Japanese Automaker Warranty Expenses:Sales revenue fell and so did claims, but warranty accruals actually rose last year. Because of the pandemic, unit sales fell to their lowest level of the last ten years. But while claims are down, accruals are up, as Japanese manufacturers seemingly prepare for increased costs down the road.

It's an Olympic year and a pandemic year. And while the world worries about the new virus variants and their effects on the reopening of shops and offices, for at least a few weeks its attention has been on the athletes in Tokyo.

Coincidentally, it's also time for us to take an accounting of the warranty expenses of all the Japanese carmakers. Although none of them release quarterly figures for their warranty expenses, all release at least some warranty metrics on at least an annual basis. And because they end their fiscal years three months later than do automakers based in most other countries, this gives us a slightly more current view of market conditions.

Unfortunately, that also means we have to wait three extra months to get a complete reading of the Japanese auto market each year. And that in turn delays our annual tabulation of the worldwide automotive warranty totals and averages until this month at the earliest. Last year, for instance, the worldwide report was published in the September 10 edition of the newsletter.

Methodology

We are currently tracking the warranty expenses of nine automotive manufacturers based in Japan. From each of their annual reports, for fiscal years that always end on March 31, we extract three essential warranty metrics and two sales metrics, and we use these figures to calculate three additional metrics.

All nine manufacturers include in their annual reports a figure for the year-ending balance in their warranty reserve funds. Only the top three -- Toyota Motor Corp., Honda Motor Company Ltd., and Nissan Motor Company Ltd. -- reveal the amount of warranty accruals they make during the year. And only Toyota and Honda also reveal the amount of warranty claims they pay per year. For all the other missing metrics, we had to fashion estimates.

The companies that we are including in the "other" category in the charts below include three passenger car makers -- Mazda Motor Corp., Mitsubishi Motors Corp., and Subaru Corp. -- as well as one car/motorcycle manufacturer -- Suzuki Motor Corp. -- and two car/truck makers -- Isuzu Motors Ltd. and Hino Motors Ltd.

All nine publish the amount of automotive revenue they raise through product sales, as well as the number of vehicles they sell per year. Using the claims and accrual totals and the sales data, we calculate claims as a percentage of sales revenue (the claims rate) and accruals as a percentage of sales revenue (the accrual rate), as well as the average amount of accruals made per vehicle sold (the other accrual rate).

The top three Japanese auto manufacturers accounted for 78% of the group's revenue last year, and, we reckon, 74% of the fiscal year 2021 claims paid, 79% of the 2021 accruals made, and 77% of the warranty reserves held at the end of March 2021. The other six, bunched together under the "other" heading, accounted for the balance.

By the way, we are adopting the convention that the year ended March 31, 2021 will be called fiscal 2021, even though some companies call it fiscal 2020, while the year ended March 31, 2012 will be called fiscal 2012. The ten years between fiscal 2012 and fiscal 2021 are the subject of the charts below, though we have additional data that we won't include here that stretches all the way back to April 1, 2002. Readers can find additional data stretching back an additional six years in the July 25, 2019 newsletter.

Warranty Claims Totals

Because all the companies report their financial figures in Japanese yen, we will keep all the data in their native state here. In weeks to come, as soon as some of the tardiest Chinese companies get around to publishing their annual reports for 2020, we will assemble a worldwide report in which everything will be converted into U.S. dollars. But for now, a handy rule of thumb is to think of a single yen as a U.S. penny, or a dollar rounded off as worth 100 yen, and a billion yen as $10 million.

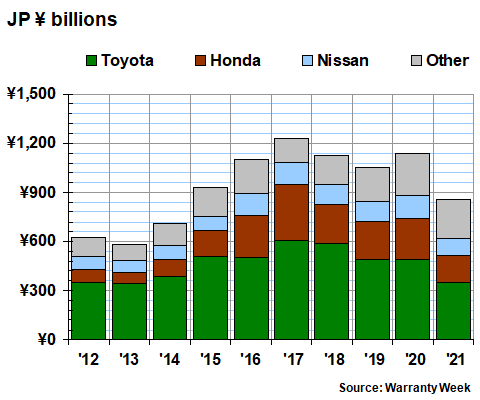

In Figure 1, we can see that claims payments plunged in fiscal 2021 -- below even the levels seen six years before in fiscal 2015. We estimate that Japanese auto manufacturers paid 918 billion yen in claims, down by nearly 20% from fiscal 2020 levels. Notably, claims fell faster than sales, which declined by -16% in terms of units sold and by -13% in terms of revenue.

Figure 1

Top Japanese Auto Manufacturers

Claims Paid per Year

(in billions of yen, fiscal 2012-2021)

We should note that each of these manufacturers are releasing one single set of warranty metrics for all their products in all the countries where they manufacture and/or sell them. So these are measures of the nine Japanese companies, not measurements of the Japanese market itself.

