U.S. Commercial Vehicle Makers:The warranty expense data in their latest financial reports suggest that the top U.S.-based truck, bus, construction equipment, and agricultural vehicle makers are doing just fine, with relatively stable amounts of claims and accruals, after several reported noticeable expense spikes in previous years.

In addition to cars, appliances, and computers, trucks and other large vehicles generate significant amounts of warranty expense. But from the looks of their recent warranty metrics, it's been a relatively quiet and predictable year for large vehicle makers.

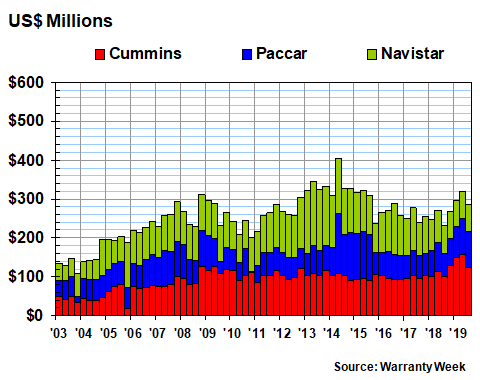

Let's start with a look at the quarterly claims payments of three of the largest truck manufacturers. Navistar International Corp. has the International truck and IC bus brands, and also sells diesel engines to other manufacturers. Paccar Inc. has the Kenworth, Peterbilt Motors, and DAF truck brands, and the Dynacraft parts brand. Cummins Inc. manufactures diesel and natural gas-powered engines, as well as backup generators and power generation equipment.

In Figure 1, we can see that Cummins and Paccar are paying a slightly elevated amount of claims in recent quarters, while Navistar is down a bit. For the third quarter of 2019, Cummins paid out $123 million, up $22 million from the same quarter in 2018. Paccar paid out $93 million, up by $33 million from 2018. But Navistar paid out $70 million, down by $1 million from 2018.

Figure 1

On-Highway Truck Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2019)

Navistar is now paying out an average of $70 to $80 million per quarter in claims, far below the $100-million-plus amounts it regularly spent from 2011 to 2017. Paccar has also said goodbye to the $100-million-plus amounts it regularly spent each quarter from 2013 to 2015. But Cummins has spent over $100 million per quarter for the past six quarters in a row, something it had not done since 2012-2014.

For the first nine months of 2019, Cummins has seen its claims cost rise by 38%. Paccar's has risen by 29%. And Navistar's claims costs are down by 11%.

Truck Accruals

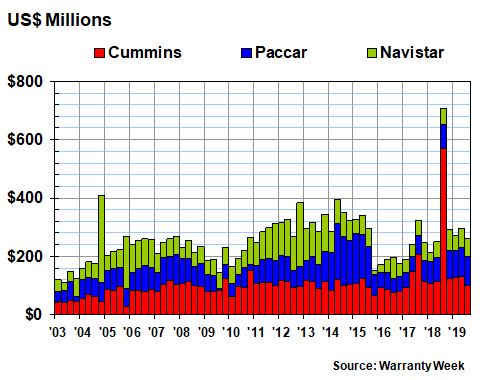

In Figure 2, we're looking at the amounts of accruals each manufacturer has set aside per quarter to finance what they expect to pay in claims in the future. The figure that jumps out is the $571 million that Cummins set aside in last year's third quarter, caused primarily by the failure of its diesel engines to pass an emissions test in California. In this year's third quarter, the company set aside only $101 million. But as we detailed above, now its claims payouts are rising.

Paccar, meanwhile, saw its quarterly accruals rise from $81 million last year to $98 million in this year's third quarter. Navistar's claims rose by $9 million to $64 million.

Figure 2

On-Highway Truck Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2019)

For the first nine months of the year, Cummins' accruals have fallen by 55%. Paccar's are up 22%, and Navistar's are up 31%. But Navistar's previous accrual spikes in 2012-2013 and 2004 are now far behind it, as are Paccar's accrual spikes in 2014-2015 and 2009.

