Warranty Services:

While most of the service providers in the warranty industry focus exclusively upon the sale and administration of extended service plans, a handful of intrepid companies have outsourced product warranty claims processing for manufacturers in the consumer electronics industry, where repairs can be performed by any of tens of thousands of service centers.

After looking at warranty analysis tools and warranty claims processing software packages, it's time to take a first look at some of the warranty claims processing service networks. These networks are run by companies that insert themselves into the web of communications between consumers, service centers, parts distributors, and manufacturers.

When one thinks of a warranty service, inevitably what comes to mind are the multiple companies selling extended warranty contracts and administering extended service plans. However, there also are numerous product manufacturers that have outsourced all or part of their basic warranty operations to outside companies, primarily for reasons of network complexity, but also for reasons of cost. These are what we mean by warranty claims processing service networks: the companies that manage the processing and formatting of claims, the dispatching of field service professionals, and/or the operations of a call center/technical support center.

Oil & Water?

One might think that basic product warranties and extended warranties/service agreements are two totally separate entities that don't mix. In strictest terms, a manufacturer's product warranty is a type of guarantee, while an extended warranty is an insurance product. Guarantees are issued along with a product purchase. Extended warranties are a product purchase in and of themselves. If it's free and it's bundled with the purchase, it's a warranty. If it's sold for an additional amount of money and it's optional, it's an extended warranty. But it's not so simple.

One might think that basic product warranties and extended warranties/service agreements are two totally separate entities that don't mix. In strictest terms, a manufacturer's product warranty is a type of guarantee, while an extended warranty is an insurance product. Guarantees are issued along with a product purchase. Extended warranties are a product purchase in and of themselves. If it's free and it's bundled with the purchase, it's a warranty. If it's sold for an additional amount of money and it's optional, it's an extended warranty. But it's not so simple.

Extended warranty companies frequently sell wrap-around policies that from day one will enhance a basic warranty, covering additional uses and components of a product not covered by the basic product warranty. For instance, a flat screen TV's basic warranty may be invalidated by commercial use as opposed to consumer use. An extended warranty might cover that. An automobile's basic bumper-to-bumper warranty almost never covers brake pads or windshield wipers. An extended warranty might. So it's not always just an extension of the duration of the free-fix promise. It's also sometimes an enhancement of the product warranty.

Product warranties and extended warranties are more like salt and fresh water. They're connected and they mix, but there's no confusing a freshwater lake with an ocean. Where the river ends and where the ocean starts might cause some arguments, but everyone would agree there's a border somewhere.

For the duration of this article, we're going to call the basic manufacturer's product warranty the OEM business, short for original equipment manufacturer. The sale of extended warranties, whether the contract is backed by the manufacturer, a retailer, or a third party, we'll call the ESP business, short for extended service plan. OEM is fresh water. ESP is salt water.

Warranty Service Companies

Both OEM & ESP

- EDS Warranty Services

GE-Zurich Warranty Management Inc.

Global Warranty Group

KeyPrestige Inc.

SatisFusion Inc.

ServiceBench Inc.

Service Net Inc.

VAC Service Corp.

ESP Only

- AIG WarrantyGuard

Aon Warranty Group

Assurant Group

Century Warranty Services Inc.

CNA National Warranty Corp.

Cross Country Home Services

Equiguard Inc.

First Assured Warranty Corp.

First Warranty Group

NEW Customer Service Companies Inc.

1SourceAutoWarranty.com

Premier Lease & Loan Services

Ultimate Warranty Corp.

Viking Warranty

Warrantech Corp.

Warranty Corporation of America Inc.

Warranty Direct

Warranty Warehouse

The above chart lists most of the third party warranty service companies known at this point to Warranty Week. There are numerous online automobile extended warranty marketing companies that are not on the list, for reasons that are more thoroughly outlined in the Feb. 24 and May 27 editions of Warranty Week. Most of the insurance companies owning or backing the ESP vendors are not listed separately unless they sell the policies to consumers directly under their own brand names.

OEMs Can Be ESPs Too

Also missing are some of the retailers and manufacturers such as Circuit City, Sears, Dell, Gateway, Thomson Multimedia, Eastman Kodak, and American Standard Companies, which sell their own brands of extended warranties -- some in partnership with one of the third-party administrator companies in the list above, some backed by an insurance company with interests in the service contract business, and others on a completely independently and self-insured basis. But that's another article for another time: on the complex relationships, partnerships, and competition within just the ESP food chain. Earlier this year, it took British regulators 89 pages to merely outline their findings regarding the relationships among OEMs, retailers, and third party administrators in the U.K. extended warranty marketplace. And they're still not done.

