U.S. Auto Parts & Powertrain Warranties:

Total claims, accruals, and warranty reserves were down slightly for the auto parts manufacturers overall, while the powertrain manufacturers continue to take on a larger proportion of the industry-wide warranty expenses.

This week we are highlighting the warranty expenses and trends of the top U.S.-based automotive parts and powertrain manufacturers. This group is a combination of powertrain manufacturers, other auto parts manufacturers, retailers offering warranties on select products, and dealers offering warranties on used vehicles.

In the past, we have broken the auto parts industry into two sub-categories: manufacturers of powertrain components such as engines, transmissions, and axles, and manufacturers of other automotive components. The powertrain versus other dichotomy highlights one of the main trends of this industry: the powertrain manufacturers, though smaller in number, account for a larger proportion of warranty expenses among the parts makers. Presenting these trends is certainly helpful, and next week we will release a series of charts analyzing and summarizing the trends for all U.S.-based vehicle manufacturers.

However, it's not exactly that there's something inherent in powertrain components that makes warranty expenses higher. Instead, the real dichotomy is between manufacturers that sell parts directly to end-user consumers, and those who supply parts to other manufacturers. If the part breaks, it's the manufacturer that sold the product to the consumer pays to fix it; they don't send the consumer directly to the parts supplier. While the manufacturer of the end-product can pass on the warranty claims to the parts supplier to recover the costs, this is usually only in the case of a mass recall. So the overarching trend within the auto parts industry is that consumer-facing manufacturers have higher warranty expenses than parts suppliers selling to OEMs.

In this report, we endeavor to highlight the top 13 companies in the auto parts industry, and present data on their warranty expenses. We began by gathering data from the annual reports and quarterly financial statements of all of the U.S.-based automotive parts suppliers. The list included 125 companies, of which 61 were still in business and trading publicly in 2022. We gathered three essential warranty metrics: claims paid, accruals made, and reserves held. We also gathered data on product sales revenue, which we used to calculate two additional metrics: claims as a percentage of sales (the claims rate) and accruals as a percentage of sales (the accrual rate).

There were a couple of big news stories in the auto parts and powertrain industries in the past year. The private equity firm Apollo Global Management Inc. acquired Tenneco in November of 2022 and the company stopped reporting its warranty data in the fourth quarter of the year. So while we included Tenneco's warranty expenses from the first, second, and third quarters in this report, they will not report in the future. The other big piece of news is that Cummins, the largest company in this report, acquired Meritor Inc. in August 2022. Meritor reported its warranty data for the first and second quarters of 2022, but from the third quarter and into the future, Meritor's warranty expenses will be part of Cummins' totals.

The top 13 companies named in our charts below are an exemplary cross-section of the different types of manufacturers present in the auto parts industry. Those 13 companies are: Cummins Inc., O'Reilly Automotive Inc., Standard Motor Products Inc., BorgWarner Inc., Westinghouse Air Brake Technologies Corp., Eaton Corp., LKQ Corp., Brunswick Corp., Dana Inc., LCI Industries, Aptiv plc, Allison Transmission Holdings Inc., and American Axle & Mfg. Holdings Inc.

We posit that those who sell parts directly to consumers, such as Cummins, and those who sell aftermarket parts through retailers, such as Standard Motor Products, will have higher warranty expense rates, while the tier 1 suppliers who sell parts directly to OEMs, such as BorgWarner and Dana, will have lower expense rates. The retailers themselves, such as O'Reilly, will also have low expense rates, simply because they do not segment their revenue in their expense reports but only offer warranties on select products. Of course, these are just general trends, and we acknowledge that some of the companies on this list supply parts to both OEMs and aftermarket retailers.

