Medical & Scientific Equipment Warranty Report:In the year of the pandemic, nothing seemed to happen as expected. Sales were up but warranty expenses were down, especially during the tumultuous second quarter. And some warranty expenses seem to have been shifted from early to late in the year, by both manufacturers and their customers.

There has arguably never been a year in which doctors, hospitals, and the equipment they rely upon have been more important. Discussions about medical equipment and scientific instruments went mainstream in 2020, as the nightly news covered everything from ventilator shortages to spike protein mutations in detail. Some people even believed the doctors and scientists more than the politicians!

Normally, we get around to looking at medical equipment and scientific instrument warranty expenses deep into the middle of the cycle, after detailing all the much larger industries first. For instance, in 2018 we left it until the end of May. But after a year in which cars were lightly used, planes were parked on runways, and most of the entertainment industry remained at a standstill, our priorities have also changed.

At the end of every quarter since 2003, we have harvested from the annual reports and quarterly financial statements of some 197 U.S.-based manufacturers of medical equipment and scientific instruments the following three warranty metrics: the amount of claims they paid, the amount of accruals they made, and the amount of funds they held in their warranty reserves.

We also gathered data on product sales, looking for the best number that expressed the amount of revenue raised through sales of capital equipment, not including service revenue, consumables revenue, or royalty/investment revenue. And using that, we divided the claims and accrual totals by sales to calculate the percentage of sales going toward claims (the claims rate) and the percentage of sales going towards accruals (the accrual rate).

Years ago, we noticed that while most medical and scientific equipment manufacturers had fairly low claims and accrual rates, those whose products included lasers and/or X-rays seemed to have far higher expense rates. And so, we separated the list of 197 companies into two parts: 45 whose products use lasers and/or X-rays, and 152 that do not.

Warranty Claims Totals

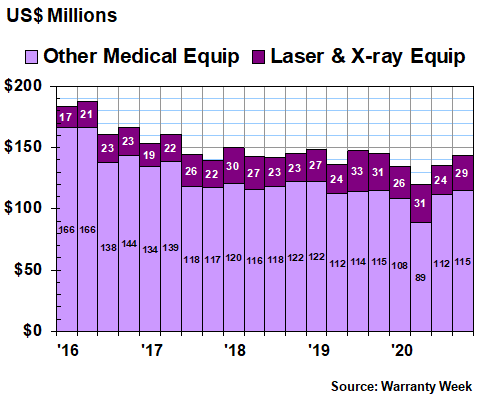

In Figure 1 we are looking at the total amount of claims paid by these manufacturers over the past 20 quarters, covering the years 2016 to 2020. Usually, we include just the annual totals, but this time around we wanted to spotlight the quarterly fluctuations, especially those that happened in mid-2020.

As can be seen in the chart below, the second-quarter reading from last year was the lowest in recent memory, suggesting that either customers were not in a position to submit claims, manufacturers were not in a position to process them, or perhaps a little of both. During the months of April, May, and June 2020, of course, most universities were on remote learning schedules, most doctors and hospitals were overwhelmed by the pandemic, and most manufacturers were struggling to keep their factories open.

Figure 1

Medical & Scientific Equipment Warranties

Claims Paid per Quarter by U.S.-based Companies

(in US$ millions, 2016-2020)

And then by the second half of 2020, things were more or less back to normal, at least in terms of warranty claims processing volumes in this industry. Still, comparing the quarters of 2020 to the same periods in 2019 reveals a few additional curiosities.

First of all, claims payments by laser & X-ray equipment makers were actually up significantly during the second quarter, from $24.4 million in 2019 to $30.6 million in 2020. But then they plunged in the third quarter, from $33.2 million in 2019 to $23.7 million in 2020.

Second of all, while claims dipped significantly for all the companies in the "other" category during the first half of the year, they were relatively flat during the second half of the year. In other words, if there was any difficulty submitting or processing claims during the early days of the pandemic, it didn't artificially push up the totals later on.

On an annual basis, laser and X-ray manufacturers saw their claims totals fall by -5% to $109 million, from a $115 million total in 2019. Other medical and scientific equipment makers saw their claims total fall by -8%, from $463 million in 2019 to $424 million in 2020. And then their combined total fell by -$44 million, from $578 million to $533 million.

