Truck & Heavy Equipment Warranties:

As the lockdowns grew, some manufacturers reduced their warranty accruals drastically in the spring of 2020, but claims remained about the same anyhow. Some got it right, but most reduced their accruals by too much, while a few cut accruals even though sales rose.

As more year-end 2020 warranty expense data continues to appear in the annual reports of top manufacturers, it continues to confirm two major points. First, this was not your typical economic downturn, and second, the way things turned out was not the way one might have predicted a year ago.

In the truck and large vehicle manufacturing industries that we will look at this week, warranty claims hardly changed and only a few companies managed to adjust warranty accruals in proportion to sales. But perhaps the biggest surprise was finding that some manufacturers saw increasing sales but reacted as if they were contracting.

We gathered data from eight large vehicle makers and one truck engine manufacturer. From the on-highway and vocational truck industry, we included data from Cummins Inc.; Navistar International Corp.; Oshkosh Corp.; and Paccar Inc. From the off-road construction and farm equipment industries we included Caterpillar Inc.; Deere & Co.; and Terex Corp. And from the recreational vehicle industry, we included Thor Industries Inc. and Winnebago Industries Inc. AGCO Corp., a major manufacturer of agricultural equipment, is still a week or two away from publishing its 2020 annual report, and so it was not included in these tabulations.

From the annual reports and quarterly financial statements of these companies, we gathered four essential metrics: the amount of warranty claims paid, the amount of warranty accruals made, the amount of warranty reserves held, and the amount of warranted product revenue. Using the latter metric as our denominator, we also calculated claims paid as a percentage of sales (the claims rate) and accruals made as a percentage of sales (the accrual rate).

Since the main purpose of this exercise is to give readers an early look at 2020 trends, we are including only data from the past five years, though such data exists back to early 2003. Also, because we spotlighted Navistar, Deere, and Winnebago in the February 4 newsletter, we won't do so again here, though they are included in the totals.

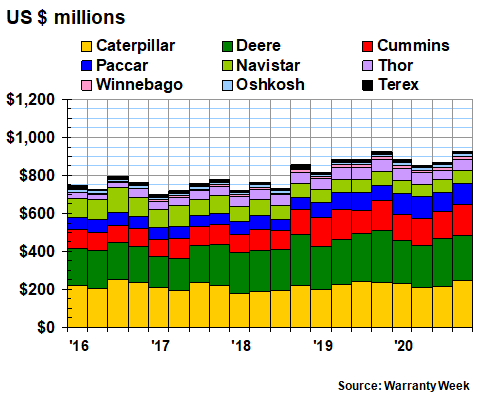

Warranty Claims Totals

In Figure 1, we're looking at 20 quarters of claims payments reported by the nine companies, and nothing really looks unusual. Claims payments remain close to the $850-$900 million range where they've spent the last nine quarters, and the shares of the individual companies haven't changed much either.

This suggests that unlike the passenger car industry that we looked at in last week's newsletter, the commercial customers in these industries had little difficulty arranging for warranty work to be done during the pandemic. There was no sharp downturn in claims during the second quarter -- well, there was a -3.4% decline in the second quarter of 2020, followed by a -1.4% decline in the third quarter and a -0.04% decline in the fourth quarter, compared to the same quarters in 2019.

Figure 1

Nine U.S.-Based Truck & Heavy Equipment Manufacturers

Claims Paid per Quarter

(in millions of dollars, 2016-2020)

Individual companies saw somewhat larger changes. Winnebago saw claims rise by $13 million or +29%, and Paccar saw claims rise by $94 million or +27%. Oshkosh reported an $8.9 million increase in claims, an 18% increase.

The other six reported modest declines in claims paid. Thor was down -8.4%. Navistar was down -7.1%. Deere was down -4.4%. And Terex was down -3.4%. Caterpillar and Cummins, however, were down by less than one percent last year.

All but Winnebago and Thor also reported product sales revenue declines, ranging from Oshkosh -7.0% to Navistar -34%. In other words, while customers were able to navigate the pandemic lockdowns when it came to getting warranty work done, they didn't stop by the showrooms to place as many orders as usual (except for the RV showrooms, which were more crowded than usual precisely because of the lockdown's effect on air travel and hotel accommodations).