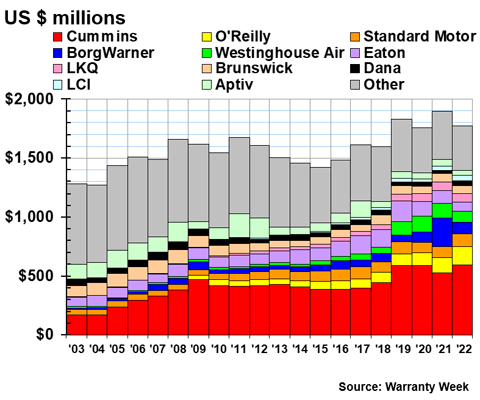

Warranty Claims Totals

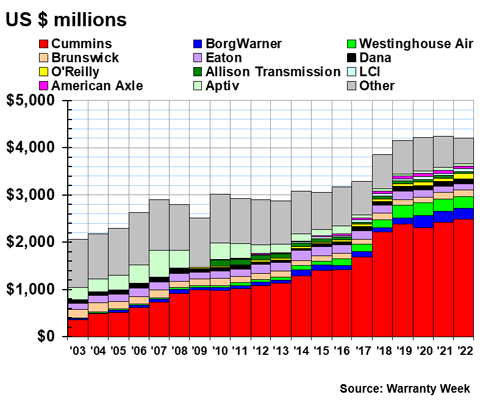

In Figure 1, we are taking a look at the total warranty claims expenses of the auto parts manufacturers for the past 20 years.

Figure 1

U.S.-based Auto Parts & Powertrain Manufacturers

Claims Paid per Year

(in US$ millions, 2003-2022)

The auto parts industry as a whole saw warranty claims fall by -7% to an industry-wide total of $1.77 billion. The 11 named companies in Figure 1 accounted for 79% of this total.

Cummins, primarily a powertrain manufacturer, was again the largest claims payer. The company paid $596 million in warranty claims in 2022, up 12% from the year prior. This is actually a new record high for the company, exceeding the old record from 2019 by just $6 million.

The second-highest claims payer was O'Reilly Auto Parts, the nationwide retailer. The company paid $153 million in claims in 2022, a 21% increase from 2021. This was the O'Reilly's highest-ever warranty claims total. This number has risen steadily every year since the company started reporting warranty data in 2009.

Three others saw their warranty claims totals increase. Standard Motor Products, ranked third, saw a 21% increase to $152 million. LCI saw a 41% increase in total claims to $44 million. Dana saw the steepest increase of 64%, from $28 million in 2021 to $46 million in 2022. These fluctuations have been fairly normal for the company, and $28 million was actually on the low side, with this increase representing a return to more typical warranty expenses.

BorgWarner had the biggest decrease in its total claims, which fell by -60%. This is primarily because, according to the manufacturer's 2022 annual report, "In 2021, the Company recorded a higher warranty provision due to an unfavorable customer warranty settlement that resulted in cumulative charges of $124 million that did not repeat in 2022." Interestingly, this claim was made by an OEM (not named in the report) for which BorgWarner is a parts supplier. While not unheard of, this is certainly a big win for that OEM's supplier recovery department. Further illustrating the levels of complexity that warranties can have, especially when multiple manufacturers are involved, BorgWarner notes that "the Company is pursuing a partial recovery of this claim through its insurance coverage," though "there can be no assurance that there will be any recovery."

Westinghouse Air Brake saw its claims cost fall by -27% to $91 million, and Eaton saw its claims decrease by -28% to $81 million. Aptiv also saw claims fall by -27%, to $43 million.

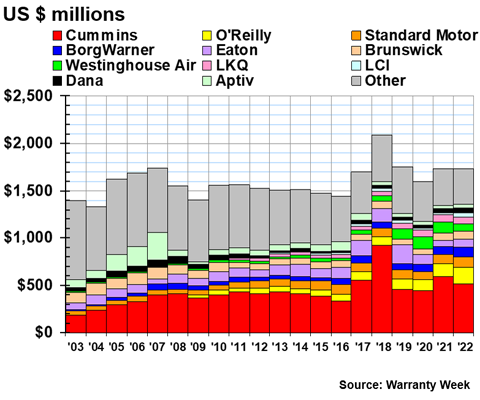

Warranty Accrual Totals

Figure 2 shows total warranty accruals for this industry for the past 20 years. Total industry-wide warranty accruals were $1.73 billion in 2022, an almost totally lateral move from the year prior (technically a 0.03% increase). The 11 named companies in Figure 2 account for 78% of this total.

