U.S. Truck & Heavy Equipment Warranties:

The U.S.-based truck and heavy equipment manufacturers fared the pandemic better than most. Warranty activity in this industry barely lulled in 2020, and total warranty reserve balances hit a record high for the fourth year in a row, despite Navistar's departure from the list.

Continuing our series of 20-year charts showing warranty expense trends by industry, this week we are looking at the U.S.-based truck and heavy equipment manufacturing industries. These companies make a variety of commercial vehicles, including on-highway trucks, buses, and recreational vehicles (RVs), and equipment used for agriculture, mining, construction, and railroads.

Changing things up a little bit, we are going to keep the manufacturers of whole commercial vehicles separate from the parts and powertrain manufacturers, which we will analyze next week. This is because commercial vehicle warranties work differently than those for consumer vehicles. Each component of a large vehicle is often supplied separately, and thus has a discrete warranty attached to it. So one truck could theoretically have separate warranties for the chassis, engine, transmission, axles, and other major components, perhaps even made by different manufacturers. While a few of the manufacturers in this report do make parts as well, this distinction allows us to highlight the interactions between these two aspects of the industry.

Trucks and heavy equipment represented 13% of all warranty accruals made in the United States in 2022, and 11% of claims. This makes the industry the third-largest provider of warranties in the United States, after consumer vehicles and computers.

This report includes data on 24 companies in the U.S.-based large vehicle industry. Of these, the two largest by far are Deere & Co. and Caterpillar Inc., both primarily makers of construction and agricultural equipment. Joining them in the top 12 are Paccar Inc., Thor Industries Inc., AGCO Corp., Winnebago Industries Inc., Oshkosh Corp., Terex Corp., Rev Group Inc., Lucid Group Inc., and Proterra Inc. Lucid Group and Proterra are both electric vehicle manufacturers and newcomers to this report, since they only recently started reporting their warranty data.

One huge name among the U.S.-based truck manufacturers is missing from that list. Navistar Inc. was acquired by Traton SE, the truck and bus division of Volkswagen, in mid-2021. Since they are such a huge part of the American trucking landscape, we included their warranty data until the acquisition in the following charts. Note that another big name in American truck manufacturers, Mack Truck, has been part of Volvo AB since 2000. We will take a look at Traton and Volvo, along with other European truck manufacturers such as Daimler, as part of our worldwide heavy equipment report later this year, once the foreign companies on different timelines publish their annual reports.

In addition to the 12 companies named above, 12 more companies comprise the relatively small "Other" category: Astec Industries Inc., Blue Bird Corp., The Greenbrier Companies Inc., Shyft Group Inc., Miller Industries Inc., Workhorse Group Inc., Lightning eMotors Inc., Arrival Ltd., Nikola Corp., Hyliion Holdings Corp., Phoenix Motor Inc., and Rush Enterprises Inc. Lucid, Lightning, Nikola, Hyliion, and Phoenix are all electric vehicle companies that started reporting their warranty data in the past year.

From the 2022 annual reports of each of these 24 companies, we gathered data on the total amount of warranty claims paid, total warranty accruals made, and total warranty reserves held. We also recorded each company's total product sales revenue, in order to calculate our two expense rates: claims as a percentage of sales (the claims rate) and accruals as a percentage of sales (the accrual rate). While we report these data annually in this report, we record them quarterly.

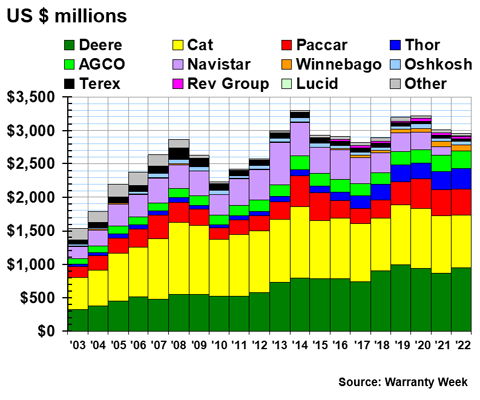

Warranty Claims Totals

Let's begin with warranty claims paid. As shown in Figure 1, in calendar 2022, the truck and heavy equipment industry in the United States paid $2.95 billion in claims, down from recent years. Of course the disappearance of Navistar brought totals down in 2021 and 2022.

Figure 1

U.S.-based Truck & Heavy Equipment Manufacturers

Claims Paid per Year

(in US$ millions, 2003-2022)

Deere & Co. had the largest total warranty expenses of all heavy equipment manufacturers in the world in 2021, based on all three warranty metrics. In 2022, Deere paid $951 million in warranty claims, up 10% from the year prior. This is the company's second-highest clams total; the record high total was recorded in 2019.

