U.S. HVAC & Appliance Warranty Report:

The big story in the appliance and HVAC industries is several major mergers and acquisitions in recent years, which have increased the precision of our data but driven down industry totals. Meanwhile, warranty expense rates for the appliance industry are lower than ever, showing savings on warranty expenses per product sale.

Total warranty claims and accruals have dropped for the U.S.-based appliance and HVAC industries in recent years, but this is not another pandemic story. Instead, this is a story about mergers and acquisitions that changed the face of the HVAC and appliance industries in the country.

In Figures 1-3 and 6 below, we see big drops in totals from 2018 to 2019. That year, United Technologies Corp. announced that it was preparing to merge with Raytheon Co. to form Raytheon Technologies Corp. However, Raytheon was mainly interested in United Technologies' aerospace business, and the company announced that its HVAC business would spin off as Carrier Global Corp., and its elevator and escalator business would spin off as Otis Worldwide Corp. This was all finalized in the spring of 2020, but the warranty expenses for the aerospace and HVAC portions of the business were reported separately starting in 2019.

It seems that United Technologies' aerospace division accounted for more of its total warranty expenses than we originally guessed. Since the company did not segment its warranty expenses by business, we typically included the totals in our reports on both HVAC and aerospace. Both industries ended up with slightly inflated totals due to the inclusion of the total for the other business. Now, Carrier is in the HVAC group, Otis is in the building materials group, and Raytheon is in the aerospace group. Raytheon did not report its warranty expenses prior to the merger, so the combination of the two companies' expenses kept aerospace totals around the same level. But the HVAC numbers dropped significantly.

The breadth of certain manufacturers can be a challenge for us at Warranty Week when creating these industry-wide reports. General Electric Co. comes to mind. The company as it currently exists deals in aerospace as a maker of jet engines, power generation with wind turbines and renewable energy, and medical and scientific equipment, and does not segment its warranty expenses in its annual and quarterly reports. The company has announced plans to separate these three businesses next year, which will likely drastically change the warranty expense numbers in all three industries. GE also used to manufacture appliances, but the company sold this division to the Chinese Haier Group Corp. in 2016. Haier retained the name GE Appliances. Haier, formerly known as Qingdao Refrigerator Co., partnered with the German Liebherr in the 1980s; the name "Haier" comes from the Chinese transliteration of Liebherr. Haier also made a bid for Maytag Corp. back in 2005, though the company was ultimately outbid by Whirlpool Corp., the largest U.S.-based appliance company in this report.

Our last story of mergers and acquisitions in HVAC and appliances in 2019 and early 2020 is Ingersoll Rand. In February 2020, Gardner Denver Holdings Inc. completed the merger with the industrial technologies and services segment of Ingersoll Rand plc, and promptly renamed itself Ingersoll Rand Inc. At the same time, the remaining HVAC and refrigeration business of Ingersoll Rand plc renamed itself Trane Technologies plc, including the Thermo King brand. Trane was originally acquired by Ingersoll Rand in 2008, and spun off independently again after this merger.

To create this report, we began with a list of 57 companies, 32 of which mainly manufacture household or food service appliances, and 25 of which mainly manufacture commercial and residential heating, ventilation, and air conditioning (HVAC) systems.

From each company's annual reports and quarterly financial statements, we gathered data on the total amount of warranty claims paid, the amount of accruals made, and the ending balance of the warranty reserve fund. We also recorded total product sales revenue figures, which we used to calculate our two expense rates, total claims as a percent of product sales (the claims rate) and total accruals as a percent of sales (the accrual rate).

We also identified the top 11 companies with the largest warranty expenses for the HVAC and appliance industries combined. These companies are: Whirlpool Corp., Carrier Global Corp., United Technologies (pre-merger with Raytheon), Trane Technologies plc, Johnson Controls International plc, Emerson Electric Co., Middleby Corp., Newell Brands Inc., A.O. Smith Corp., Lennox International Inc., and Manitowoc Co. Inc.

The following six charts represent the past 20 years of warranty expenses in the U.S.-based appliance and HVAC industries.