Figure 2

U.S.-based Auto Parts & Powertrain Manufacturers

Accruals Made per Year

(in US$ millions, 2003-2022)

Looking at Figure 2, perhaps the first question that comes to mind is, what happened in 2018? This was the year that Cummins faced major issues with its diesel engine emissions compliance efforts. The additional accruals were first made in 2018 when the problem became known, and then the claims began to increase. Looking back at Figure 1, we see that Cummins' claims totals did increase starting in 2019. Comparing to Figure 2, we also see that while the accruals for this were primarily made in a lump sum, the increase in claims was more dispersed. This is a great example of the lag time between when a warranty problem is detected, and when the bills actually come due.

In 2022, Cummins' total warranty accruals decreased by -13% to $515 million, despite revenue increasing for the year. Westinghouse Air Brake saw accruals fall by -32% to $79 million. While the general trend for our top 11 companies was increased revenue, Cummins and Westinghouse were the only two that decreased their warranty accruals at the same time.

LCI saw its accruals increase by 64%, exceeding its increase in revenue. Eaton's accruals were up by 28%, O'Reilly by 26%, BorgWarner by 24%, and Standard Motor Products by 22%. Despite this, the industry total barely budged, an intriguing interruption to the step pattern the totals have shown since 2017.

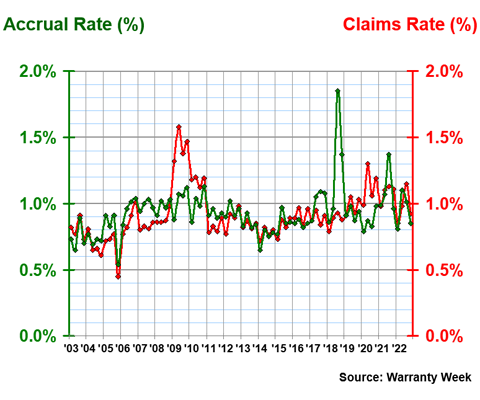

Warranty Expense Rates

As we posited at the beginning of this article, the powertrain suppliers tend to have higher warranty expense rates than the suppliers of other auto parts. There is also a disparity between the expense rates of those supplying parts to OEMs, versus those selling directly to end-user consumers or aftermarket retailers.

To make Figures 3 and 4, we divided the industry into two groups: powertrain suppliers and other auto parts suppliers. Then we took the claims and accrual totals and divided them by the total product revenue for each segment to calculate our two expense rates. We did so on a quarterly basis, as sometimes this reveals short-lived spikes or declines that the annual data does not.

Figure 3 shows the average claims and accrual rates for the powertrain aspect of the industry. While the powertrain manufacturers are a minority in the industry (about 20%), they tend to have higher expense rates. Please note that Figures 3 and 4 have different y-axis scales.

Figure 3

U.S.-based Powertrain Manufacturers

Average Claims and Accrual Rates

(as a % of sales, 2003-2022)

Overall, the powertrain manufacturers had a 20-year average claims rate of 0.93% with a standard deviation of 0.17%, and an average accrual rate of 0.92% with a standard deviation of 0.19%.

Relative to this long-term average, the industry was on par in 2022, though we see in Figure 3 that there has been more volatility in recent years. This makes sense especially because the expense rates were impacted by disruptions to revenue from the pandemic. In contrast to the past two years, the years after the Great Recession showed smooth and predictable trend lines. The spike that disrupted that smooth trend in 2018 is again due to the Cummins emissions compliance problems.

