European Automaker Warranty Expenses:

Following the merger of FCA and PSA, we're down to just five major automakers in the euro zone: Stellantis, VW, BMW, Mercedes, and Renault. And now that all five have filed their annual reports for 2021, it's time to take a look at their warranty expense reports for the last five years.

Although the first manufacturers to disclose their warranty expenses were based in the United States, the practice soon spread worldwide, especially among the automakers. Though they report their expenses in a mix of currencies, languages, and accounting systems, the metrics still follow a common pattern that allows us to make some comparisons.

Every year since 2003, we have collected five essential metrics from the annual reports of each of the automakers: the amount of claims they paid per year, the amount of warranty accruals they made each year, the amount of warranty reserves they kept at the end of each year, and two sales metrics: the amount of automotive product revenue they reported and the number of vehicles they sold.

Using the claims, accrual, unit sales, and revenue data, we calculated three additional metrics: claims as a percentage of sales revenue (the claims rate), accruals as a percentage of sales revenue (the accrual rate), and accruals made per vehicle sold (accruals divided by unit sales).

In this week's newsletter, we are looking at just the five major automakers that report their revenue in euro. In future newsletters, we will take a look at the metrics of Volvo Car AB, which just filed their annual report this week, Jaguar Land Rover, which is now part of Tata Motors Ltd., as well as the many Asian automakers that we track.

This week we are looking at BMW AG, Mercedes-Benz AG, Renault S.A., Stellantis N.V., and Volkswagen AG. BMW, short for Bayerische Motoren Werke, makes both passenger cars and motorcycles, and has both the Mini and Rolls-Royce brands under its wing as well. Mercedes-Benz is the new official corporate name of Daimler AG, which makes everything from trucks to luxury cars. The new corporate name, which has been interchangeable with the primary brand of cars, is derived from the surname of one of the co-founders, Karl Friedrich Benz (who is credited as one of the inventors of the motor car), and the first name (Mercedes) of the daughter of one of the company's other early inventors, Emil Jellinek.

Renault, which is based in France, makes trucks and vans, and is in an alliance with Nissan Motor Co. Stellantis, which is actually based in Amsterdam, is the new company formed through the mergers of long-established European brands such as Fiat, Chrysler, Citroen, Peugeot, Maserati, Opel, and Vauxhall. And VW is the parent of multiple brands as well, including Porsche, Scania, MAN (trucks), Bugatti, Lamborghini, and Bentley.

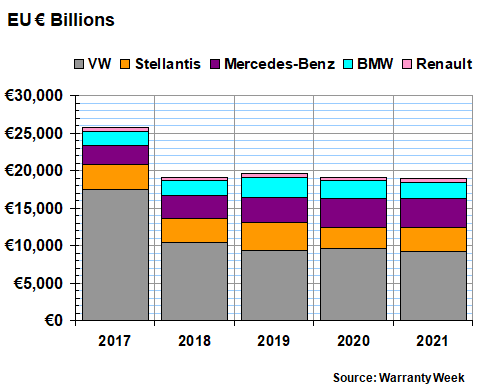

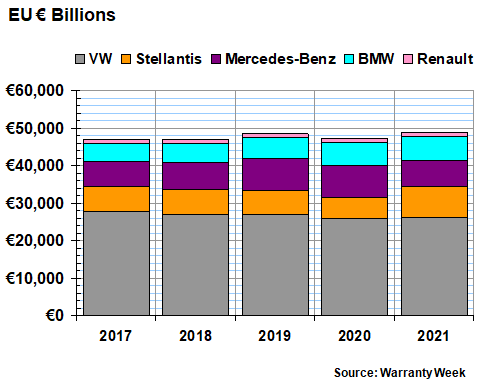

Since all five companies use the same currency in their financial statements, we will keep everything denominated in euro, and in percent. In Figure 1 we are looking at the total annual amount of claims paid by the companies from 2017 to 2021, with VW by far the largest.

Figure 1

Warranty Claims Paid By

Five European Manufacturers

(in EU € billions, 2017-2021)

Last year, though, VW's claims cost actually declined from 9.63 billion euro to 9.27 billion euro -- a 3.6% drop. The only other decline among these five was reported by BMW, which saw claims fall from 2.35 billion euro to 2.22 billion euro -- a 5.7% decline.

Stellantis, which in 2020 was still known as Fiat Chrysler Automobiles, seems to have accounted for the merger with the PSA Group as an acquisition, so it would be incorrect to describe its 2021 totals as an increase. But the amount of claims it reported paying in 2021 (3.18 billion euro) was nearly 10% higher than the amount it reported paying in 2020 (2.90 billion euro). Renault was also up 10%, from 497 million euro to 548 million euro.

And then Mercedes-Benz in 2021 reported paying 3.84 billion euro in claims, up only slightly from Daimler's 3.77 billion euro in 2020. We should note that the reason we spell out euro all the time instead of using the currency symbol is the problem some computer systems still have when displaying the symbol. They have the same problem displaying the marks over certain vowels, such as the O in Citroen, which we will also avoid using.

