Warranty Claims & Reserves, Part 2:

The electronics sector tends to have shorter warranties than other sectors such as vehicles. Yet their warranty costs have ranged all the way up to four percent of sales. And while the average size of their warranty reserves is on the small side, some industry segments keep very large balances.

In this Part 2 examination of the warranty claims rates and reserve fund balances of the U.S. manufacturing sector, we take a deeper look at the electronics sector, including computers, semiconductors, telecom gear, and medical equipment.

We began the process with a list of 675 U.S.-based electronics manufacturers, a subset of all the warranty-issuing manufacturers that we've tracked since 2003. From the financial reports of each of these companies, over the past 67 quarters, we extracted three key metrics: the amount of warranty claims paid, the amount of warranty reserves held, and the amount of warranted products sold.

Using the claims and sales data, we calculated the claims rate, which is the percentage of sales spent on claims during any given period of time. We also calculated the amount being spent per month on claims by all these companies. And then we divided their reserve fund balance by this amount, to calculate the fund's capacity to pay claims, in months.

In other words, if a company reports paying $3 million in claims paid during a three-month quarter, that it has $10 million in warranty reserves at the end of that quarter, and made $100 million in sales during that quarter, their claims rate would be $3m / $100m = 3.0%, their monthly claims cost would be $3m / 3 = $1m, and the capacity of their warranty reserve would be $10m / $1m = 10 months.

Industry Averages

It turns out that over the past 17 years, the industry average for all manufacturers based in the U.S. has been 1.5% for the claims rate and 18 months for the reserve fund capacity. Each industry and sector is different, and would be above or below those averages. In fact, with 67 different measurements over the past 17 years, some of these industries and sectors could be both above and below the averages at different times.

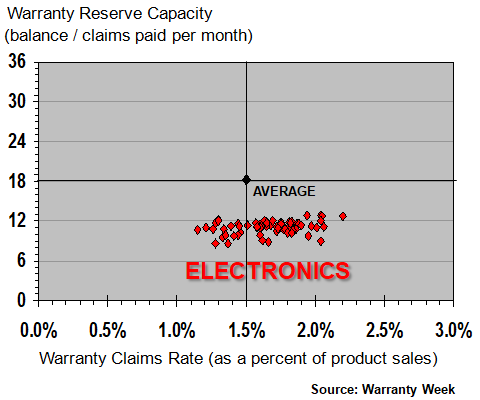

The electronics sector, in fact, has been both above and below the all-manufacturer 1.5% claims rate average at different times over the past 17 years. In Figure 1 below, we can see this from the fact that there are data points both to the left and to the right of the middle line, which represents the all-manufacturer 1.5% average. However, most electronics manufacturers also tend to keep less-than-average reserve balances, as is shown by the fact that all 67 data points are below the horizontal line at 18 months.

Figure 1

Electronics Manufacturer Warranties

Claims Rate & Reserves Held by U.S.-based Companies

(as % of sales & months of coverage, 2003-2019)

The averages for the 675 electronics manufacturers are actually 1.7% for the claims rate and 11 months for the reserve capacity. In other words, the electronics manufacturers are slightly above average in terms of cost, and somewhat below average in terms of capacity. This is closely related to the fact that many computers and consumer electronics items have just one-year warranties, in contrast to the multiple-year terms typically found with other types of warranted products such as airplanes, passenger cars, and HVAC systems.

Computer Industry Warranty Metrics

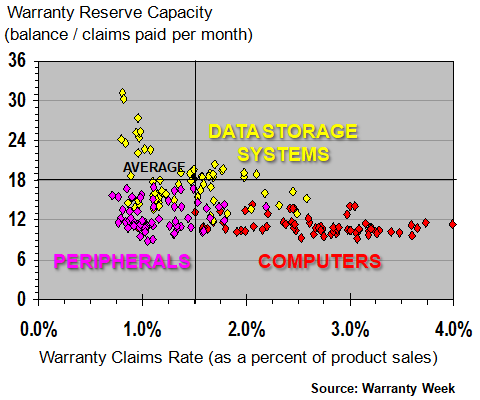

In Figure 2, we're looking at three closely-aligned segments of the computer industry: the computers themselves, the data storage systems hat run alongside them, and the peripherals such as monitors, printers, keyboards, and other devices they connect with.

The first thing to notice is that we had to widen the horizontal scale to fit all the computer data points, which include instances where the industry-average claims rate was as high as 4.0%. In fact, none of the 67 data points for this group was below the 1.5% all-industry average. Their lowest-ever reading was the 1.7% claims rate measured late in 2018.

