Medical & Scientific Equipment Warranty Report:

Claims and accrual totals fell to record lows, but this is due to mergers, privatizations, and changes in accounting of some major players, rather than a decline in the industry. Meanwhile, reserve balances are rebounding, in part from large accruals made in anticipation of a recall.

Medical and scientific equipment became a much bigger part of our cultural conversation in the past few years, from ventilators to vaccine production. We might expect that this increased emphasis on this sector led to higher warranty costs, yet warranty claims and accruals totals in the industry have dropped precipitously since 2020.

Yes, a few of the biggest companies in the industry have gradually brought down their warranty costs over the past two decades. But the biggest reason for this drop is that Thermo Fisher Scientific Inc., responsible for 20% of the industry's warranty claims in 2020, stopped reporting its warranty expenses in 2021. Two more relatively large players, Varian Medical Systems Inc. and Hill-Rom Holdings Inc., both ceased reporting as well. Varian was acquired by Siemens Healthineers, based in Germany, and Hill-Rom was acquired by Baxter International Inc., which is based in the USA but has not reported its warranty expenses since 2005.

We've gathered these data on the warranty expenses of the top warranty providers in the medical and scientific equipment industry every quarter since the beginning of 2003. We began with a list of 175 U.S.-based companies that primarily manufacture medical and/or scientific instruments that are offered for sale with product warranties included. The SEC requires all publicly trading, U.S.-based manufacturers to report their warranty expenses in their annual and quarterly reports, but there's always a few in every group that skirt this in various ways.

From each company's annual reports and quarterly financial statements, we gathered three warranty metrics: the amount of claims paid, the amount of accruals made, and the year-end balance in the warranty reserve fund. Though this report presents annual calendar-year figures for the past 20 years, we gathered these data quarterly in order to be able to correctly apportion the expenses of companies whose fiscal years differ from the calendar year.

We also gathered data on the amount of capital equipment sold, which in this industry usually involves product revenue minus consumables. Some companies were very good about segmenting their revenue this way; others not so much. Whenever possible, all service, licensing, royalties, and investment revenue was similarly subtracted. The goal was to get as close as possible to just the sale of goods that carry warranties and generate claims costs.

Using the claims and accrual totals alongside these product sales totals, we calculated two additional metrics: warranty claims as a percentage of sales (the claims rate), and warranty accruals as a percentage of sales (the accrual rate). These were measured and graphed quarterly, so there are 80 measurements per metric rather than just 20.

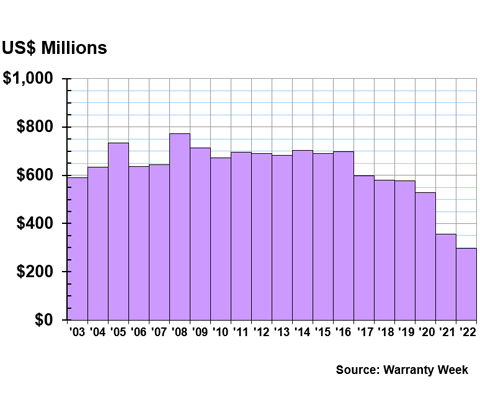

Warranty Claims Totals

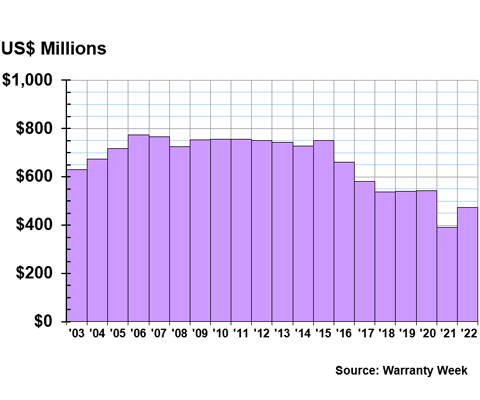

Figures 1 and 2 present the the same claims totals, visualized two different ways. Figure 1 shows the industry-wide totals, while Figure 2 highlights the expenses of the top 10 warranty claims payers in the industry.

As we can see in Figure 1, the industry recorded its lowest-ever warranty claims total in 2022. Claims totaled $298 million, down -16% from 2021.

