The building trades accounted for 21% of all warranty accruals made by U.S.-based manufacturers in 2022. Under the umbrella of the building trades, power generation had the highest total warranty accruals, followed by appliances & HVAC. These two industries will be the focuses of upcoming articles. This week, we are zooming in on the third- and fourth-largest industries in the buildings sector: new home builders, and their suppliers of building materials, fixtures, and furniture.

This article presents the twenty-year data for new home, building materials, and appliance & HVAC manufacturers, in order to paint a fuller picture of the warranty expenses associated with building construction. We do not include power generation equipment warranties in these charts, as we have in the past, since the majority of the manufacturers in that industry are dealing with power grid infrastructure, rather than something like a rooftop solar panel. The largest company in U.S. power generation is currently General Electric, which sold its appliance division to the Chinese Haier Group Corp. in 2016. While we do include the appliance & HVAC numbers in the following charts, we will delve deeper into this industry next week, and not linger on them here.

We began with a list of 226 companies that are engaged in the building trades and publicly trading on a U.S. stock exchange, thus publishing their warranty expenses in their annual reports and quarterly financial statements. Of those companies, 58 are builders of new homes, 111 are suppliers of building materials, fixtures, or furniture, and 57 manufacture household or food service appliances and/or commercial and residential heating, ventilation, and air conditioning (HVAC) systems.

From these lists, we also identified the top 10 largest companies in each industry based on their warranty expenses. The top 10 new home builders are: Lennar Corp., D.R. Horton Inc., PulteGroup Inc., NVR Inc., Taylor Morrison Home Corp., Toll Brothers Inc., Skyline Champion Corp., Cavco Industries Inc., KB Home, and M.D.C. Holdings Inc. We also identified the top 10 building materials companies in terms of their warranty expenses: Stanley Black & Decker Inc., Pentair plc, Acuity Brands Inc., Mohawk Industries Inc., Cornerstone Building Brands Inc., Masco Corp., American Woodmark Corp., La-Z-Boy Inc., PGT Innovations Inc., and MKS Instruments Inc.

From each company's financial statements, we extracted three warranty metrics: the amount of claims paid, the amount of accruals made, and the ending balance of the warranty reserve fund. We also recorded total product sales revenue figures, which we used to calculate our two warranty expense rates: claims as a percent of sales (the claims rate) and accruals as a percent of sales (the accrual rate).

Warranty Claims Totals

Figure 1 shows total warranty claims in the three industries over the past 20 years. Total claims rose for all three in 2022, though these totals remain below pre-Great Recession levels.

Figure 1

Homebuilding & Materials Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2022)

The Appliance & HVAC industry still accounts for the largest share of warranty claims among the building trades, though this proportion and totals overall have decreased in recent years. This fall is mainly the result of Raytheon's merger with United Technologies Corp. in 2020. Raytheon acquired United Technologies' aerospace business, but Carrier Global Corp., the HVAC manufacturer, and Otis Worldwide Corp., the elevator company, both spun-off as independent companies in 2019. This improves the specificity of our data going forward, but does create the dip from 2018 to 2019 we see for the Appliance & HVAC industry in Figures 1, 2, and 6.

Total warranty claims for U.S.-based Appliances & HVAC rose by 5% in 2022, but the year's total of $1.1 billion is half the industry record, set pre-recession in 2007 at $2.3 billion. We will discuss this industry in greater detail in next week's newsletter.

Total claims for the new home builders rose by 20% in 2022, to a total of $955 million. This was a $159 million increase over the course of a year. This is the second-highest this claims total has ever been. The record high number was recorded in 2006, at the height of the housing bubble. As we can see in Figure 1, warranty expense totals began to fall for the homebuilders over a year before the Great Recession officially started. The homebuilders were hit the hardest in the recession, and took a long time to bounce back from the bottom. But Figure 1 shows us that the pandemic and recent "economic downturn" didn't make even a dent in the warranty claims totals for the new homebuilders. If there's a recession on the horizon, it certainly does not have the same origins as 2008.

Total claims for the building materials manufacturers, including makers of plumbing and electrical fixtures, furniture, windows, flooring, roofing, carpets, and doors, rose by 8% in 2022 to a total of $840 million. This total is on the higher side for the industry, exceeded only by the claims total we recorded in 2009. But as we see in Figure 1, claims totals have been very consistent for this industry over the past two decades, with the lowest range out of the three industries.

Warranty Accrual Totals

Figure 2 shows the total accruals for the three industries, while Figure 3 zooms in on the Homebuilders category. Total accruals across the three industries have remained around the same level for the past decade, but the proportions between the three have shifted. The builders of new homes took a huge hit in the recession, and have slowly but steadily rebounded, while the appliance & HVAC totals have dropped in recent years, in part due to the Raytheon-United Technologies merger we detail above.

Figure 2

Homebuilding & Materials Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2022)

Total accruals for the Appliance & HVAC industry rose by just 2%, or $28 million, in 2022, to a total of $1.2 billion.