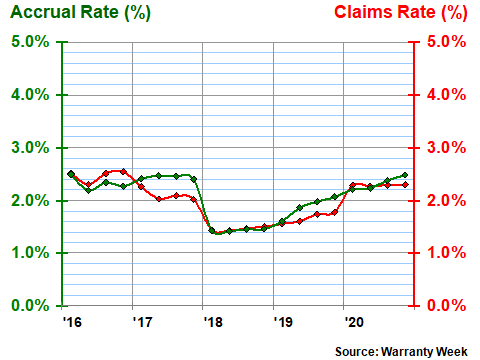

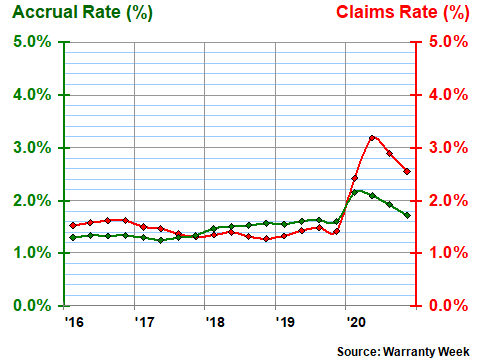

Caterpillar Slowly Rises

Caterpillar, for instance, saw a -0.7% decline in claims, but a -23% decline in sales, which combined to produce a modest increase in claims rate. As can be seen in Figure 2, its claims rate was close to 2.3% for most of last year, while its accrual rate rose to 2.5% by year's end.

Figure 2

Caterpillar Inc.

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2016-2020)

It was the construction machinery market leader's highest warranty expense rates since 2017, after both metrics dipped below average in both 2018 and 2019. But also please note how close together the green and red lines have been for the past five years. That's a signal that the company has mastered the art and science of warranty management, even during a worldwide health emergency.

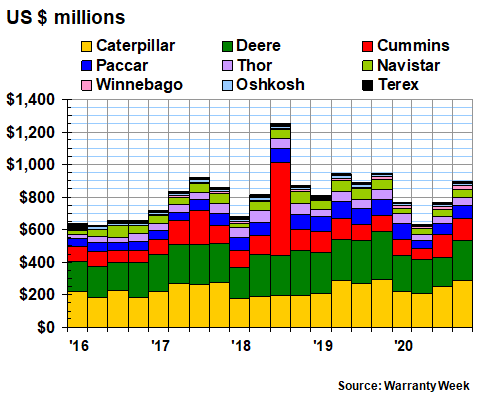

Warranty Accrual Totals

Where the truck and heavy equipment industries most closely resembles the passenger car industry is in the measure of warranty accruals. These are the amounts of money each of the companies believe they will need in the future, to pay claims on the equipment they sell each quarter. In other words, these amounts are based on predictions and feelings as much as they are on hard data.

In ordinary times, accruals usually remain proportional to sales, unless a company detects a change in product quality, reliability, or repair cost. But in unusual times, such as this past year surely was, strange things can happen.

And in the second quarter of 2020, when the virus emptied office buildings and shuttered construction sites, manufacturers reacted by slashing accruals. The $635 million these nine manufacturers accrued during those dark days was the lowest quarterly total they reported since early 2016.

Figure 3

Nine U.S.-Based Truck & Heavy Equipment Manufacturers

Accruals Made per Quarter

(in millions of dollars, 2016-2020)

Deere slashed warranty accruals by $215 million last year, from $1.066 billion to $851 million. That represented a -20% decline in accruals -- almost double the company's -10% sales decline. Paccar cut accruals by -24%, nearly matching a -29% decline in sales. And Navistar cut accruals by -35%, almost exactly matching its -34% sales decline.

At the other extreme, Winnebago really nailed it: sales rose +35%, and so did accruals. But its RV competitor Thor Industries whiffed it: sales grew +18% but accruals were cut -16% in 2020.

There were a few other notable mismatches. Cummins, which had a noticeable rise in accruals during the third quarter of 2018 (related to its inability to meet diesel engine emissions limits), saw sales fall -16% last year but cut accruals by only -3.3%. Terex cut accruals by -5.4% but sales fell -29%. And Oshkosh saw sales fall by -7.0% but cut accruals by -17%.

Cummins Recovers

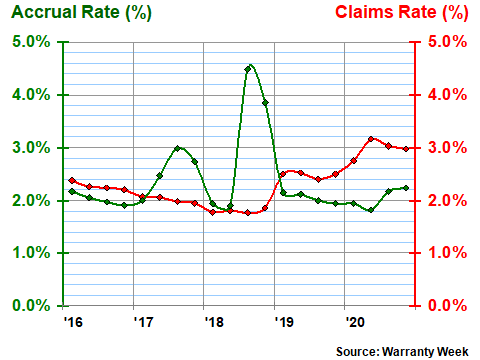

In Figure 4, we're shining the spotlight on Cummins. As is obvious, the truck engine manufacturer had two really bad quarters in 2018, due to what the company called an "Engine System Campaign" linked to emissions testing by the California Air Resources Board and the U.S. Environmental Protection Agency.