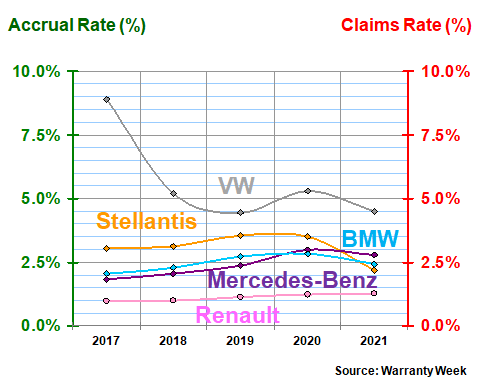

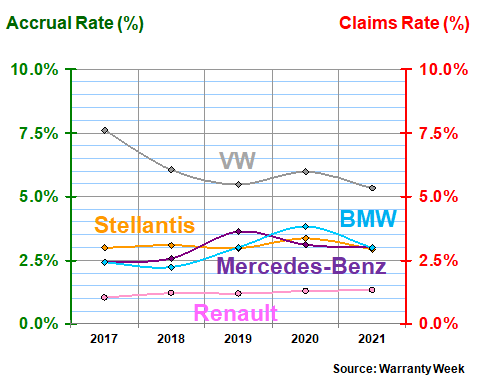

Warranty Claims Rates

In Figure 2, we have taken the data from Figure 1 and divided it by product sales figures, in order to calculate the claims rate for each company over the past five years. Back in 2017, VW was still paying the claims from its diesel engine emissions testing scandal, so its claims rate was at the much-elevated level of 8.9%. But now it's down to the much more manageable level of 4.5%.

Figure 2

Warranty Claims Rates of

Five European Manufacturers

(as a percentage of product revenue, 2017-2021)

Mercedes reduced its claims rate from 3.0% in 2020 to 2.8% in 2021. But as the data from 2017 to 2019 shows, that's still above the company's usual range.

BMW cut its claims rate by 0.4%, from 2.8% in 2020 to 2.4% last year. Stellantis, which absorbed the very low warranty claims levels of PSA Group during the merger, saw its claims rate drop from 3.5% to 2.2%. And Renault, which has always had a low claims rate compared to these others, remained lowest at just under 1.3%.

Warranty Accrual Totals

While warranty claims are the amounts manufacturers pay to dealers and other repair organizations for the warranty work they perform on cars sold in the past, warranty accruals are the amounts they set aside as each new car is sold. In that sense, these are the amounts the companies believe they will spend in the future on warranty work. So they are a good measure of what the companies predict will happen.

Once again, the Stellantis numbers rose primarily because of the addition of the PSA brands. FCA accrued 2.78 billion euro in 2020 and Stellantis accrued 4.24 billion in 2021. That's an increase of over 50%, which would be extraordinary were it not for the merger that caused it. PSA did not file an annual report for 2020 (because the merger closed in early 2021) so we may never know for certain how much was FCA and how much was PSA.

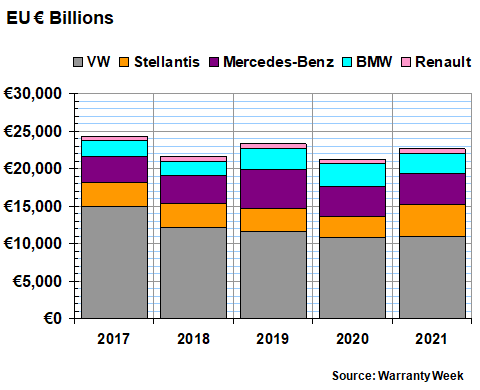

Figure 3

Warranty Accruals Made by

Five European Manufacturers

(in EU € billions, 2017-2021)

VW's accruals did grow a bit in 2021, but the trend has been downward for multiple years. Mercedes' accruals rose about 5.5%, from 3.93 billion to 4.15 billion, but both those measures are down from the 5.22 billion it set aside in 2019.

BMW, which had a spike in its accruals in 2020, was back down to a more normal range in 2021, with accruals falling a swift 15% to 2.71 billion euro. Renault, which always has a low accrual total, kept this expense low in 2021 at 574 million euro.

Warranty Accrual Rates

There are at least two ways to measure accrual rates, and we will do them both here. In Figure 4, we're looking at the amounts detailed in Figure 3, divided by product sales totals, which yields a measure of the percentage of sales revenue that's being set aside as warranty accruals.

In Figure 5, we will look at the average amount of accruals made per vehicle sold, which is calculated by dividing the accrual totals by the unit sales totals reported by each company.

As we can see in Figure 4, VW continues to have the highest accrual rate and Renault continues to have the lowest. And the other three companies seem to be tied for either second-highest or second-lowest.

Figure 4

Warranty Accrual Rates of

Five European Manufacturers

(as a percentage of product revenue, 2017-2021)

Actually, last year VW was at 5.3%, down from 6.0% in 2020. Renault was up slightly at 1.33%. Stellantis was second-lowest at 2.93%, while Mercedes was second-highest at 3.01%. And then BMW was right in the middle at 2.99%. But to the unaided eye, it looks like a three-way tie at three percent.

