 2023.

We're still waiting for some stragglers in the Japanese auto industry that are late to report their annual data for the 2022 fiscal year. With that said, the three top Japanese automakers featured in this report, Toyota Motor Corp., Honda Motor Company Ltd., and Nissan Motor Company Ltd., account for around three-quarters of the total product revenue of all Japanese automakers, and similar proportions of total warranty claims, accruals, and reserves among their compatriots.

The main reason we are not discussing the other Japanese auto manufacturers, namely Mazda, Mitsubishi, Subaru, Suzuki, Isuzu, and Hino, is that the majority do not report their warranty data at all. One exception to that rule is Subaru, which does present some of its warranty expense data, but is just perennially late to publish its annual reports. If we were to include these companies, we would mainly be presenting our own estimates based on total product sales revenue, which they all do report, and industry average claims and accrual rates. Estimates will be useful for our upcoming annual Worldwide Auto Warranty Expenses report, as small parts of the whole, but are not really worth discussing in the context of this single-country spotlight on the Japanese automakers.

Toyota and Honda both report all three of our key warranty metrics in their annual reports: claims paid, accruals made, and reserves held. Nissan, however, includes just the figures for accruals and reserves, so we had to do some algebra to create our own estimates for their annual claims payments.

All three companies also provide detailed figures on their product sales revenue and annual vehicle sales, and using those figures, we calculated three additional warranty metrics: claims as a percent of sales revenue (the claims rate), accruals as a percent of sales (the accrual rate), and accruals made per vehicle sold. Once again, the claims rate for Nissan is estimated, while the figures for Toyota and Honda are reported data.

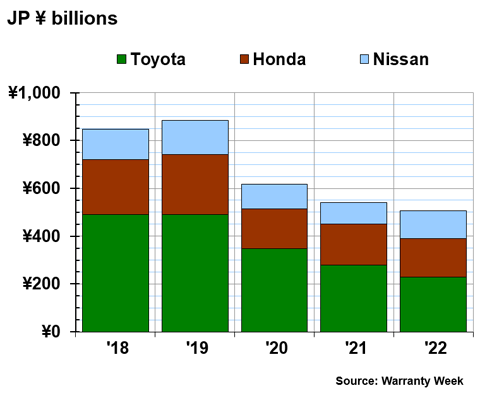

Warranty Claims Totals

Figure 1 presents the annual warranty claims totals of the three companies in billions of yen from 2018 to 2022. We can see that claims totals have fallen for the three combined over the past five years, with Toyota seeing the most drastic drop.

Figure 1

Top Japanese Auto Manufacturers

Claims Paid per Year

(in billions of ¥ yen, fiscal 2018-2022)

During fiscal 2022, Toyota paid ¥229.6 billion in warranty claims, a drop of -17% from the year prior. Honda paid ¥160.8 billion, down -7%. We estimate that Nissan paid about ¥115.5 billion in claims, based on its reported accruals and the ending balance of its warranty reserve fund. This was an increase of 28% from our estimate of its total claims payments from the year prior.

Looking back into our archive of data, claims between the three companies fell to their lowest totals in 2012, and doubled over the next four years, peaking at about ¥1.1 trillion in 2016. We can see in Figure 1 that they stayed relatively high over the next few years, before dropping in 2020, at the onset of the pandemic.

This is a common trend we've seen in the warranty data across industries, countries, and continents recorded during 2020: lower claims (and in some cases, accruals as well) during the early pandemic, in this case simply because lockdowns made it nearly impossible for consumers to bring their cars to auto dealerships for warranty work. What's surprising in these data is that claims totals actually dropped even further a few years afterward. In 2022, Toyota and Honda both saw their total claims drop, and those decreases are even larger when adjusted to the U.S. dollar, due to the yen's depreciation. Similarly, Nissan's increase in claims is diluted to a much smaller total increase when adjusted to the dollar.

