Aerospace Warranty Report:The big story was Boeing, which was caught in the perfect storm of rising expenses and falling sales. But across the industry, warranty claims and accruals were up after years of slow declines. And expense rates rose as well, though not as high as the levels they were at a decade ago.

Even as idle airport runways are filling up with parked aircraft awaiting the return of packed flights, and as airlines await some sort of financial aid or bailout in the meantime, it's time to look at the data from the warranty expense reports filed by aircraft manufacturers for the year ended in December 2019.

We began with a look at the annual reports and quarterly financial statements of some 100 U.S.-based companies that are primarily manufacturers of parts, components, and systems used in commercial airplanes and helicopters. We then separated that list into aerospace OEMs and aerospace suppliers. Ten companies, led by Boeing Company, General Dynamics Corp., and Textron Inc., are on the OEM list, and 90 companies, led by United Technologies Corp., Honeywell International Inc., Garmin Ltd., and L3Harris Technologies Inc., are on the supplier list.

We should note that General Electric Company, despite being a major manufacturer of jet engines for aircraft, is not on the list. Nor are international firms such as Airbus Group, Bombardier Inc., or Dassault Aviation Group, which will be addressed in a separate newsletter focused just on the worldwide manufacturers or airframes and jet engines.

From the books of the 100 companies on our list, we gathered three essential warranty metrics: claims paid per year, accruals made per year, and the balance in their warranty reserve funds at the end of each year. Data was gathered for the years 2003 to 2019. We also gathered product sales data, and with that we calculated the percentage of sales going towards paying claims (the claims rate) and the percentage of sales going towards accruals (the accrual rate).

Warranty Claims Totals

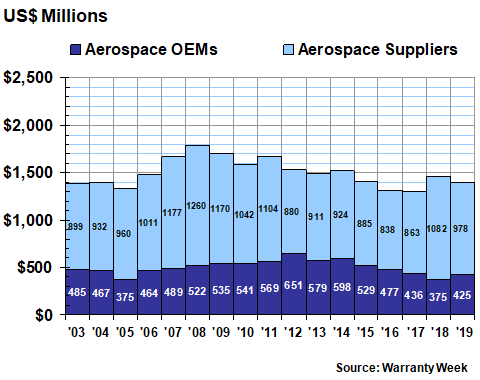

In Figure 1 we're looking at the 17 annual totals for claims paid by these 100 companies. Total claims payments in 2019 were down by $54 million to $1.4 billion, but that obscures a split between the two groups. Claims were up by $51 million for the OEMs, but were down by $105 million for their suppliers. It was the first increase for the OEMs since 2013-14, and the first decline for the suppliers since 2015-16.

Figure 1

Aerospace Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2019)

Boeing saw a 29% increase in claims paid last year, linked primarily to the grounding of its 737 MAX jet in March 2019. Strangely, in that first calendar quarter of 2019, Boeing reported paying only $8.0 million in claims. But then the totals jumped, to $56 million in the second quarter, then $102 million in the third quarter, and $83 million in the fourth quarter.

General Dynamics, which owns the Gulfstream Aerospace Corp., saw just a slight upturn in claims payments last year, while Textron, which owns the Beechcraft, Hawker Aircraft, and Cessna brands, saw a 10% increase in claims.

On the supplier side, claims doubled for L3Harris Technologies Inc., following the merger and renaming of Harris Corp. and L3 Technologies Inc. But the sum is less than the pieces. Harris, the surviving company, saw its claims rise from $14 to $28 million from 2018 to 2019. But L3 Technologies reported $19 million in claims during the first quarter of 2019, before discontinuing its financial statement filing. In the final nine months of 2018, it reported $41 million in claims. So in reality, the merged companies reported $47 million in claims paid during 2019, down from the $69 million they paid separately in 2018.

United Technologies, which underwent its own merger (with Raytheon) and de-merger (of Otis and Carrier) earlier this month, saw claims rise by $19 million last year. Raytheon, we should note, used to report its own warranty expenses, but ceased doing so in 2016. Most military contractors, in fact, report no warranty expenses at all (i.e. Lockheed Martin Corp., Northrop Grumman Corp., etc.).