Warranty Expense Rates

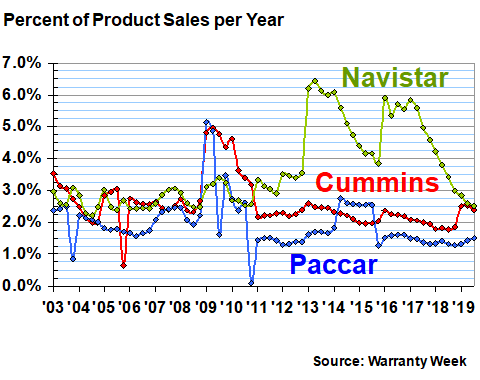

In Figure 3, we're taking the claims payments in Figure 1 and dividing each by the corresponding amount of product sales, to calculate a claims rate for each of the three companies. As in previous charts, Cummins is in red, Paccar is in blue, and Navistar is in light green.

We note that while Cummins and Paccar saw their highest claims rates during the recession of 2009, Navistar had its bad years from 2013 to 2017. And that was caused primarily by the same malady Cummins is now facing: diesel emissions test failures. But also note that Navistar's claims rate has fallen consistently for all of the past 10 quarters, from a high of 5.8% in early 2017 down to 2.5% in the third quarter of 2019.

Figure 3

On-Highway Truck Warranties

Average Warranty Claims Rates

(as a % of product sales, 2003-2019)

By the end of September 2019, Paccar's claims rate was down to 1.5%. Cummins was at 2.4%. And Navistar was at 2.5%. All three's claims rates were therefore below their long-term averages.

Over the long term, Paccar has reported the lowest average claims rate (1.9%), while Cummins has been the most consistent. Navistar has reported the highest average claims rate (3.6%), and has been the least consistent. By consistent, we mean the standard deviation of the claims rate measurements. The higher the standard deviation, the lower the stability of the data. Navistar's standard deviation is 1.2%, while both Paccar's and Cummins' are slightly under 0.8% (but Cummins' is fractionally lower than Paccar's).

Truck Accrual Rates

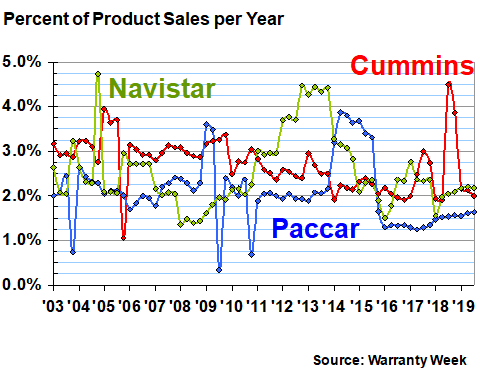

In Figure 4, we're looking at the accrual data from Figure 2, divided by sales to calculate the accrual rate. There are six occasions where the manufacturers have seen their accrual rates spike: Navistar in 2004 and again from 2012 to 2013, Paccar in 2009 and again from 2014 to 2015, and Cummins in 2005 and again in 2018.

Figure 4

On-Highway Truck Warranties

Average Warranty Accrual Rates

(as a % of product sales, 2003-2019)

By the end of the third quarter, Cummins had an accrual rate of two percent. Navistar was slightly higher at 2.2%, while Paccar was slightly lower at 1.6%. All three were therefore below their long-term average accrual rates.

Long term, Paccar has reported the lowest average accrual rate (2.1% of sales), while Cummins has reported the highest (2.7%). However, Cummins has also been the most consistent, with a standard deviation of 0.6% to Paccar's 0.7% and Navistar's 0.8%.