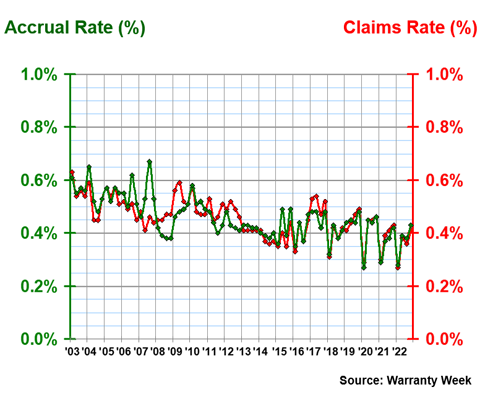

In Figure 4, we're looking at the warranty expense rates of the other parts suppliers.

Figure 4

U.S.-based Auto Parts Manufacturers

Average Claims and Accrual Rates

(as a % of sales, 2003-2022)

The other auto parts manufacturers had a 20-year average claims rate of 0.46% with a standard deviation of 0.07%, and an average accrual rate also of 0.46% with a 0.08% standard deviation.

The lower averages and standard deviations both tell the story of a lower degree of volatility among these manufacturers compared to the powertrain manufacturers. As we stated above, this is not the result of greater merit or accounting practices of these companies, but rather the result of the way these companies function, typically not coming into direct contact with the end-user consumer that utilizes the product.

However, volatility has clearly entered into the equation in the past few years, especially since the pandemic. In the first quarter of 2022, the other parts suppliers' overall claims rate was 0.27%; in the fourth quarter, the claims rate was 0.41%. This is a jump by 0.14%, two standard deviations, over the course of one year. So clearly there are more fluctuations in these expense rates now than ever before for these manufacturers, though there is also an overall downward slope to the trend line.

Warranty Reserve Balances

Figure 5 shows the year-end warranty reserve fund balances across the auto parts industry.

Figure 5

U.S.-based Auto Parts & Powertrain Manufacturers

Reserves Held at Year's End

(in US$ millions, 2003-2022)

Total warranty reserves for the industry were down by -1% to $4.2 billion, just slightly lower than 2021's record total. The 11 named companies in Figure 5 accounted for 87% of the total. This includes Allison Transmission and American Axle, both of which qualified for the top 11 in terms of their reserve balances but did not have claims or accrual totals high enough to be named in Figures 1 and 2.

Cummins alone accounted for 59% of the industry-wide warranty reserve balance in 2022. Its reserve balance grew by $52 million in 2022 to a total of $2.48 billion, the highest the company has ever recorded.

BorgWarner has the second-largest warranty reserve in the industry. They added $9 million to this fund in 2022, reporting a total of $245 million at the end of the year. Westinghouse Air Brake's reserve balance fell by -$17 million to $242 million.

Brunswick's total claims fell and accruals increased slightly in 2022, resulting in a 13% increase in its reserve fund. They added $17 million for a total of $147 million. O'Reilly's total reserves increased by 28% to $99 million. Aside from Cummins, O'Reilly added the largest amount of money to its reserve fund, $21 million. The company's claims and accrual totals were both up by similar percentages, indicating that its warranty business overall is growing.

We're delighted to announce the official schedule of events for the highly acclaimed 2nd Annual Global Warranty & Service Contract Innovations, scheduled for April 18-19, 2023, at the Hyatt Regency Long Beach, California. Hear top industry leaders discuss tools and strategies for cross-functional, data-driven new product development, customer service to expand market share and ensure compliance. The all new agenda features riveting case studies and timely panel discussions. Plus, you'll want to participate in the always-popular industry-specific roundtable discussion groups and hot off the press market news flashes from Warranty Week.

To register and view the schedule of events, please visit: www.globalwarrantyinnovations.com.

Register with code WW300 for $300 off, exclusively for Warranty Week subscribers!