Apple's Warranties & Service Contracts:In its brand new annual report, the company details its declining product warranty expenses while providing financial clues that suggest its market-leading extended warranty program had a really good year.

Apple Inc., which has one of the nation's largest product warranty program and one of the world's largest extended warranty programs, just released an annual report that details how its warranty expenses are declining while its AppleCare protection program may have resumed growing after several years of stagnation.

We found the data that suggests these trends in Apple's annual report for the fiscal year ended September 26, 2020, which the company filed with the U.S. Securities and Exchange Commission last week. From page 53, we gathered the figures listed for product warranty claims paid and accruals made, as well as the ending balance in the company's warranty reserve fund.

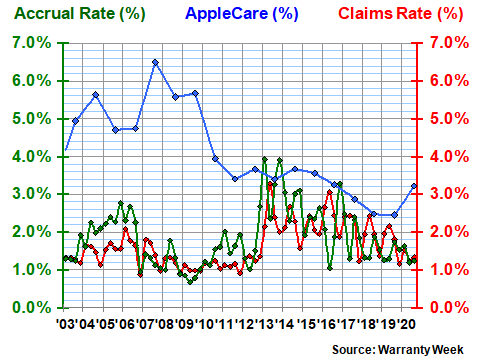

We also found figures for product sales revenue, and used those to calculate the percentage of sales spent on claims (the claims rate) and the percentage of sales set aside as warranty accruals (the accrual rate).

From Apple's balance sheet, we found figures for deferred revenue under the heading of current liabilities. This is the closest we can get to any data concerning extended warranty sales. However, the company seems to have discontinued providing separate figures for deferred revenue under the heading of non-current liabilities, which we used to create our estimates in the past. No matter -- elsewhere they provide a total for all deferred revenue, so it's a straightforward process to subtract the current portion from the total to derive the non-current portion.

Extended warranty sales are not typically disclosed by manufacturers. But the revenue cannot immediately be recognized as a sale, because the duty to perform is typically spread over several years. Under existing accounting rules, service contract revenue must be initially deferred completely, and then it can be gradually recognized as time passes. For instance, with a two-year service contract, a company could recognize half the revenue after one year, and the rest after the second year has passed.

Using the figures for deferred revenue on Apple's balance sheet, we were able to calculate the amount of new AppleCare service contract sales revenue, as well as the amount of previously deferred service contract revenue that was recognized as completed. And we were able to calculate the ratio between AppleCare sales and product sales revenue.

Warranty Claims

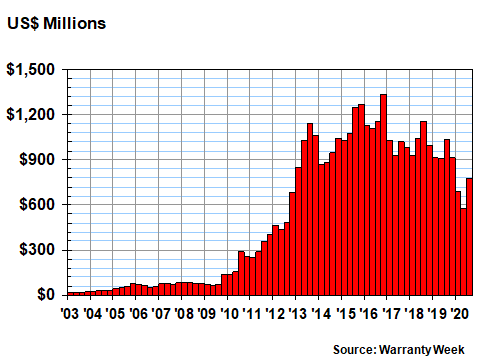

Figure 1 contains the quarterly claims totals reported by Apple over the past 17-3/4 years. Because Apple's fiscal year begins in late September, it's always one quarter ahead of the calendar. In other words, the most recent fiscal year included the fourth quarter of calendar year 2019, and the first three quarters of calendar year 2020 in the chart below.

Figure 1

Apple's Product Warranties

Claims Paid per Quarter, 2003 to 2020

(in Millions of U.S. Dollars)

Apple reported paying $2.96 billion in claims last year, down by more than $900 million from fiscal 2019 levels. Claims paid during its fourth fiscal quarter (the months of July, August, and September) fell by $258 million, from $1.03 billion to $776 million. But as the chart above shows, claims rose by $200 million from the third fiscal quarter -- the height of the pandemic and the lowest quarter for claims activity since 2012.

Warranty Accruals

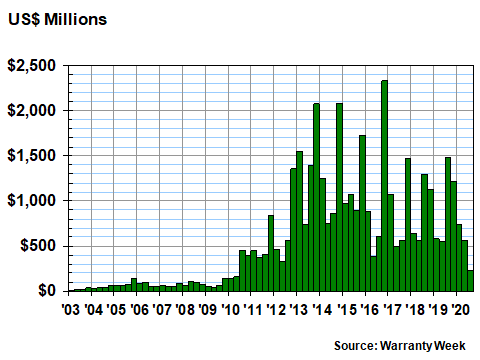

Apple's warranty accruals, meanwhile, fell to their lowest quarterly level since 2010. The total accruals for the months of July, August, and September added up to only $226 million, and for the entire fiscal year to only $2.74 billion. Those figures were down by -85% for the quarter, and by -27% for the entire fiscal year.