Accruals for the building materials companies rose by 11%, or $80 million, in 2022, to a total of $836 million. Among this category, the company with the highest total claims and accruals was Stanley Black and Decker, maker of tools and household hardware. The company accrued $155 million for warranty expenses in 2022, a modest 3% rise.

Water treatment company Pentair, which makes pool filters and pumps among other things, increased its accruals by 53% to $85 million, and lighting company Acuity Brands Inc. rose by 72% to $52 million. Other big rises in total accruals were reported by Cornerstone Building Brands, which increased by 68% to $44 million, and American Woodmark, which rose by 65% to $36 million. These increases in warranty accruals coincided with rises in product revenue, though not by the same large margins. This also coincided with a big jump in claims totals for Acuity and American Woodmark, indicating warranty costs rising at a rate that exeeds overall growth.

MKS Instruments Inc. is the only company among the top ten that managed to lower its total claims and accruals while raising revenue in 2022, meaning they were actually saving money on warranty expenses per product. MKS' total accruals fell by -19% to $31 million. MKS, along with new home builder Taylor Morrison, made it into our recent article Largest Nine-Month Warranty Expense Rate Changes because they both reduced their claims and accrual rates significantly over the first three quarters of the year.

Figure 3 zooms in on the dark green Homebuilders category we see in the middle of Figure 2. Figures 2 and 3 illustrate the dramatic rise and fall of warranty expenses among the home builders due to the housing bubble collapse and Great Recession. These companies build homes ranging from mobile homes to McMansions.

Figure 3

New Home Warranties

Accruals Made by Top U.S.-based Manufacturers

(in US$ millions, 2003-2022)

This chart probably shows the most dramatic picture of the Great Recession that we can illustrate using warranty data. Total annual accruals for the industry rose as high as $1.12 billion in 2005, and fell as low as $230 million in 2011. These years are not the "buzz" years of 2008 or 2009, which we usually discuss in terms of the recession. This industry started falling before the public noticed what was going on, at which point the stock market subsequently crashed, and it took much longer than any other U.S.-based manufacturing industry to recover.

In 2022, total accruals for the homebuilders again exceeded $1 billion, for the first time since the height of the housing bubble in 2006. The 2022 total was $1.06 billion, a 13% rise from the year prior. Accruals in the industry have increased especially steeply in the past two years. Unlike the Great Recession, where housing was hit first and the effects were long-lingering, the pandemic barely affected the new home builders.

Of course, recessions can originate in many different sectors, and come about for a wide variety of reasons. But this arc is certainly intriguing, and the present-day clearly contrasts with the situation in this industry in 2008. We don't want to say anything pessimistic about how warranty expense totals for the homebuilders are getting to the same highs they hit before the bubble popped and economic collapse ensued, or how warranty expenses set new records in 2022 across the vehicle sector as well. Inflation certainly plays a part here too.

Lennar Corp., the country's second-largest home builder by number of closings according to Builder Magazine, has the highest warranty expenses among the new home builders. Lennar saw a jump in total claims and accruals in 2018, when it acquired CalAtlantic Group Inc., which itself was the product of the 2015 merger of Standard Pacific Homes and Ryland Homes. Lennar reported $275 million total accruals in 2022, a 26% jump from the year prior, coinciding with a 25% increase in product revenue and 23% increase in warranty claims.

The next-highest was D.R. Horton, the country's largest maker of prefabricated houses, which saw accruals rise by 17% to $187 million, and claims rise by 25%, despite sales only increasing by a very slight 1%. NVR, ranked third in terms of warranty expenses, saw accruals rise by just 2% to $97 million. The company's accrual rate decreased, though, since revenue rose by 19%, exceeding the increase in warranty cost.

PulteGroup and Taylor Morrison both managed to decrease accruals while increasing sales. PulteGroup's accruals fell by -9% to $85 million, while Taylor Morrison's accruals fell by -2% to $77 million.

Skyline Champion, the mobile home manufacturer created in 2018 through the merger of Skyline Corp. and Champion Enterprises Holdings LLC, saw accruals rise by 24% to $54 million, and claims rise by a similar level. The biggest jump of the top companies was by Cavco Industries, a competitor in the mobile home sector, which rose accruals by 48% to $53 million, while its total claims rose by 37%.

Overall, the new home builders are seeing growth in total sales revenue, but this growth is exceeded by jumps in warranty costs. Homebuilding has always been a volatile industry, directly dependent on economic conditions and consumer behavior. There's also so many different things that can go wrong with building a new home, and it can be challenging to keep warranty costs down, especially in certain climates, and with different levels of customization. Even still, some of the companies tend to have much more volatile warranty expense rates than others. While we do not break down each homebuilder's accruals per homes sold in this newsletter, we did so in our January 19, 2023 article, with data as recent as the third quarter of 2022.

Figure 4 presents the industry average claims and accrual rates for the new home builders for the past 20 years. The EKG-like, oscillating quality of this chart highlights the volatility in warranty expenses that many of the companies in this industry face.

Figure 4

New Home Warranties

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2022)

We can see in Figure 4 that the drops in homebuilding revenue in the Great Recession drove up the industry-wide average claims rate during those years. We can assume that the accrual rate did not rise as well because the companies lowered their accruals as revenue stopped rolling in, keeping the two numbers in proportion to each other. But the recession didn't stop people already living in new, prefabricated homes (perhaps struggling to pay their mortgages) from filing warranty claims when failures arose.