Caterpillar reported $778 million in warranty claims payments in 2022, down -9% from the year prior. This total had remained above $800 million from 2007 until this year, except for the year 2018.

Claims payments for Paccar, the parent company of on-highway truck brands such as Kenworth, Peterbilt, DAF, and Leyland Trucks, remained consistent with the year prior. The company paid $399 million in warranty claims last year, a 1% increase. Oshkosh Corp., another maker of on-highway trucks as well as military vehicles, was also very consistent, with claims increasing by 3% to $58 million.

RV manufacturer Thor Industries saw claims increase by 11% to $300 million, while Winnebago Industries saw an increase of 37% to $91.5 million. These were actually jumps by around the same dollar amount, about $25 million, but the two companies are on different scales by hundreds of millions of dollars. The smaller Rev Group saw claims stay the same, with a small decrease of just -1% to $31.4 million.

Agricultural equipment manufacturer AGCO saw its total warranty claims increase by 8% to $262 million. Heavy equipment manufacturer Terex saw one of the few decreases, with claims down -23% to $35 million.

Among those companies in the "Other" category, most remained consistent with their claims totals. The exceptions are the tow truck manufacturer Miller Industries, the electric truck, van, and bus maker Lightning eMotors, and the electric delivery van company Workhorse Group. Miller Industries saw a 55% increase in claims, though this was just from $2.7 million to $4.2 million. Still, a record high claims total for the company. Lightning eMotors saw an increase by 81% from $626,000 to $1.14 million. This was the first time the warranty claims total exceeded one million for the company, though it has only reported three years of warranty data. Finally, Workhorse Group saw a decrease by -25% to $1.39 million. The company has reported five years of warranty data.

The most interesting takeaway from these data is the lack of big movement in recent years. Based on Figure 1, you'd never know there was a pandemic or even any rumblings of the word "recession" in the past few years. This tracks with the nature of this industry, and some of the big headlines we've been seeing in recent years. Trucking never ceased activity despite the pandemic, and thus warranty claims never stopped rolling in. Maybe some construction projects were postponed, but a global pandemic doesn't stop demand for growing food or the movement of goods. Heavy equipment remained active, and warranty work was continually necessary. This is a big contrast with the consumer vehicle industry, and many other industries in the United States, where we have noticed sharp dips in claims totals from the early days of the pandemic.

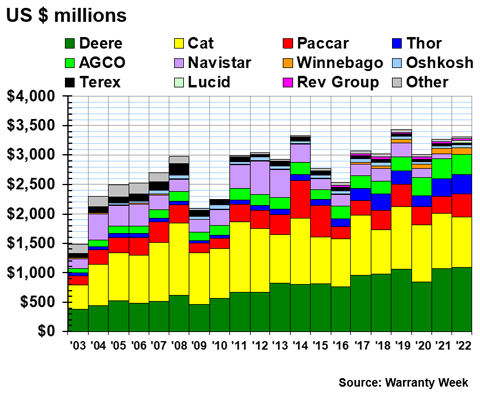

Warranty Accrual Totals

The warranty accrual totals shown in Figure 2 are a little more consistent with the economic "story" of the past 20 years, colored by the Great Recession and the pandemic. This makes sense, since warranty claims are something that happen to a company without their control, while accruals are made actively. Accrual totals also reflect industry-wide dips in sales, since accruals are made per unit sold. Dips in accruals also come right away, whereas changes to claims totals are delayed since they are often paid a year or up to several years after the initial sale.

Figure 2

U.S.-based Truck & Heavy Equipment Manufacturers

Accruals Made per Year

(in US$ millions, 2003-2022)

One great thing about these 20-year charts is that they allow us to compare the severity of the dips in 2008/2009 and 2020. As we see in Figure 2, the Great Recession had a huge impact on warranty accruals in this industry, especially in 2009 and 2010 (there is also an impact on claims visible in Figure 1, but not nearly as steep). On the other hand, we see that the pandemic only made a small dent in accruals in this industry during 2020, basically just a blip from which the industry had already recovered by the next year. Again, this is not the story of every industry; in fact, most were profoundly affected by the pandemic. But heavy equipment fared relatively well, as these vehicles are related to many of the essential services that remained active during the overall global economic lull of 2020.

In total, the truck and heavy equipment industries accrued a total of $3.3 billion in 2022 for future warranty claims payments. This total was up just a little bit from the year prior.

Deere, our largest company, saw total accruals increase by just 2% to $1.09 billion in 2022. This company has remained consistent in its annual accruals in the past few years, with the exception of the pandemic year 2020. This 2% increase is perhaps a little bit surprising since product sales were up 21% from the fourth quarter of 2021 to the same quarter in 2022, meaning that total accruals per vehicle sold were down a little bit.

