Civilian Aircraft Report:Warranty expense rates have been steadily declining since 2011 and are now at their lowest levels ever. That means the manufacturers of everything from biplanes to business jets are cutting their warranty costs by remarkable amounts. Meanwhile, per mile, air travel is even safer than walking.

Because only a handful of manufacturers account for the vast majority of civilian aircraft sales revenue, and because most of those manufacturers include warranty expense reports in their financial statements, it has become possible to estimate the size of the entire worldwide industry's spending on claims and accruals.

In broad terms, the universe of airplane manufacturers can be split into three segments. First are the commercial airliner manufacturers, led by the American Boeing Company and the European Airbus Group N.V. And then there are three manufacturers of the smaller commercial aircraft typically used on shorter flights: the Canadian company Bombardier Inc., the Brazilian manufacturer Embraer S.A., and the French company GIE Avions de Transport Regional (ATR), a partnership of Airbus and Leonardo S.p.A.

Other commercial airline manufacturers of the past, such as McDonnell Douglas, Lockheed, Curtiss-Wright, Vickers, De Havilland, Fokker, Saab, Hawker, and Aerospatiale, have either left the business or have been acquired by one of the above companies. In terms of worldwide market share for new units, it really comes down to these five, with additional up-and-coming possibilities arising from military spin-offs in China and Russia.

The second segment are the general aviation manufacturers, who make everything from biplanes to business jets. Market leaders include Textron Inc. (Cessna and Beechcraft), General Dynamics Corp. through its (Gulfstream Aerospace Corp.) subsidiary, and the Dassault Aviation Group, makers of the Falcon family. Bombardier Aerospace is also in this segment with its Learjets.

Other general aviation manufacturers include the Chinese-owned Cirrus Aircraft Corp.; Austria's Diamond Aircraft Industries GmbH; Italy's Costruzioni Aeronautiche Tecnam S.r.l; Germany's Flight Design GmbH; Switzerland's Pilatus Aircraft Ltd.; France's Daher; Australia's Mahindra Aerospace; Piper Aircraft Inc. (now owned by the Sultan of Brunei); Mooney International Corp.; and CubCrafters Inc.

Then there are some specialists. Quest Aircraft Co. makes planes that can take off or land almost anywhere in the wilderness, using very short and irregular runways. American Champion Aircraft Corp. and Extra Flugzeugproduktions und Vertriebs GmbH make aerobatic planes. Waco Aircraft Corp. makes old-fashioned biplanes. Thrush Aircraft Co. and Air Tractor Inc. make crop dusters. But none of them report their claims and accrual totals, and most of them are still private companies, so we will have to construct both revenue and warranty expense estimates for each of them.

Excluding Military Warranties

The third segment are the military plane makers, led by the U.S. company Lockheed Martin Corp., and by its arch-rivals Aviation Industry Corp. of China (AVIC), and JSC United Aircraft Corp. (UAC) of Russia. Lockheed Martin makes the F-35 Lightning II. AVIC makes the Shenyang J-31 fighter. UAC owns Sukhoi, makers of the Su-30MK fighter, Tupolev, makers of the Tu-95 bomber, and Mikoyan, makers of the MiG family of military aircraft.

Dassault Aviation is also in the military aircraft business with its Mirage and Rafale jets. Embraer still makes some turboprops flown by various South American air forces. There are still some operational military jets made by Boeing. And then there are a handful of other countries that have their own national military jet manufacturers, such as India, Iran, Israel, Japan, South Africa, Sweden, Taiwan, and the UK.

However, military plane warranties are very different than civilian aircraft warranties, and are not detailed in any company's financial statements. For instance, Lockheed Martin reports no warranty expenses, despite reporting $43.9 billion in product sales last year. Boeing and General Dynamics do significant amounts of defense work, but sources tell us that all their reported warranty expenses arise from the civilian side of the house. So that's the last word we'll have to say about military product warranties.