Elsewhere, Honeywell reported a $48 million decline in claims paid. Moog Inc. and FLIR Systems Inc. reported modest declines in claims. Ametek Inc., John Bean Technologies Corp., and Teledyne Technologies Inc. reported modest increases in their claims totals. And at Garmin, for the fourth year in a row, claims remained about the same.

Warranty Accruals

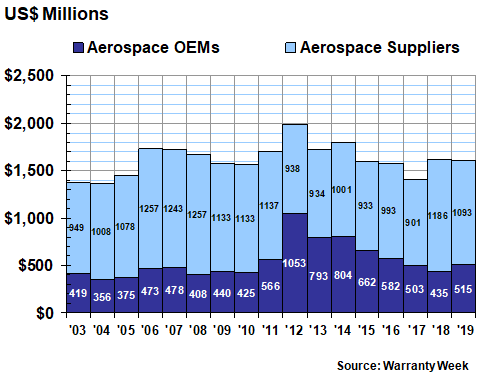

The warranty accrual totals followed a pattern similar to claims. As can be seen in Figure 2 below, the overall total was down somewhat, but the OEMs saw an increase while the suppliers saw a decrease.

Accruals fell back a bit to just over $1.6 billion. But accruals were up by $80 million for the OEMs and were down by $92 million for their suppliers. It was the first increase for the OEMs since 2013-14, and the first annual decrease for the suppliers since 2016-17.

Figure 2

Aerospace Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2019)

Amazingly, accruals actually decreased for Boeing, from $232 million in 2018 to $188 million in 2019. And accruals actually doubled for General Dynamics, from $129 million in 2018 to $258 million in 2019.

On the supplier side, L3Harris once again topped the list of increases with its merger-driven enlargement. But three suppliers -- Trimble Inc., Moog Inc., and Woodward Inc. -- each saw nearly a 50% increase in their accruals. The big decline, however, was reported by Honeywell (-$35 million), and the big increase was reported by United Technologies (+$31 million).

Warranty Expense Rates

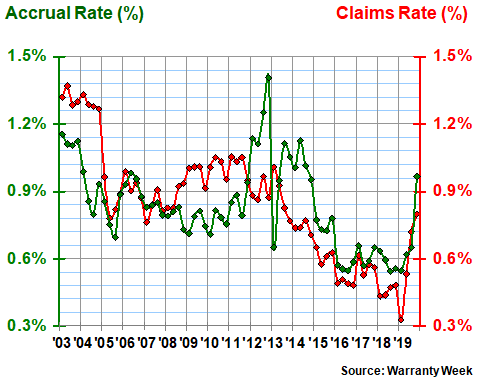

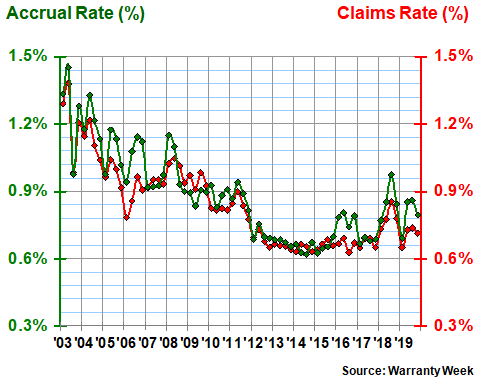

In Figures 3 and 4, we have taken the claims and accrual totals in Figures 1 and 2 and divided each by the corresponding amount of product sales revenue, to calculate the claims and accrual rates for both the aerospace OEMs and their suppliers. In order to better illustrate the spikes and troughs, we have increased the rate of measurement from once a year to quarterly, resulting in 136 data points per chart.

In Figure 3, we can clearly see a massive spike in the claims and accrual rates for the OEMs in 2019. It should come as no surprise that the source of this surge is primarily Boeing, which saw its claims rate rise from 0.3% at the end of 2018 to 0.8% at the end of 2019, and saw its accrual rate rise from 0.4% to 0.6% at the same time.

