Worldwide Heavy Equipment Warranty Report:

Claims were up a bit last year but warranty accruals fell significantly, as did product revenue. As a result, the industry's claims rate was also up a bit while the average accrual rate fell. And the combined warranty reserve fund balances of the 52 companies we're tracking in this category grew five percent to a record $9.81 billion.

While the warranties issued for passenger cars and light trucks get all the attention, there is a huge warranty chain management operation on the commercial side, for the sorts of heavy equipment used in construction, agriculture, and mining.

We're tracking 52 heavy equipment manufacturers worldwide, of which 23 include their warranty expense figures in their annual reports. Together, we estimate, these 23 companies accounted for about 81% to 82% of the worldwide heavy equipment industry's warranty expenses last year. So it's relatively easy to fashion estimates for the remaining 18% to 19%, and to create a report on their global warranty expenses.

Warranty Expense Reports

For each of those 23 companies, we examined their annual reports for the past 18 years and extracted four key metrics: the amount of warranty claims they paid, the amount of warranty accruals they made, the amount of warranty reserves they held, and the amount of product sales revenue they reported. Using the claims, accrual and sales figures, we calculated two additional metrics: warranty claims as a percent of sales (the claims rate), and warranty accruals as a percent of sales (the accrual rate).

For the other 29 companies, we created estimates for their warranty expenses. And in cases where the company was either privately-held or government-owned (and therefore did not publish its revenue figures), we used the figures in the IC Yellow Table, published annually by the online magazine International Construction, to help us fashion our own revenue estimates as well.

We found companies reporting their financials in U.S. dollars, European euro, Japanese yen, Chinese yuan, Korean won, and Swedish kronor. To help us convert all of these figures into U.S. dollars, we relied on a table of annual average currency exchange rates published by the U.S. Internal Revenue Service (IRS).

Worldwide Claims Totals

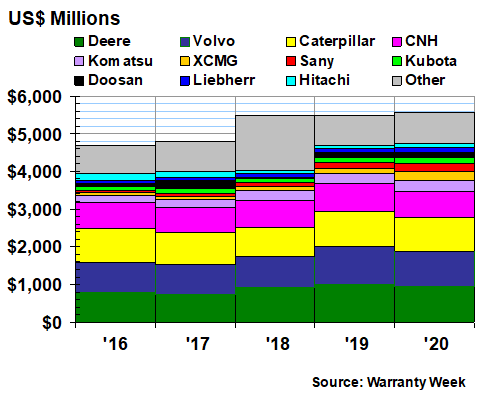

The next step was then to calculate a total for each of our metrics, which we will present in the charts that follow. Figure 1 contains the past five years of data for worldwide warranty claims, as well as names of the top 11 claims payers of 2020.

Claims were up slightly in 2020, rising by $92 million to $5.58 billion last year. From 2018 to 2019, the worldwide claims total barely budged, sticking at around $5.48 billion. But the total was below $5.0 billion from 2003 to 2017, so this 2020 measurement represents a new high for this warranty metric.

Figure 1

Top Heavy Equipment Makers Worldwide

Claims Paid per Year

(in US$ millions, 2016-2020)

In Figure 1, the data for the XCMG Group, Sany Heavy Industry Co. Ltd., and Liebherr Group are our own estimates. The data for the other eight named companies are taken from their annual reports.

Among those for which we have hard data, Deere & Company is once again the largest claims payer, a title it briefly lost in 2019 to Volvo AB. Volvo slips back to second place for 2020, with its claims total falling by nearly $99 million, or -9.5%. Caterpillar Inc. is in third place, with an $897 million claims total in 2020 that fell just slightly from 2019 levels. CNH Industrial N.V. is in fourth, with a $685 million claims total that fell about -8.5% from 2019 levels. And Komatsu Ltd. is in fifth place, with a $303 million claims total that grew about +15% from 2019.

On a proportional basis, the largest drop in claims last year was reported by Epiroc AB, a spin-off of Atlas Copco. The Haulotte Group saw its claims total fall by -9.7%, just a hair larger than Volvo's -9.5% drop.

At the other extreme, the company now known as Metso Outotec Oyj reported paying nearly no claims in 2019, so when its claims returned to normal in 2020, the percentage gain flew off the chart. Meanwhile, Wacker Neuson SE saw its claims nearly triple last year to $12.8 million, and the Manitou Group saw its claims cost rise from $5.1 million in 2019 to $8.0 million in 2020.