These three market segments are more or less distinct from each other. There are a handful of crossovers, of course. AVIC and UAC also have a small-but-growing presence in the commercial airliner industry, particularly within their home countries. Boeing and Airbus still have a small-but-shrinking presence in the business jet market. And, as was mentioned, Bombardier makes both commercial airliners and business jets. But for the most part, each manufacturer fits predominantly into just one of the three segments.

Fortunately for us, eight of the top ten civilian aircraft manufacturers report their warranty expenses in their financial statements. Unfortunately for us, some such as Bombardier and Textron that also make a variety of land-based vehicles, and they do not separate the warranty expenses of those units from the warranty expenses of their aviation divisions.

Therefore, for the non-reporting manufacturers such as AVIC and ATR (and at least for now, UAC, which has yet to publish its 2017 annual report), we will have to estimate their annual warranty expenses. And for the diversified more-than-just-plane manufacturers, we will include the entire company's warranty expenses, leaving it up to those with a higher pay grade than us to estimate their aviation-only segment's share.

For each company, we converted all their warranty expense figures into U.S. dollars, using prevailing exchange rates reported for each year. However, several non-U.S. companies such as Bombardier and Embraer already made those conversions for us, because they report their revenue and expenses in U.S. dollars.

Boeing vs. Airbus

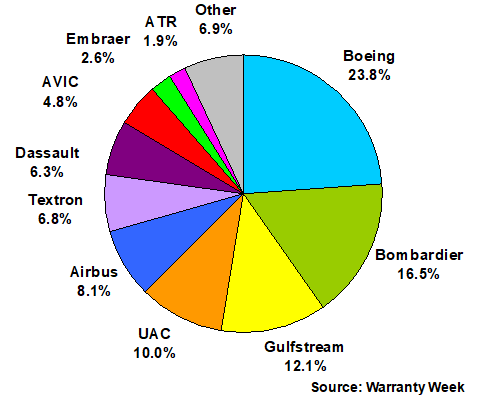

In Figure 1, we are dividing up the worldwide civilian aviation market's estimated $1.013 billion total for warranty claims paid. Industry experts will immediately notice there doesn't seem to be a correlation to market shares based on sales. For instance, in the chart below, Boeing is number one but Airbus is fifth? Their revenues are comparable, but Boeing's claims cost is almost three times larger than the Airbus total? That doesn't make sense. However, it is a mathematical fact. We'll leave the explanations up to others to deliver. In fact, we hope some aviation experts actually know the answer to this riddle, and send us their solutions.

Figure 1

Top Airframe Makers Worldwide

Share of Claims Paid

(percent of US$1.01 billion total, 2017)

As was mentioned, the Bombardier and Textron numbers include more than just planes. Besides regional and business jets, Bombardier has sold more than 100,000 train cars that now carry at least 500 million passengers a day. Besides Cessnas, Textron makes everything from golf carts to helicopters. And until 2013, the Textron numbers also included extended warranties for all those products. And there are other exceptions as well. Therefore, depending upon your assumptions, either a little or a lot of the claims in the chart above probably came from outside the aviation industry.

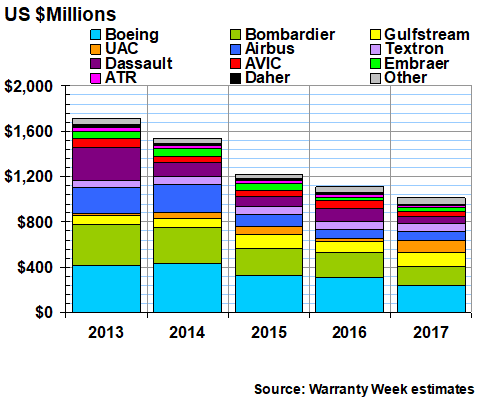

Downward Five-Year Trend

In Figure 2, we're looking at the five-year trend in claims paid. Notice that it's been trending downward for all that time. That's because Dassault, Airbus, Bombardier and Boeing have each cut their annual claims cost considerably over the past five years. Collectively, just those four are down by nearly $750 million in claims paid since 2013. Meanwhile, their sales are up by more than $9.3 billion over that same time period. In other words, claims as a percentage of sales is also declining.