Warranty Claims Totals

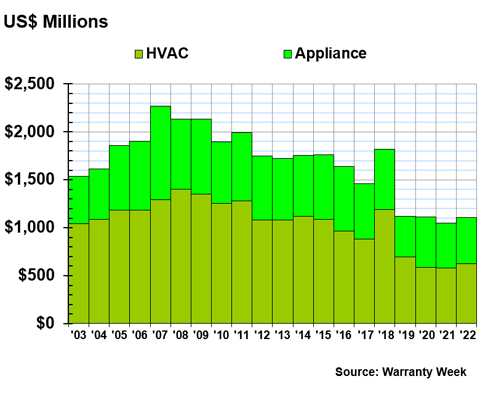

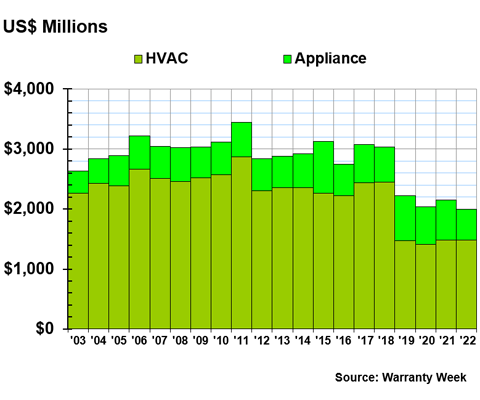

First, we are going to compare the warranty claims totals for the HVAC and appliance industries. In 2022, total claims for these 57 manufacturers were up by 5%, or $57 million, to a total of $1.10 billion. Figure 1 shows this total broken down by industry segment.

Figure 1

HVAC & Appliance Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2022)

HVAC saw a bigger increase in claims totals than appliances did. HVAC warranty claims totaled $628 million in 2022, an 8% increase from the year prior. Total appliance claims for 2022 were $477 million, just a 2% increase from 2021.

As we see in Figure 1, total HVAC claims dove by $498 million, or 42%, just from 2018 to 2019. As we mentioned above, this is not the result of a major breakthrough in technology or accounting, but rather the merger of Raytheon and United Technologies' aerospace business. In 2018, United Technologies reported payment of $493 million in warranty claims. Carrier Global Corp., the spin-off of United Technologies' HVAC business, reported a $164 million warranty claims total in 2019. However, we will note that 2018 was an anomaly for United Technologies with abnormally high warranty expenses, and typically, it looks like HVAC warranties accounted for about one-half to two-thirds of United Technologies' total warranty claims payments per annum.

On the bright side, our data on HVAC warranties will be more specific and accurate to the industry going forward, since United Technologies' aerospace warranty costs are no longer included in these data.

Total appliance warranty claims have also been falling in recent years, though to a lesser extent than in the HVAC industry. The industry recorded its lowest claims total in 20 years during 2019. Admittedly, some of the members of this group of companies don't have as much of a presence as they used to, and these numbers seem to reflect the increasing popularity of non-U.S.-based appliance companies.

These low claims totals during the pandemic are a little odd when we consider the homebuilding and real estate boom of the past few years. Countless Americans moved away from cities and renovated farmhouses and homes in the suburbs, likely purchasing new kitchen appliances if not purchasing a new build. At the same time, appliance service technicians likely had trouble making home calls in the early days of the pandemic, influencing these lower totals. The 2021 and 2022 totals are less than half of the high for the industry, which we recorded in 2007.

Warranty Accrual Totals

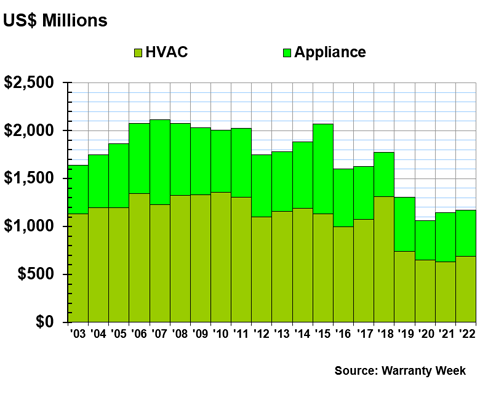

Figures 2 and 3 show total accruals for the HVAC and appliance industries over the past 20 years. Figure 2 breaks down the totals by industry segment.

Figure 2

HVAC & Appliance Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2022)

Accruals for the two industries were up by 2% to a total of $1.17 billion in 2022.

Total accruals for the HVAC and appliance industries moved in different directions in 2022, though not drastically. Total accruals for the HVAC companies totaled $687 million in 2022, an 8% increase from 2021. On the other side, total accruals for the appliance companies decreased by -5% to $484 million.

Interestingly, though the totals for both industries are currently around half of the totals reported in 2007, the ratios between the two remain consistent. HVAC accounts for 60% of the total accruals, while appliance accounts for 40%.