Caterpillar's accruals decreased by -9% to $850 million, again despite a 17% increase in sales from the fourth quarter of 2021 to the fourth quarter of 2022. Basically, this means that the accrual rates for Caterpillar and Deere, which is total accruals as a ratio to product revenue, have decreased over the past year.

The general industry-wide trend was increased warranty accruals, with Caterpillar being one of the few exceptions. The other four decreases were AGCO, down just -2%, Terex down -7%, Rev Group down -17%, and Workhorse Group down -53%.

Paccar saw one of the biggest increases in accruals among the industry, with its total up by 29% to $386 million. This was consistent with its sales increase of 26% from the fourth quarter of 2021 to that quarter in 2022. Oshkosh Corp. saw its total accruals increase by 15%. However, this is relative to an amazing 362% increase in product sales. It is an odd mismatch, and these increased sales may likely result in higher claims totals down the road and a need for higher accruals in the future to make up for it.

On the other hand, Winnebago saw its total accruals rise by 18%, while its product sales decreased by -18%. This is a less favorable mismatch, with less money coming in overall and more of it going toward expenses. Recall that claims were up even more than accruals for the company. Thor, our other large RV manufacturer, saw a similar pattern. Total accruals rose by 16%, while revenue fell by -21%.

Though the totals themselves are rather small, and the "Other" category is only barely visible in Figure 2, some of the companies we're tracking saw huge increases in their total accruals in 2022. For some, this is the result of less consistent accounting practices for warranty expenses rather than a big recall or other heightened anticipated warranty cost. For example, the transportation manufacturing corporation Greenbriar Companies, which mainly makes marine barges and freight railcars, saw total accruals increase by a shocking 972%, while revenue increased by 43%. Accruals increased from $1 million to $9.7 million. We went back into the company's accrual history, and it looks like they have gotten into a pattern of decreasing accruals for a year or two, relying on the reserve balance to pay claims, then making a lump sum accrual after a few years to replenish the fund. Its total reserve balance actually went down over the same period.

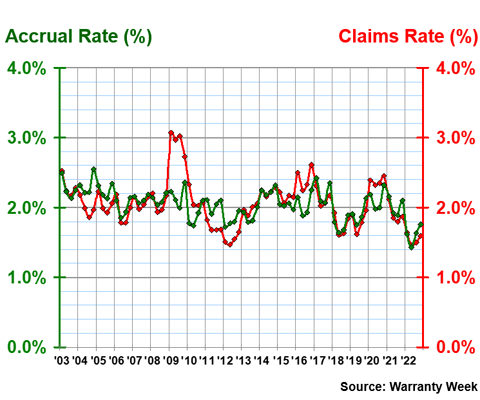

Warranty Expense Rate Averages

Next, we are going to take a look at the industry average claims and accrual rates. This shows the claims and accruals tempered by the total industry-wide product revenue, helping us get a better sense of the trends for the past two decades.

Figure 3

U.S.-based Truck & Heavy Equipment Manufacturers

Average Claims and Accrual Rates

(as a % of sales, 2003-2022)

In the fourth quarter of 2022, the industry average claims rate was 1.59%, and the average accrual rate was 1.76%. These numbers are notably lower than those of the passenger car industry. As we reported in last week's newsletter, the consumer vehicle industry had an average claims rate of 2.44% and an average accrual rate of 2.26% in the fourth quarter of 2022. The figures for the commercial vehicles are closer to the United States national average claims rate of 1.33% and accrual rate of 1.32% in that same quarter, the most recent for which we have data.

As we see in Figure 3, the average expense rates for this industry have hovered around 2% for the past few decades, with the exception of the big spike in the claims rate that came in 2009 as a result of lower revenue during the height of the Great Recession. The 20-year average claims rate for the industry was 2.05%, with a standard deviation of 0.33%, and the 20-year average accrual rate was 2.04% with a standard deviation of 0.22%.

We endeavored to see which of the large companies in this industry are anomalies compared to these industry-wide averages. AGCO reported the highest claims and accruals rate among the top companies in the industry. Its average claims rate for 2022 was 2.13%, and its average accrual rate was 2.66%. The company was not very consistent in its accruals; the accrual rate was 3.10% in the first quarter of 2022, but only 2.10% in the second quarter. This is not a metric that loves volatility.