The second thing to notice is that although there is quite a bit of mixing going on, each of the three industries does tend to stake out its own territory. The computer data points are almost all in the lower-right box, with below-average warranty reserve capacities and above-average claims rates. The peripherals data points are mostly in the lower-left box, with below-average warranty reserve capacities and below-average claims rates. And the data storage systems are in all four boxes, both above and below average.

Figure 2

Computer Manufacturer Warranties

Claims Rate & Reserves Held by U.S.-based Companies

(as % of sales & months of coverage, 2003-2019)

The long-term averages for the computer manufacturers are 2.7% and 11 months. For the peripheral manufacturers, it's 1.2% and 12 months. But for the data storage system manufacturers, it's 1.4% and 18 months -- very close to the all-industry average. However, the claims rates of the computer manufacturers and the reserve capacities of the data storage manufacturers have a higher-than average standard deviation, reflecting the respective horizontal and vertical spread of their data points.

Semiconductor Manufacturers

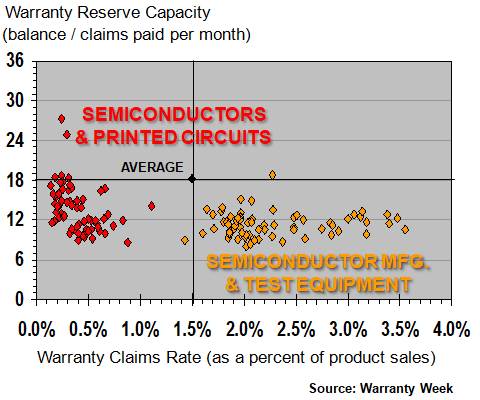

We divided the world of semiconductor and printed circuit board manufacturers into two groups: one group of 133 companies that makes the actual chips and devices, and one group of 21 companies that make the manufacturing and test equipment these other companies use to produce the actual chips and devices. Advanced Micro Devices Inc., Nvidia Corp., and Teradyne Inc. are examples of the former group, while Applied Materials Inc. and Lam Research Corp. are examples of the latter group.

The reason we separate them in this way is clear from a glance at Figure 3. All 67 of the claims rate measurements for the actual device manufacturers were below average, while all but one of the measurements for the manufacturing and test equipment companies were above average. And all but a handful of these data points were below 18 months as well.

Figure 3

Semiconductor Manufacturer Warranties

Claims Rate & Reserves Held by U.S.-based Companies

(as % of sales & months of coverage, 2003-2019)

Our theory is that the higher warranty expense in this industry is built into the factory machinery they use to manufacture and test their products. The lower warranty costs are in the devices they manufacture. It would be as if the lathes, drill presses, and molds used to make car parts and appliances experienced all the claims on the factory floor, so that the actual parts and pieces they produce could perform flawlessly. It's unusual to say the least.

The data bears this out. The average claims rate of the semiconductor and printed circuit manufacturers was only 0.4% over 17 years. But the average claims rate for their manufacturing and test equipment suppliers was 2.3% -- much higher than the all-manufacturer average. Ironically, at 14 months the device makers had a higher reserve capacity than their suppliers did at 11 month, though both were far below the all-manufacturer average of 18 months.

Medical Equipment

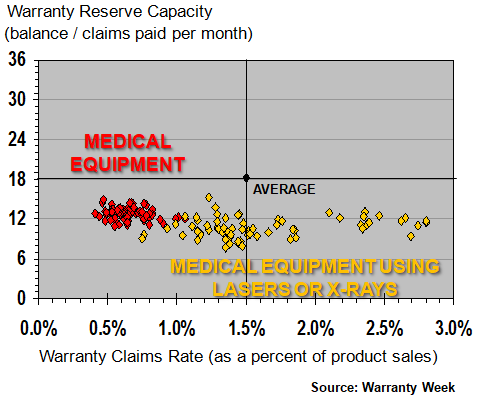

There's a similar separation in the medical device and scientific equipment industry, but it's not based on their position within the supply chain. Instead, it's based on the technology they use in their equipment. Bottom line, any company whose products use lasers or X-rays will have much higher warranty costs than those who don't.

In Figure 4, we can see that while the medical equipment companies have relatively low claims rates, the medical equipment companies whose products use lasers or X-rays have a much higher average claims rate. The data points of both groups, however, are rather tightly arrayed along the 12-month warranty reserve capacity line, suggesting they keep on hand about as much in reserves as they spend in a year on claims.

Figure 4

Medical Equipment Manufacturer Warranties

Claims Rate & Reserves Held by U.S.-based Companies

(as % of sales & months of coverage, 2003-2019)

Thermo Fisher Scientific Inc. and Agilent Technologies Inc. are the kind of companies on the list of 149 medical device and scientific instrument manufacturers. Varian Medical Systems Inc. and Dentsply Sirona Inc. are among the 22 additional manufacturers whose medical devices or scientific instruments make use of lasers or X-rays.