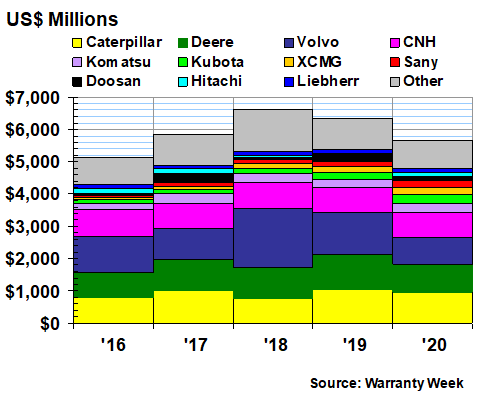

Warranty Accrual Totals

In terms of their warranty accrual totals, Caterpillar and Volvo swapped places last year. While they both cut their warranty accruals significantly, Volvo cut theirs much deeper, and fell to third place on the chart in Figure 2 below.

With this warranty metric, the peak year was 2018, when heavy equipment manufacturers around the world set aside $6.63 billion in warranty accruals. That total fell to $6.32 billion in 2019 and to $5.66 billion in 2020.

Figure 2

Top Heavy Equipment Makers Worldwide

Accruals Made per Year

(in US$ millions, 2016-2020)

In the chart above, the figures for XCMG, Sany, and Liebherr are estimates, while the figures for the other eight are taken from their annual reports and converted into dollars using the IRS exchange rates. About 81% of the total comes directly from these annual reports, while the remaining 19% are our own estimates.

Among those for which we have hard numbers, Caterpillar cut its accruals by -8% to $968 million, while Volvo cut its accruals by -36% to $832 million. In between them in second place on the list, Deere cut its accruals by -20% to $851 million. CNH was a $784 million and then it's a long drop to Komatsu at $286 million.

Out of the 22 companies that reported their warranty accrual totals in both 2019 and 2020, exactly half were up and half were down. Proportionally, Volvo made the deepest cut in terms of both dollars and percentages. Other big declines were reported by Linamar Corp., Manitowoc Company Inc., and Doosan Corp.

Among the 11 that increased their accrual totals last year, Metso again led the list as its accruals returned to normal after an unusually low total in 2019. Same thing happened to Hitachi Ltd., which reported an unusually low accrual total in 2019 and a return to normal in 2020. Further down the list, Zoomlion Heavy Industry Science and Technology Company Ltd. boosted its accruals by +30%; Komatsu was +22%, and Haulotte was +18%.

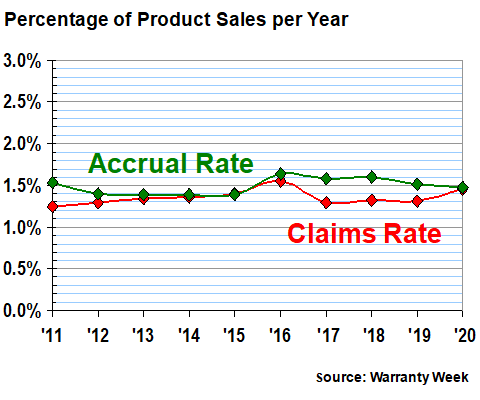

Warranty Expense Rates

According to the IC Yellow Table, construction equipment revenue fell by -5.8% to $191 billion last year. By our estimates, warranty claims were up +1.7% while warranty accruals were down -10% last year. With revenue figures, we diverge a bit from the IC Yellow Table, in that we count each company's total heavy equipment revenue and warranty expenses -- not just for construction equipment by also for farm equipment, mining equipment, road paving, and in the case of companies such as Volvo, even for some on-highway trucks.

On that basis, the pool of product revenue we're looking at is twice as large: $381.57 billion, which was down -8.6% from 2019 totals. And this is the base number that we used to calculate the claims and accrual rates for the industry as a whole. Anything else, such as an attempt to get from a heavy equipment number to just a construction equipment number, would involve high levels of conjecture on our part.

So what we see in Figure 3 is an attempt to take the total claims and total accrual numbers from Figures 1 and 2 and divide them by total product revenue figures for the 52 heavy equipment manufacturers we're tracking worldwide. Last year, they spent an average of 1.5% of their product revenue on claims, and set aside about 1.5% of their revenue as warranty accruals. If you want to get technical, the accrual rate was 0.022% higher than the claims rate last year, but in Figure 3 they look as if they're directly on top of each other.