At first, its accrual rate soared to 4.5%, then dropped back to 3.9%. But by the end of 2020, that entire manufacturing excursion was largely winding down, and accruals were back down to 2.2%, though claims remained somewhat elevated at 3.0%.

Figure 4

Cummins Inc.

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2016-2020)

Still, not all the bad news is in the distant past. In the fourth quarter of 2020, Cummins paid $165 million in claims -- a new quarterly record. And that's the main reason the fourth quarter 2020 total in Figure 1 was nearly as high as the fourth quarter 2019 total.

Paccar Jumps in 2020

The clearest example we can find of a pandemic effect within these industries is Paccar, the parent company of the Kenworth, Peterbilt, Leyland Trucks, and DAF truck brands. As can be seen in Figure 5 below, its claims rate spiked above 3.0% in the second quarter of 2020, while its accrual rate rose above 2.0% for the first half of last year (and dropped just below 2.0% in the third quarter).

Figure 5

Paccar Inc.

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2016-2020)

In its defense, however, Paccar's long-term accrual rate over 72 quarters has been 2.1%, so what looks like a spike in the 2020 data is really just a return to average after years below average. It's long-term average claims rate is 2.0%, however, so it was above that level all year.

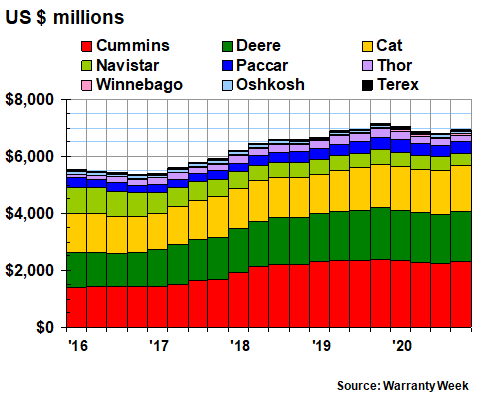

Warranty Reserve Totals

We have one more metric to detail: the balance in the warranty reserve funds of the nine manufacturers at the end of each of the past 20 quarters. In Figure 6, we see a gentle rise in the combined totals through 2017 and 2018, before a peak of $7.14 billion in the last quarter of 2019. By the end of 2020, their combined balances had dropped back to $6.93 billion, a -2.9% decline from the peak quarter.

Figure 6

Nine U.S.-Based Truck & Heavy Equipment Manufacturers

Claims Paid per Quarter

(in millions of dollars, 2016-2020)

Cummins has by far the largest warranty reserve fund within this group, reporting a $2.31 billion balance by the end of 2020, which was actually down by $82 million from year-end 2019. Second was Deere, with a $1.74 billion balance, down by $57 million. And third was Caterpillar, with a $1.61 billion balance, which was actually up by $71 million from the end of 2019.

Among the others, Terex and Winnebago reported modest increases in reserves by year's end, while Navistar, Paccar, and Thor reported modest decreases in reserves. Oshkosh's reserve balance was up by a slim $300,000 to $64.6 million.

Claims-Reserve Ratio

We have one more metric to detail, which is the ratio between claims and reserves. It's measured by taking the balance in the warranty reserve fund and dividing it by the amount of claims paid per month, which results in a theoretical number for the number of months those reserves would last if no further accruals were made.

The theory is that if a company's product warranties have a typical duration of one year, that ratio should be close to 12 months. If warranties average two years, it should be close to 24 months. And so on. In industries such as commercial aviation and HVAC equipment, which usually feature very long warranties, this ratio can be as high as 80 to 110 months on occasion.

It turns out that by the end of 2020, at least in the trucking and heavy equipment industries, huge warranty reserve cushions are somewhat uncommon. Seven of these companies had ratios between 10 and 20 months, while Deere was at 22 months and Cummins was at 42 months. Back at the end of 2019, Navistar was just above 20 months and Cummins was at 45 months, while all the others were below 20 months at that time. Terex was as low as nine months.

In other words, some of these companies may be underfunding their warranty liabilities, which isn't much of a problem as long as they remain in business and are able to pay claims out of cash on hand, if necessary. Their investors won't be happy about the negative earnings surprises that would follow such adjustments, of course. But given the severity of the global health crisis last year, and given all the bankruptcies that followed the 2008-09 recession (especially in the RV industry), perhaps this is not the most prudent warranty management policy?