December 20, 2018 |

|

ISSN 1550-9214 |

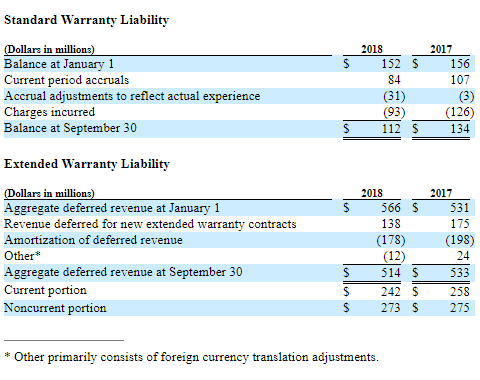

ASC 606 Causes Warranty Accounting Changes:Though it's mainly about revenue recognition, ASC 606 also forces manufacturers and retailers to separate product warranty from extended warranty, and account for each differently. But to get there, the FASB confuses the issue with new terminology and vague concepts.Fifteen years ago, after the Enron and WorldCom scandals, the Financial Accounting Standards Board required all public companies to publish details about all their guarantees, including their till-then-top-secret warranty expenses. Suddenly, the unknown became known, and by taking a few key numbers out of a company's annual report, we could measure the cost of warranty to the nearest dollar. That rule was called FASB Interpretation Number 45, or FIN 45, and for six years it mandated that all warranty providers who accrue those expenses had to reveal details about them. And then, in 2009, FASB made some revisions to the warranty disclosure rules, and included them in a new unified set of rules called the Accounting Standards Codification, or ASC. All the sections are numbered, as are the subsections and paragraphs. Section ASC 460, Guarantees, is the most up-to-date source of the product warranty disclosure rules. Specifically, paragraph ASC 460-10-50-8b states that a warranty provider must explain the methodology that led them to determine the amount of warranty liabilities they expect, and how they determined the amount of deferred revenue resulting from sales of extended warranties, which now must be detailed as well. Product Warranty TableAnd then ASC 460-10-50-8c is where the details of what's required in those warranty expense disclosures are listed. Basically, the provider of a product warranty must include a text table in their financial statement that includes the beginning and ending balance of their warranty reserve fund, the amount of claims paid (in cash or in kind), the amount of accruals made, and any adjustments they made because of acquisitions, currency fluctuations, or changes in estimate. Future revisions, however, may remove those references to extended warranties and deferred revenue from ASC 460-10-50-8b. They weren't included in the original FIN 45 rules that went into effect in 2003. And they haven't gained much of a following in the past decade, so they won't be missed. Most companies either still lump their product and extended warranty disclosures together, or they still keep their extended warranty details unpublished. So in effect, ASC 460 is being edited back into status quo ante, as a Latin-loving lawyer might say (we are not lawyers). Meanwhile, a new rule called ASC 606, Revenue from Contracts with Customers, became effective for public companies in their fiscal year which began after December 15, 2017. It has lots of different parts, but the ones most relevant to warranty professionals are the ones covering extended warranty disclosures. We're just past a year after that date, so that means all annual reports filed with the U.S. Securities and Exchange Commission from now on must comply with the new rules. The International Financial Reporting Standards Foundation has adopted a parallel accounting rule, called IFRS 15, Revenue from Contracts with Customers, which went into effect at the beginning of this year. This brings essentially the same set of standards into force in Europe, India, Canada, Australia, Russia, Korea, and several other countries, though they spell the word recognise in the British style. And that word is actually central to the concept within ASC 606 and IFRS 15: revenue from extended warranty and service contract sales must be initially deferred and recognized on some acceptable schedule. But it also makes an attempt to cover long warranties and additional coverages, such as those that include accidental damage protection. And it's going to cause a lot of confusion. Extended Warranty TableSome manufacturers such as International Business Machines Corp. and Brunswick Corp. are already including separate tables in their financial statements for their product warranty expenses and extended warranty revenue. But some still combine their product warranty and extended warranty tables into one, by including deferred revenue and recognized revenue in the same FIN 45 table as claims and accruals. This is not good and must stop, as a good accountant might say (we are not accountants). But it takes FASB pages and pages of standards-making to explain all of this. And to explain it, the rules create some new terms and more clearly define others, in hopes that the manufacturers start separating their product warranties from their extended warranties. We think it just adds to the confusion. According to the FASB, a warranty now includes two components: an "assurance-type warranty" and a "service-type warranty." According to section ASC 606-10-55-34, the difference between them is as follows: If a warranty, or a part of a warranty, provides a customer with a service in addition to the assurance that the product complies with agreed-upon specifications, the promised service is a performance obligation. Therefore, an entity should allocate the transaction price to the product and the service. If an entity promises both an assurance-type warranty and a service-type warranty but cannot reasonably account for them separately, the entity should account for both of the warranties together as a single performance obligation. Is that clear? No? Well, that's why there are lawyers and accountants (and warranty newsletters). FASB defines an extended warranty in the glossary as "an agreement to provide warranty coverage in addition to the