Auto Parts Supplier Warranty Report:

Slowly but surely, the companies that manufacture powertrain components such as engines and transmissions have seen their share of the warranty expenses rise, while the other parts suppliers have seen their share slowly shrink. And both claims and reserves are at record levels.

As the first quarter of 2020 comes to a close, everything has changed. But it's also the season when we find out how warranty expenses changed for manufacturers in 2019, as long ago as that now seems. This week, we take a look at automotive parts suppliers and especially the makers of engines and transmissions.

We began by gathering some data from the annual reports and quarterly financial statements of all of the U.S.-based automotive parts suppliers. We gathered three essential warranty metrics: claims paid, accruals made, and reserves held. And we gathered data on product sales revenue, which we used to calculate two additional metrics: claims as a percentage of sales, and accruals as a percentage of sales.

Our list included 120 companies, which we split into two groups: 24 manufacturers of powertrain components such as engines, transmissions, and axles, and 96 manufacturers of other automotive components. Leaders in the first group included Cummins Inc., Eaton Corp., BorgWarner Inc., LKQ Corp., and Dana Inc. Leaders in the second group included Westinghouse Air Brake Technologies Corp., Standard Motor Products Inc., Brunswick Corp., Aptiv plc, and Illinois Tool Works Inc.

Warranty Claims

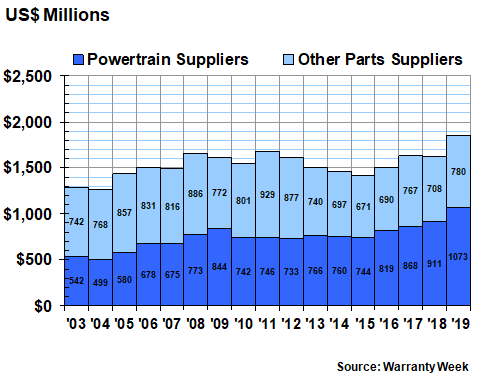

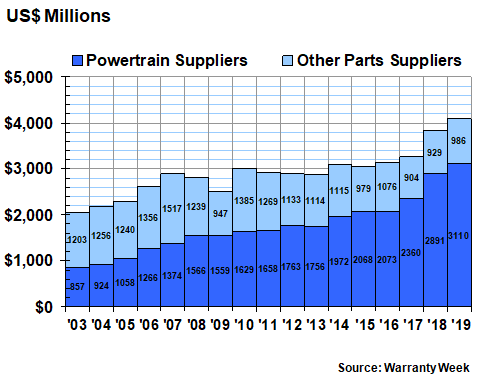

In Figure 1 we are adding up the totals for claims paid during each of the past 17 years. As is clear from the data, the powertrain suppliers, though fewer in number, account for the majority of the claims paid during any given year. Last year, their share of the total was 58%, up from 56% in 2018.

Figure 1

Automotive Supplier Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2019)

The powertrain suppliers saw their claims cost rise by $161 million, or 18%, to a new high of $1.073 billion in 2019. Other parts suppliers saw their claims cost rise by $71 million or 10% to $780 million, their highest total since 2012.

On the powertrain side, Cummins was both the largest claims payer and had the largest annual increase in claims payments. Its annual claims cost jumped from $443 million to $590 million -- up by almost a third. Other powertrain suppliers with big annual increases included Eaton, up $30 million, and LKQ, up $13 million.

Among the other suppliers, the big increase was Westinghouse Air Brake Technologies Corp., which more than doubled its claims cost to $118 million. Carlisle Companies Inc. saw claims rise by $12 million, and LCI Industries saw a $5.6 million increase.

In terms of claims cost reductions, there were several cuts worth noting. BorgWarner cut its claims cost by $16 million, or 22%. Brunswick cut its claims costs by $12 million. Wabco Holdings Inc. cut claims costs by $6.7 million. Allison Transmission Holdings Inc. cut its claims costs by $6.0 million. And Illinois Tool Works cut its claims costs by $5.0 million, a 10% reduction over 2018 levels.

Warranty Accruals

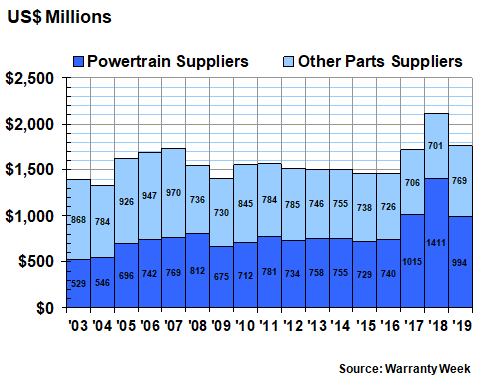

In Figure 2 we're looking at the amount of warranty accruals reported by U.S.-based manufacturers over the past 17 years. In 2019, their collective totals dropped by $348 million. But as the chart shows, it was the powertrain suppliers' $416 million decline that set the pace, more than offsetting a $68 million increase in accruals reported by the other parts suppliers.

Figure 2

Automotive Supplier Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2019)

The cause of this year's decline in accruals as well as this year's increase in claims is primarily the problems that Cummins has been having with its diesel engine emissions compliance efforts. The additional accruals were first made in 2018 when the problem became known, and then the claims began to increase. So this is an example of the lag time between when a warranty problem is detected, and when the bills actually come due.