Figure 1

Medical & Scientific Equipment Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2022)

Back in 2019, the industry paid $578 million in warranty claims, almost twice the 2022 total. This drop-off in the past two years was really odd for us to see in the data, especially since this is an industry where total warranty claims payments have stayed within the same range, from about $550 million to $750 million, since we started tracking it back in 2003.

This previous consistency is impressive, and quite different than many of the other industries we've highlighted in the past few months during this series of 20-year charts. There is basically no evidence of the Great Recession in these charts. Figures 1, 3, and 5 especially show that warranty expenses in the industry barely budged between 2008 and 2009. Medical and scientific equipment is really an outlier in this way.

Thinking about this, it is clear that this drop from 2020 to 2021 was unlikely to be the result of the pandemic-induced economic downturn. How could an industry where warranty costs were so unaffected by the huge global economic collapse of 2008 take such a hit from an event where medical equipment actually became more important?

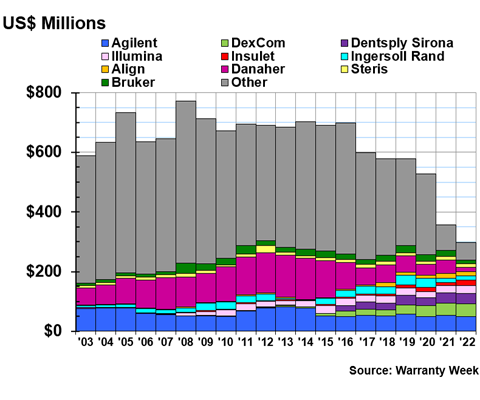

Figure 2 shows these same totals, but highlights the top 10 claims payers of 2022. This helps us dig in to where this drop came from, since it's not merely the result of the tides of the economy.

Figure 2

Medical & Scientific Equipment Warranties

Claims Paid by Top 10 U.S.-based Companies

(in US$ millions, 2003-2022)

Agilent Technologies Inc. was the top claims payer in the industry in 2022, with a total of $50 million. DexCom Inc., in second, paid $43 million in claims, and Dentsply Sirona Inc., ranked third, paid $33 million.

But by far, the top claims payer of 2020 and every year prior was the "Other" category. So we dug in to the "Other" category, identified all of the companies that reported in 2020 but did not do so in 2022, and found our culprits.

As we mentioned in the introduction, Thermo Fisher Scientific Inc. accounted for 20% of all industry claims in 2020, totaling $108 million. Claims costs had been steadily rising for the company for more than a decade. Then, in 2021, the company started lumping in its warranty costs with "other accrued expenses." The company reported $3.35 billion in other accrued expenses during 2022. From there, it's unfortunately impossible for us to make any estimates about the company's current warranty claims payments or accruals made.

But Thermo Fisher only accounts for half of the drop from 2020 to 2022. Varian Medical Systems Inc., which paid $62 million in claims in 2020, was acquired by Siemens Healthineers in April 2021. The company makes radiation oncology equipment and software. Additionally, Hill-Rom Holdings Inc., which makes a variety of hospital equipment, was acquired by Baxter International Inc. at the end of 2021. Hillrom paid $17 million in warranty claims during 2021. Baxter, though also based in the United States, has not reported its warranty expenses since 2005. Its medical products division seems to make some equipment used for dialysis, but primarily produces IV fluid and anesthetics, which definitely don't come with product warranties.

There was one more big departure from the industry since 2020. PerkinElmer Inc. paid $15 million in claims in 2020, but that number dropped to $1.5 million in 2021, and $0 in 2022. The bulk of the company was sold to the private equity firm New Mountain Capital in 2022. A portion of the company's medical and scientific businesses remained public under the name Revvity Inc., but that company has not reported any warranty expenses in its annual reports since the split.

In 2020, ranked by total warranty claims payments, Thermo Fisher was number one, Varian was second, Hillrom was tenth, and PerkinElmer was eleventh. Together, the four of them paid $205 million in claims during 2020. And the four combined reported paying $0 in 2022. Suddenly, that $231 million drop from 2020 to 2022 doesn't seem nearly as foreboding or ominous. The story here isn't really about precipitous collapse, but rather about the importance of adhering to the SEC's warranty accounting standards.