Of course, Toyota, Honda, and Nissan are three different companies, and do not represent the entirety of their national auto market. However, for some reason they've all followed the same trend, and have seen drops in their claims totals that have sustained since that initial early pandemic dip. There's something else at play here, but these manufacturers are comparatively tight-lipped about what's changed to save them so much money recently.

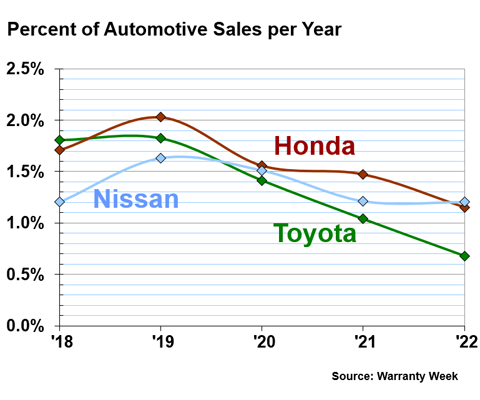

Warranty Claims Rates

Figure 2 shows five years of annual warranty claims rates for the three manufacturers. We calculated the claims rate by dividing each company's total claims by its total product sales revenue. This ratio is an especially useful tool for analysis in cases like this, where the value of currency has such a big impact on changes in totals.

Figure 2

Top Japanese Auto Manufacturers

Warranty Claims Rates

(as a percentage of sales, fiscal 2018-2022)

In 2022, Toyota had a claims rate of 0.68%. In 2021, Toyota had a claims rate of 1.04%, so this percentage dropped by about a third in just one year. In 2018, at the beginning of this five-year period, Toyota's claims rate was 1.81%.

In 2022, Honda's claims rate was 1.15%. This was also a drop for the company, though not quite as steep. In 2019, the company's claims rate was 2.03%.

We estimate Nissan's claims rate in 2022 at 1.20%.

We will remind our readers that these rates are much lower than those we have seen from comparably-sized automakers from other countries. GM and Ford usually have claims rates between 2% and 3%, and the majority of the big European automakers hover within that same range, though some are even higher, closer to 4% or 5% of product sales revenue spent on claims. And one percent can mean millions of dollars of expenses here, and a bigger chunk of sales revenue going right back to costs.

In line with what we saw in Figure 1, Toyota and Honda both saw their claims rate decrease by larger margins than the decreases of their total claims. Usefully, all three saw their annual product revenue barely change from 2021 to 2022, each by less than 10%, so these ratios are a fairly consistent way to adjust for that currency depreciation.

It's amazing to see all three major Japanese automakers decrease their claims rates over four consecutive years, especially when they were already on the low side for the industry.

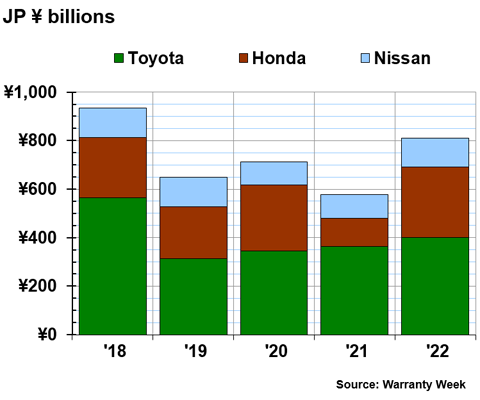

Warranty Accrual Totals

Next, in Figure 3 we're taking a look at total warranty accruals made by these three companies over the past five years. Honda more than doubled its accruals, while Toyota and Nissan barely changed the amount of money they set aside for warranty costs.

