Homebuilder Warranty Report:

As happened in 2007, the warranty metrics of the U.S.-based single-family home builders seem to have hit a bit of a plateau in 2019. Unit sales and warranty claims are up, but all the other metrics are little-changed from 2018 levels. And now, it's hard to imagine how 2020 will turn out.

It's beyond surreal to write this newsletter the day after the World Health Organization declared the coronavirus to be a pandemic. Originally, this collection of new home warranty data was intended to be an early look at recent market trends, possibly providing a reading of the deteriorating health of the overall manufacturing economy, as it did in 2007.

But at this point, last year's data is too old to be useful. What happened this afternoon is what matters, and what will happen in the months ahead is what's concerning. Still, the 2019 warranty data is now available, so let's take a quick look at what would ordinarily be a leading indicator: the new home industry.

We began by looking at the annual reports of every publicly-traded single-family home builder listed on a U.S. stock exchange. From each of their last 17 annual reports, we extracted three warranty metrics: claims paid, accruals made, and reserves held, all in millions of dollars. And we extracted two sales metrics: homebuilding revenue and number of units closed, sold, or delivered.

Using the accrual and revenue figures, we calculated the percentage of home sales revenue being accrued for warranty expenses (accruals / revenue = percent). Using the delivery data, we calculated how much money was being accrued per home sold (accruals / units = dollars). So there are two accrual rates, one a percentage and the other a dollar amount.

Sales Were Up Again

The total number of new homes sold in the U.S. last year, according to the U.S. Census Bureau, was 708,000. The builders we're following in this report delivered 236,000 of those units, or about 33% of the total market. Leaders include D.R. Horton Inc., Lennar Corp., PulteGroup Inc., NVR Inc., and KB Home, which each delivered more than 10,000 units last year. Unit sales for the publicly-held builders was up 8.4%, versus 7.8% for the industry as a whole.

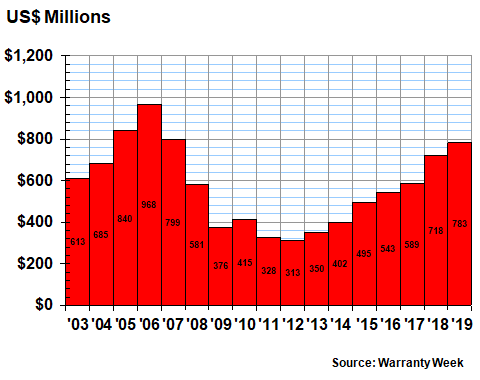

In Figure 1, we are looking at the annual claims payments reported by the publicly-held builders. Claims rose from $718 million in 2018 to $783 million in 2019, a 9.1% increase. So that's a little faster than sales growth, but not by much.

Figure 1

Homebuilding Warranties

Claims Paid by U.S.-based Builders

(in US$ millions, 2003-2019)

Hovnanian Enterprises Inc. reported a substantial drop in claims payments, from $43 million in 2018 to $19 million in 2019. Toll Brothers Inc. brought its claims cost down by about $15 million, from $114 million in 2018 to $99 million last year.

Taylor Morrison Home Corp., which just recently acquired William Lyon Homes, saw its claims payments soar from $42 million to $68 million, reflecting its newly-enlarged size. In addition, Lennar and Meritage Homes Corp. each saw their claims payments rise by about 25% last year.

Warranty Accruals

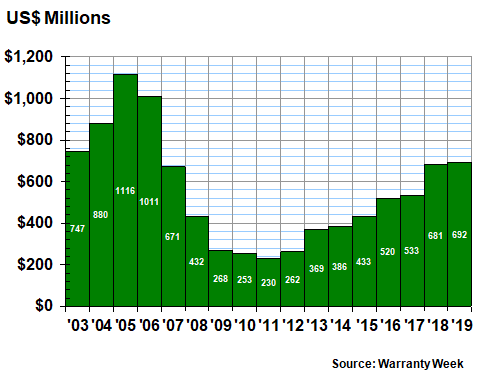

In Figure 2, we're looking at the total amount of warranty accruals reported by the builders over the past 17 years. As with the claims data above, there is an obvious decade-long dip in the totals, reflecting the deep recession suffered by the industry beginning in 2007. But while claims were up by 9.1%, accruals rose by only 1.6%, or barely at all.

Figure 2

Homebuilding Warranties

Accruals Made by U.S.-based Builders

(in US$ millions, 2003-2019)

Once again, Hovnanian led the way in cost-cutting, reducing its accruals from $26 million in 2018 to $15 million in 2019. But Taylor Morrison, which as we mentioned saw claims rise in tandem with a major acquisition, actually cut its accruals from $52 million to $44 million.

On the flip side, NVR and D.R. Horton raised their accruals by more than 10%, as did two smaller companies, Century Communities Inc. and LGI Homes Inc.

