Worldwide Automobile Warranties:Manufacturers representing well over 90% of the world's car sales now reveal their warranty expenses in their financial statements. So we've fashioned estimates for the remainder to create some benchmarks for the industry's warranty expense rates: 2.6% of revenue and $577 per vehicle.

While warranties have a worldwide presence, outside of a few industries the disclosure of warranty expenses is primarily an American phenomenon. Thanks to the accounting scandals at the turn of the century, U.S.-based manufacturers are now required to disclose the size of their liabilities, including warranties.

Strictly speaking, that's not true for companies based elsewhere. Companies that sell their shares in New York might still need to follow U.S. accounting rules, but those based in Europe or Asia can choose to keep their warranty expenses secret. Fortunately, in the automobile industry, most have chosen to include at least the size of their warranty reserve in their financial statements. The problem is finding them, buried in the notes, sometimes not even labeled as warranty costs (one manufacturer called them "provisions for obligations for on-going operational expenses").

However, thanks to efforts by sharp readers, we have recently been able to find warranty expense data in the financial reports of Nissan Motor, Isuzu Motors, Kia Motors, Volvo Cars, Dongfeng Motor, BAIC Motor, SAIC Motor, Changan Automobile, and Mahindra & Mahindra, which now makes a worldwide estimation of the industry's total warranty costs possible. In fact, with these additions, we have now raised our hard numbers vs. estimation ratio for the world's car industry to well over 90% of total sales. In other words, while we're calling these charts estimates, there's much more math and much less guesswork involved than such a label implies.

The bigger problem with the data is the conversion of it all into U.S. dollars. As any reader of recent financial news is keenly aware, the U.S. dollar is now at record highs, and the value of several other currencies are in chaos because of trade sanctions and tariffs. One major market has seen its currency fall 45% just this year.

Thankfully, none of the worst-impacted currencies figure heavily into the foreign exchange rates used in the charts below, which are derived from the conversion rates that the manufacturers themselves included in their financial statements. Ultimately, most of the accounting is done in dollars, euro, and yen, not in bolivar, rubles, or lira. In other words, the manufacturers themselves have already done all the cumbersome currency conversions before they report their warranty metrics to their shareholders.

There are no estimates necessary for the revenue or unit sales figures, however. Almost all of the 27 car manufacturers we're tracking releases annual sales revenue figures, and most also reveal how many vehicles they have sold. However, the complicating factor there is that the manufacturers based in Japan and India follow a fiscal year that ends in March. Most others end in December. So there is a problem getting them all to align. Before you can add up all the annual figures, you have to decide what year it is.

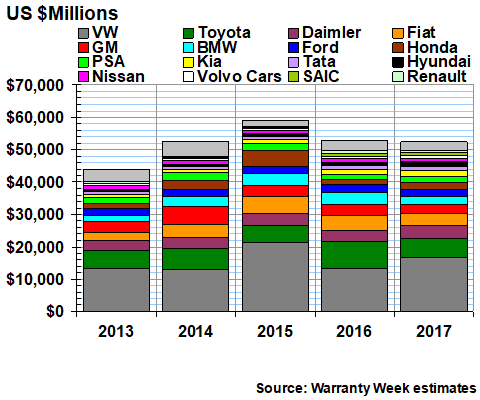

Warranty Claims

In Figure 1 we are detailing the claims payments of the world's carmakers for the past five years (and for some, the five most recent fiscal years ending March 31, 2018). In calendar/fiscal 2017, claims were up sharply to $53.37 billion, primarily because of Volkswagen's soaring claims payments. You can see it there in the dark gray at the bottom of the column: VW paid the equivalent of US$19.83 billion in warranty claims last year, more than Toyota, Fiat Chrysler Automobiles, Ford, General Motors, and Daimler combined. Its claims rate rose to 8.9%, three or four times as high as its competitors. It is by far the most money a single manufacturer in any industry has ever paid in claims in a year, in any year -- calendar, fiscal, Julian, or Sothic.