The goal of including the charts in this article is to illustrate a point. While there are numerous ESP companies, especially in the automotive sector, there are far fewer service companies engaged in both ESP and OEM, and only a select few of them are focused primarily upon the OEM business. Why is that? If, as the data suggests, the size of U.S. manufacturers' product warranty settlements are on the order of $21 to $23 billion per year, why are there so few service companies present in that food chain? If only 10% of that money is spent on administration, it's still a $2.1 billion opportunity for outsourcing. Given the clamor that the "application service providers" caused three or four years ago in the telecommunications and dot-com businesses, it's a wonder that so few outsourcing companies have seized the opportunity to manage warranty claims services.

One could easily conclude that most OEMs prefer to run their warranty business themselves, but after talking with five of the OEM/ESP companies on the lists above, that apparently is not the case. Especially in the consumer electronics and small appliance sectors, and especially among OEMs importing manufactured products from Japan, Korea, China, or Europe, the manufacturers and importers instead seem to prefer to work with an experienced domestically-based middleman capable of managing a vast data processing network that connects them with potentially tens of thousands of authorized service centers and millions of consumers.

No Going Back?

In fact, of the five service companies interviewed for this article, none reported ever losing an American OEM client after the manufacturer decided they'd be better off bringing warranty back in-house. They've lost OEM clients to each other, and some OEMs prefer to use more than one service provider rather than signing with one exclusively. One service provider reported losing a Canadian appliance manufacturer to an in-house effort. Another reported losing an American retailer when they took their ESP program back in-house. But no American OEM has decided to "insource" what they previously outsourced. Quite the opposite is true. They usually outsource some little piece of their aftermarket efforts, then they keep building upon that base until it not only includes warranty, but also technical support and even rebate processing.

|

Kenneth Kopp, director of marketing at SatisFusion Inc., bristled at the suggestion that his company was a warranty outsourcing service company. "We've been working with the manufacturers -- of consumer electronics, housewares, photographic, lawn and garden, computers, and peripherals -- for over 20 years," he said. And while warranty is a big part of the business, SatisFusion is more generally a post-sale customer relationship service company, doing everything from managing rebates to running promotional campaigns. SatisFusion's marquee customers within the OEM warranty space include Panasonic Consumer Electronics Co. and Toshiba America Consumer Products Inc. Previously independent, the company merged with the Warranty Corporation of America late last year. |

Ken Kopp SatisFusion |

Nina Doherty, director of marketing at ServiceBench Inc., said that when the inevitable "What do you do?" question comes up at a cocktail party, she always says that ServiceBench is a supply chain management applications company. Among the supply chain applications it manages is warranty. But the company also provides applications such as parts ordering, service dispatch, product registration, and service network management. "First and foremost, we're a service provider."

Name That Business

So what does one call this business? In the dot-com era, ASP was the noun and outsourcing was the verb. But the application being sold usually had more to do with electronic messaging and little to do with warranty. Besides, at this point calling yourself a warranty ASP would conjure up unpleasant images of incinerated venture financing and bankrupt Web-based companies sold by the pound for scrap. WISP, for Warranty Industry Service Provider, doesn't sound right. So for the moment, unless a reader has a better suggestion, we're stuck with OEM warranty service company.

"I don't think there's a good acronym," Doherty said. A veteran of the telecom industry, she's also uncomfortable with the term outsourcing. "When a company that we work with talks about our relationship, they always talk about it as a partnership. Outsourcing implies that they're not participants."

Most of the companies listed above as both OEM/ESP service providers seem to focus primarily on the consumer electronics and home appliance markets. Some have clients in commercial air conditioning, power tools, and even the plumbing business. But what they all seem to lack is a foothold in the automotive industry. While the ESP list is filled with sellers of auto extended warranties, there doesn't seem to be a role for OEM service providers to play between the automaker and their dealer networks.

James Tucker, president of VAC Service Corp., said he thinks the reason has a lot to do with the tightly-coupled relationship between the factory, the dealer, and the service center. "I think the difference in the automotive business is that you as an administrator are captive to that dealer," he said, "because he not only sells the product, but he also does the repairs. So you're kind of at his mercy." In contrast, in the refrigerator business, a consumer can take their defective unit to any of 4,000 repair centers, no matter which dealer sold them the product.

Tucker said his company performs claims management in both the OEM and the ESP sectors. For some clients such as online retailer Orion Sales Inc., it does both. He estimates that roughly 60% of his business is OEM, while 40% is ESP.