scope of coverage of the manufacturer's original warranty, if any, or to extend the period of coverage provided by the manufacturer's original warranty." A separately priced contract is defined in the glossary as "an agreement under which the customer has the option to purchase an extended warranty or a product maintenance contract for an expressly stated amount separate from the price of the product." But if you're looking for a definition of an assurance-type warranty or a service-type warranty, or the difference between them, the paragraph above is all they include. New DefinitionsSo now that the FASB has upset the status quo, and seemingly required warranty providers to change the way they account for warranties, what is all the fuss about ASC 606? To answer that question, we need to first quote some of the actual language of the rule: ASC 606-10-55-30 A performance obligation is defined in the glossary as a promise in a contract by the seller to deliver one or several products or services, once or several times. Therefore, a service warranty is a performance obligation. An assurance warranty is not. Next there is a reference to another section (25-16) about promises in contracts, which says they can be both written and implied, and both explicit and implicit, and are usually based on the "reasonable expectation of the customer." So that all fits well with the definition of a warranty. What's unclear is if this covers contracts for products that happen to come with warranties, or contracts specifically for warranties: service contracts that are sold separately from the product with the warranty. Or does it cover both? Remember, the subject of this whole ASC 600 series is revenue. The 400 series of FASB standards are for liabilities. So that's why warranties are covered in ASC 460, and extended warranty revenue is covered in ASC 606. But product warranties don't normally generate revenue. So why are there all the sections about warranties in ASC 606? Separate Tables?It seems like this whole effort is a convoluted way to compel manufacturers and retailers to clearly separate guarantees and warranties on the one hand from service contracts and extended warranties on the other hand. With ASC 606, we're talking about sales of service contracts and how the revenue must be initially deferred and gradually recognized over the life of the contract. And that's all dressed up with all this "assurance-type warranty" and "service-type warranty" malarkey. And that's more or less confirmed by the next section, ASC 606-10-55-32: If a customer does not have the option to purchase a warranty separately, an entity should account for the warranty in accordance with the guidance on product warranties in Subtopic 460-10 on guarantees, unless the promised warranty, or a part of the promised warranty, provides the customer with a service in addition to the assurance that the product complies with agreed-upon specifications. In other words, never mind. Product warranties and guarantees are covered elsewhere, not by Section 606. That hasn't changed. The next section (ASC 606-10-55-33) carves out some additional exceptions to the "service-type warranty" rule. Paying for return shipping is not a performance obligation, nor is it a service-type warranty. Reverse logistics are not performance obligations. Statutory warranties as required by law are not performance obligations. However, the longer the coverage of the warranty, the more likely it is to be a service warranty and therefore a performance obligation, the rule states. Unfortunately, a long time period is not defined in the glossary. Therefore, the new rule could easily ensnare lifetime warranties, solar warranties, building material warranties, performance warranties, and anything covered by a warranty for a longer-than-usual duration in a given industry. But there's no revenue in long warranties. There is revenue in service contracts. So why suggest that long warranties could somehow grow revenue and become service contracts merely because they are long? Already, this unfortunate phrasing is having an effect in the solar industry. For instance, SolarEdge Technologies Inc. has adopted ASC 606 and has concluded that "performance obligations that extend for a period greater than one year" include what it calls "warranty extension services." But it also notes that these services involved deferred revenue, which means they were service contracts, not long warranties. So it didn't affect the warranty reserve. But it did force the company to reclassify nearly $4 million in retained earnings as long-term deferred revenue. Not InsuranceBut let's face it: It could have been worse. The FASB could have told us to treat extended warranties and service contracts like insurance. In fact, let's be thankful that they invented a term such as service-type warranty and didn't use a more natural-sounding phrase like "product insurance." That would have upset all those decades-long efforts at the state level to make sure that extended warranties and service contracts are regulated separately from insurance, despite the family resemblance they share. A better ASC topic to make new rules about would be the need for manufacturers and retailers to actually set aside funds to pay for those long warranties -- actual cash on escrow somewhere or backed by insurance. Many state laws already require proper reserves for extended warranties and service contracts, as a condition of license. But lifetime warranties go down with the ship. And those warranty reserve balances they leave behind could turn out to be just book entries -- just another unfunded liability to be discharged by the bankruptcy court. In last week's newsletter we mentioned some of