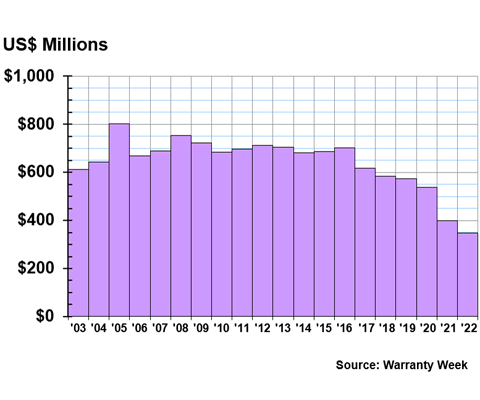

Warranty Accrual Totals

Because those four companies, especially Thermo Fisher and Varian, used to account for such a large portion of the industry's warranty expenses, the top 10 charts are not the most useful illustrative tools for the discussion of the historical data. The size of the Other category in Figure 2 subsumes the relatively small bars that represent the remaining claims totals of the top manufacturers in the industry. For this reason, we are not highlighting the top 10 lists for our other two warranty metrics, total accruals and reserves.

Figure 3 shows the industry totals for warranty accruals over the past 20 years. Accruals totaled $348 million in the industry in 2022.

Figure 3

Medical & Scientific Equipment Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2022)

Agilent Technologies, which ranked first in claims and second in accruals, put aside $50 million for warranty expenses in 2022. DexCom, second in claims and third in accruals, put aside $43 million.

Many of the other top 10 companies dropped their accruals in 2022. Dentsply Sirona, ranked fourth, accrued $27 million, down -40% from 2021, and Illumina Inc. accrued $23 million, down -30%. Align Technology Inc., ranked seventh, put aside $16 million, 10% less than it did in 2021. Bruker Corp., in eighth, accrued $13 million, -45% less than the year prior. Rounding out the list are ResMed Inc., down -20% to $13 million, and Steris plc, down -25% to $12 million.

Ingersoll Rand Inc., ranked sixth, increased its accruals by about 30% to $20 million. As we discussed in our HVAC & Appliance Warranty Report, Ingersoll Rand Inc. is the successor of Ingersoll-Rand plc, which spun off its industrial segment as Trane Technologies after merging with Gardner Denver Holdings Inc. in early 2020. Ingersoll Rand Inc. makes syringe pumps and compressors, fluid management equipment, and air compressors, hence its inclusion in this report.

Finally, we have Insulet Corp. in the top spot. The company had the highest accruals in the industry in 2022, despite only ranking thirteenth in 2021. Insulet makes insulin pumps for people with diabetes, primarily the Omnipod. The company's accruals increased eightfold from 2021 to 2022. Insulet accrued $87 million in 2022, an increase of more than 700%.

In its 2022 annual report, Insulet stated:

In 2022, the Company issed voluntary Medical Device Corrections ("MDCs") for its Omnipod DASH PDM related to its battery and for its Omnipod 5 Controller related to its charging port and cable. The Company initially accrued an estimated liability of $68.9 million related to these MDCs, which was subsequently revised by $11.0 million, resulting in a net charge of $57.9 million for the year ended December 31, 2022. The $11.0 million change in estimate primarily resulted from significantly fewer customers requesting a replacement Omnipod DASH PDM prior to the Company's updated PDM being available.

The company only paid $18 million in claims in 2022, so the majority of that lump sum accrual is currently sitting in its warranty reserve fund. The FDA did not announce the recall of these insulin pumps until mid-November of last year, so we can assume that claims totals will be much higher for 2023.

This is a big development from what we reported in our Largest Nine-Month Warranty Reserve Fund Changes newsletter back in February, which was based on the third quarter data. In its financial report from the third quarter of 2022, Insulet reported that it issued a voluntary recall of these same insulin pumps, and had accrued just $37 million. So the "voluntary medical device correction notice" quickly developed into a FDA-mandated recall, and the accruals almost doubled in the space of a few months.