Not Just Warranties

"That's why we consider ourselves a full service company, and not so much a warranty company," he said. "Not only do we take the calls for the manufacturers, but in some cases we also distribute parts. In other cases we refurbish products. We also do technical assistance."

Most of VAC's operations are squarely in the consumer electronics and appliance industries, he said. But Tucker noted that the company is already "dabbling" in the automotive business, specifically in the tire sector. While the acronym VAC stands for Video Aid Corp. and the company's roots are in ESP sales through consumer electronics retailers, Tucker himself came out of the Ford Motor Co., where he developed the 12-year/12,000-mile powertrain warranty program for used cars. "I've stayed away from the auto business for years," he said, but he can no longer resist the urge.

Kopp noted that same kind of effect at his company -- where you've been largely determines where you go. "That's our roots," Kopp said of SatisFusion's focus on consumer electronics. "The leadership in our organization -- we all came from this industry. Our founder and chairman and all these folks came from Thomson, GE, RCA, Mitsubishi, and Philips. We know this stuff. And that's a big part of what we build."

SatisFusion markets a post-sale customer relationship management service optimized for the needs of the consumer electronics, housewares, and photographic industries. If SatisFusion had developed a service optimized for the automotive industry or the aircraft industry, and if all its executives had come out of Ford, Chrysler, or Boeing, the company would probably count a whole lot of those types of companies as clients, he said.

SatisFusion's Wheel of Satisfaction

Kopp agreed that the reason for the poor showing for service providers in the auto industry has to do with the fact that so few auto dealers sell multiple manufacturers' vehicles. They may sell close cousins like Jeep and Dodge side-by-side, or perhaps Honda and Acura. An adventurous dealer might even sell three or four nameplates -- perhaps an import, a domestic, and a luxury brand. But which dealers would sell 25 different brands, and would therefore need to interact with 25 different manufacturers? Because the dealers and their service operations are usually tied to specific manufacturers, the need for a middleman to arbitrate the chaos in the network is not as strong in automotive, he said.

Computers Becoming More Like CE?

Kopp predicted that the computer industry will increasingly face this network chaos problem as more and more independent service centers take on repairs for multiple brands. "A computer service center authorized for Apple, HP, Compaq, and Toshiba -- that's four different claims systems they have to file," he said. As companies such as Gateway move away from the company store concept and as Dell looks for growth in the indirect sales channel, the computer service business will begin to look less like the auto business and more like the consumer electronics industry, and the need for a middleman will increase, he said.

Then again, warranty is warranty. "The discipline of warranty claim processing, of being able to take a manufacturer's business rules -- what they pay and what they don't pay -- and reducing those to a series of electronic validations, of being able to take files in from the people fixing this stuff and bouncing them against those variables, then taking those files and turning them around to a manufacturer for payment or further review -- those disciplines do not change across any of these verticals: medical, automotive, aircraft, consumer electronics, or computer," Kopp said. There's also not much difference based upon the geography of the client, he added. The processes don't change much depending upon whether the factory is located in the U.S., Korea, Japan, China, France, or Holland.

What's different, Kopp said, is the service end of each industry. Central air conditioners and washing machines are serviced differently than laptops or watches. Who selects the repairman? Is he dispatched to the customer site or does he wait for drop-offs or mail-ins? Does each service center have an exclusive territory, or do they compete for business? Are they captive to one manufacturer, or do they service the wares of several? Are most of the repairs under $100 or are they rarely that small? Even within just the computer industry, there are very real service differences between the process controlling how business and consumer products are fixed.

James Rushton, vice president of sales and marketing at KeyPrestige Inc., said his company is able to serve clients as diverse as Friedrich, Bosch, and Pioneer because the company developed a rather generic model of its target customer: one that manufactures durable goods covered by warranty and repairable by any of numerous independent service centers. Each specific industry has its peculiar nuances, but the core KPI warranty claims processing system is the same whether the product is a television or a washing machine.

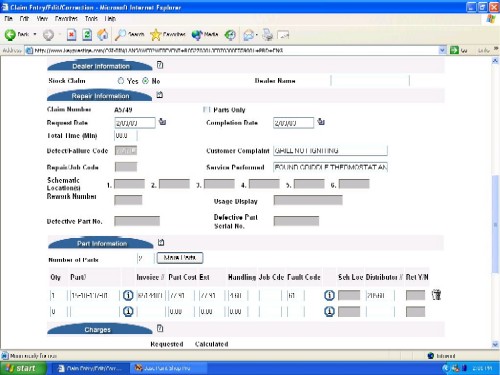

KeyPrestige's ClaimWorks Interface

"Seventy-five percent of the performed logic to process a claim is the same, whether you're servicing consumer goods or automobiles," he said. Either type of manufacturer is looking for specific bits of information, such as the owner's address, the model name or number, serial numbers, parts numbers, etc. In consumer electronics, they generate a claim number. In HVAC, they generate a service order number. While the terms used may be slightly different depending upon the industry, they're in effect just speaking different dialects -- not different languages. Either way, the screens can be customized to fit the terminology used in each specific industry.

