October 17, 2019 |

|

ISSN 1550-9214 |

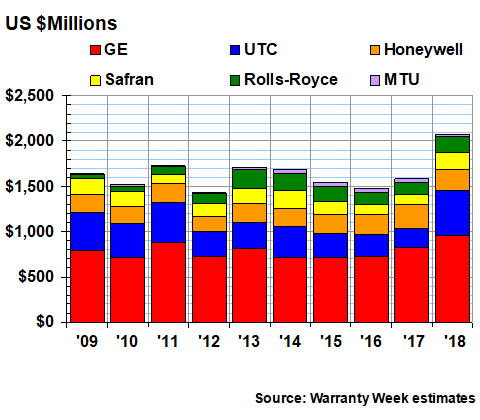

Jet Engine Warranty Expense Report:On the one hand, the warranty expenses of the top engine makers are setting record highs. On the other hand, that increase could be caused by the non-aviation product lines of some of these conglomerates. But we might know the answer soon, as some of those product lines are spun off.Last week we detailed the warranty expenses of all the world's civilian airplane manufacturers. This week, we hoped to spotlight the warranty expenses of all the suppliers of jet engines to companies such as Airbus, Boeing, Bombardier and Embraer, but there are some complications that prevent us from going that far. The list of the world's top jet engine manufacturers includes Rolls Royce plc; GE Aviation, a subsidiary of General Electric Co.; Pratt & Whitney, a subsidiary of United Technologies Corp.; Safran Aircraft Engines, a division of the Paris-based Safran S.A.; Honeywell Aerospace, a division of Honeywell International Inc.; the Munich-based MTU Aero Engines AG; and privately-held Williams International. There are several other turbofan manufacturers descended from the Soviet era. OJSG Aviadvigatel and its parent JSC United Engine Corp. are owned by the Russian government. JSC Klimov makes engines descended from Rolls Royce and Renault designs. NPO Saturn, also part of United Engine Corp., was formed through a merger of Rybinsk Motors and Lyulka-Saturn. And then there's Ivchenko-Progress ZMKB, which is owned by the Ukrainian government. There are also a couple of new manufacturers emerging in China as well. However, there is no publicly available warranty expense data for any of these companies. There are also several joint ventures amongst and between some of the top industry players. The Engine Alliance is a joint venture between GE Aviation and Pratt & Whitney. CFM International is a joint venture between GE Aviation and Safran Aircraft Engines. PowerJet is a joint venture between Safran and NPO Saturn. International Aero Engines AG, also known as IAE, is a joint venture of Pratt & Whitney, MTU Aero Engines, and Japanese Aero Engine Corp. Rolls Royce and Avio S.p.A. are former IAE shareholders. And Avio in turn was formerly part of Fiat S.p.A. However, those two along with MTU and ITP Aero, a Spanish subsidiary of Rolls-Royce, are also partners in a joint venture called EuroJet Turbo GmbH. Six Warranty Expense ReportersWe have gathered warranty expense reports for six of these companies: GE, United Technologies, Honeywell, Rolls Royce, Safran, and MTU. The first three report their warranty expenses in U.S. dollars. Rolls Royce reports in pounds sterling. Safran and MTU report in euro. We converted everything into dollars. All report just one set of figures for all their warranty expenses worldwide. This means that the GE figures include not only warranty expenses from the turbofans used in jet airplanes, but also the turbines used for gas-driven power plants and the wind turbines generating carbon-free electricity, not to mention all the medical equipment and other products GE sells. It also means the United Technologies metrics include not only Pratt & Whitney, but also Carrier HVAC systems and Otis elevators, as well as the product lines of new acquisitions such as the avionics and entertainment systems of Collins Aerospace. In its most recent annual report, GE said that aviation accounted for 26% of its product revenue and 25% of its total revenue. United Technologies, meanwhile, said that Pratt & Whitney accounted for 29% of its total revenue last year. And Honeywell said commercial aviation accounted for just under 20% of its net sales last year. So the problem that we face when trying to reach a worldwide total for jet engine warranty expenses is that turbofan manufacturing accounts for a minority of the total revenue for these three companies. So turbofan warranty expenses are probably also a minority of their company-wide totals. However, even if we were to assume that warranty expenses occur at the same proportional rate as revenue (which they definitely do not), we'd just be multiplying one estimate by another to determine warranty expense market shares. Also, for the Russian and Chinese manufacturers, we'd just be making wild guesses. Instead, what we will do is detail the worldwide warranty expenses of the parent companies of the six turbofan manufacturers that include warranty metrics in their annual reports. And that means the charts that follow will also include quite a large amount of HVAC warranties, windmill warranties, thermostat warranties, and even elevator warranties. We will have to leave it to others to determine what percentage of these expenses should be allocated towards turbofans, for both these six manufacturers by themselves as well as for their joint ventures. From each of these six companies, we gathered three essential metrics: the amount of warranty claims paid per year, the amount of warranty accruals made per year, and the amount of warranty reserves held at the end of each year. We also gathered product revenue data from each, and used that along with their claims and accrual totals to calculate two ratios: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate). Warranty Claims TotalsIn Figure 1, we are looking at their annual claims totals for the past ten years. As was mentioned, all these figures have been converted into U.S. dollars to allow them to be included in a single chart. And from this chart it is clear that claims paid by these six companies surged last year to a new height of $2.07 billion, thanks to a more than doubling of UTC's claims total from $207 million in 2017 to $493 million in 2018. Figure 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||