Construction & Farm Equipment

While on-highway trucks and engines are one side of the market, the other side includes both construction and farm equipment. Here we're looking at three of the largest U.S.-based manufacturers: Deere & Co., which makes both construction and farm equipment; Caterpillar Inc., which makes construction and mining equipment as well as backup generators and power generation equipment; and AGCO Corp., which focuses on farm equipment through brands such as Fendt, Challenger, Massey Ferguson, and Valtra.

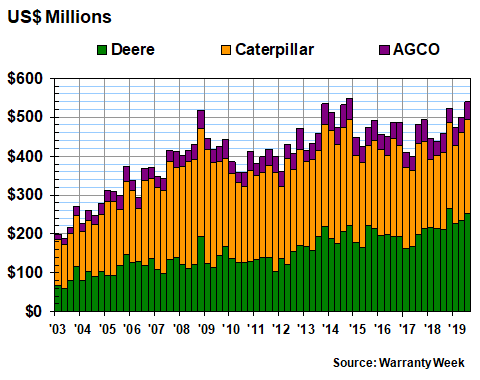

In Figure 5 we're looking at the quarterly claims payments reported by these three manufacturers. Those payments have generally been rising in proportion to sales over the past 17 years, with the exception of some dips during the last recession and some spikes in 2008 and 2013-2014.

In the third quarter of 2019, Deere and Cat reported comparable increases in claims payments. Deere's costs rose from $212 million a year ago to $252 million in the third quarter of this year. Caterpillar's rose from $197 million to $242 million. AGCO's, meanwhile, fell from $50 million to $46 million.

Figure 5

Off-Highway Vehicle Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2019)

Deere reported its highest quarterly total of $266 million at the end of 2018. But its quarterly claims total has been over $200 million for the last eight consecutive quarters -- something that happened in only five of the 59 previous quarters. Cat reported its highest quarterly totals back in 2008 and 2014. And AGCO also set its high water mark back in 2014. None have been close to breaking those records this year.

For the first nine months of 2019, Caterpillar's claims cost is up the most, at $106 million, or 19%. Deere's claims costs are up by $73 million, or 11%. And AGCO is down by about $6.1 million, or -4.4%.

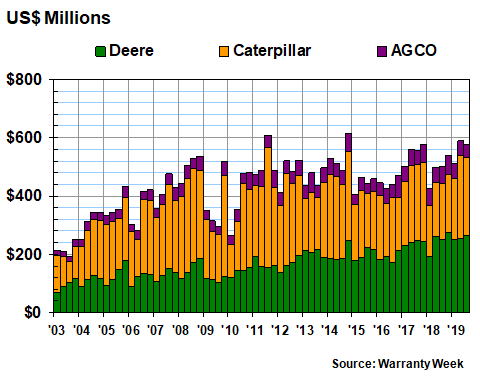

Accrual Totals

The amount of accruals reported by the three manufacturers has also remained essentially proportional to sales, with the exception of a big dip in 2009 and 2010, and short-lived spikes in 2011 and 2014. But the downturn was most noticeable at Caterpillar, as were the short-lived spikes.

In recent quarters, Cat has also shown the most volatility. In the third quarter, its accruals are up by $75 million to $269 million. And for the first nine months, its accruals are up by $203 million to $759 million.

Figure 6

Off-Highway Vehicle Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2019)

In contrast, Deere's accruals are up $13 million to $263 million, and its nine-month total is up by $69 million to $772 million. AGCO's accruals are actually down, by $8.8 million for the quarter and by $18 million for the nine months.

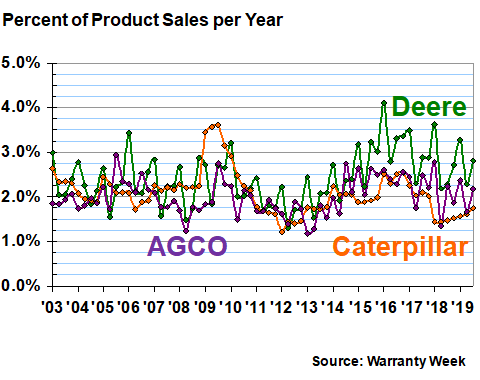

Claims Rates

In Figure 7, we're looking at the claims data from Figure 5, divided by sales. What's clear is that all three manufacturers have kept their claims rates relatively steady, and coincidentally very close to one another. Long-term, over 67 quarters, these three companies have reported an average claims rate of 2.2%. Deere is a bit above that at 2.4%, while Cat (at 2.1%) and AGCO (at 2.0%) are slightly below that level.

