Computer Industry Warranty Report:Though the totals and averages are declining, we can't be sure it isn't caused primarily by all the companies going private or getting acquired by non-reporting parents, and thereby dropping from the list of warranty expense report providers.

While much of the computer industry's manufacturing activity has shifted to other countries, and some of the industry's largest warranty providers have decided to take themselves private, there is still a core group of U.S.-based computer OEMs and their suppliers that still account for roughly a third of all product warranty expenses reported by U.S. companies.

We began the process of counting their warranty expenses by making a list of all the U.S.-based computer industry manufacturers that have reported their claims and accrual activities in their financial statements since 2003. We found 24 companies engaged primarily in the manufacturing of computer systems; 44 companies manufacturing data storage systems; 154 manufacturing semiconductors and printed circuit boards; and 59 manufacturing various computer peripherals such as monitors and terminals.

Warranty-providing leaders in the computer industry included Apple Inc., Hewlett Packard Enterprise Co., HP Inc., and IBM Corp. These were the survivors -- most of the remaining 20 companies on the list had either been acquired, gone private, or gone out of business since warranty expense reporting began in 2003.

Mergers & Acquisitions Take a Toll

In the data storage sector, it's also a story of the survivors. After 16 years, pretty much all that's left are the majors -- NetApp Inc., Seagate Technology, and Western Digital Corp. Almost everyone else has been acquired or gone out of business (or has merely been delisted, as happened to Quantum Corp.).

On the semiconductor list, leaders include Advanced Micro Devices Inc., Applied Materials Inc., Coherent Inc., Kulicke and Soffa Industries Inc., and Lam Research Corp. Former leaders such as KLA-Tencor Corp. no longer have much product warranty expense, having recently reclassified most of it as extended warranty expenses. Nvidia Corp., meanwhile, has apparently discontinued including warranty expense reports in its financial statements, leaving us guessing what its warranty costs might actually be.

Among the peripherals manufacturers, most of the big guys are now gone from the list. Microsoft and Harman International were always more at home on the consumer electronics list, and while Microsoft stopped reporting its warranty expenses in 2012, Harman stopped in early 2017 when it was acquired by Samsung. Lexmark International, meanwhile, went private in 2016.

The major warranty providers still on the peripherals list include Daktronics Inc., Diebold Nixdorf Inc., Dover Corp., NCR Corp., and Zebra Technologies Corp. Some of them aren't what would be considered classic peripheral makers -- Diebold and NCR make bank and retail equipment, and Daktronics makes electric signs. But if not this group, then which to put them in?

Various other companies that manufactured products that belong in one or more of these categories, but were engaged primarily in other industries such as consumer electronics, aerospace, or medical equipment, were excluded from these lists. That had no effect on the computer or data storage lists, but did exclude a few dozen manufacturers from the semiconductor and peripherals lists. Chief among them were Honeywell International (aerospace), Agilent Technologies and Roper Technologies (medical equipment), and all the solar power equipment manufacturers.

From each of the 281 companies that we found to be engaged primarily in the computer, storage, chips, or peripherals industries, we gathered four metrics: warranty claims paid, accruals made, reserves held, and revenue from products sold. Using the claims, accrual, and revenue figures, we calculated two additional metrics: claims as a percentage of sales, and accruals as a percentage of sales.

Warranty Claims

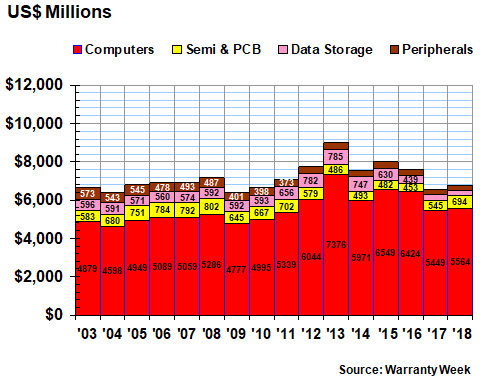

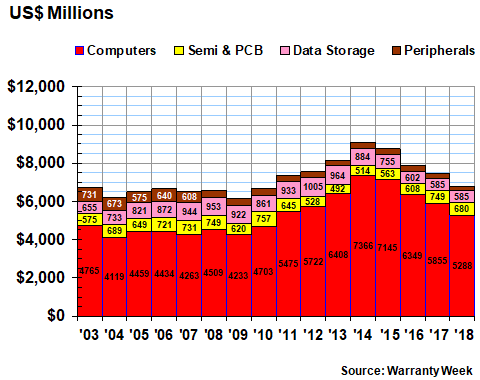

In Figure 1 we are providing the industry totals for claims paid over the past 16 years. Together, the four groups reported paying $6.775 billion in claims last year, up $183 million or 2.8% from the year before.