The difference between them is vast. The larger group averages an 0.7% claims rate and 13 months of reserve capacity. in contrast, the laser and X-ray group averages a 1.6% claims rate and 11 months of reserve capacity.

However, the laser and X-ray group' claims rate also comes with a 0.5% standard deviation, reflecting the wide left-to-right spread of the data points. The larger group's standard deviation is only 0.1%, which reflects the relatively tight cluster of its 67 data points. As we mentioned last week, the more closely-packed the cluster, the more predictable and consistent the group's warranty expenses.

Telecom Equipment

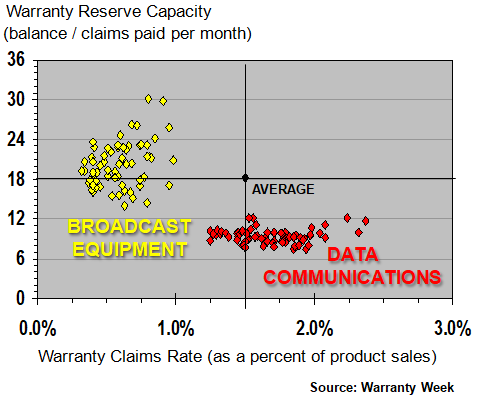

Next we close out this roundup of the warranty expenses of the electronics sector with two pairs of telecom equipment industry segments. In Figure 5 we're looking at broadcast and data communications equipment, while in Figure 6 we're looking at telephone and satellite/microwave equipment.

In Figure 5 we can see the data communications segment following the same horizontal spread as several other segments, close to 12 months on the vertical scale but spread somewhat more broadly on the horizontal scale. The average for this group is 1.7% and 9.4 months, which is why most of the data points are in the lower-right box.

In contrast, the broadcast equipment manufacturers are spread across both the upper and lower halves of the left side of the chart. Their average claims rate is much lower at 0.5%, but their reserve capacity is much higher at 20 months. However, the standard deviation of that latter measure is a relatively high 4 months.

Figure 5

Telecom Equipment Manufacturer Warranties

Claims Rate & Reserves Held by U.S.-based Companies

(as % of sales & months of coverage, 2003-2019)

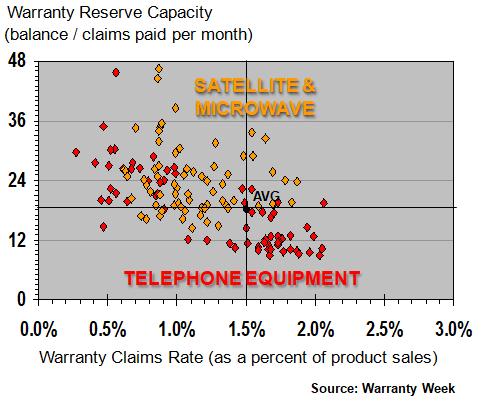

In this final chart, we've mashed together the data points for both the telephone equipment and satellite/microwave equipment manufacturers. That's a field of some 86 companies, but many of the largest, such as Nortel, Tellabs, and Lucent, are long gone from the active list.

The rapidly contracting revenue and claims payments over the past 17 years is one of the main reasons that both groups have data points in all four boxes. What they were in 2003 is not at all what they were in 2019. As a result, both these groups have the highest volatility of any groups in the electronics sector.

The telephone equipment makers have a 1.2% average claims rate with an 0.5% standard deviation, while the satellite/microwave equipment makers have a 1.0% average claims rate with a 0.2% standard deviation. But it's their reserve capacities that are even more chaotic. The telephone group averaged 18 months with a standard deviation of 8 months, while the satellite/microwave group averaged 24 months with 7 months of standard deviation. Only the aerospace OEMs, covered in last week's newsletter, had a higher standard deviation (11 months).

Figure 6

Telecom Equipment Manufacturer Warranties

Claims Rate & Reserves Held by U.S.-based Companies

(as % of sales & months of coverage, 2003-2019)

Going back to Figure 1 for a moment, one reason that the data points of the group as a whole is in such a tight cluster is because some of its largest members, such as Apple Inc., HP Inc., and Cisco Systems Inc., are themselves so consistent and predictable when it comes to warranty expenses. However, when you get down to industry segments that they're not in -- medical devices, broadcast equipment, satellite/microwave -- the metrics become less predictable and more volatile.

Furthermore, although there's certainly no one-to-one mapping, the relatively low reserve capacities of 12 months or less seen in many of these industry segments correlate well with product warranties that typically last only a year. The vehicle makers average 22 months and the building trades average 21 months. But the electronics manufacturers average only 11 months of reserve capacity. And the data communications segment has an even lower average of only 9.4 months.