Figure 2

Apple's Product Warranties

Accruals Made per Quarter, 2003 to 2020

(in Millions of U.S. Dollars)

The obvious reason for the decline would seem to be the worldwide economic downturn triggered by the pandemic, which hit during Apple's second fiscal quarter. Since warranty accruals are usually kept proportional to product sales, one would expect accruals to fall precipitously during a severe downturn.

The problem is, Apple's product sales did not fall. Well, they were down by -3.4% during the months of January, February and March 2020, compared to the same months in 2019. but they were up by +10% in the months of April, May, and June, and they were up by +3.2% for the entire fiscal year. So why did accruals fall so sharply?

Apple no longer provides unit shipment data, so all we have are dollar amounts for product sales. iPhone sales revenue did slip by -3.2% last year, but Macintosh and iPad sales revenue were each up by +11% year over year. Sales of AirPods, Beats, Apple TV, Apple Watch, HomePod, iPod Touch and other products and accessories were up by a healthy +25%. And as we mentioned, product sales revenue was up by +3.2% for the entire year. So why did accruals fall?

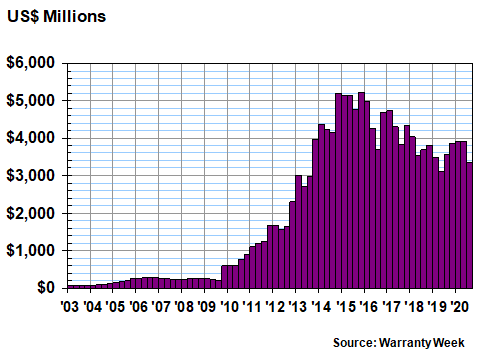

Warranty Reserves

With a downturn in both claims and accruals, it's no surprise to see a drop in the balance in Apple's warranty reserve fund. But it is surprising to see such a small drop in the chart below. From the end of September 2019 to the end of September 2020, the balance dropped from $3.57 billion to $3.35 billion, a $216 million or -6.1% decline.

The balance was a bit lower in March 2019 ($3.12 billion), but has otherwise been higher than it was at the end of every quarter since 2013. Apple's warranty reserve balance peaked at $5.24 billion at the end of December 2015.

Figure 3

Apple's Product Warranties

Reserves Held per Quarter, 2003 to 2020

(in Millions of U.S. Dollars)

So we have something of a mystery on our hands. Apple's product sales grew +3.2% but its claims fell -23%, its accruals fell -27%, and its reserves fell -6.1%. And while the iPhone is the company's main product line, accounting for well over 60% of product sales revenue for the past eight years, its sales fell by only modest amounts while other product lines saw healthy sales gains.

Extended Warranty Metrics

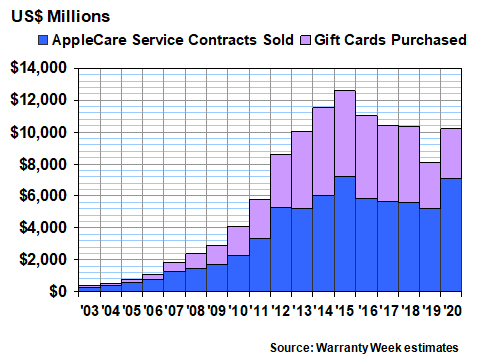

The last piece of the puzzle is the incredible upsurge we think we're seeing in AppleCare service contract sales. But we have to caution readers that while everything above is based on facts and our own fourth grade math, everything below is based on estimates, fantasy, conjecture, and wild guesses. And so, like the polling predictions from the most recent U.S. election, don't believe everything you read.

Apple most decidedly does not say how AppleCare is doing. Contract sales revenue is buried within the "services" category, which also includes digital music sales. And even though Apple does include figures for deferred revenue in its annual report, that category also includes gift cards and revenue for promised software upgrades.

We think we've found a work-around. Basically, since most AppleCare service contracts are for two years, half the deferred revenue must be current and half must be non-current. Meanwhile, all the gift card revenue must be classified as current, because those cards could be used at any time.

On that basis, we have used two figures to estimate a third. Apple said it has $6.64 billion in current deferred revenue, and $10.2 billion in total deferred revenue, so we guessed that it has $3.56 billion in non-current deferred revenue. In turn, we estimate that in fiscal 2020 $7.11 billion of its $10.2 billion in deferred revenue is from AppleCare, while $3.09 billion is from gift cards.