Figure 1

Computer Industry Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2018)

The bulk of the spending came from the computer manufacturers, and the bulk of that spending came from Apple Inc. We assume the bulk of that spending came from smartphones, not laptops or desktops, so we're going to have to widen our definition of a computer to include handheld voice/data/image processors.

Including Apple, the computer manufacturers saw claims rise by $115 million or 2.1% in 2018. Apple's claims were up by 4%; HP's claims were up by 1%; HPE's claims were down by 2%; and IBM's claims fell by 25%, from $165 million in 2017 to $123 million in 2018.

On the other lists, two of the biggest percentage drops in claims paid were reported by Diebold Nixdorf and Western Digital. Applied Materials, Coherent, and Lam Research reported the largest percentage increases in claims paid. For instance, Lam nearly doubled its claims costs, from $159 million in 2017 to $271 million in 2018.

Warranty Accruals

Warranty accruals across the four computer industry sectors barely rose last year, remaining more or less at a combined level of $6.27 billion. But the totals changed more noticeably for each of the four sectors: computer accruals rose $72 million to $5.05 billion; semiconductor accruals fell by $12 million to $693 million; data storage accruals fell by $35 million to $310 million; and peripheral accruals fell by $22 million to $218 million.

The warranty expenses of the data storage and peripherals sectors are now at their lowest-ever annual levels -- so small that numerical labels no longer fit within the boxes on the charts. But at least the computer sector is once again above the $5 billion mark, after slipping below it in 2017 as well as in 2009 and 2004.

Figure 2

Computer Industry Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2018)

HP reported the largest accruals increase of all, raising its annual total from $925 million in fiscal 2017 to $1.042 billion in fiscal 2018. Apple also increased its accruals, but only by $33 million, which equates to less than 1% of its 2017 total. HPE and IBM both cut their accruals last year, by $27 million and $51 million, respectively.

Among the companies on the other lists, there were a few major increases and a lot of major decreases. The increase roster was topped by Coherent, which increased its accruals by nearly a third. Applied Materials, Kulicke and Soffa Industries, Lam Research, and Zebra Technologies also reported large-scale increases in their annual accrual totals.

On the other hand, the number of major warranty providers reducing their annual warranty accrual totals by 10% or more was a quite lengthy list that included Cree Inc.; Daktronics; Diebold Nixdorf; Electro Scientific Industries Inc.; Electronics for Imaging Inc.; NetApp Inc.; Teradyne Inc.; and Western Digital Corp. KLA-Tencor deserves an honorable mention, having recently discovered that most of its warranty accruals were actually preventative maintenance contract revenues. And of course Nvidia ceased reporting its accruals, though we estimate a significant decrease occurred last year.

Warranty Expense Rates

In the next four charts, we will take the annual claims and accrual totals from Figures 1 and 2 and divide each by the corresponding annual product sales totals. It's important to note that the product sales totals do not include service, licensing, or royalty revenue, nor sales of consumables or other non-warranted products, so that they best represent the ratio between the warranty expense and the warranted product sales revenue.

As in the automotive industry, the end user customer-facing companies seem to always have the highest warranty expense rates, while the OEM-facing suppliers pay far less. But it's not so clear-cut in the computer industry, because many suppliers, such as the disk drive companies, sell both to OEMs and to consumers. And some of the peripheral companies make point-of-sales systems, banking machines, and other computing equipment that is sold directly to end user businesses.

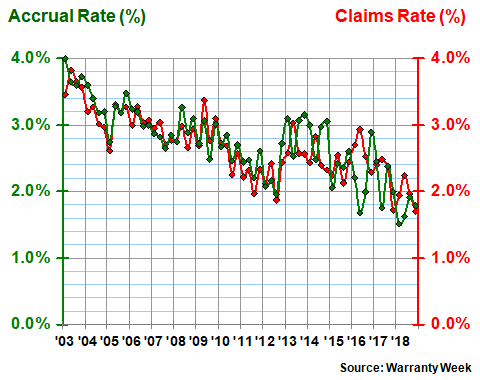

However, the relationship between their expense rates still holds, as can be seen in the figures below. The computer makers have the highest expense rates, though they've decreased from nearly four percent back in 2003 to around two percent now. Over the long term, their average claims and accrual rates have been about 2.7%, with a standard deviation of roughly 0.5%.

As is apparent in Figure 3, the long-term trend has been primarily downward. Though expense rates rose in 2013, in the five years since they have generally resumed their decline.