Figure 2

Top Airframe Makers Worldwide

Claims Paid per Year

(in US$ millions, 2013-2017)

We have data going all the way back to 2003, but as was mentioned, the Textron figures also include extended warranties before 2013. For instance, the company reported $250 million in claims paid in 2012, but only $60 million in claims paid in 2013 (we detailed this change in the April 13, 2017 newsletter). So if we included pre-2013 data, the chart would have included an even steeper, but misleading, decline.

Warranty Accruals

The flip side of the claims payments is the total for accruals made. When a company sells a plane, it sets aside an amount of accruals it believes will be sufficient to pay for all its warranty claims. And then it pays those claims as they arise. Over time, it adds or removes funds from its warranty reserve, adjusting for past over- or under-accruals. But these accrual totals are the amounts each company believes will be needed to pay for all the warranty claims related to units sold last year.

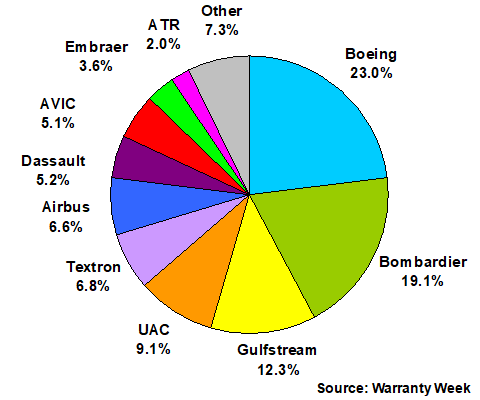

In Figure 3, we're assigning another "market share" figure for each of the top ten manufacturers, based on a worldwide total estimate of $1.189 billion in accruals made. Once again, Boeing is in first place, as expected. But Airbus has fallen from fifth to sixth place, which once again defies explanation.

Figure 3

Top Airframe Makers Worldwide

Share of Accruals Made

(percent of US$1.19 billion total, 2017)

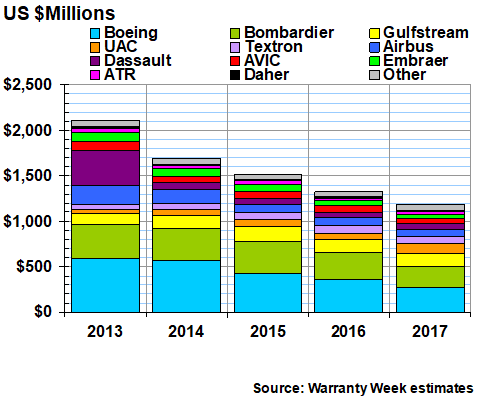

In Figure 4, we're once again going back five years, but this time we're looking at accruals made rather than claims paid. Once again, there is an annual decline for each year. And once again, four manufacturers -- Boeing, Bombardier, Airbus, and Dassault -- account for the bulk of that decline.

Figure 4

Top Airframe Makers Worldwide

Accruals Made per Year

(in US$ millions, 2013-2017)

As was already mentioned, civilian product sales for those four companies were up by just over $9.3 billion from 2013 to 2017. So the decline in their warranty expenses could not be linked to a decline in their sales, because their sales did not decline during that period (however, there were slight declines in revenue from 2014 to 2015 and again from 2016 to 2017). Instead, the downward slope seems to be a genuine reduction in expense rates, which implies either a more efficient warranty process, less warranty work being done, and/or higher quality products getting sold.

Exemplary Safety Record

Of course, in civil aviation, product failure is not an option. And industry statistics suggest that 2017 was the safest year on record, with 399 fatalities caused by accidents -- the lowest annual total since 1937, when flying was a rare luxury reserved for the rich and famous. On a per-mile basis, air travel is now safer than walking. In fact, there were no accident-caused fatalities on commercial airlines in the U.S. from 2009 until earlier this year, though there were several military mishaps.