Figure 1

Worldwide Automobile Warranties

Claims Paid by Car Manufacturers

(in US$ millions, 2013-2017)

Hyundai Motor and Kia Motors also saw their claims cost rise significantly last year, but so did sales, so all is well. The big drops were reported by GM, BMW, and Honda, with smaller declines reported by Toyota and Nissan. Ford, Daimler, and FCA remained about the same. And then our estimates suggest that PSA Group, Renault, and Suzuki Motor each saw significant increases last year, but those are just estimates. If they're wrong, we invite those manufacturers to correct the record.

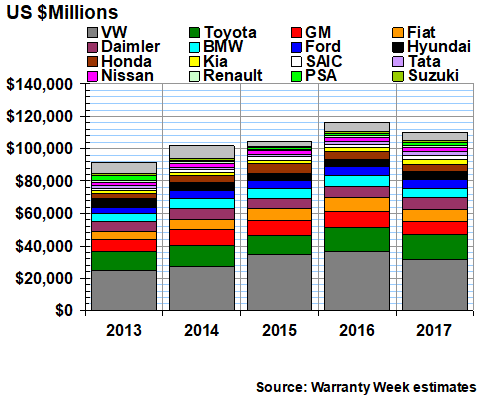

Warranty Accruals

Accruals are different from claims in that they consist of money set aside at the time of sale, in some cases years before the claims are settled for warranty work done on vehicles that have been on the road for a while. For instance, soon after the VW diesel emissions scandal became big news in the fall of 2015, the company set aside the equivalent of US$21.37 billion in warranty accruals -- money it was still spending on claims last year. Once that money is set aside, it remains in the warranty reserve fund until the claims are paid.

So it should come as no big shock to hear that worldwide warranty accruals actually dropped by about $214 million last year, after falling by 11% from 2015 to 2016. And thanks again to VW, 2015 remains the record high year, with accruals nudging just above US$59 billion worldwide, as can be seen in the chart below.

Figure 2

Worldwide Automobile Warranties

Accruals Made by Car Manufacturers

(in US$ millions, 2013-2017)

VW did actually increase its accruals last year, but it wasn't by the largest percentage in the industry. Hyundai, Kia, and Volvo Cars raised their accruals by even higher percentages. Honda, Daimler, and Tata also raised their accruals by significant amounts. But all of those increases were more than offset by big declines reported by GM, FCA, Toyota, and BMW, among others.

And once again, a couple of estimates are among the top 16 that we've found room to label in the charts. We estimate that PSA increased its accruals by US$474 million, while Renault reduced its accrual total by $91 million last year. For those keeping score at home, the worldwide total last year came in just shy of US$52.53 billion in 2017. About 91% of that total came from the disclosures in the financial statements of the manufacturers themselves, while the remaining 9% were part of our estimations.

Warranty Reserves

Like a checking account, the accruals are added into, and the claims are paid from, the warranty reserve funds of the manufacturers. Because of multi-year warranties, the amount of reserves any given manufacturer has on hand at any given point in time will always exceed the annual totals for new accruals or claims payments. Historically, the ratio has been a little over two to one.

In 2017, for instance, car manufacturers ended the year with about 2.1 times as much money in their reserves as they either paid in claims or set aside in new accruals per year. The exact total was US$110.057 billion in reserves. That would pay for the next 24 months and 3 weeks of claims, if claims rates remained the same in the future (but they never do).

In Figure 3, we've added in estimates for Renault, PSA, and Suzuki to the known balances for the other 13 named manufacturers. And we've included an "other" slice for the remaining $4.87 billion in reserves held by the 11 manufacturers that didn't make the cut, as well as estimates for the car manufacturers based in Russia, Iran, Turkey, and elsewhere for which we could not find any reliable warranty, sales, or production data. Once again, readers are urged to please help us fill in the gaps.

With warranty reserves, once again VW is dominant, but once again its record high water mark is now behind it, having peaked at the equivalent of US$36.56 billion in 2016. Toyota was next, with the equivalent of US$15.28 billion in its warranty reserve fund as of March 31, 2018. And then GM is in third, with $8.33 billion at the end of 2017 (down from $9.7 billion at the end of 2016). We note that each company is now several years into their respective warranty traumas, and so their balances should continue to remain stable or even subside as the amount of time since their point of maximum pain grows.