Figure 2 illustrates that the pandemic did have an effect on these industries, as it did all global manufacturing. While claims totals remained consistent in 2020, total accruals hit an industry low, as sales decreased and companies attempted to hold on to as much revenue as they could.

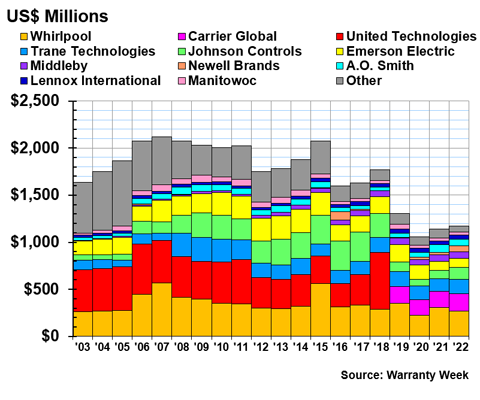

Figure 3 represents these same data in a different way, showing total warranty accruals by company. The 11 manufacturers named in Figure 3 had the largest warranty claims, accrual, and reserve totals across the HVAC and appliance industries.

Figure 3

HVAC & Appliance Warranties

Accruals Made by Top U.S.-based Manufacturers

(in US$ millions, 2003-2022)

The largest U.S.-based appliance company in terms of warranty expenses is Whirlpool Corp., especially since the company acquired Maytag Corp. in 2006. Whirlpool accrued $267 million in 2022, a -13%, or $40 million, decrease from 2021.

Figure 3 helps illustrate the way that the United Technologies-Raytheon merger affected warranty expenses in the HVAC industry. As we noted in the discussion of Figure 1, 2018 was also a particularly expensive year for United Technologies' warranty division, which made the company's departure from the charts even more dramatic. In 2019, Carrier Global accrued about half of United Technologies' usual accrual total, but only one-third of the company's anomalously high 2018 accrual total. In 2022, Carrier reported $184 million in total warranty accruals.

Trane Technologies, another product of a recent merger and spin-off, had the third-highest warranty accrual total in 2022. The company accrued $157 million in 2022, a 17% increase from the year prior.

Between 2008 and 2019, Trane was owned by Ingersoll Rand. The company's totals from before the merger are factored into the "Other" category from 2003 to 2008, hence the large Other total in the early years of this chart. It was called Trane Inc. back then, and was technically a different company. Trane now also owns the Thermo King brand, since the de-merger from Ingersoll Rand that became official in early 2020. Ingersoll Rand's totals from the period between 2008 and 2019 are included under the Trane name, since the brand accounted for the majority of the company's warranty expenses, as illustrated by the low totals for "Trane" (really Ingersoll Rand pre-merger) from 2003 to 2007 in Figure 3.

Ranked fourth in terms of total 2022 accruals is Johnson Controls International, which owns the York International brand. The company increased its accruals by 38% in 2022, to a total of $126 million.

Emerson Electric accrued $93 million in 2022, the same amount as the year prior, despite a drop in revenue. Middleby Corp. accrued $71 million in 2022, only $3 million more than the year prior, despite a spike in revenue. And Newell Brands increased its accruals by 162%, or $42 million, to $68 million. The company made one other abnormally high lump sum accrual of $92 million back in 2016, but usually accrues between $0 and $20 million annually. It looks like the majority of these lump sums end up being deposited right into the warranty reserve fund.

Rounding out the top 11 largest appliance and HVAC companies, A. O. Smith's total accruals were down by -21% to $64 million, Lennox International's accruals were up by 16% to $51 million, and Manitowoc's accruals were down by -10% to $27 million. A. O. Smith and Manitowoc are the only two of the group that managed to decrease total accruals but increase their revenue, meaning they actually saved money per unit sold from year to year.

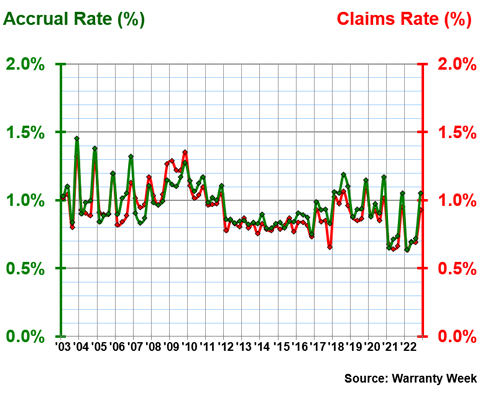

Warranty Expense Rates

Figures 4 and 5 show the average claims and accrual rates for the HVAC and appliance industries, respectively, over the past twenty years. We will see that the HVAC companies, which are fewer in number but have higher overall totals, had smoother and more consistent expense rates over the past two decades, while the warranty expense rates for the appliance industry are more chaotic and volatile. In recent years, the appliance expense rates have been trending downward to the same level as the HVAC expense rates. Historically, appliances had higher warranty expense rates than HVAC systems.