All three of the named companies in Figure 1 saw their claims totals fall faster than the industry average of -20%. Honda's claims were down by -34% to 166 billion yen; Toyota's claims were down by -29% to 348 billion yen; and we estimate that Nissan's claims fell by -27% to 104 billion yen. The industry total fell by -225 billion yen from a level of 1,142 billion yen in fiscal 2020.

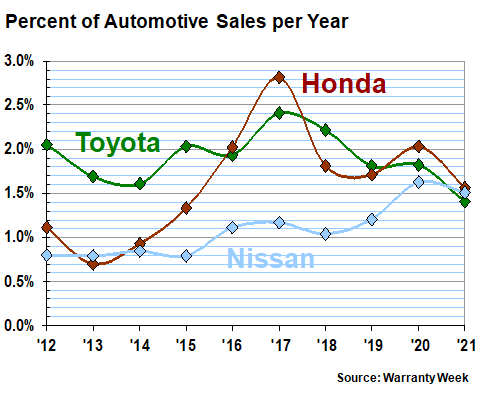

Claims Rates

Because claims fell faster than sales, all three claims rates also declined. Toyota slipped from 1.8% to 1.4%. Honda fell from 2.0% to 1.6%. And Nissan declined from 1.6% to 1.5%. As can be seen in Figure 2 below, that placed the top three's claims rates into a tighter cluster than they've ever been in before -- closer than they were even in fiscal 2020.

Figure 2

Top Japanese Auto Manufacturers

Warranty Claims Rates

(as a percentage of sales, fiscal 2012-2021)

We wanted to also plot the industry average, but it made the chart look even messier, so we thought it best to explain it in text instead. Because we estimate that some of the six companies in the "other" category had higher claims rates than the top three, the industry average claims rate was 1.7% in fiscal 2021, down from 1.8% the year before.

In general, the average claims rate has remained in a range between 1.5% and 2.0% for the past seven fiscal years, but from fiscal 2012 to fiscal 2014 it was below 1.5%. And that's a sign of the deep impact the air bag recalls and other manufacturing excursions have had on the Japanese automakers.

Warranty Accrual Totals

Surprisingly, we estimate that Japanese automotive warranty accruals were actually up in the year ended March 31, 2021. But actually, it should be no surprise, because the three named companies in Figure 3 each included their accrual totals in their annual reports. And while Nissan reported a decline, Toyota and Honda both reported increases.

Toyota reported a 10% increase in accruals, to 346 billion yen. Honda reported a very large increase of 60 billion yen, bringing its annual total to 272 billion yen. But Nissan cut its accruals by 28 billion yen, dropping its total below 100 billion yen for the first time since fiscal 2013.

Figure 3

Top Japanese Auto Manufacturers

Accruals Made per Year

(in billions of yen, fiscal 2012-2021)

The industry total, we estimate, was just under 900 billion yen, which was up by 48 billion yen, or about 5.7%, from fiscal 2020 totals. And therefore the industry average accrual rate also rose, jumping from 1.4% in fiscal 2020 to 1.7% in fiscal 2021.

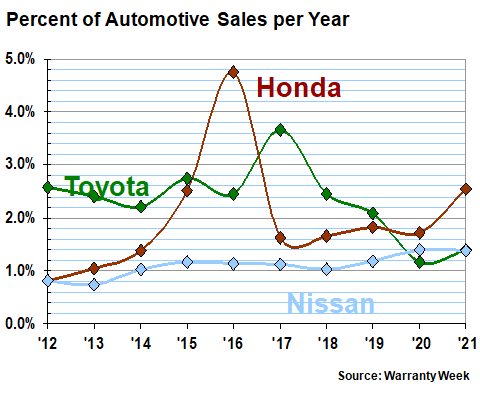

Accrual Rates

In Figure 4, we can see a big jump in Honda's accrual rate, rising from 1.7% in fiscal 2020 to 2.5% in fiscal 2021. But that's not as bad as fiscal 2015-2016, when the company made the bulk of the payments it faced due to the cost of the air bag replacements.

Toyota's accrual rate rose more modestly, from 1.2% in 2020 to 1.4% in 2021. And Nissan's accrual rate actually dipped slightly, though at the scale of this chart it looks as if it remained steady at 1.4%.

Figure 4

Top Japanese Auto Manufacturers

Warranty Accrual Rates

(as a percentage of sales, fiscal 2012-2021)

The simple reason for Nissan's slight decline is the interplay between accruals and sales in the percentage rate calculations. Nissan's accruals were down -23% while sales revenue fell only -21%. So that slight imbalance drove the accrual rate down by three-hundredths of a percentage point -- again, almost imperceptible at this scale.