One factor helping accelerate Boeing's expense rate increase was a massive decline in sales revenue from commercial airplanes (from $57.5 billion in 2018 to only $32.3 billion in 2019). But Gulfstream also saw a big jump in its accrual rate (from 2.1% to 3.5%), even though sales were up 18%. And Textron actually saw some slight decreases in its warranty expense rates, even in the wake of a slight decline in sales.

Figure 3

Aerospace OEMs

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2019)

At the end of 2019, the aerospace OEMs were averaging a claims rate of 0.8% and an accrual rate just below 1.0%. It was their highest readings since 2013 and 2014, respectively. However, as is obvious in Figure 3, these expense rates were much higher in the years before that. In fact, the 17-year averages are both near 0.8%, so what we saw in 2019 was more or less a return to normal after half a decade below average.

Supplier Expense Rates

In Figure 4, it's clear that the suppliers are now at the low end of their 17-year average expense rates, though they've seen a slight upturn in recent years. Both expense rates hit bottom in 2014. By the end of 2019, the claims and accrual rates crept up to 0.7% and 0.8%, respectively. But both were higher in 2018.

Figure 4

Aerospace Suppliers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2019)

Among the suppliers, L3Harris saw the largest expense rates declines. Its claims rate fell from 0.6% in 2018 to 0.3% in 2019, while its accrual rate fell from 0.9% to 0.3% over the same time period. But this was entirely due to the blending of the previously separate Harris and L3 product lines.

Moog cut its claims rate from 0.6% to 0.4%, but kept its accrual rate at 0.5%. United Technologies, Garmin, and FLIR Systems each shaved a few tenths of a point off both their claims and accrual rates.

Meanwhile, Ametek, Teledyne, and John Bean Technologies each added about a tenth of a point to both their claims and accrual rates in 2019. Crane Company added a tenth to its claims rate and cut a tenth off its accrual rate. And Woodward Inc. saw its claims rate jump from 0.4% to 0.6% while letting its accrual rate fall to 0% in the quarter ended December 31, 2019.

Warranty Reserves

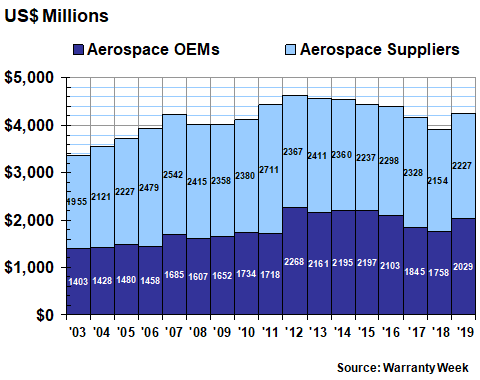

Finally, as can be seen in Figure 5, after six years of declines, the balance in the warranty reserve funds of the aerospace manufacturers took a turn upward in 2019. And that increase came on both the OEM and supplier sides. The OEMs raised their reserves by $270 million, while their suppliers increased their reserves by $72 million. On a combined basis, it was their highest balance since the end of 2016.

Figure 5

Aerospace Warranties

Reserves Held by U.S.-based Companies

(in US$ millions, 2003-2019)

As with the other metrics, L3Harris led the increases in this metric as well. Harris alone had $27 million in its reserve at the end of 2018, while L3 had $88 million. After the merger, they had $112 million, which is actually less than they had separately. But for Harris, technically the surviving party in the merger, that represents more than a quadrupling of reserves.

Further down the list, General Dynamics added $139 million, Boeing added $140 million, and United Technologies added $99 million. Honeywell reported the biggest reserve decline (-$41 million, -13%). However, on a proportional basis, Crane's decline from $18 million to $11 million was somewhat larger (-40%).

OEM/Supplier Split

One last metric before we go: in rough measure, the suppliers have accounted for about twice as much claims and accruals as the OEMs have in any given year. In 2019, the ratio was even larger than usual, at 70% suppliers for claims, and at 68% suppliers for accruals. But they're usually closer to 50/50 in terms of reserves. And in 2019, the share of reserves held by suppliers fell to 52% of the $4.26 billion total. It's been lower, but from 2003 to 2011 it was always close to 60%. Then the pattern changed. And it hasn't yet changed back.

|