Figure 3

Worldwide Automobile Warranties

Reserves Held by Car Manufacturers

(in US$ millions, 2013-2017)

With this warranty metric, in fact, VW was actually one of the biggest decliners, with its reserve balance falling by $5 billion or nearly 14% in 2017. GM's fell by a slightly bigger percentage, smaller amount, but BMW was the big winner, cutting its reserves by the equivalent of US$1.77 billion last year (a 25% decline). But keep in mind that these year-to-year comparisons are complicated by changes in the value of the dollar. In fact, BMW reported 307 million euro just in "translation differences."

Daimler, PSA, Kia, Tata, and SAIC saw the biggest balance increases of the year, from a percentage point of view. Ford and Hyundai reported smaller increases, and Toyota and Nissan remained about the same. In terms of estimates, we have Suzuki down for a moderate increase, and Renault down for a moderate decrease. But of the $110 billion total, all but 3% is hard numbers.

Accrual Rates

It would be too complex and difficult to chart the accrual rates of 27 different car manufacturers, given how many of them seem to have convergent warranty metrics. Worldwide, the average accrual rate last year was 2.6% of sales revenue, and many of the top manufacturers were very close to that benchmark. Besides, in several recent newsletters, specifically the March 8, July 5, and July 19 weekly editions, we've detailed many of those metrics for most of the largest OEMs worldwide.

Instead, what we're going to do this week is to organize the accrual data by the home base of the manufacturer. There is plenty of car sales and production data organized by country, but there is no warranty data constructed that way. And because of the worldwide footprints of the manufacturers themselves, not to mention the fact that they release only one set of top-level worldwide figures for their warranty expenses, all we can do is group them by the location of their headquarters and the currency in which they report their claims, accruals, and reserves. As far as we know, there are no warranty statistics for cars made and sold in one country by a company based in another country.

Passenger cars really are a global business. For instance, VW is huge in China, and BMW exports SUVs made in South Carolina, but neither company reveals their warranty expenses just for those markets. But both companies are based in Germany, are part of the European Union, and report their warranty metrics in euro. GM sold its Opel and Vauxhall operations to PSA last year, moving the warranty expenses of two iconic European brands from the U.S. column to Europe. Similarly, the source of most of Tata's warranty expense is Jaguar Land Rover, based in the UK. But its warranty expenses are reported in India and denominated in rupee.

So in the charts below, we have organized the world into six markets, based solely upon the location of a given company's headquarters and the currency used in their financial reports. The EU is home to seven car manufacturers, of which all but one (Volvo Cars) report their warranty expenses in euro. The figures for India are an average of Tata and Mahindra. The figures for South Korea are an average of Hyundai and Kia. The USA figures include GM, Ford, and Tesla, and for the years of 2013 and 2014 only, also include FCA US (Fiat combined Chrysler's warranty expenses with its own after 2014).

In addition, for the Europe, China, and Japan figures, we had to perform some estimation. In Europe, neither PSA nor Renault release any warranty expense data. PSA used to do so, but ceased doing so a few years ago. In Japan, the inclusion of Mitsubishi, Mazda, Subaru, and Suzuki require estimates. And in China, we had to fashion estimates for Great Wall Motors.

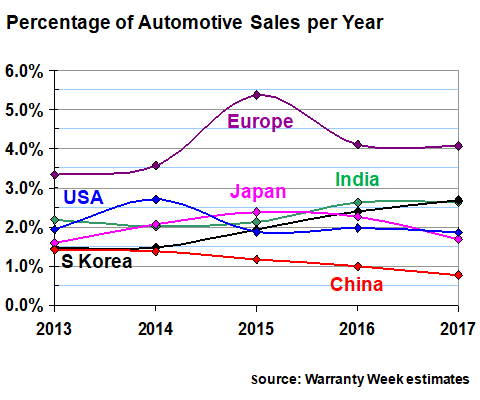

In Figure 4, note that the accrual rates for the U.S., South Korea, India, and Japan basically remain in the middle of the pack. In contrast, Europe is always the highest, while China is always the lowest. Once again, the worldwide average in 2017 was 2.6%, meaning the typical provision for warranty expenses is 2.6% of automotive revenue (not including finance or investment income).