Among the top warranty providers in the industry, one of the largest claims declines was reported by Danaher Corp., which saw its claims cost fall from $54 million in 2019 to $36 million in 2020. Agilent Technologies Inc. saw its claims cost fall from $57 million to $49 million.

Others saw much gentler declines. Thermo Fisher Scientific Inc. saw its claims cost slip from $112 million to $108 million. And Ingersoll Rand, Inc. (formerly Gardner Denver Inc.), which we're including here because of its medical compressor and vacuum pump product lines, saw its claims cost fall by -$1.4 million to $30.5 million.

On the side of increasing claims totals, glucose monitoring equipment maker DexCom Inc. saw claims rise from $32 million in 2019 to $37 million in 2020. Align Technology Inc., which makes orthodontics equipment, saw its claims total rise from $10 to $11 million. Insulet Corp., which makes insulin injection systems, saw claims rise from $11 to $13 million. And Hill-Rom Holdings Inc., which makes hospital beds, paid out $20 million in claims last year, up from $18 million in 2019.

Warranty Accrual Totals

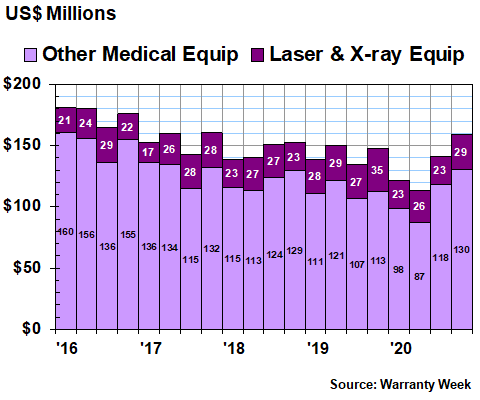

As can be seen in Figure 2, there is a noticeable notch in the accrual data for the first half of 2020, followed by a noticeable rise in the totals for the second half of the year. This would suggest that manufacturers time-shifted some of their accruals from the first half to the second half of the year.

A closer look at the data supports this theory. For all medical and scientific equipment manufacturers, accruals were down -13% in the first quarter and were down -25% in the second quarter of 2020, compared to the same periods in 2019. And then in the third quarter, accruals were up +5%, followed by an +8% increase in the fourth quarter.

Figure 2

Medical & Scientific Equipment Warranties

Accruals Made per Quarter by U.S.-based Companies

(in US$ millions, 2016-2020)

For the year as a whole, warranty accruals were down by -$37 million or -6.5% to $534 million. But this does not begin to tell the story of the volatility within the year, particularly during that second quarter. It also doesn't take note that the laser and X-ray equipment manufacturers were down -$19 million or -16% for the year, nor that their accruals fell in every quarter, compared to 2019.

The thing is, none of these cuts can be justified by proportional sales declines. In fact, sales were up. For the laser and X-ray equipment makers, sales were up +6.7% for the year. For the others, sales were up an even stronger +23%.

One of the best examples of this disconnect between sales and warranty expenses is Hologic Inc. The company, whose products address women's health issues, saw its sales rise by +16% in its fiscal year, while accruals fell -27% and claims fell -21%. Steris saw its capital equipment sales nearly double in the nine months ending December 31, but it cut its accruals by -7% and its claims by -4%.

And then there were some companies whose warranty accruals were is almost perfect alignment with sales. For instance, DexCom saw sales rise +31% while accruals rose +25%. PerkinElmer Inc. saw sales rise +38% while accruals rose +26%. ResMed Inc. saw sales rise +10% and accruals rose +9.3%.

Warranty Expense Rates

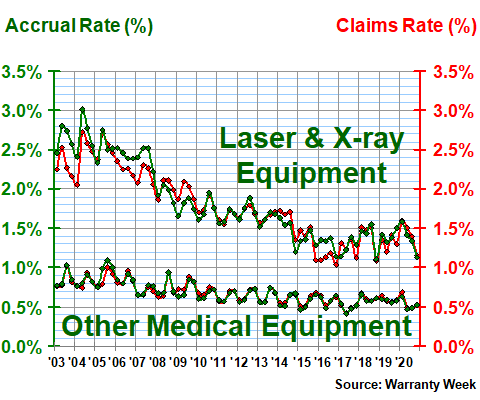

The reason we make such a fuss about proportionality is because the claims and accrual rates are calculated by dividing the claims and accrual totals by sales. Therefore, the data in Figure 3 below is based on dividing the totals in Figures 1 and 2 by sales data. If they rise and fall proportionally, the rates don't change. But if one metric rises while the other falls, then the rates change accordingly.