One could surmise that this exemplary safety record comes at a high cost, but on a per-dollar basis, commercial airliners have lower warranty costs than cars, trucks, buses, or trains. While the makers of those land vehicles typically spend north of two percent of their sales revenue on warranty work, civilian aircraft manufacturers in recent years have spent well under one percent of their revenue on warranties.

However, unlike in the car or truck business, where we can readily calculate how much each manufacturer is accruing per vehicle sold, in the airplane business such an exercise would yield bizarre results. Comparing the warranty costs associated with a $375 million jumbo jet to those generated by a $100,000 crop duster is much different than comparing a luxury Porsche to an economy-size Volkswagen, or a Maserati to a Fiat. Plus, a big source of the difference would be the fact that Boeing and Airbus are warranting just the airframe. Other manufacturers warrant the avionics, engines, interiors, and other additional parts and systems.

However, it theoretically would be possible to compare the accruals of Boeing to Airbus, or perhaps Embraer to Bombardier. The problem would be that while the sales totals of Boeing and Airbus are similar, their warranty expense rates are not. And we can't explain why. Also, before we could use the Bombardier numbers, we'd have to make some assumptions about the relative expense rates of trains and planes, since each accounts for roughly half the company's total revenue.

The truth, however, is that size matters. It would be like comparing scooters to trucks. Commercial airliners cost so much per unit, and so many are now being sold that just the top five manufacturers account for 76% to 80% of the entire civilian aircraft industry's annual revenue. In other words, their heft in terms of both units sold and price per unit are largely the determining factors in the overall industry's claims and accrual rates, since those are calculated as a percentage of sales revenue.

Warranty Expense Per Dollar

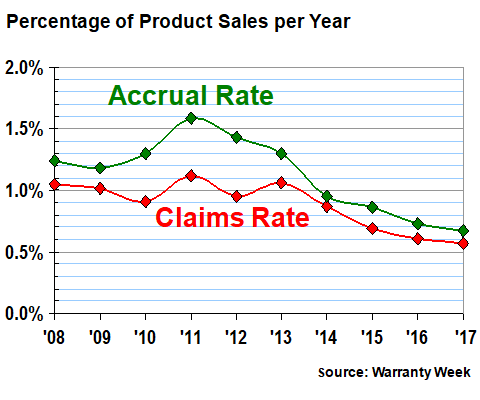

In Figure 5, we've taken the entire industry's sales figures along with the amounts of claims paid and accruals made, using actual figures when possible and estimates when not, and calculated a pair of percentage rates for the past ten years. Note that we estimate that 2011 was the high point for both rates, which have now declined to their respective low points.

Figure 5

Top Airframe Makers Worldwide

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2008-2017)

Again, we're not sure why this is happening. Readers have suggested that the spike was closely linked to the introduction of new product families such as the Airbus A380 and the Boeing 787 Dreamliner, which took their first commercial flights in 2007 and 2011, respectively. Once the airlines get used to them and the manufacturers work out all the bugs, warranty expenses would be expected to decline, as they apparently did and continue to do. At least that's the theory.

No matter what the explanation for the decline, the numbers prove it's real. Back in 2011, our industry estimates suggest that civilian airplane manufacturers spent $1.38 billion on claims while selling $123.6 billion worth of new products, for a 1.1% claims rate. Last year, we estimate that claims fell to $1.01 billion while sales grew to $178.2 billion, so the claims rate slipped under 0.6% for the first time ever.

The decline in the accrual rate was even steeper: 1.6% in 2011 to 0.7% in 2017 -- down by more than half in only six years. And once again, that decline took place while sales were rising. Unless there's been a change in the cost or frequency of repairs, accrual rates would normally remain about the same from one year to the next. So this is a remarkable achievement for the aviation industry, to be driving down warranty costs while sales are up.

|