Figure 3

Computer Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2018)

Last year, Apple's claims rate rose, but it cut its accrual rate anyhow. However, HP, HPE, and IBM each saw both their claims and accrual rates fall in 2018. IBM, in fact, turned in one of the largest proportional reductions in its accrual rate among all manufacturers last year, cutting it from 2.6% at the end of 2017 to 1.9% at the end of 2018.

Data Storage Expense Rates

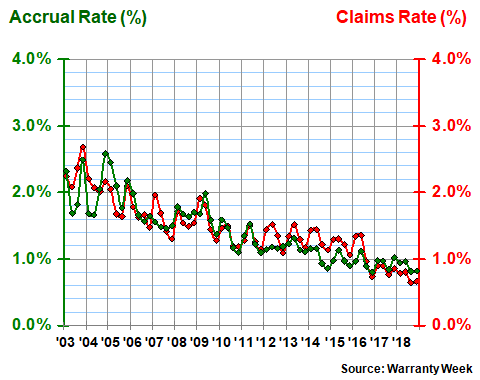

In the data storage industry, acquisitions have had a significant effect on the industry totals and averages. For instance, of the top 10 warranty providers on our list in 2003, only three are still independent companies: Seagate, Western Digital, and Quantum Corp. Maxtor was acquired by Seagate. Storage Technology Corp. was acquired by Oracle. Iomega was acquired by EMC, which later sold it to Lenovo. And SanDisk Corp. was acquired by Western Digital.

This record of major acquisitions is the primary reason that warranty expenses have been declining. However, as can be seen in Figure 4, what was left behind has also seen its expense rates steadily decline. In other words, the high-cost manufacturers were acquired, while the remaining low-cost manufacturers continued to cut their costs further.

Figure 4

Data Storage Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2018)

Seagate cut its accrual rate from 1.4% in 2017 to 1.1% in 2018. Western Digital cut its accrual rate from 0.9% to 0.7%. Western Digital also saw its claims rate fall from 0.8% to 0.5%, while Seagate's claims rate remained about the same. The overall industry's claims and accrual rates are now far below their 1.4% long-term average, with all eight data points coming in below one percent last year.

Semiconductor Expense Rates

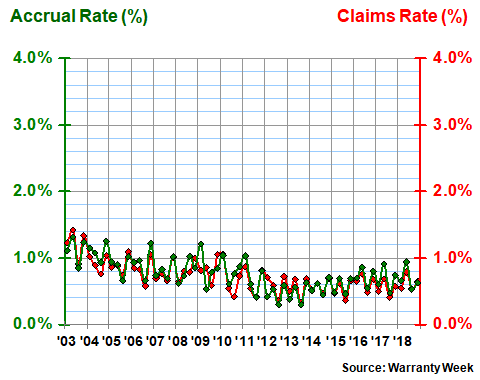

We will take a deeper look at warranty expenses in the semiconductor and printed circuit board industry next week. But in this week's newsletter, we want to note that expense rates, while still low, have been lower in the recent past. But then again, as can be seen in Figure 5, they were somewhat higher a decade or more ago.

The long-term average claims and accrual rates are near 0.75%, which is low. However, the standard deviation for those rates is around 0.25%, which is relatively high compared to the average. This suggests there's been a lot of volatility, not only from year to year, but also seasonally, within a given year.

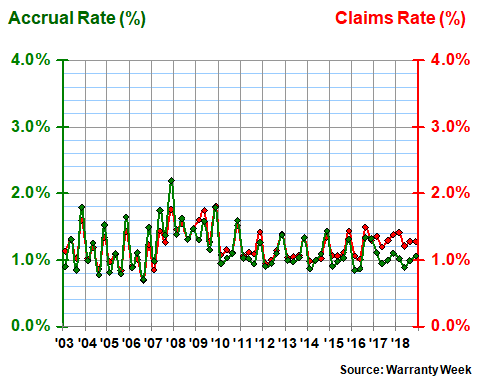

Figure 5

Semiconductors & Printed Circuit Boards

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2018)

Among the 154 companies on this list of semiconductor and PC board makers, there were both spectacular increases and decreases in their warranty expense rates. Kulicke and Soffa led the increases, with its claims rate rising from 0.4% to 2.7%, and its accrual rate rising from 1.2% to 2.7%. One major cause was a 32% decline in product sales, but the expenses themselves are also up significantly.

Among the spectacular decreases is KLA-Tencor, which as we mentioned, reclassified most of its product warranty expenses to instead be extended warranty revenue. Accordingly, it discontinued the reporting of claims and accruals, resulting in a clean 100% decline in its warranty expense rates, and its departure from the ranks of the top warranty providers.