There are also a few companies strikingly at the lower end of the spectrum. Oshkosh Corp. had the lowest expense rates in the industry, with an average claims rate of 0.37% and accrual rate of 0.42% for 2022. These rates are usually a little closer to 1%, but it looks like this company's big spike in revenue helped bring these percentages down last year. Terex also had low expense rates, with a claims rate of 0.88% and an accrual rate of 0.89% for 2022. Astec Industries, a manufacturer of road-building equipment, had an average claims rate of 0.91% and accrual rate of 1% for the year.

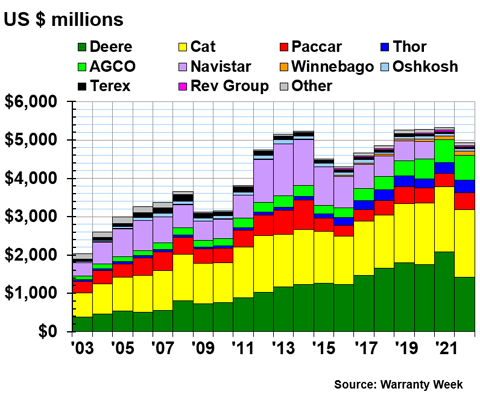

Warranty Reserve Balances

Our final warranty metric is the total amount each company holds in its warranty reserve fund. As we see in Figure 4, the heavy equipment industry set a new record high in 2022, with total reserves equaling $5.83 billion. This is the fourth record-setting year in a row for this industry's warranty reserves, reflecting a larger nationwide trend we've noticed in several other industries in recent warranty reports. Record-setting totals were certainly not expected so soon after Navistar, once the third-largest manufacturer in this report, was acquired and stopped reporting separately.

Figure 4

U.S.-based Truck & Heavy Equipment Manufacturers

Reserves Held at Year's End

(in US$ millions, 2003-2022)

Deere's warranty reserves exceeded $2 billion for the second year in a row, setting its own company-wide record high for reserves. Its balance increased by 10% to $2.29 billion. Caterpillar also reached a record high reserve balance, increasing by 4% to $1.76 billion.

Among the top companies, Paccar saw the biggest increase in its warranty reserves. Its reserve fund balance jumped by 27% to $438 million. This actually does not set a record for the company, which saw its highest reserve balance back in 2007 before the recession hit.

2022 was an expensive year for the RV manufacturers overall. Winnebago's warranty reserve balance increased by 19% to $122 million. Its accruals went up by 18% and its claims went up by 37%, while product revenue went down by -18%. Thor's reserve balance increased by 12%, its accruals increased by 16%, and its claims increased by 11%, while its product sales decreased by -21%. There is likely a relationship between these data and the fact that RVs became more popular than perhaps ever before in the dark days of the pandemic, when international travel became nearly impossible and United States National Park visitation broke records.

Among those in the "Other" category, Workhorse Group saw the biggest change in its reserve balance, which decreased by -52% to $2.2 million. Workhorse is an interesting case among the smaller companies in this industry, especially as an electric vehicle maker. The company's claims were down -25%, accruals down -53%, and total product revenue in the fourth quarter was down a whopping -690% from the same quarter a year prior. It looks like the company has actually been slowly subtracting from a lump sum accrual of about $8 million it made in 2018, the first year for which it reported warranty data.

One reason the reserve balances for this industry keep hitting new records is the appearance of several new electric vehicle manufacturers onto the scene. This includes the electric bus and EV charging manufacturer Proterra, which made the cut for Figure 4 with a reserve balance of $25.5 million in its fourth year of reporting. The company's reserve balance was up 10%, while accruals increased by 7%, and product revenue by 24%. Claims actually slightly decreased by -1%. Great news for them.

The other EV companies in this report are the Lucid Group (which made the cut for Figures 1 and 2 in its first year of reporting warranty expenses), Workhorse Group, Lightning eMotors, Nikola Corp., Hyliion Holdings, and Phoenix Motor. The EV makers as a whole still have some work to do to master their warranty accounting practices, to be expected since the majority of them reported their warranty expenses for the first time in their 2021 or 2022 annual reports. But we welcome them onto the scene and would like to encourage more manufacturers in this growing aspect of the heavy equipment and large vehicle industries to report their warranty data as well.

We're delighted to announce the official schedule of events for the highly acclaimed 2nd Annual Global Warranty & Service Contract Innovations, scheduled for April 18-19, 2023, at the Hyatt Regency Long Beach, California. Hear top industry leaders discuss tools and strategies for cross-functional, data-driven new product development, customer service to expand market share and ensure compliance. The all new agenda features riveting case studies and timely panel discussions. Plus, you'll want to participate in the always-popular industry-specific roundtable discussion groups and hot off the press market news flashes from Warranty Week.

To register and view the schedule of events, please visit: www.globalwarrantyinnovations.com.

Register with code WW300 for $300 off, exclusively for Warranty Week subscribers!