Figure 4

Worldwide Automobile Warranties

Accrual Rates by Manufacturers' Home Base

(percent of revenue, 2013-2017)

We hesitate to use emotional words such as "best" and "worst" in relation to warranty expenses, because common sense would suggest there is no correlation between product quality and accrual rates. Yes, European manufacturers have the highest accrual rates, but that's a more factor of taxes and labor rates (not to mention emissions scandals) than it is about reliability. Conversely, nobody would suggest that China's cars are the best in the world because its manufacturers set aside less than one percent of their revenue to pay for warranty costs.

In fact, while the Chinese figures are mostly hard numbers (of the top Chinese brands, only Great Wall Motors requires us to insert estimates because of a lack of data), we would question the reality of some of those calculations. Many of those manufacturers are in joint ventures with European, Japanese, Korean, or American companies, and it's unclear who ends up ultimately paying the bills when such a jointly-manufactured car needs warranty work. And while most of the U.S., European and Japanese manufacturers now include recall costs as part of their factory warranty expenses, it's unclear what is and isn't being counted by the Chinese manufacturers.

However, when you take the accrual totals reported by these companies and divide it by their reported revenue, you end up with the figures at the bottom of Figure 4. We don't question the output of our calculator; we question the input, and whether items such as operating revenue mean the same thing with joint-ventures as they do with own-brand.

If anything, the overall Japanese numbers require more estimation than the others. Neither of the French manufacturers report their warranty expenses, though the other five European carmakers do. However, in Japan we had to fashion estimates for Suzuki, Mazda, Subaru, and Mitsubishi. Therefore, if any figures are to be called into question, Japan should be at the top of the list.

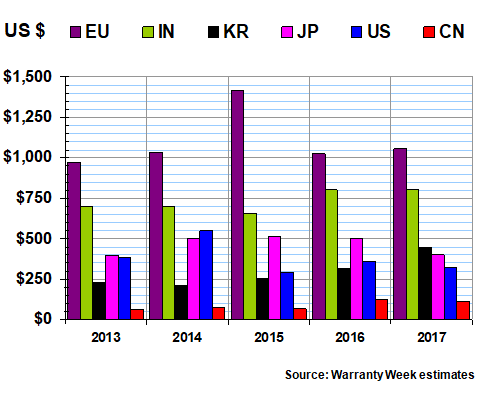

Accruals Per Vehicle Sold

The same uncertainty works its way into the calculations in Figure 5, where we took the total accruals reported by companies based in each region and divided them by the number of vehicles sold. First, there are inevitably some trucks and motorcycles counted in the numbers. Second, there is again the question over the accounting behind the joint ventures in China. And third, there is again the uncertainty of some of the estimates required for manufacturers that have not yet finalized their sales data for 2017 (here's looking at you, Suzuki).

But what we do know is that the research company known as IHS Markit reported that 94.5 million vehicles were sold worldwide last year. And the OEMs on our list reported selling 93.8 million of them. So even if the figures we're about to present in Figure 5 are imprecise, they're probably not off by much.

Again, the methodology is simple: gather up the accrual figures and the sales data, organize it into six regions, and divide the amount of accruals made by the number of vehicles sold. And once again, on that basis, Europe is always at the top and China is always at the bottom.

Figure 5

Worldwide Automobile Warranties

Accrual Rates by Manufacturers' Home Base

(per vehicle sold, 2013-2017)

Once again, a lot of the blame can be laid at the feet of VW for the bulging figures seen in 2015 for Europe, as was the case with the protrusions in Figures 4 and Figure 2. But with this measure, Tata comes in second-highest, no doubt because of the higher-than-average warranty expenses generated by Jaguar Land Rover.

Once again, South Korea, Japan, and the U.S. are in a pack in the middle, around $300 to $400 per vehicle. And China is once again unbelievably low, accruing only US$111 per vehicle sold in 2017 (and that's down from an equally incredulous $127 level in 2016). Readers with any insight into Chinese warranty accounting principles are encouraged to help us make sense of our data.

The worldwide average accrual, by the way, was $556 per vehicle in 2017, down about six dollars from 2016 levels. Because of VW, it was much higher in 2015. But in 2013 it was somewhat lower. In fact, for what it's worth, over the past five years, the average accrual made per vehicle sold has been exactly US$577. And once again, well over 90% of the data that goes into that calculation is based upon the reports of the manufacturers themselves.

|