The industry average claims rate across 20 years was 0.96%, with a standard deviation of 0.30%. This is by far the most volatile expense rate in this newsletter, but actually not the highest standard deviation that we have seen while analyzing the 20-year data for all U.S.-based manufacturing industries. So it could be worse. The industry average accrual rate over 20 years was 0.84%, with a standard deviation of 0.13%. So on average, the new home builders are spending less than 1% of their total revenue on warranty expenses.

The oscillation we see in Figure 4 is also the result of seasonal construction and buying patterns, though it's interesting that these have become more pronounced in the past decade. Every year, we see the highest expense rates in this industry in the first quarter, bottoming out in the third quarter, and then rising a bit in the fourth quarter. We can assume part of this pattern is just that home sales go up in the summer months, are lowest during the first three months of the year, and somewhere in between during the spring and holiday seasons.

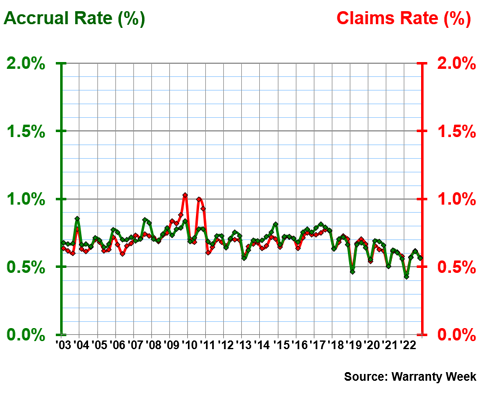

Figure 5 shows the industry average claims and accrual rates for the building materials manufacturers.

Figure 5

Building Material Warranties

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2022)

Immediately, it's evident that the building materials companies have much more consistent warranty expense rates. This is a pattern we have noticed across many industries, including in our recent articles on the vehicle sector: suppliers tend to have lower and more consistent expense rates than the manufacturers to which they provide parts. Think of the building materials manufacturers as the suppliers to the homebuilders, who in turn sell their product directly to end-user consumers (homeowners). The suppliers, like the makers of the windows or sheetrock that go into the homes, tend not to interact directly with the end-user consumer, so their warranty expenses tend to stay lower. If a pipe breaks in a new prefabricated home, the homeowner is filing the warranty claim with the homebuilder, not the pipe manufacturer. While the homebuilder can then pass on those expenses to their supplier, it can be a long and inefficient process. It's no coincidence that the building material manufacturer with the highest warranty expenses, Stanley Black & Decker, also has a considerable consumer power tool business, in addition to selling household hardware.

The industry average claims rate over 20 years for the building materials manufacturers was 0.68%, with a standard deviation of 0.09%. The average accrual rate was 0.70%, with a standard deviation of 0.08%.

It's also interesting to see this visualization of the contrast between the building materials companies and the homebuilders during the Great Recession. The materials suppliers did see a bit of a rise in their average claims rate, but clearly, there was a much greater impact on the homebuilders themselves.

Lastly, we are going to take a look at the warranty reserve balances for these three industries over the past two decades. Figure 6 shows a similar story to Figures 1 and 2, with the homebuilders taking on a larger proportion of total expenses, while the appliance & HVAC manufacturers' share of the total decreased in recent years.

Figure 6

Homebuilding & Materials Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2022)

Total warranty reserves for the appliance & HVAC industry narrowly remained the highest among the three industries. However, the appliance & HVAC total fell by -7%, or $155 million, to $1.99 billion in 2022. This was actually the first time since we started recording these data in 2003 that total reserves for this industry fell below the $2 billion threshold. At their height in 2011, total reserves for this industry totaled $3.44 billion. We will delve deeper into individual manufacturers in this industry in next week's newsletter.

The homebuilders' warranty reserves grew by 14%, or $242 million, in 2022, to a total of $1.94 billion. Interestingly, this is actually the highest total reserves we have recorded for this industry since 2003. So appliance & HVAC warranty reserves hit a record low, and new home builder warranty reserves hit a record high concurrently.

Among the homebuilders, D.R. Horton had the highest reserve balance in 2022, up 19% to $464 million. Lennar's reserves were up 11% to $418 million. Next are Toll Brothers with $164 million, Taylor Morrison with $162 million, and NVR with $144 million.

Total reserves for the Building Materials manufacturers fell by -4%, or $54 million, to $1.19 billion in 2022. The industry's highest year-end reserve balance was recorded in 2017, and the lowest was 2003, the first year for which we have data available.

Cornerstone Building Brands accounted for $202 million of that total, followed by Stanley Black & Decker at $127 million, Owens Corning at $88 million, and Masco Corp. at $80 million. Owens Corning, a roofing, insulation, and fiberglass company, didn't make the top 10 lists for total claims or accruals, but had the third-largest warranty reserves among the building materials manufacturers at the end of 2022. Recently, the company has been accruing almost twice its annual claims total, leading to a rising reserve fund balance.