That having been said, the industry that KPI also has been unable to crack despite its best efforts is automotive. Rushton said he also suspects that's because the dealerships already are so closely tied to the manufacturers. He's made presentations to Hyundai Motor Co., Kia Motors Corp., Harley-Davidson Inc., Deere & Co., and a few others in the automotive sector, but each elected to keep the closely-coupled relationship they have with their dealers in-house. In keeping with its service focus, KPI declined to license its ClaimWorks software to any of these manufacturers. "So we didn't see any opportunity to go anywhere with them," Rushton said.

|

Doherty said she suspects the reason why warranty service companies seem to specialize in one industry or another has a lot to do with credibility. It takes some time for a service company to become familiar with all the business rules in a specific industry, let alone the products and their parts. Once they develop that expertise around the business processes of a single client in a specific industry, they're more likely to pitch their skill set to a prospect in the same industry than they are to a company manufacturing something completely different. And that prospect is more likely to listen to the pitch if the service company's reference accounts are in businesses just like theirs. |

Nina Doherty ServiceBench |

"None of these companies have been around so long that they have become the de facto experts on a specific industry," she said. "And when you get a foothold and you get some intelligence, as far as understanding how servicing works, it's hard to leverage that industry and take what you're able to do and develop a best practices and apply it in another industry. In some respects, it's a lazy way to sell. But it's also a smart way to sell."

Marquee customers at ServiceBench include Whirlpool Corp. for its independent service contractors and Electrolux AB for servicers of their Frigidaire brand. What they have in common, besides of course their appliance-dominated product lines, is the need to bring in an outside manager to act as a middleman between sales, parts, service, and customers.

"If they have a service network that they're interacting with, they have to have a process that handles claims," she said. If they're potentially working with thousands of authorized service centers, and each service center works with dozens of brands, that network may not be all that easy to manage. ServiceBench's strength is that it provides a customizable Web-based interface that can act as a buffer and a telecommunications manager for all of these thousands of potential interactions.

ServiceBench acts as a clearinghouse -- a middleman that receives problems and dispatches solutions. Where ServiceBench does best, Doherty said, "is with companies that have multiple entities that they need to connect with, and where it's that connection that can be so challenging. That technology is not simple," she added.

The Middleware Myth

"There was a time two years ago," Doherty recalled, "when middleware was going to solve everything, and enterprise networks were going to take over the world, and everyone would be connected seamlessly throughout their different applications, with all their business partners. But it never really seemed to work..."

Doherty said ServiceBench has never lost an OEM's warranty account when that OEM took the operation back in-house. She notes that what's more common is a situation where an OEM begins by outsourcing some aspect of their aftermarket operation, then outsources a little more. "In large companies especially, they have multiple IT projects going on. And the warranty people are not necessarily first in line," she said.

Kopp said it's not in the best interests of an electronics or appliance manufacturer to try to act like a phone company. "The manufacturer is focused on building and delivering product into the retail space," he said. "From a warranty claims point of view, if you have thousands of service centers out there, it's very likely you have many hundreds if not thousands of different formats that somebody can use to create and send a claim in. It's not in the best interest of manufacturers, nor is it in the best interests of the service community, for each manufacturer to build a system to do that."

Had things happened differently, Kopp said the consumer electronics industry could have ended up with 50 different manufacturers having 50 different claims entry protocols. An independent service center that may be authorized to repair for 25 of them would have to teach their staff 25 different formats in which to file warranty claims. The better approach would be to have a middleman service bureau to arbitrate between the 50 manufacturers and the thousands of service centers.

"By and large, these are family-owned businesses fixing this stuff," Kopp said. Asking them to become software experts or data processing experts is not the best way to go. A better solution would be for each service center to work with a handful of middlemen who in turn work with all the manufacturers.

Economies of Scale

Dan Tafel, general manager of business development at Service Net Inc., said he thinks the reason his company has been so successful with manufacturers in the consumer electronics and appliance industries has a lot to do with the economies of scale. Build a network for one client, and it can be leveraged for the next client. By word of mouth or simply as people move around from company to company, the news spreads that somebody has solved the many-to-many connection problem.