In Figure 3, we can see that the expense rates in 2020 remained fairly stable, ranging from 0.5% to 0.7% for the other medical equipment makers and between 1.1% and 1.6% for the laser and X-ray manufacturers. However, the gap between the pairs, which has averaged 0.7% to 0.8% in recent years, widened to more than one percent in 2020, especially in the second quarter.

By the end of the year, meanwhile, things got back to normal. The laser and X-ray manufacturers had an average claims rate of 1.2% and an average accrual rate of 1.1%, while the other medical equipment manufacturers had average expense rates of 0.5%. And the gap between them was therefore slightly below average at 0.6%.

Figure 3

Medical & Scientific Equipment Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2020)

Hill-Rom and Align Technology saw two of the largest claims rate increases among the biggest warranty providers in the industry, while Hologic and Steris saw two of the largest claims rate declines. Hill-Rom and Illumina Inc. saw the largest jumps in their accrual rates, while Hologic and Steris were again the lowest. As we previously noted, their sales doubled while their expenses did not, driving the big declines in expense rates.

Varian Medical Systems Inc., which is one of the largest manufacturers of X-ray and radiation therapy equipment on our list, and which is about to be acquired by Siemens AG, saw its claims rate rise from 4.2% to 4.6%, while its accrual rate fell from 4.9% to 4.6%. Its claims total actually rose only slightly, but its product sales fell -11%.

In contrast, Thermo Fisher, which is one of the largest warranty providers on the "other" list, saw a +30% increase in product sales. And though its accrual total remained the same at $115 million in both 2019 and 2020, that jump in sales alone drove its accrual rate down from 0.6% to 0.45%.

One more item to note: for years we have observed a seasonal pattern in the expense rate data, and indeed in Figure 3 we can see the expense rates rising late in the year and then falling early the next year. This phenomenon was said to relate to the calendars and budget cycles of university laboratories and teaching hospitals. However, it seems to have disappeared in 2018 and 2019, and reversed itself in 2020.

Warranty Reserve Balances

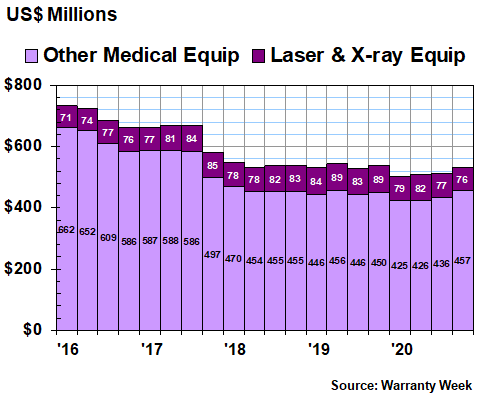

Our final warranty metric is the balance left in the warranty reserve funds of each of these companies at the end of each quarter. At the end of the fourth quarter of 2020, that balance stood at $533 million, down by -$5 million since the end of 2019, but up slightly from the balances at the end of the first three quarters of 2020.

At $504 million, the balance in March 2020 was the lowest we've ever observed for this industry, going all the way back to early 2003. But it's clear that whatever is causing this trend, it goes back years before the word coronavirus entered the mainstream media. In fact, the gradual declines go all the way back to 2012 or 2013.

Figure 4

Medical & Scientific Equipment Warranties

Reserves Held per Quarter by U.S.-based Companies

(in US$ millions, 2016-2020)

Varian Medical Systems cut its reserve balance the most, letting it drop from $46 million at the end of 2019 to $39 million at the end of 2020. However, proportionally, Hologic's drop from $14 to $10 million and Insulet's drop from $8.5 to $6.7 million were somewhat larger in size.

Ingersoll Rand, which as we explained in the March 18 newsletter underwent a complex merger and name change last year, saw its warranty reserves jump as a result of that merger from $23 million at the end of 2019 to $54 million at the end of 2020.

Leaving that aside, the two largest reserve increases outside of mergers were DexCom ($7 to $12 million) and PerkinElmer ($9 to $12 million). ResMed ($20 to $24 million), Danaher ($73 to $86 million), and Thermo Fisher ($93 to $100 million) get honorable mentions.

|