the manufacturers that are already revising their warranty disclosures to comply with ASC 606. For instance, KLA-Tencor Corp. has this thing they call "non-standard warranty bundled with equipment sales." Basically, it's an enhanced service level agreement that's available for sale, above and beyond the standard 12-month warranty. An example would be response to claims made outside the 40-hour work week. That's a performance obligation and a service-type warranty that needs to be accounted for separately. However, KLA-Tencor has also now determined that its product warranties are performance obligations. "The Company will account for the standard 12-month warranty for a majority of its products that is not separately paid for by the customers as a performance obligation since the Company provides for necessary repairs as well as preventive maintenance services for such products. The estimated fair value of the service will be deferred and recognized ratably as revenue over the warranty period," it says in its summary of significant accounting policies. Therefore, KLA-Tencor has effectively zeroed out its warranty reserve, reducing the balance from $42 million in June to only $347,000 in September. It has discontinued inclusion of the FIN 45 warranty table as well. And it has begun reporting balances for items called deferred system revenue and deferred service revenue (but not the cash flow into or out of those accounts from new or old contract sales). So we have no idea how much money the company spent on claims, made in accruals, sold in new service contracts, or recognized as revenue. In our opinion, the company is using ASC 606 as a cloak with which to shield itself from meaningful analysis of either its product warranty or extended warranty activities. It's now back to pre-2003 levels of transparency. Not Sales ReturnsNetgear Inc., meanwhile, discovered when it adopted ASC 606 that most of its warranty reserves were actually set aside to pay for sales returns, not break/fix expenses. In other words, the defect those funds were intended to pay for was the simple fact that nobody had bought the product. That's neither an assurance warranty nor a service warranty. It's not a warranty at all. It's a sales return. Netgear therefore reclassified $57.9 million, moving it from warranty to sales returns, and its warranty reserve balance plummeted. Its claims cost dropped from $35.8 million a quarter last year to $857,000 per quarter now, and its accrual rate dropped nearly 50-fold, from over 10% to only 0.2%. And by that reclassification, we can infer that 97% of its historical warranty costs weren't warranty costs at all. Oops! Other companies have made small adjustments thanks to implementation of ASC 606. For instance, Tesla Inc. has changed the way it accounts for lease revenue, and how it treats the product warranty liability expenses and the maintenance plan revenue associated with those leased vehicles. But that entailed reclassifying only $4.6 million last quarter for a company with $644 million in its warranty reserve fund at last count. There are sure to be more companies who in the months ahead suddenly realize that their warranties aren't really warranties, or that their product warranties and extended warranties are different and need to be separated. We hope they also absorb the lesson that the material changes in those respective accounts need to be disclosed, and they need to be in separate tables. The ideal would be something simple, like IBM currently includes in its financial statements:  So here's our best non-legal, non-accounting, non-professional advice: Be like IBM. Separate your tables. Unfortunately, the FASB has confused the whole issue, dressing it up with newly-manufactured phrases and made-up definitions that take a long time to get to a simple conclusion: separate your product warranties from your service contracts. We'd suggest the SEC immediately launch a safety recall of all copies of ASC 606 before somebody gets hurt (but if they did that, they might need to amortize the recall expense over no more than one year, because anything longer would turn it into a performance obligation). What the next edition of ASC 606 needs is help from someone who works in the business -- someone who knows the difference between a product warranty and an extended warranty, someone who knows that extended warranties and service contracts are sold separately while product warranties are not, and someone who knows how to defer and recognize revenue using the straight-line method and/or as claims arise. It's not rocket science, but it is a science, and while warranty professionals know how it works, it's obvious from cases like this that the people writing these standards just don't get it. Happy Holidays!Next week is Christmas and the Monday afterwards is New Year's Eve, so Warranty Week will be taking a two-week break, returning with our next newsletter on January 10, 2019. Incredibly, this is the seventeenth holiday break we've taken since the publication was launched in November 2002. And even more incredibly, there are still about four dozen subscribers among our 7,100 or so weekly recipients that have been there from the first few months until this, the 766th installment in an ongoing series of weekly newsletters. And so, for the seventeenth time, on behalf of our editor, our webmaster, and our photo editor, we'd like to take this opportunity to thank all of you for subscribing. We'll be back for another series of newsletters focused on product warranties and service contracts next year. Until then, we wish all our readers a happy holiday and a healthy, safe, and prosperous new year! | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||