Warranty Reserves

The year-ending balance in the warranty reserve funds of the publicly-traded builders actually declined by about $750,000, nearly too little to register on the chart below. But also note that the $1.4 billion balance at the end of 2018 was an all-time record, while both claims and accrual totals remain below their peaks. The question we won't know the answer to for a while is whether 2018 was the peak for this metric.

Figure 3

Homebuilding Warranties

Reserves Held by U.S.-based Builders

(in US$ millions, 2003-2019)

Hovnanian let its warranty reserve balance fall by about $5.7 million, but that wasn't one of the largest reductions proportionally. That title goes to Toll Brothers, which cut its balance by $57 million or 22%. Meritage, a much smaller company, cut its balance by $2.5 million or 10%.

The newly-enlarged Taylor Morrison grew its warranty reserve balance to $120 million, a 28% increase. D.R. Horton and Century Communities each grew their balances by about 22%. Other notable increases included PulteGroup (+$12 million), and KB Home (+$6.3 million).

Warranty Accrual Rates

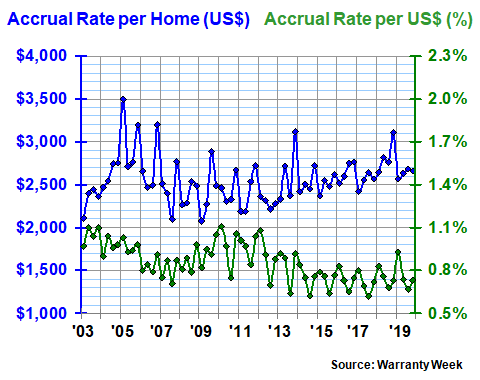

The data in Figure 4 takes the accrual totals in Figure 2 and divides them by both revenue and units sold. It's two different ways to measure the accrual rate, which are possible because 1) all builders release unit sales data, and 2) all of these companies build single-family homes. Some build luxury residential palaces and others build modest and inexpensive starter homes. But they're all basically single-family homes, not office towers or sports stadiums.

In 2019, the average accrual rate for all sizes of single-family homes was $2,659 per unit sold, about $23 less than in 2018, but about $100 more than the long-term average. The other accrual rate, expressed as a percentage of revenue, was 0.7% for three of the four quarters of last year. For that metric, the long-term average is 0.9%.

Figure 4

Homebuilding Warranties

Average Warranty Accrual Rates

($ per home and % of revenue, 2003-2019)

Almost every builder reduced the amount of money they accrued per new home sold in 2019. The sole exception was NVR, which increased its accrual rate per unit from $3,646 in 2018 to $3,860 in 2019. Every other builder reduced its accruals per unit sold -- even those whose accrual rates as a percentage of revenue rose (a function of rising prices).

Accruals Per New Home Sold

In Figures 5 through 9, we are going to detail these recent increases in the form of lines representing 20 different companies. So that the data remains readable, we will present them in groups of four companies at a time.

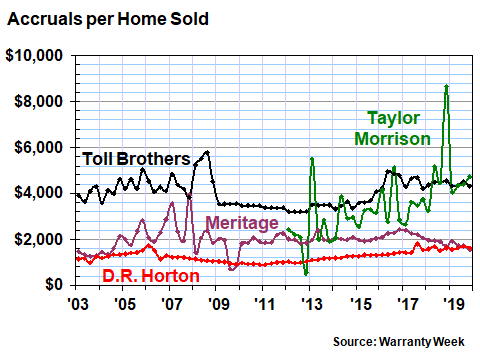

In Figure 5, we're looking at three companies that have recently reported relatively stable accrual rates per home sold: D.R. Horton, Meritage, and Toll Brothers. And there is one that saw accruals spike as recently as last year: Taylor Morrison Home.

Figure 5

Homebuilding Warranties

Warranty Accruals Made per Unit Sold

(in US Dollars, 2003-2019)

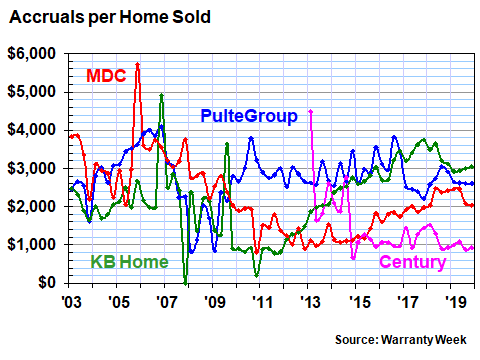

In Figure 6, three of the companies reported comparable accrual rates per unit sold in 2019: KB Home ($3,049), PulteGroup ($2,603), and M.D.C. Holdings Inc. ($2,044). But they took very different pathways to get there over the past 17 years. Century Communities, meanwhile, a much younger homebuilder, saw its accrual rate fluctuate wildly for its first two years before settling down to a predictable range for the last five years.