Figure 3

Top Japanese Auto Manufacturers

Accruals Made per Year

(in billions of ¥ yen, fiscal 2018-2022)

Toyota reported an 11% increase in total accruals, to ¥400.4 billion. Nissan reported a 23% increase in accruals, to ¥119.3 billion. Interestingly, when we converted these totals to U.S. dollars, just to get a sense of what amount of these increases was simply due to the change in the value of the Japanese currency, we found that Nissan's accruals in dollars barely increased, by only 2%, and Toyota's accruals actually decreased a bit, by -8%. Although the numbers in Figure 3 are in yen, as reported by the three companies, it's useful to note that these changes are mainly due to forces at play larger than internal accounting practices, or even anticipated future warranty costs.

With that said, Honda's drastic increase in its accruals is still drastic, and still more than double, even when converted to the dollar. In yen, Honda accrued ¥289.9 billion, a 145% increase from the year prior. However, this total has a difference of only a few billion yen from the company's total accruals in 2020, so it seems like 2021 was the anomalous year for Honda's accruals, not 2022.

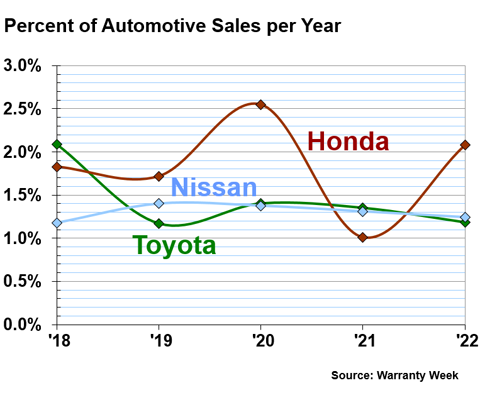

Warranty Accrual Rates

Figure 4 shows the accrual rates of our three companies. As with the claims rate, this is an especially useful metric to separate the manufacturers' changes in warranty expenses from the yen's depreciation, since the revenue of each did not change much from 2021 to 2022.

We see that Honda's accruals are, in fact, a return to normal after lower-than-usual accruals in 2021, while Toyota and Nissan have been extremely consistent in their accruals per product sales over the past three years.

Figure 4

Top Japanese Auto Manufacturers

Warranty Accrual Rates

(as a percentage of sales, fiscal 2018-2022)

In 2022, Toyota had an accrual rate of 1.19%, down a little bit. At the beginning of our data frame, in 2018, the company's accrual rate was 2.09%, so it is putting aside a much smaller proportion of total product sales revenue for warranty accruals these days. Just prior to this period, in 2017, the company's accrual rate spiked to around 3.7%, but fell again rather quickly.

Nissan's accrual rate in 2022 was 1.24%, also down just a small bit. Weirdly, Toyota and Nissan have been accruing just about the same proportion of their respective product revenues; it's rare for two separate companies to map each other so closely for multiple years. Nissan has actually had the most consistent accrual rate of the three, not straying too far above or below 1% for over a decade.

Honda's accrual rate jumped back up in 2022, after falling in 2021 due to the halved accruals in that year. In 2022, Honda's accrual rate was 2.08%. The company's accrual rate jumped a bit in 2020, but not nearly as much as it did back in 2016, when it reached nearly 5%. The accrual rate fell back down quickly, and has stayed below 3% since then.

Accruals Per Vehicle Sold

In the passenger car industry, the manufacturers always disclose the number of units they sell worldwide, so it's a relatively straightforward process to calculate how much they accrue per unit sold. But then it gets a bit complicated. Toyota also makes buses and boats. Honda also makes planes, motorcycles and generators. Nissan makes trucks and boat engines. All of those products generate warranty expenses, so some of each company's accruals must go towards those product lines.

For our purposes, let's assume they don't. Or more precisely, let's assume the main product line of each company is passenger cars and light trucks. And this isn't as big a leap of faith as it might sound. In terms of revenue, for instance, around 80% of Honda's sales revenue comes from cars. So even if the expenses of motorcycles and generators are different, it wouldn't move the averages tremendously.

In fiscal 2022, Toyota sold 8.8 million units, Nissan sold 3.3 million units, and Honda sold 2.6 million units. If we divide those figures into the accrual totals detailed in Figure 3, we get accrual per vehicle figures of ¥45,389 for Toyota, ¥36,087 for Nissan, and ¥110,757 for Honda.