Service Net's roster of marquee customers includes Maytag Corp.; Sony Corp.; Philips Electronics N.V.; and Office Depot Inc., Tafel said. The company, which was previously known as Service Net Solutions LLC, recently bought back the 51% stake owned for the past two-and-a-half years by Kemper Insurance Companies. While having a rich parent with deep pockets helped Service Net land accounts such as Office Depot, being independent hasn't stopped it from recently signing clients such as Lennox International Inc., MTD Products, and Leslie�s Poolmart Inc.

At KeyPrestige, the marquee list of customers includes General Electric (for both home appliances and the extended warranties sold through retailers by the GE-Zurich Warranty Management joint venture); the BSH Home Appliances unit of German manufacturer Robert Bosch GmbH; Sharp Electronics Corp.; and Sanyo Fisher.

|

Rushton said KeyPrestige offers its menus and data entry screens in English, French, and Spanish to address the needs of manufacturers selling into the U.S., Canada, and Latin America markets. Besides the obvious language and currency differences, he added that there's a need to localize the tax computation and reporting routines built into the ClaimWorks system. For example, in the U.S. a manufacturer must generate a Form 1099 report at the end of the year for each service center it pays for warranty work. In Canada, the manufacturer also must pay national and provincial sales taxes on that amount. |

Jim Rushton KeyPrestige Inc. |

The biggest challenge KeyPrestige faces, Rushton said, is to convince OEMs that the way they've been doing warranty is no longer viable. "The majority of manufacturers doing claims processing and analysis are doing it the same way they did 25 years ago," he said. "And that is: the service centers are sending in the paper white copies, they're doing a visual pre-audit, some of them enter all of the information into a computer system to validate all of the information on the claim for accuracy against their business rules, but many of them enter only partial information to feed accounts payable."

In recent years, some of the manufacturers have developed their own Web-based electronic commerce sites which serve multiple purposes, Rushton said. First, it forces the service centers to do the data entry work, which speeds the processing of claims and cuts down on re-keying mistakes. Second, the Web site serves as an order entry system for parts. Third, it serves as a publishing mechanism for service bulletins and other relevant news from the OEM.

KeyPrestige has OEM clients in five different industries, and Rushton said he thinks the manufacturers and service centers in each are at different points in that transition from paper to computer. Consumer electronics is the most advanced, with 94% of claims now arriving in an electronic format. Home appliances and plumbing are a little less advanced, while power tools and HVAC are further back. The difference is striking. Rushton said the computer-formatted claims are processed in an average of 3.5 days. Paper claims take an average of 31 days to process. Obviously, the service centers will get paid faster if they make the transition.

Warranty Claims Analysis Services

Whether the claim arrives electronically or on paper, it ends up entered into the same KPI database. From there, manufacturers are free to browse the data, looking for patterns or anomalies in the parts data or service reports. KPI also regularly feeds all the claims data into the client's own accounts payable, quality control, and engineering systems.

"And if they need something on the fly, we have an on-demand query tool," Rushton added. So if they're going into a meeting in an hour and they need to know the failure rate of a specific part, they can drag and drop the information into a report that they can then take with them. They can choose to have it output into an Excel spreadsheet, a Microsoft Access format, or even an HTML format that can be printed or posted.

Rushton said the OEM therefore loses none of the visibility they might once have had if they outsource their aftermarket operations to a service company. Tafel said that rather than losing visibility of their products' performance in the field, he thinks the outsourcing model is actually an improvement upon the previous level of data collected by most OEMs.

Rushton said the OEM therefore loses none of the visibility they might once have had if they outsource their aftermarket operations to a service company. Tafel said that rather than losing visibility of their products' performance in the field, he thinks the outsourcing model is actually an improvement upon the previous level of data collected by most OEMs.

"To be a warranty service provider for the OEM market, you need to develop a perspective about what warranties look like from the OEM side," he said. "A critical component of that is reporting on product performance. We can actually send very detailed reports back to the OEM, by the timing of failure, what failed, the part name or the component that failed. And that information allows them to actually push back on their suppliers."

Kopp agreed that OEMs lose no visibility of their fielded products when going through a service bureau. "One of the beautiful things about our platform is that warranty data is immediately accessible," he said. "We have manufacturers now where we have audit queues set aside specifically. The manufacturers come into our system and they can modify these audit queues." They may want to sort the claims based on specific parts, specific dates, or specific models, using the warranty data as an early warning of a quality problem within one of their suppliers, or perhaps in their own factory. "We communicate very closely with these folks through that data."