Figure 4

Apple's Protection Plans:

Service Contracts vs. Gift Cards Sales

Estimates for Fiscal Years 2003 to 2020

(in Millions of U.S. Dollars)

Last fiscal year, we estimated that $5.23 billion came from AppleCare and $2.91 billion came from gift cards. And as is detailed in Figure 4, we estimate that the only fiscal year with more AppleCare sales was 2015, when the total surged to $7.25 billion.

But whether it's $5 billion or $7 billion, we believe that AppleCare is the world's largest extended warranty program. Assurant Inc. had $7.1 billion in net earned premium last year, but it came from the protection programs of a variety of retailers and car dealers, not one brand name program.

Among the top car manufacturers, a few vehicle service contract programs are around a billion dollars, but none are in the multiple billions. Some of the mobile phone carriers may be in that territory, but none have yet hit $5 billion. So correct us if we're wrong, but at $7.11 billion, we believe AppleCare is the world's largest product protection program.

Protection Program Comparison

As was mentioned, Apple paid $2.96 billion in claims last year, and made $2.74 billion in accruals. If we look at just the accruals, then AppleCare is 2.6 times larger. That ratio has bounced all around over the years, but it hasn't been that high since fiscal 2009, when the iPhone was seen as an expensive but fragile product well worth protecting, and the attach rate just for AppleCare might have been well over 50%.

Now, we don't know. But what we do know is that AppleCare had a very good year -- perhaps its second-best ever. And we can estimate that AppleCare sales were equivalent to about 3.2% of Apple's product revenue last year, and that represented the first increase in that metric in five years. See the blue line in Figure 5 below.

Figure 5

Apple's Protection Plans:

Claims Paid, Accruals Made & AppleCare Sales

as a Percentage of Product Revenue, 2003 to 2020

The company's product warranty claims and accruals, meanwhile, were the equivalent of 1.3% and 1.2% of product revenue, respectively, in the last fiscal year. Those metrics are represented by the red and green lines in the chart above.

Back in calendar 2013 and once in calendar 2016, there were occasions when Apple could have accrued more money into its product warranty fund than AppleCare brought into its deferred revenue account. But for the rest of the past 18 years, we estimate that AppleCare sales have vastly outpaced product warranty expenses.

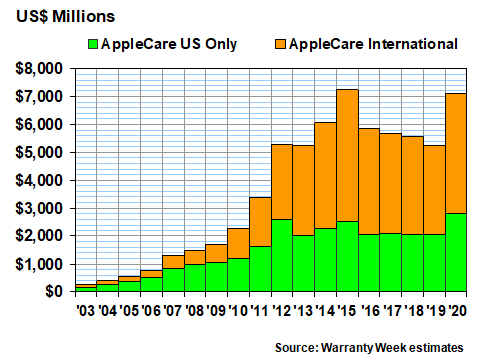

International Protection Plans

One more thing we want to mention. In September, the AppleCare+ program, which includes accidental damage protection, and sometimes also loss and theft coverage as well, became available for the first time in Norway, Denmark, and Finland. AppleCare+ for the Macintosh expanded worldwide two years ago. The point we want to make is that AppleCare and AppleCare+, while they are doing well in the United States, are probably doing better outside the United States.

In Figure 6, what we've done is make assumptions about our assumptions, and then we multiplied our assumptions against each other. So don't put too much confidence into the data. But if AppleCare was a $7.11 billion program last year, we believe that 60% of that revenue came from outside the U.S., representing some $4.28 billion. And again, we believe the only year that figure was higher was in fiscal 2015.

Figure 6

Apple's Protection Plans:

AppleCare U.S. vs. International Sales

Estimates for Fiscal Years 2003 to 2020

(in Millions of U.S. Dollars)

Also notice that for the previous four fiscal years, we estimate that the U.S. arm of the protection program was stuck just above $2 billion, while the international total slowly declined from $3.80 to $3.18 billion. Both those numbers were up last year by decisive amounts. We estimate that U.S. AppleCare sales rose +38%, while international AppleCare sales rose +35%.

So maybe this is the answer to the puzzle: Perhaps the reason Apple's product warranty expenses are down so much is because extended warranty sales are up so much? In other words, if a product is covered by both a warranty and an extended warranty, the company has a choice of which bucket gets the expenses.

And if you look back at Figures 1 and 3, it's clear that both product warranty claims totals and reserve balances are on a multi-year decline. Until this past year, so was AppleCare revenue. But in fiscal 2020, protection plan sales rose faster than product sales, while product warranty expenses plummeted.

|