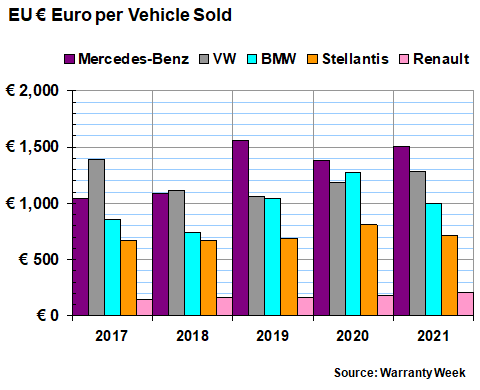

The accrual rate per vehicle provides a different view. Of course, Mercedes and VW are selling trucks in addition to cars, while BMW is selling motorcycles in addition to cars. But while they do a wonderful job of segmenting their sales, they provide just one set of numbers for their warranty accruals. So therefore these accrual rates are an average across all their product lines, not just passenger cars.

As we can see in Figure 5, Mercedes-Benz has the highest accrual rate per vehicle sold, with last year's 1,507 euro level being the highest of the past five years. VW reported almost the exact opposite trend, with accruals falling from 1,391 euro per vehicle in 2017 to 1,282 euro last year.

Figure 5

Warranty Accruals Made per Vehicle Sold by

Five European Manufacturers

(in EU € euro, 2017-2021)

On this measure, there is no three-way tie in the data. Renault continues to clearly have the lowest cost per unit, at 213 euro in 2021. Stellantis also remains low at 715 euro in 2021, down from 808 euro in 2020. And BMW cut its accrual rate per vehicle the most -- from 1,274 euro in 2020 to 999 euro in 2021.

VW sold the most vehicles last year, at 8.6 million. Stellantis was second at 5.9 million. Mercedes was third at 2.8 million, and BMW and Renault were tied for fourth at 2.7 million units sold by each.

But remember, there is also the average selling price per vehicle to consider. For Mercedes, for instance, 1,507 euro is barely over three percent of the average selling price per vehicle. And Stellantis, though it sets aside only half as much as that, also has an average selling price half as high as Mercedes, so its accrual rate is also near three percent.

In addition, some of the luxury brands have luxury warranty perks -- everything from free donuts to free loaner cars while your car is in the shop. As Figure 5 illustrates, those donuts aren't really free. Nor is all the goodwill, or the white glove treatment. Luxury cars have expensive warranties.

Warranty Reserves

Our sixth and final warranty metric is the balance in the warranty reserve funds of each of the five companies at the end of each of the past five years. Unlike the U.S.-based automakers, which post their warranty expenses quarterly, the European companies disclose their reserve balance only once a year, in their annual reports.

Figure 6

Warranty Reserves Held by

Five European Manufacturers

(in EU € billions, 2017-2021)

On this measure, VW is far in front, and everybody else is far back. At the end of last year, VW reported 26.31 billion in reserves -- nearly 54% of the whole pie. And while that total was up from 2020, it was far below the level of previous years.

Stellantis was newly boosted into second place, with 8.22 billion euro in reserves, as a result of combining its FCA balance with PSA's acquired reserves. Mercedes was third, with 6.79 billion euro on account in December 2021, down preciptously (in a good way) from 8.48 billion at the end of 2020. BMW was just behind at 6.60 billion euro, up from 6.13 billion at the end of 2020. And Renault was far back, with 1.00 billion euro in its warranty reserve fund at the end of last year -- about the same as it's been for the past few years.

Later on this year we will add in the Japanese automakers, which concluded their fiscal years last week and will most likely publish their annual reports in June. The top Korean automakers already have reported their 2021 totals, but we will hold them until we get data from the top Chinese manufacturers as well. And then, probably sometime in July, we will be ready to size up the worldwide warranty metrics of the automotive industry.

Warranty Management Conference Next Week

These past few years, it sure has been easy to stay home and avoid business travel, what with wars, pandemics, supply chain upheavals, political gridlock, and cancelled flights to be considered. But as the weather gets warmer and those perils begin to recede at least a bit, could it be time to think about attending a warranty conference again?

Next week, the Global Warranty & Service Contract Innovations conference makes its debut in San Diego. It's being put together by Strategic Solutions Network, the same company that assembles the long-running Extended Warranty & Service Contract Innovations conference that's scheduled for October in Nashville.

And while that event later this year is squarely focused on service contracts and extended warranties, this new spring show features a mixture of manufacturers such as Deere, Thermo King, GE Appliances, and Navistar, as well as administrators such as American Home Shield, Clyde, Centricity, and New Leaf. And there's also a focus on commercial service contracts as well as on emerging technologies and new market entrants.

The venue is the Hotel Solamar in San Diego's Gaslamp District, and the dates are April 12 and 13. And as much fun as it can be to zoom all day in sweatpants, those of you yearning to shake a hand, clink a glass, or swap a business card might think about making the trip to the West Coast. See you there, in person!