At the end of September 2019, Deere's claims rate stood at 2.8%, continuing a multi-year above-average excursion that stretches back to 2014. Cat was also on a bit of an upswing at 1.7% by the end of the third quarter, but has been below-average for almost three years. And AGCO, at 2.2% in September, was also slightly above trend.

Figure 7

Off-Highway Vehicle Warranties

Average Warranty Claims Rates

(as a % of product sales, 2003-2019)

However, the warranty expenses of these off-road vehicle manufacturers have remained far more consistent over time than their on-highway peers, with standard deviations that range from 0.3% to 0.6%. Caterpillar's spike in 2008-2009 had more to do with falling sales than rising claims. And AGCO has yet to report a claims rate over three percent.

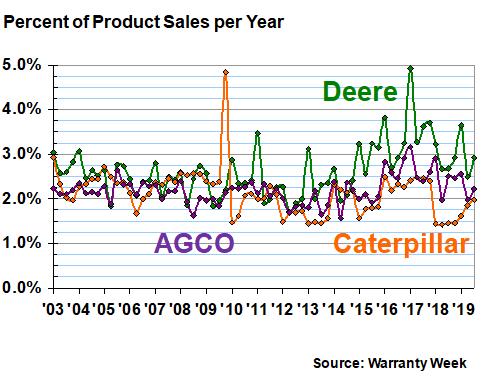

Warranty Accrual Rates

Finally, in Figure 8 we have the accrual rates of these three manufacturers over the past 17 years. Once again, the most striking feature is the occasional spikes, such as Cat's 4.8% in 2009, and Deere's 4.9% in 2017. Even AGCO saw its accrual rate rise above three percent very briefly in early 2017.

Figure 8

Off-Highway Vehicle Warranties

Average Warranty Accrual Rates

(as a % of product sales, 2003-2019)

With this metric, each of the manufacturer's long-term averages are a little higher as well. Deere is at 2.6%, AGCO is at 2.2%, and Cat is at 2.1%. Together, their long-term average is 2.3%, with a standard deviation that's actually a tiny bit lower than their claims rate's level of volatility.

At the end of September, Deere's accrual rate was a bit above average at 2.9%, while AGCO's was at its average of 2.2%, and Cat was a little below average at 2.0%. For Cat, however, that rate represented a rise after six quarters below two percent.

For all six of these large vehicle and engine manufacturers, however, the good news is that 2019 has been a relatively quiet year for their warranty expenses. Navistar, Cummins, Paccar, and Deere are returning to normal after spikes in previous years. Caterpillar and AGCO have been stable for a decade or longer.

In terms of sales, there's also little to report. Caterpillar and Cummins reported small increases in product sales during the first nine months of the year, and AGCO and Deere reported small declines in sales during the third quarter.

The other two reported swift increases. Paccar saw product sales rise 14% to $17.66 billion for the first three quarters of the year, and Navistar reported a 22% increase in product sales to $8.33 billion.

Happy Holidays!

Incredibly, this is the seventeenth year-ending issue of Warranty Week, which began with a report on the warranty disclosures of online shopping websites at the end of 2002. It has been a pleasure to send some 7,000 of you more than 800 newsletters in the decades since then.

We're going to take a two-week break, and will return in a new decade, on January 9, 2020. Until then, we wish all our readers a happy holiday and a healthy, safe, and prosperous new year!

|