Warranty Expense Rates

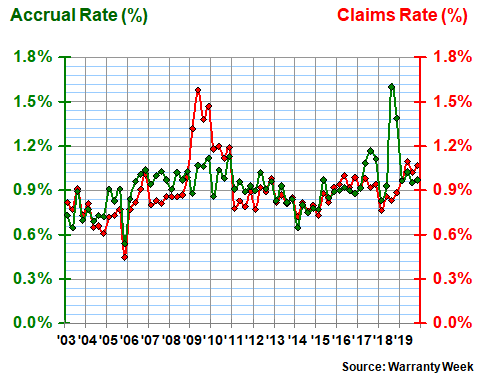

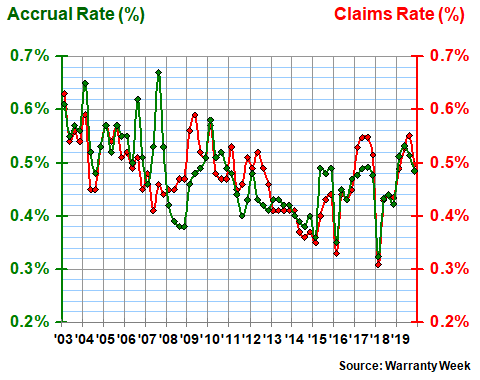

For the powertrain suppliers, product sales were down by about 2.4% in 2019. But for the other parts suppliers, product sales were actually up by about 4.0%. We used these amounts to divide the expenses in Figures 1 and 2 to calculate the expense rates detailed in Figures 3 and 4. But we did so on a quarterly basis, because sometimes this reveals short-lived spikes or declines that the annual data does not.

In Figure 3 we're looking at the expense rates of the powertrain suppliers. Over the long term, their claims and accrual rates both average around 0.9%. But in recent years they've been a bit above that rate. In the second half of 2018, in fact, because of the Cummins emissions compliance problems, they were significantly above average.

Figure 3

Powertrain Suppliers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2019)

In Figure 4, we're looking at the warranty expense rates of the other parts suppliers. In 2018 they seem to have had the exact opposite problem: expense rates suddenly diving in the first quarter, a phenomenon that also happened at the start of 2016. But the more concerning phenomenon is the fact that in the middle of 2019, the industry's claims rate and accrual rate hit a nearly decade-long high level, with the claims rate peaking at 0.55% and the accrual rate peaking at 0.53%.

Figure 4

Other Parts Suppliers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2019)

Powertrain companies cutting their claims rates by significant amounts include BorgWarner, Allison Transmission, Visteon Corp., and Wabco Holdings. Other parts suppliers cutting their claims rates significantly include Tenneco Inc., Advance Auto Parts Inc., and Illinois Tool Works Inc.

Those that saw big increases in their claims rates include Eaton, LKQ, LCI, Cummins, and Meritor. Eaton and LKQ also saw their accrual rates jump significantly. Paradoxically, Meritor saw its claims rate rise and its accrual rate fall, while Tenneco saw its claims rate fall but raised its accrual rate significantly anyhow.

Warranty Reserves

In Figure 5, we're looking at the year-ending balances in the warranty reserve funds of the 120 automotive suppliers that we're tracking. Funds on hand hit a new high of $3.11 billion for the powertrain suppliers, while expanding to a three-year high of $986 million for the other parts suppliers. And for the second year in a row, the powertrain suppliers accounted for more than three-quarters of the combined total, which surpassed $4 billion for the first time.

The powertrain suppliers first surpassed half the industry's total in 2008. Then they passed two-thirds in 2015. Last year and again in 2018 they surpassed three-quarters of the combined total. Meanwhile, as can be seen in Figures 1 and 2, the powertrain companies accounted for more than half the claims and accruals in every year since 2013, after having done so only once in the 10 years between 2003 and 2012. So a slow but seemingly permanent realignment has happened between the powertrain manufacturers and the other parts suppliers.

Except for slight contractions in 2008-2009 and again in 2012-2013, the powertrain manufacturers have let their collective balances grow every year since 2003. In contrast, the other parts suppliers surpassed a $1.5 billion balance in 2007 and haven't done so again. In fact, in five of the last 12 years, including 2018 and 2019, the other parts suppliers let their balance slip below $1 billion.

Figure 5

Automotive Supplier Warranties

Reserves Held by U.S.-based Companies

(in US$ millions, 2003-2019)

Once again, Cummins led the way, with a $181 million gain driving its year-ending balance up to $2.389 billion by the close of 2019. Westinghouse Air Brake, however, added $114 million in 2019 to its $154 million balance in 2018, driving up the size of its fund by nearly three-quarters. Dana added $26 million, which expanded its fund by more than a third. BorgWarner added $13 million, and Eaton added $11 million.

At the other extreme, Brunswick let its balance decline by $24 million. Allison Transmission's balance shrunk by $14 million. Aptiv plc, the new Delphi, cut its balance by $13 million. Meritor reduced its reserves by $9 million.