That Nissan figure sounds kind of low, until you remember that back before the air bag problems, Honda and Toyota accrued much less per unit. Back in 2005, all three accrued just around the same amount per vehicle, about ¥36,000.

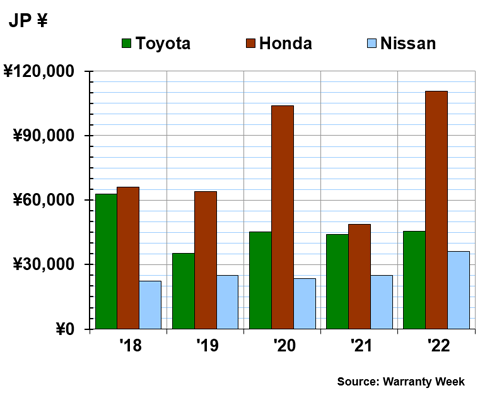

Figure 5

Top Japanese Auto Manufacturers

Accruals Made per Vehicle Sold

(in ¥ yen, fiscal 2018-2022)

Honda's accruals per vehicle jumped by 127% from 2021 to 2022. Even adjusted to dollars, to discount yen depreciation, the figure still almost doubled.

The last time we saw a spike in Honda's accrual per vehicle, it was related to the recall of defective Takata airbag inflators. These costs peaked for Honda during 2015. This time around, it looks like the issue may have been faulty rear-view cameras in certain SUVs, affecting around 1.2 million vehicles. Certainly, one would expect a high-profile problem to accompany an increase in accruals per vehicle this steep, but all we found were some smaller recalls of seat belts and brakes in a few years of a few models.

Nissan's accruals per vehicle increased quite a bit, 44% over just a year. In 2018, the figure was at ¥22,266 accrued per vehicle; this is a huge increase over just a few years. This is especially true particularly of Nissan, since it's had the most consistent accruals and accrual rates of the three over the past twenty years.

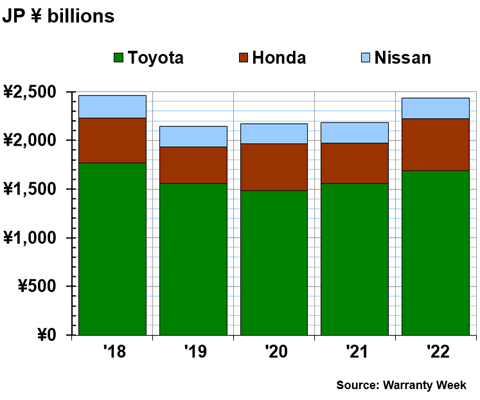

Warranty Reserve Totals

Our final metric is the amount of money the three manufacturers keep in their warranty reserve funds at the end of each fiscal year. Toyota by far has the largest warranty reserve fund, at a greater proportional difference to Honda and Nissan compared to our other warranty metrics.

Figure 6

Top Japanese Auto Manufacturers

Reserves Held at Year's End

(in billions of ¥ yen, fiscal 2018-2022)

On March 31, 2023, Toyota held ¥1.69 trillion in its warranty reserve fund, up 8% from the year prior. However, note than when converted to U.S. dollars, this total actually went down, to the lowest total of the last five years. So while Toyota's warranty reserve balance went up, the yen depreciated even more, resulting in that balance being worth less than it was a year prior in U.S. dollars. Of course, this doesn't really matter to the company when engaging with the Japanese auto market, or even in Europe. But all three companies do significant business in the United States, so it's a useful way to provide additional context to these data.

Honda's ending reserve balance in March 2023 was ¥535.1 billion, up 28%. Nissan's reserve balance increased by just 2%, to ¥215.0 billion. As we have seen with many of the other totals in this report, an increase this small converts to a decrease in U.S. dollars.