We calculate the claims and accrual rates by dividing the totals detailed in Figures 1 and 2 by the corresponding product sales totals. With this pair of measures, it's fairly easy to see by eye how the percentage rates have been trending.

Please note that Figures 4 and 5 are on different scales. The y-axis of Figure 4 is from 0% to 2%, while the y-axis of Figure 5 is from 0% to 4%.

Figure 4

HVAC Warranties

Average Claims & Accrual Rates

(as a % of product sales, 2003-2022)

At the end of 2022, the HVAC industry had an average claims rate of 0.93%, and an average accrual rate of 1.05%. Over 20 years, the industry-wide average claims rate was 0.93%, with a standard deviation of 0.16%. The average accrual rate was 0.96%, also with a standard deviation of 0.16%. These standard deviations are not the lowest we have seen in this series of 20-year warranty data reports, but they are certainly much lower than those of the appliance industry. This means that overall, the HVAC industry's warranty expenses are more predictable and consistent.

We can see in Figure 4 that the smoothest period for the industry was from 2011 to 2017. The most volatile period was from 2003 to 2008, though the expense rates were driven up by drops in revenue from the Great Recession after that. It looks like the industry is entering another more volatile period, likely the result of the mergers and acquisitions in this industry in recent years.

Figure 5 shows the average claims and accrual rates for the U.S.-based appliance manufacturers.

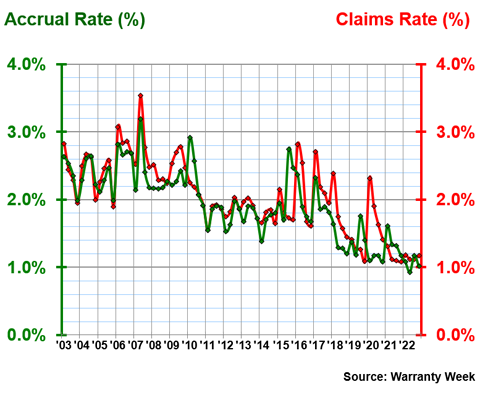

Figure 5

Appliance Warranties

Average Claims & Accrual Rates

(as a % of product sales, 2003-2022)

The average claims rate for the industry in the fourth quarter of 2022 was 1.18%, and the average accrual rate was 1.01%. As we can see in Figure 5, this is on the low side for these percentages. This is good news for the appliance industry, meaning that warranty expenses take up a smaller portion of total revenue now than ever before. In the fourth quarter of 2022, the HVAC and appliance industries had very similar warranty expense rates.

The average claims rate over the past 20 years was 2.03%, with a standard deviation of 0.54%. The average accrual rate was 1.93%, with a standard deviation of 0.52%. These are particularly high standard deviations for the claims and accrual rates.

The appliance manufacturers have clearly had much more unpredictable and varied warranty expenses over the past two decades compared to the HVAC industry. The record high claims and accrual rates for the U.S.-based appliance industry were recorded during the second quarter of 2007. The record lows have both been recorded rather recently. The lowest-ever claims rate for the industry was recorded in the fourth quarter of 2021, and the lowest accrual rate was in the second quarter of 2022.

Our final warranty metric is the total balance left in the warranty reserve funds of these 57 companies at the end of each year.

Figure 6

HVAC & Appliance Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2022)

Warranty reserves between the two industries totaled $1.99 billion in 2022, a -7%, or $155 million, decrease. This was actually the first time this figure dipped below $2 billion since these data began to be reported in 2003.

Of course, part of this story is again the merger of United Technologies and Raytheon. At the end of 2018, United Technologies reported a warranty reserve fund balance of $1.45 billion. In 2019, Carrier Global, the spin-off of United Technologies' HVAC business, reported a warranty reserve balance of $488 million. The other $960 million were deposited in the warranty reserve funds of either Raytheon or the other spin-off from this merger, elevator manufacturer Otis Worldwide.

One tidbit to note is that Whirlpool decreased its warranty reserve fund balance by -34%, or $96 million, in 2022, to a total of $190 million. Emerson Electric, Newell, and Manitowoc all also decreased their reserve balances. Carrier, Trane, and Lennox increased their balances, but not enough to offset the drops from the other companies.