Figure 3

Top Heavy Equipment Makers Worldwide

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2011-2020)

This sort of conjunction also happened in 2015, when the expense rates were both at 1.4%. But in most years, the accrual rate has been a bit above the claims rate, which of course leads to a gradually increasing warranty reserve balance (see Figure 4 below).

But before we jump to that, let's look a bit deeper at the changes in expense rates for the individual companies. There is no way to put this data into a chart without making it look like a mess of spaghetti on a plate. So we will give some of the details as plain text.

Changes Since 2019

From a quick glance at Figure 3, it looks like the average claims rate was up in 2020 while the average accrual rate was down. Among the 23 companies for which we have exact figures taken from their annual reports, only four reported declining claims rates and only eight reported declining accrual rates. Only Zoomlion, Epiroc, and Lonking reported declines in both expense rates.

Among just the companies for which we have hard numbers, the highest claims rates of 2020 were reported by Deere, CNH, and Volvo, and the lowest claims rates were reported by Sandvik AB, Hitachi, and Zoomlion.

Among just the hard numbers, CNH, Deere, and Caterpillar had the highest accrual rates, while Sandvik, Hitachi, and Linamar had the lowest.

Compared to 2019, the biggest jumps in claims rates were reported by Metso, Wacker Neuson, and Manitou, while the biggest declines were reported by Zoomlion, Lonking Holdings Ltd., and Epiroc.

And finally, compared to 2019, the biggest upward changes in accrual rates were reported by Metso, Hitachi, and Wacker Neuson, while the biggest declines were reported by Doosan, Volvo, and Linamar.

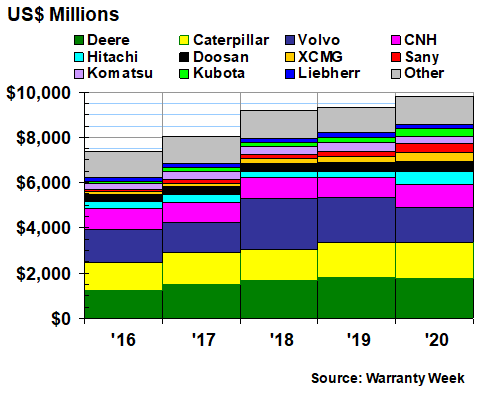

Warranty Reserve Totals

Our final warranty metric is the balances left in the warranty reserve funds of these heavy equipment manufacturers at the end of each fiscal year. We should note that some companies such as Oshkosh Corp. end their fiscal years three months before December 31, while others such as Komatsu end their fiscal years three months after December 31. In all cases, we simply time-shifted their data to line up with the majority, who end their fiscal years on December 31.

As of year-end 2020, we estimate that these 52 manufacturers carried $9.81 billion in warranty reserves, up about five percent from year-end 2019, and higher than at any time since counting began in 2003. But a look at the data in Figure 4 reveals that the balance has been climbing every year since 2016. And we went back and looked: this balance has risen in every year except 2009 and 2015.

Figure 4

Top Heavy Equipment Makers Worldwide

Reserves Held per Year

(in US$ millions, 2016-2020)

The 23 companies for which we have exact data accounted for 82% of the total, while our estimates for the additional 29 companies filled in the remaining 18% of the total. Out of the top 11 companies named in Figure 4, estimates were needed for just XCMG, Sany, and Liebherr. The rest are taken from annual reports and converted using IRS exchange rates.

The biggest jump in reserves was reported by Hitachi ($245 million to $604 million) while the biggest decline in reserves was reported by Volvo ($1.98 billion to $1.56 billion). All the other changes were an order of magnitude smaller than those.

On a percentage-change basis, however, some of the largest increases were reported by Metso, Zoomlion, and Kubota Corp., while some of the largest decreases were reported by Linamar, Epiroc, and Haulotte. on balance, there were 14 increases in reserves and nine decreases.

And so, if you're looking for a one-sentence snapshot of the global heavy equipment industry's warranty expenses last year, here it is: claims rose +1.7% to $5.58 billion; that total represented 1.5% of sales; accruals fell -10% to $5.66 billion; those accruals represented 1.5% of sales; and reserves grew +5.0% to $9.81 billion.