Figure 6

Homebuilding Warranties

Warranty Accruals Made per Unit Sold

(in US Dollars, 2003-2019)

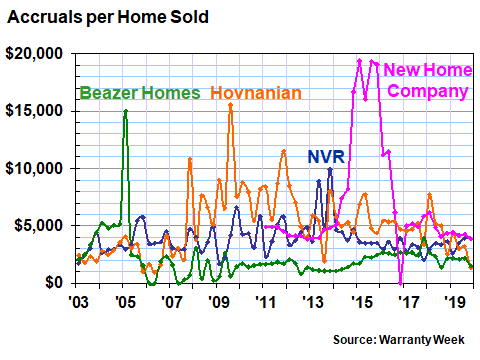

In Figure 7, we had to raise the vertical scale to a maximum of $20,000 per unit sold to fit the spikes in the data produced by Hovnanian, Beazer Homes, and New Home Company Inc. In three of the four quarters of 2015, for instance, New Home Company set aside more than $19,000 in accruals per new home sold -- an astronomical amount in an industry where $2,563 is the long-term average.

Figure 7

Homebuilding Warranties

Warranty Accruals Made per Unit Sold

(in US Dollars, 2003-2019)

The vertical scale is so great that it obscures the clear separation between the companies at the end of 2019. Beazer Homes and Hovnanian were each accruing around $1,400 to $1,500 per new home sold, while NVR and New Home Company were up around $3,900. At this scale, the lines look to be much closer together. But Beazer and Hovnanian are among the builders accruing the least, while NVR and New Home Company are among the companies accruing the most.

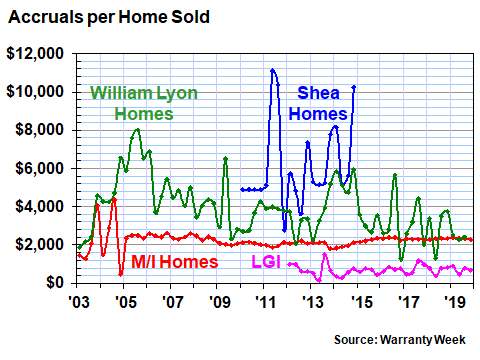

In Figure 8, we're including two builders that still report their warranty metrics, and two that stopped. M/I Homes Inc. and M/I Homes Inc. continue to report their warranty metrics. But Shea Homes only did so from 2010 to 2014 because it sold corporate bonds that required it to file its financial statements with the U.S. Securities and Exchange Commission during that time. When it redeemed the bonds, it ceased reporting. And then William Lyon did so until it was acquired by Taylor Morrison.

Figure 8

Homebuilding Warranties

Warranty Accruals Made per Unit Sold

(in US Dollars, 2003-2019)

M/I Homes is one of those unremarkable builders that never hits any extremes. Its claims were down by $1 million. Its reserves fell by $39,000. Its accrual rate per home sold fell by $69.34 last year. None of those rose to the level of most or least, making them worthy of mention. And as can be seen in Figure 8, its accrual rate has been nearly flat for 15 of the last 17 years.

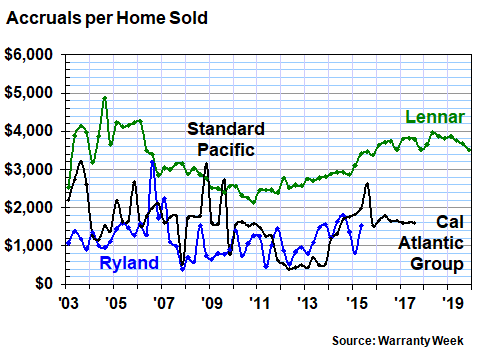

Finally, in Figure 9 we have four names but in reality only one surviving company. Standard Pacific Homes and Ryland Homes merged in 2015, and the surviving company renamed itself the CalAtlantic Group. And then in 2018, Lennar acquired CalAtlantic. And at the end of 2019, Lennar was accruing just over $3,500 per unit sold, or just below one percent of its homebuilding revenue.

Figure 9

Homebuilding Warranties

Warranty Accruals Made per Unit Sold

(in US Dollars, 2003-2019)

There seem to be three bands of accrual levels: starter home, luxury unit, and midrange. In the lower band, accruing $1,500 or less per new home sold, are the residences of Beazer, Century Communities, Hovnanian, LGI, and Meritage. In the highest band, accruing $3,500 or more per home, are Lennar, New Home Co., NVR, Taylor Morrison, and Toll Brothers. And then in the middle band, between those extremes, are the homes of D.R. Horton, KB Home, M.D.C. Holdings, M/I Homes, and PulteGroup.

Had this newsletter been published last week, we would have said it's beginning to look like warranty expenses in the new home industry have peaked yet again, as it did in 2007. But as the annual reports themselves might state in their careful language, recent events have reduced visibility into future quarters and have made it extremely difficult to issue projections for this fiscal year. And as the stock touts might say, past performance does not indicate future results.