Cree and Teradyne turned in impressive expense rate reductions. They both saw their claims rates fall to 0.8%. Cree then cut its accrual rate from 2.2% to 0.7%, while Teradyne cut its accrual rate from 1.1% to 0.8%. Lam and Coherent saw both their expense rates rise, while both Applied Materials and AMD saw their claims rates rise but cut their accrual rates anyhow.

Peripheral Expense Rates

The U.S.-based portion of the peripherals industry has shown the least amount of warranty cost reduction. In fact, at the end of 2018, its average claims rate was slightly higher than its long-term average of 1.2%, while its average accrual rate was only slightly below that level. Warranty expense rates were highest in 2007 and lowest in 2006. They've remained between these extremes ever since.

Figure 6

Peripheral Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2018)

We should note that in past years we've included Microsoft in this industry category, which caused its warranty expenses to soar in the years after the Microsoft Xbox 360 had its manufacturing excursion. We briefly considered shifting the company to the computer category, because of the success of the Surface tablets and notebooks, but ultimately moved the company to the consumer electronics category, because that's where the Xbox belongs. It doesn't matter much anyway, however, because Microsoft discontinued reporting its warranty expenses in 2012. But this shift also removes that 2007-era bulge from the peripherals data in Figures 1, 2 and 6.

Among the remaining providers of computer peripherals on our list, expense reductions were the order of the day. Diebold Nixdorf, 3D Systems Corp., and Electronics for Imaging Inc. each made significant reductions to both their claims and accrual rates. 3D Systems also saw a healthy increase in sales, which helped reduce expense rates. Daktronics, meanwhile, saw its claims rate rise but cut its accrual rate anyhow, from 2.0% in 2017 to 1.5% at the end of 2018. NCR, Dover, and Xerox saw their warranty expense rates remain more or less the same.

Warranty Reserves

Finally, our last metric to examine is the year-ending balance in the warranty reserve funds of these 281 companies. As can be seen in Figure 7, the entire industry total fell for the fourth year in a row. The amount of reserves held by companies in all four segments is now down from its 2014 peak of $9.1 billion to just under $6.8 billion. Reserves fell by $703 million or 9.4% last year.

Figure 7

Computer Industry Warranties

Reserves Held by U.S.-based Companies

(in US$ millions, 2003-2018)

Among the individual segments, the data storage reserve balance was relatively unchanged but the other three balances fell. The peripherals companies cut their collective reserves by 25%, while the computer companies cut their by 10% and the semiconductor companies cut theirs by 9.2%.

Among the computer manufacturers, the weight was decidedly on the reduction side. Apple singlehandedly reduced its warranty reserves by $504 million, from $4.3 billion at the end of calendar 2017 to $3.8 billion at the end of calendar 2018. HP Enterprises reduced its reserves by $45 million, while IBM reduced its reserves balance by $34 million. In contrast, HP Inc. increased its balance by $17 million.

Among the other three industry segments, balance reductions slightly outnumbered increases. At the top of the list of reductions were Daktronics (-$2.4 million); Diebold Nixdorf (-$37 million); Dover (-$12 million); Electronics for Imaging (-$3.6 million); and NetApp (-$5.0 million). Proportionally, Diebold and Dover were the largest percentage decreases (-48% and -20%, respectively).

At the other extreme, the list of companies reporting the largest warranty reserve fund balance increases included AMD (+$1.0 million); Applied Materials (+$10 million); Coherent (+2.7 million); Kulicke and Soffa (+$1.2 million); Western Digital (+19 million); and Zebra Technologies (+$4.0 million). Proportionally, Zebra Technologies was the largest increase (+22%).

Disappearing Warranty Providers

However, the driving force behind the declining reserve balance is disappearance. Of the $400 million in reserves held by the top five acquisitions of the last five years -- EMC, Lexmark, SanDisk, Tyco, and VeriFone -- only the reserves of SanDisk were acquired by a company that still reports its warranty expenses to the public. Lexmark and VeriFone went private, EMC was acquired by a private company, and Tyco was split into multiple pieces and sold, primarily to buyers from other industries besides computer peripheral.

Going back even further, the warranty expense-reporting portion of the U.S.-based computer industry once included Dell, Sun Microsystems, Gateway, Palm, Unisys, and Silicon Graphics, among others. All of them ceased reporting their warranty expenses for one reason or another, and only Palm was acquired by a company that still reports today. That means $1.3 billion in warranty reserves went off the charts, more or less.

Therefore, before we jump to conclusions and suggest that either the computer or the data storage segments have become proficient as warranty cost-cutters, we have to admit that the major costs being cut are those of the departing companies. If we were to look at just the historical warranty expenses of still-reporting companies, many of these charts would look very different.

|