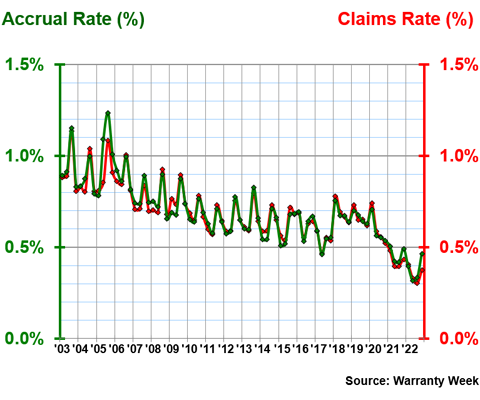

Warranty Expense Rates

The data in Figure 4 below is based on dividing the claims and accrual totals in Figures 1-3 by sales revenue data. This shows us what proportion of sales goes towards warranty expenses, and how this relationship has changed over time.

Figure 4

Medical & Scientific Equipment Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2022)

Expense rates have fallen in the industry in recent years, no surprise due to the departure of some of the largest warranty payers on the list. This includes Varian, which had claims and accrual rates of 4.6% in 2020, and likely drove up the indsutry average. But expense rates in this industry have been trending downward for the past two decades, though with some seasonal variation within each year.

In the fourth quarter of 2022, the industry average claims rate was 0.37%, and the average accrual rate was 0.47%. Back in the beginning of 2020, the industry's claims rate was 0.74%, and the accrual rate was 0.71%.

The two rates peaked for the industry back in 2005. During the third quarter of 2005, the industry average claims rate was 1.08%, and the average accrual rate was 1.24%. The two rates briefly peaked above 1% a few times in the early years of reporting, but have stayed below that threshold since 2007. The two rates hovered between 0.5% and 1% for a decade, until they dipped below half a percent for just one quarter in mid-2017.

Over 20 years, the industry average claims rate was 0.68%, with a standard deviation of 0.16%, and the average accrual rate was 0.69%, with a standard deviation of 0.17%. These standard deviations aren't the result of high volatility, as we've seen with some other industries, but from the downward trend over the span of two decades.

Warranty Reserve Balances

Our final warranty metric is the balance left in the warranty reserve funds of each of these companies at the end of each calendar year. At the end of 2022, that balance stood at $474 million, the second-lowest total we've seen in this industry.

Figure 5

Medical & Scientific Equipment Warranties

Reserves Held by U.S.-based Companies

(in US$ millions, 2003-2022)

The company with the largest warranty reserve balance in this industry is Danaher Corp., which ranked eighth in total claims, and did not make the top 10 in accruals. The company reports its warranty expenses in a bit of an odd manner, but reported paying $15 million in claims and making $0 in accruals in 2022, much lower than historical levels. We can see back in Figure 2 that the company's annual claims payments used to be much higher. Danaher reported an ending reserve balance of $95 million.

Next on the list is Insulet, which increased the size of its reserve fund ninefold in 2022 to a total of $62 million. $55 million of the $58 million accrual made in response to the recall was deposited to sit in this fund. Again, it makes sense, since the recall wasn't issued until the end of the year.

In third is ICU Medical Inc., which did not rank in the top 10 in terms of total claims or accruals. The company's reserve balance went from less than $1 million in 2021 to $57 million at the end of 2022. The company acquired Smiths Medical from the British Smiths Group plc at the beginning of 2022, and acquired a warranty reserve balance of $55.2 million in the process.

Next is Ingersoll Rand, with a reserve balance of $46 million, and then Agilent Technologies with a balance of $30 million. ResMed Inc. had $26 million in its reserve account at the end of the year, Bruker Corp. had $25 million, and Dentsply Sirona had $22 million.

Medical and scientific equipment has always been a steady business-to-business market, seemingly recession-proof based on 2008. It seems that this consistency has continued in recent years, but it's harder to see through the drops in the charts, due to mergers and other departures from reporting warranty expenses for some previous major players in the industry. We anticipate big change in this industry's warranty landscape in our next report, since GE HealthCare spun off from General Electric at the beginning of 2023, the first child of GE's split into three.