For the six other companies, we estimate that accruals fell by -7% while sales revenue slipped by -17% and unit sales fell by -14%. So again, because revenue fell faster than accruals, they also contributed to the general rise in the industry average from 1.4% in 2020 to 1.7% in 2021.

For the record, the industry average accrual rate has been below 2.0% for the last four years, was above 2.0% from fiscal 2015 to 2017, and was somewhat below it from fiscal 2012 to 2014. For the past two years, industry leader Toyota has been below average, while from 2012 to 2019 it was above average. In contrast, Honda have been above average for two years, having been below average from 2012 to 2014 and again from 2017 to 2019.

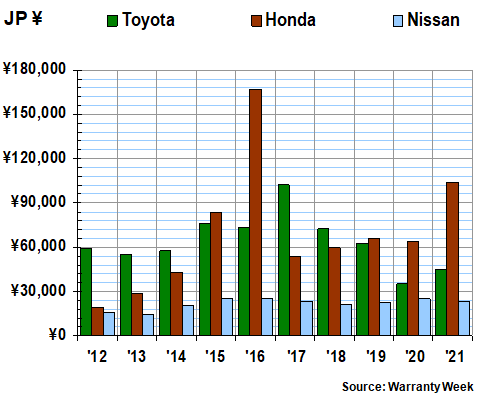

Accruals Per Vehicle Sold

With passenger cars, we have another way to measure the accrual rate, which is to divide the amount of accruals as detailed in Figure 3 by the number of vehicles sold. This works because warranty accruals are traditionally made at the time a product is sold, based on the best estimates a company has for its future warranty costs.

Therefore, this instance of the accrual rate should remain steady, unless a company predicts an increase in future warranty costs. And in Figure 5, one can instantly see that this is what Honda was predicting in fiscal 2016, when the air bag recalls were in full swing.

However, in fiscal 2021, the company also radically changed the amount it accrued per vehicle sold. Granted, the company also manufactures motorcycles, generators, outboard motors for boats, robots, outdoor power equipment, and even airplanes. But, we note, more than 80% of its revenue comes from sales of passenger cars and SUVs. So this is also the likely source of most of the recent increases in accruals seen in Figures 3, 4, and 5.

Figure 5

Top Japanese Auto Manufacturers

Accruals Made per Vehicle Sold

(in yen, fiscal 2012-2021)

In fiscal 2020, Honda accrued an average of 64,000 yen per car, the equivalent of $474. And then in fiscal 2021, this amount rose to 104,000 yen, the equivalent of $782. At the same time, Toyota raised its accruals per vehicle sold from 35,000 yen to 45,000 yen, while Nissan cut its accruals-per-vehicle average by about 1,500 yen.

As a result of all these machinations, the industry average rose from 35,000 yen to 44,000 yen last year. And while that seems like a big jump, the industry average was actually higher from fiscal 2015 to 2019. So it's more like a return to normal.

Warranty Reserve Totals

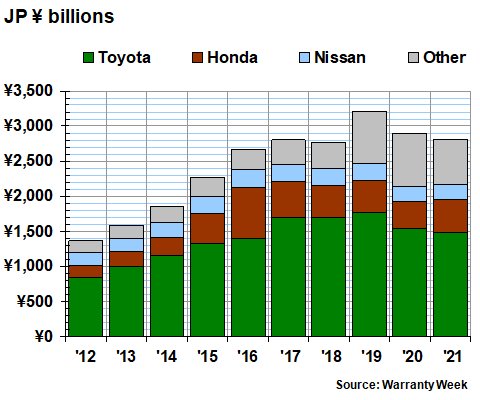

Our final metric is the amount of money the nine manufacturers keep in their warranty reserve funds at the end of each fiscal year. As of March 31, 2021, they kept 2,812 billion yen in their reserve funds, which was just a slight drop from the year before. But as can be seen in Figure 6 below, the peak came in March 2019, when the reserves held by these nine manufacturers surpassed 3,206 billion yen -- the equivalent of more than US$29 billion at that time.

Figure 6

Top Japanese Auto Manufacturers

Reserves Held At Year's End

(in billions of yen, fiscal 2012-2021)

Toyota alone accounts for well over half this total, ending March 2021 with 1,483 billion yen reported in its warranty reserve fund. But that's its lowest total for the last five years, and well below its fiscal 2019 peak. Honda is number two, with 481 billion yen on reserve, up by an even 100 billion yen since the end of fiscal 2020. And it stands alone as the only one of the nine manufacturers to increase its reserve balance last year.

Nissan, however, is not in third place with this warranty metric, as it is with claims and accruals. It's actually in fifth place for reserves, behind both Suzuki and Subaru. Suzuki, we should note, recently restated its warranty reserve balance after deciding to include recalls in the total, which it previously accounted for separately. And it still managed to cut its reserves by 62 billion yen last year, a -20% decline. Subaru cut its reserve balance by 37 billion yen last year, a -14% decline.

|